Bitcoin (BTC) is trading with an upward trend, facing resistance at $94,000 with potential for further increase. However, a famous analyst advises caution about Bitcoin's price surge, based on an important indicator.

For a sustainable price increase, capital needs to continuously flow into the market, as this provides the necessary liquidation for further growth.

bitcoin price increases in asian trading session

Bitcoin's price outlook increased on Wednesday during the early hours of the Asian trading session. Technical price formations, including the Falling Wedge, suggest potential further increase for this pioneering cryptocurrency.

At the time of writing, Bitcoin is trading at $93,714, with the potential to increase by 9% in a potential 20% surge. The Falling Wedge pattern's target is a 20% increase, determined by measuring the longest height of the wedge and applying it at the breakout point.

This price reversal began after Bitcoin's price transformed the important resistance level at $85,000 into support and turned the support zone into a price breakout point.

Bitcoin (BTC) price performance. Source: TradingView

Bitcoin (BTC) price performance. Source: TradingViewBased on the daily chart for the BTC/USDT trading pair, a daily candle closing above $91,575 could facilitate Bitcoin's continued price increase.

Buying pressure surpassing the immediate resistance level at $94,000 could drive Bitcoin's price towards the next $100,000. In an extremely optimistic scenario, BTC could extend to the $102,239 target.

Technical indicators align with this outlook. The Relative Strength Index (RSI) is rising, recording higher peaks, indicating increasing momentum. Its position below 70 suggests there is still room for growth before BTC becomes overbought and risks correction.

Similarly, the Awesome Oscillator (AO) charts are blinking green, showing buyers' control. Their position above the midline (in the positive zone) further reinforces the price increase argument.

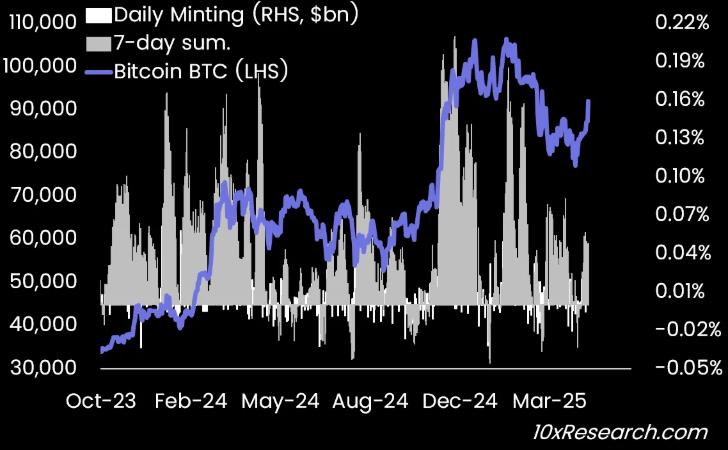

However, Markus Thielen, head of research at 10x Research, advises caution, based on the delayed stablecoin issuance indicator.

"Since our stablecoin issuance indicator has not yet returned to high activity levels, we remain cautious about the sustainability of the current Bitcoin price surge," Thielen wrote in the latest 10X research.

The stablecoin issuance indicator refers to the release or creation of new stablecoins, such as Tether (USDT) or USD Coin (USDC). Stablecoin issuance often signals capital flowing into the cryptocurrency market, and it can have significant impacts on Bitcoin's price.

These include increased liquidation and market confidence as investors anticipate profit opportunities. Both are signs of potential price increase pressure.

According to the analyst, the lack of strong capital inflow from stablecoins "raises questions about continuation." Bitcoin's price surge to the psychological level of $100,000 remains threatened.

Bitcoin vs Stablecoin Issuance Indicator. Source: 10X research

Bitcoin vs Stablecoin Issuance Indicator. Source: 10X researchNotably, stablecoins are less important as a leading indicator for Bitcoin's price. Analysts point to other factors such as capital inflows from ETFs (exchange-traded funds) or Strategy (MSTR) acquisitions.

However, if profit-taking begins, a candle closing below the midline of the price breakout point at $86,562 could reverse the trend. This could push Bitcoin back to an accumulation state below the important $85,000 level.