This article is machine translated

Show original

Those who know will understand... Binance was able to establish itself as the top centralized exchange through the pumping of newly listed altcoins.

While other exchanges also had new listing pumps, the scale and sustainability were incomparable to other exchanges at the time, and were significantly larger.

Many people came to Binance with money to enjoy the new altcoin pumping that Binance had done, and they all enjoyed the party together. Whether Binance did the new coin pumping as a back-end work or selected coins that people would like and pumped them.. Anyway, the new listing = pumping party.

As the number of success stories increased, it became a formula. People's money was piling up in Binance. Because there was so much money in the exchange.. Even if it was not a newly listed coin, but a specific sector or specific coin within the exchange, that coin was pumped like crazy.

Pumping calls for money, and that money calls for more pumping, and that pumping calls for more money.. With this virtuous cycle structure, Binance quickly took the top spot among central exchanges.

Since there is so much money in the exchange, Binance is also pushing and incubating certain stocks in the Binance Labs portfolio.

Launchpad must have known very well that it was bound to be a hit. And that launchpad created another formula for success, and many people came to Binance with their money in their pockets because of that formula for success.

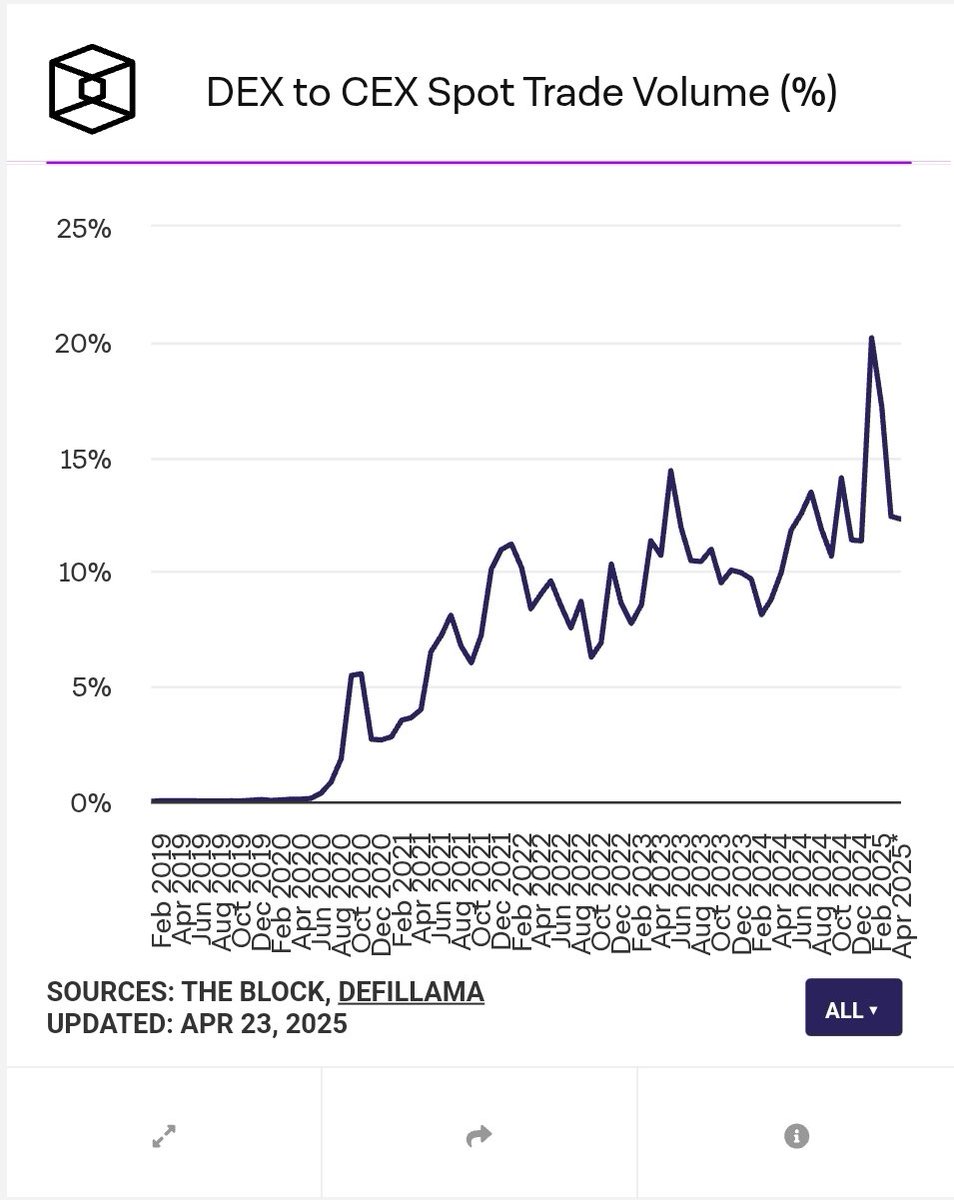

However, maybe because Jangpung came back from seeing his American brothers... I don't know what it is, but in the last meme coin season, Binance was not seen at that time. And the market leadership and transaction fees that they would have taken at that time were all taken by dexes and Solana chain.

Central exchanges have large fixed costs to operate.

1/ CEXs must operate a highly secure cold wallet/hot wallet system to store customers' assets, and must also invest in expensive security equipment and insurance to prevent hacking.

2/ There must be staff to respond to customer inquiries 24 hours a day. Since DEX is basically a decentralized system, there is no customer center, and most issues are resolved autonomously by the user community.

3/ In addition, CEX must obtain licenses according to the financial regulations of each country and operate KYC (identity verification) and AML (anti-money laundering) systems, so it also incurs legal and regulatory response costs.

4/ Since it must process deposits and withdrawals in conjunction with banks, it requires financial infrastructure and agreements, and the costs of building and maintaining the system are high.

As cryptocurrencies come under regulation, CEX will have to pay costs to comply with the regulations, which will make it more and more inefficient. Also, since it will not be able to do the illegal(?) things it has enjoyed so far, there will be less room to attract people. That's what I think. The future altcoin bull market will be like the past meme coin.

It will happen like a fireworks show centered around dex.. and the more the boom happens, the more people will chase after it and accumulate more money in their cryptocurrency wallets.. and that accumulated money will create a bigger pump.. and that pumping will create more liquidity.

That's how the glory of cex will gradually move to dex.

www.theblock.co/data/decentral...

I believe in this hypothesis.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content