Abstract

●In April 2025, the Trump administration announced the launch of a "reciprocal tariff" policy, imposing a 10% "minimum baseline tariff" on global trading partners, which triggered severe fluctuations in global risk assets.

●As a blockchain primarily using PoW (Proof of Work) mechanism, Bitcoin relies on physical mining machines for mining, and mining machines are not on the US tariff exemption list, causing significant cost pressure for mining enterprises.

●Mining machine manufacturers showed the most obvious decline in the past month, primarily because they were hit by tariff policies on both the supply and demand sides.

●Self-operated mining farms are mainly affected on the supply side, with their Bitcoin sales to cryptocurrency exchanges being less impacted by the tariff policy.

●Cloud computing power mining farms are relatively least affected by the tariff policy, as the nature of cloud computing power transfers the mining machine procurement costs to customers through computing power service fees, thus eroding platform profits significantly less than traditional mining models.

●Although the tariff policy hit the US Bitcoin mining industry, Bitcoin spot ETF funds represented by BlackRock IBIT and US stock Bitcoin hoarding companies represented by MicroStrategy still control Bitcoin's pricing power.

●Bitcoin price is no longer the sole indicator; policy trends, geopolitical security, energy scheduling, and manufacturing stability are the true keys to mining industry survival.

Keywords: Gate Research, Tariffs, Bitcoin, Bitcoin Mining

Preface

On April 2nd, the Trump administration announced the launch of a "reciprocal tariff" policy, imposing a 10% "minimum baseline tariff" on global trading partners and additional "personalized" high tariffs on countries with significant trade deficits. This policy triggered severe fluctuations in global risk assets, with S&P 500 and Nasdaq experiencing their largest single-day drops since March 2020; crypto industry assets also shrank significantly. After Trump's tariff policy announcement, China declared 84% retaliatory tariffs on the US, the EU imposed 25% tariffs on $21 billion of US goods, and global stock market total value evaporated by over $10 trillion in a single week.

[The rest of the translation follows the same professional and precise approach, maintaining the original structure and technical terminology.]2.1 Mining Machine Manufacturers

From the stock price performance, mining machine manufacturers have shown the most significant decline in the past month, primarily due to tariff policies impacting both the supply and demand sides of mining machine production. The upstream of mining machine production involves foundries like TSMC, Samsung, and SMIC. Mining machine companies first independently complete ASIC chip IC design, then submit the blueprints to foundries for chip manufacturing. After successful chip production, the foundries will mass-produce the ASIC chips, which the mining machine companies then package into mining machines.

TSMC dominates 64.9% of the chip foundry market【1】. The Trump administration requested TSMC to build factories in the US, otherwise facing tariffs exceeding 100%【2】. Foundries like SMIC, Hua Hong Semiconductor, and Samsung are also under pressure from high US tariffs. Foundries are left with only two choices: pay tariffs or reduce US orders, both of which will lead to profit decline. This pressure may be transferred to downstream mining machine manufacturers, forcing them to pay higher prices to maintain foundry order gross margins.

From the demand side, since companies like Bitmain, Canaan Creative, and Bitfily are registered in China, US mining farms such as Marathon, Riot, and Cleanspark must bear high tariffs when purchasing mining machines, incurring higher costs. Consequently, mining machine orders will likely shrink significantly in the short term. Taking Bitmain's flagship Antminer S21 Pro and Canaan's Avalon A15 Pro as examples, before tariff policy implementation and excluding operational costs, assuming electricity cost at $0.043/KWH (Cleanspark's 2024 electricity cost)【3】, with total network hashrate at 850EH/s【4】, and mining machine depreciation period of 30 months【5】, the current Bitcoin mining cost is $68,367 for S21 Pro and $75,801 for A15 Pro.

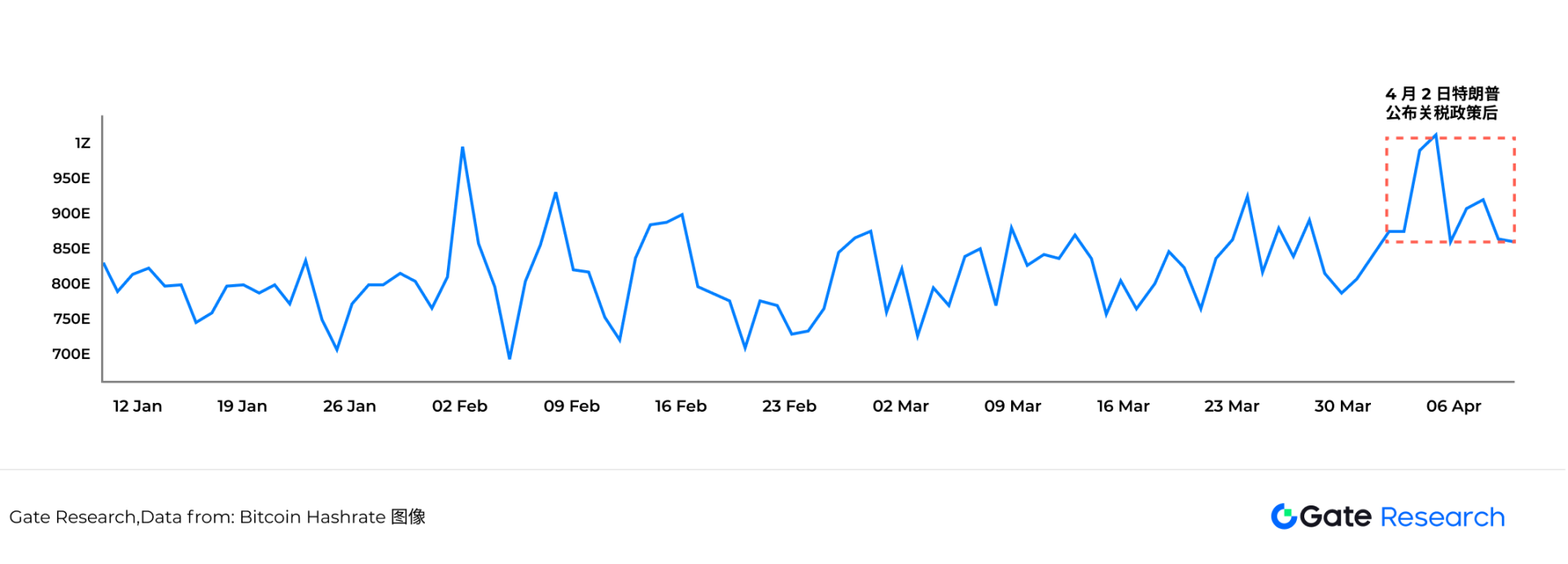

[The rest of the translation follows the same professional and accurate approach, maintaining technical terminology and preserving the original structure and meaning.]The income of cloud computing power companies is primarily driven by the total network hash rate. When the total network hash rate rises, it indicates that most miners still have a positive outlook on Bitcoin's future price, or more customers choose to purchase cloud computing power. When the total network hash rate declines, it means miners are pessimistic about Bitcoin's price trend, and the cloud computing power portion will also decrease. The data shows that after Trump announced the tariff policy on April 2, Bitcoin's daily average network hash rate even reached a historical high on April 5, breaking 1 ZH/s for the first time. [12]

Figure Two: Bitcoin Total Network Hash Rate Changes (January 2025 to April 2025)

From a cost perspective, although mining machine prices face upward pressure due to tariff policies, cloud computing power mining farms naturally have a risk buffer mechanism - essentially transferring mining machine procurement costs to customers through computing power service fees, and some customers directly share hardware investment through mining machine hosting agreements. This makes the impact of mining machine markup on platform profits significantly weaker compared to traditional mining models. This cost transfer and sharing characteristic makes cloud computing power mining farms less impacted under the Trump administration's tariff policies.

3. The Reshaping of Bitcoin Mining Landscape's Impact on Bitcoin Price

The recent US tariffs on imported Bitcoin mining equipment from China and other countries have significantly increased operating costs for US miners. This provides greater potential opportunities for non-US enterprises to enter the Bitcoin mining industry, as they can purchase Chinese-made mining machines at lower costs from other countries, thereby gaining a cost advantage. Although US mining farms can establish overseas operational bases to partially mitigate tariff impacts, it is undeniable that these tariff policies increase operational costs and policy risks for domestic US mining farms.

Based on the above reasoning, with daily Bitcoin production of 450 coins, Bitcoin miners will become more dispersed, and the discourse power of US mining companies like Marathon, Riot, and Cleanspark may decline. Since Marathon and other large mining enterprises previously adopted a hoarding strategy, while potential mining enterprises from other countries have unclear attitudes towards Bitcoin holding, they might choose a "mine-withdraw-sell" strategy. From this perspective, high tariff policies are generally negative for Bitcoin price trends. Some mining farms leaving the US also contradicts Trump's original intention of ensuring the remaining Bitcoin is "Made in America".

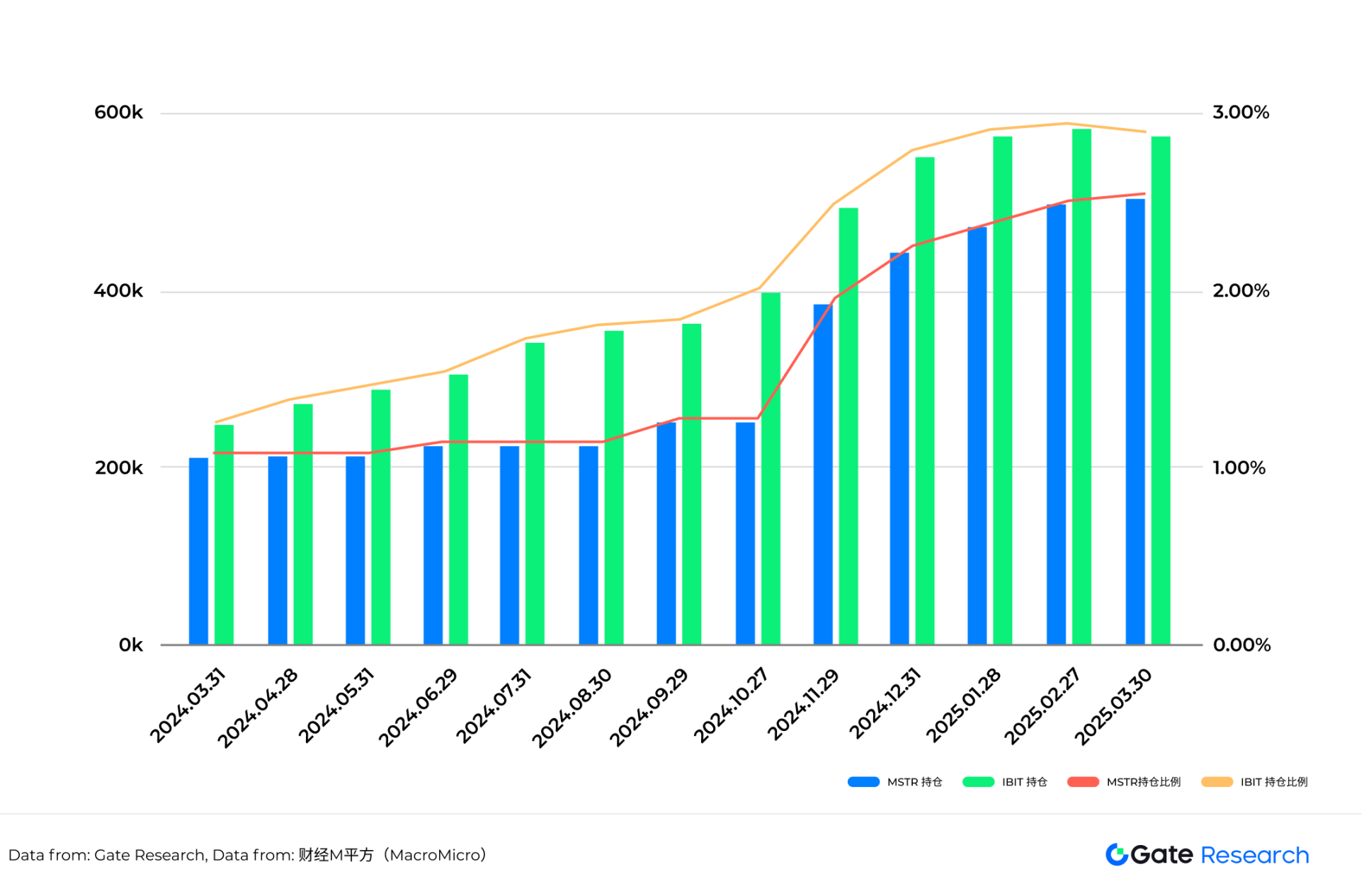

However, from a long-term perspective, Bitcoin's core logic fundamentally changed in 2024. Bitcoin spot ETF funds represented by BlackRock's IBIT and Bitcoin hoarding companies in US stocks represented by MicroStrategy still control Bitcoin's pricing power. As of April 2025, IBIT holds 570,983 Bitcoins [13], and MicroStrategy holds 528,185 Bitcoins [14]. Their Bitcoin holdings continue to increase as a proportion of total circulating Bitcoin [15], and their purchasing power is sufficient to absorb daily newly produced Bitcoin.

Table Five: MicroStrategy and IBIT's Bitcoin Holdings and Proportion

Conclusion

The Trump administration's "reciprocal tariff" policy poses dual challenges to the Bitcoin mining industry in terms of upstream costs and geographical layout. Manufacturing is under pressure due to limited supply chains and reduced demand, self-operated mining farms face dual squeezes of rising costs and capital expenditure, while cloud computing power mining farms have relatively better buffering capabilities through "risk transfer" mechanisms. Overall, North American mining expansion may be limited, with global computing power further dispersing to low-tariff regions like Southeast Asia and the Middle East, potentially causing a temporary decline in US mining enterprises' discourse power in the Bitcoin ecosystem.

Mining enterprises often involve massive investments, long cycles, and weak risk resistance; the Bitcoin network itself cannot actively adjust these risks, with its mechanism being "open, fair, competitive" rather than "defensive, responsive, regulatory". This creates a structural contradiction: the most decentralized global asset has an industrial chain most susceptible to centralized policy intervention. Therefore, mining participants must re-recognize the importance of policies. Bitcoin price is no longer the sole indicator; policy trends, geopolitical security, energy scheduling, and manufacturing stability are the true keys to mining survival.

In the short term, rising mining costs combined with some miners' "mine-withdraw-sell" behavior may marginally pressure Bitcoin prices. However, from a medium to long-term perspective, institutional forces represented by BlackRock's IBIT and MicroStrategy have become market leaders, and their continuous buying capacity is expected to offset supply pressures and stabilize market structure. The Bitcoin mining industry is at a critical period of policy reshaping and structural migration, and global investors need to closely monitor policy evolution and industry chain rebalancing caused by computing power migration.