Author: Michael Nadeau, Founder of The DeFi Report; Translation: Jinse Finance xiaozou

1. Momentum Indicators and On-Chain Key Data

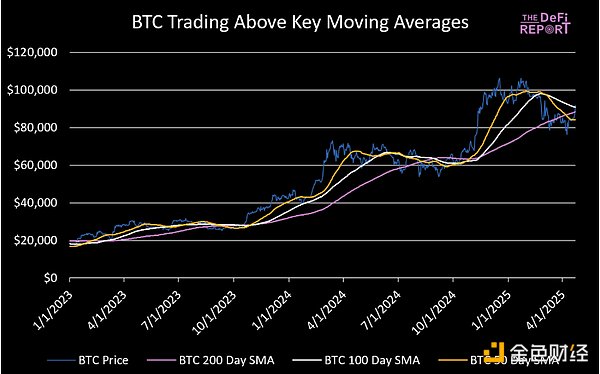

(1) Moving Average Lines

Key Conclusions:

• After forming a "death cross" on April 7, Bitcoin has now rebounded and broken through all key moving averages - a trend consistent with our previous expectations.

• Bitcoin's subsequent performance will reveal the market direction: whether it will continue the long-anticipated long-term market trend or maintain a long-term downward trend.

• We anticipate a pullback at the current level. If a pullback occurs, we will closely observe whether Bitcoin can form a higher low point above $76,000.

• If it breaks below $76,000, we will focus on support above $70,000. Holding this level would allow the bull market to continue, while losing it would confirm a cycle shift and the continuation of the downward trend.

• If Bitcoin touches and stabilizes at $95,000, it is expected to challenge the all-time high.

To this end, we will look at KPI data to see if we can find clues to predict BTC's next move.

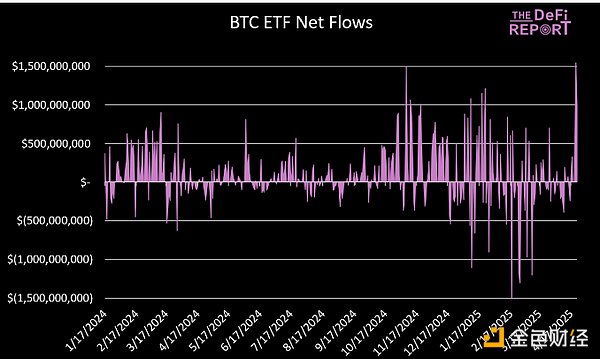

(2) ETF Fund Flows

Key Conclusions:

• ETF net outflows of $3.8 billion in February-March, and another $600 million outflow in the first three weeks of April.

• However, a significant trend reversal occurred on Tuesday with a single-day net inflow of $1.54 billion (a historical record).

• We need to observe whether this trend can be sustained. We believe that without participation from the US market and ETFs, Bitcoin will find it difficult to return to its all-time high.

[The translation continues in the same manner for the rest of the text, maintaining the original structure and translating all text while preserving the <> tags and their contents.]Overall, buying when the MVRV-Z score breaks through 2 may yield considerable returns, but historical data shows such opportunities typically appear in the early stages of a cycle (such as early 2017 and late 2020).

(10) Momentum and On-Chain Indicators Summary

• On-chain activity has shown a continuous downward trend over the past three months, a phenomenon evident not only on the Bitcoin network but also on Ethereum and Solana chains.

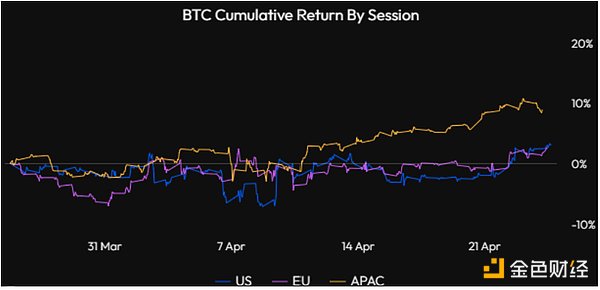

• From the data, this week's market was primarily driven by the Asia-Pacific/China region (although there was a large capital inflow in the ETF market on Tuesday, which is not reflected in the chart below). While this is a positive signal, we maintain that without strong participation from the US market, Bitcoin will struggle to restart its bull market trend.

• Stablecoin growth has shown fatigue - USDT supply has remained stagnant at $140 billion over the past four months. Historical data suggests that a slowdown in USDT stablecoin supply often synchronizes with Bitcoin's oscillation/consolidation cycles (such as April-October 2024 and September-December 2021, the latter ultimately evolving into a bear market).

• The ratio of long-term to short-term holders is a core indicator we focus on. As mentioned earlier, long-term holders typically lay the foundation for parabolic movements, while the massive entry of short-term holders is key to driving prices to new highs. Although market conditions can change rapidly, we believe such signs are not yet present. A longer period of oscillation and consolidation will create healthier conditions for new funds to enter.

• MVRV-Z score analysis shows divergent short-term return performance, but the 2-3 year outlook is more optimistic. We are more inclined to position when Bitcoin is closer to the 1 level (rather than the current level).

• It should be noted that this analysis is based on historical data retrospection. Investors should recognize the reflexive nature of the crypto market - price movements often precede narratives and on-chain activities, and the market can quickly turn.

Finally, a reminder: This on-chain data analysis does not include Bitcoin held by ETFs and centralized exchanges (approximately 18.7% of total supply).

2. Short-Term Market Landscape

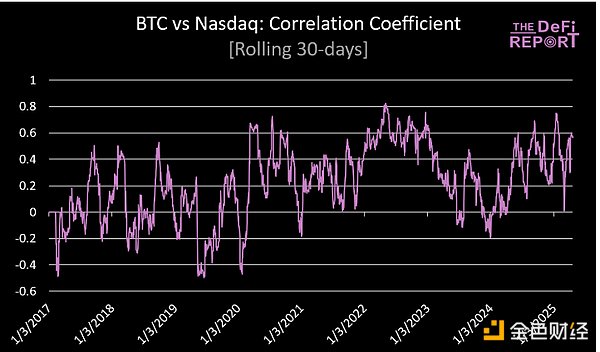

Bitcoin Decoupling from Nasdaq?

As global capital withdraws from the US market, discussions about "Bitcoin decoupling from Nasdaq" are rampant. We approach this cautiously, not because we don't believe Bitcoin will decouple. In fact, Bitcoin has historically had low correlation with the Nasdaq index (average correlation coefficient of 0.22 since January 1, 2017, with a median of 0.23).

Nevertheless, Bitcoin's correlation with Nasdaq has risen to 0.47 this year, and when Nasdaq is under pressure (on days when Nasdaq drops ≥2% since 2017), the correlation coefficient often rises to 0.4.

We believe this correlation will not change in the short term. This raises a question: Does Nasdaq have further room to fall? We believe it does.

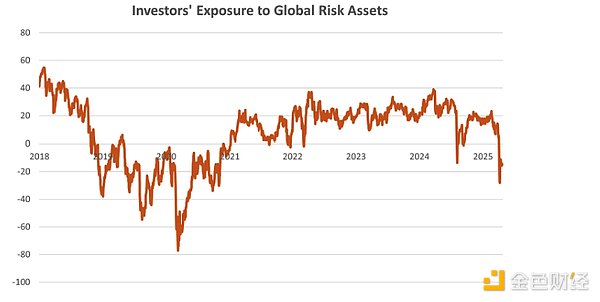

Why? Despite investors continuing to withdraw from risk assets (see below), the market is currently trading at 19x forward P/E.

Here's a comparison of bottom P/E ratios during four major market corrections:

• 2022 Bear Market: 15x (equivalent to S&P 500 at 4248 points)

• COVID-19 Pandemic: 13x (equivalent to 3682 points)

• Major Financial Crisis: 17.1x (equivalent to 4815 points)

• Internet Bubble: 20x (equivalent to 5665 points)

Important Background:

• Analysts lowered profit forecasts by 2.2% during the COVID-19 pandemic (adjustment speed was extremely fast), 4.2% during the 2022 bear market, 64% during the global financial crisis, and 38% during the internet bubble burst.

[The significant downward revision of profit forecasts during the internet bubble and global financial crisis passively raised the bottom P/E ratio]

• So far this year, profit forecasts have only been slightly lowered by 0.3%.

Meanwhile:

• Corporate layoffs have exceeded levels during the major financial crisis (mainly government layoffs) but have not yet been reflected in labor market data.

• Survey data such as the Philadelphia Fed Manufacturing Index, new housing starts, Philadelphia Fed New Orders, container ship bookings, and Los Angeles port trade volumes all show weakness.

• The Atlanta Fed predicts negative growth in the first quarter.

• The Federal Reserve is holding steady (only a 5% probability of rate cut in May).

• Tariff negotiations are quite complex, will take longer than the market expects, and may further escalate.

In summary, we believe the Trump administration is trying to "step-by-step" lower the stock market (to reduce the US dollar exchange rate and interest rates). Nevertheless, the economy may already be deeply wounded. Therefore, we believe the market may face another downturn when hard data begins to be published.

On the other hand, the market may still face uncertainty if:

• Tariff agreements progress faster than expected.

• The bond market remains stable without serious liquidity issues.

• The Trump administration successfully shifts market attention to tax cuts and deregulation (which they are currently working on).

3. Long-Term Landscape Analysis

The long-term prospects for Bitcoin and the entire cryptocurrency market are extremely optimistic.

Why?

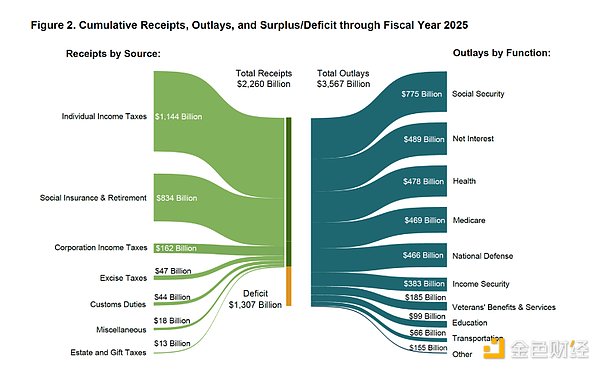

US Fiscal Deficit

The US budget deficit is expanding, not contracting!

We admit we have changed our stance on this issue multiple times. But with Musk announcing his departure from the White House in May, it's now clear that Doge is mainly a political show, targeting only small fish.

In short, this deficit train is unstoppable. The Treasury will likely continue to play a crucial role in providing liquidity. Not just in the US (as we've seen in recent years), but Europe is also increasing fiscal spending on defense and infrastructure.

We anticipate the Federal Reserve will expand its balance sheet again in the third/fourth quarter. As this process unfolds, we expect to see monetary suppression/yield curve control and global inflation rising. This will be an environment where investors prefer non-sovereign hard assets (like gold and Bitcoin) over stocks.

4. Risk Management and Final Conclusion

Our long-time readers know we like to wait for the "best batting point" and are comfortable holding cash until an opportunity appears.

Buying Bitcoin and other assets (like SOL) at the 2022 low was such a "best batting point". Adding positions before the US election last September (including meme coin allocation) was also such an opportunity.

We also believe increasing cash holdings in December last year/January this year was wise.

Is now the "best batting point" to go long on cryptocurrencies?

For us, the answer is no. We see impending risks. But we like to simplify things. We believe the core logic can be distilled to:

If you believe global trade and monetary systems are undergoing a structural reset (as we do), you can ignore Trump's rhetoric and focus on the real signals transmitted by people like Besant.

Our view is: This process will take a long time, and we haven't even finished the first half of the first inning. With the Federal Reserve holding steady, we are currently content to observe. Therefore, we choose to hold Bitcoin long-term while maintaining substantial cash reserves.

Might we miss short-term rallies? We accept that calmly. Investment must align with individual risk tolerance. Cash is also a position. Given the numerous opportunities in the cryptocurrency market, we choose to remain patient.