The number of crypto ETF applications awaiting SEC approval has reached a record 72, indicating a positive shift in the US digital asset regulatory policy.

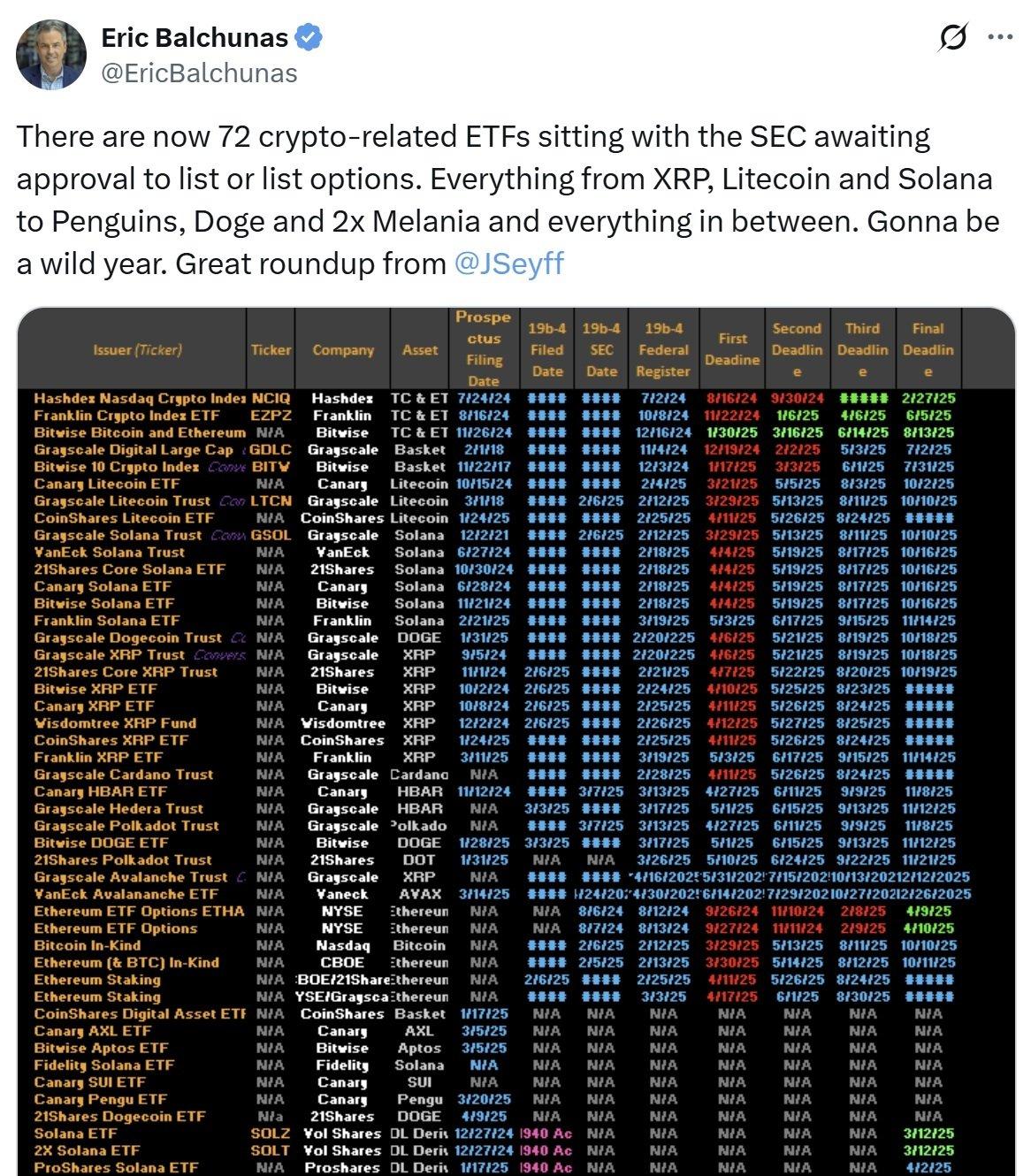

The US financial market is witnessing an unprecedented phenomenon with the record number of cryptocurrency ETF applications. According to information shared by Bloomberg's senior ETF analyst Eric Balchunas on Monday, there are currently 72 Exchange Traded Funds related to cryptocurrencies awaiting approval from the US Securities and Exchange Commission (SEC) for listing or options trading.

Based on the list compiled by his colleague James Seyffart, Balchunas published this information on the social media platform X, sparking discussions about the prospects of crypto ETFs in 2025.

Product and Issuer Diversification

The pending ETF applications include a diverse range of asset types and investment strategies. From top cryptocurrencies like Bitcoin, ETH, Solana, XRP, Litecoin, and Dogecoin, to less common products like Pengu and leveraged ETFs such as "2x Melania".

Notably, the list of applicants includes not only industry giants like Bitwise, Grayscale, and Vaneck, but also newer or more specialized organizations such as Canarx, Coinshares, 21Shares, Proshares, Tuttle Capital, Rex-Osprey, Teucrium, Fidelity, Franklin, Hashdex, and Wisdomtree.

The proposed products have diverse structures, from spot ETFs, futures-based funds, staking ETFs, to leveraged derivative instruments. This diversity reflects the trend of expanding cryptocurrency access through regulated and managed investment vehicles.

This record wave of applications demonstrates the industry's strong confidence in introducing digital asset-based ETF products into traditional financial markets, despite previous regulatory caution. Many investors and industry experts view 2025 as a pivotal year for crypto finance and accessibility through structured investment funds.

Although some Bitcoin and Ether spot ETFs were previously approved, the SEC remained cautious about products linked to other cryptocurrencies. However, the policy environment at the SEC has significantly shifted since leadership changes, with Chairman Gary Gensler's departure and Paul Atkins taking over.

Under Atkins' leadership, the Commission has signaled a more constructive stance towards cryptocurrency regulation. He has committed to addressing long-standing industry complaints regarding ambiguity and inconsistency in legal guidance.

"My top priority is to collaborate with other commissioners and Congress to build a robust legal foundation for digital assets, based on a rational, coherent, and principle-driven approach," Atkins recently stated before Congress, indicating that the SEC is currently prioritizing the establishment of clear rules for the digital asset market.