As we enter the second quarter of 2025, the crypto market is experiencing a significant adjustment. Against the backdrop of increasing macroeconomic uncertainty, investor sentiment has turned defensive, with funds flowing towards high-market-cap assets like Bitcoin. Although the Altcoin market faces pressure, core infrastructure continues to strengthen, with on-chain fundamentals remaining robust, and institutional interest staying stable through ETF channels and platform development.

VX: TZ7971

Bitcoin Regains Dominance in a Safe-Haven Environment

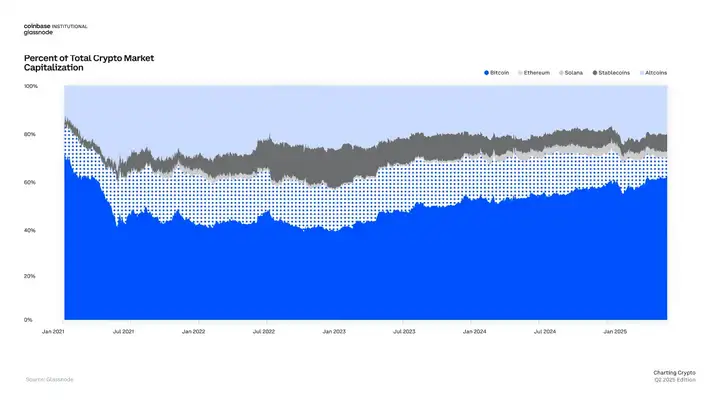

As investors shift towards high-credibility assets, Bitcoin's dominance rises to 63%, reaching its highest level since early 2021

During turbulent periods, capital moves towards perceivably high-quality assets - a trend from which Bitcoin benefits. Bitcoin currently occupies 63% of the total crypto market cap, the highest since early 2021. Meanwhile, Ethereum's share in the total cryptocurrency market cap has reduced over the past six months, while Solana's share has remained stable since early 2024.

Bitcoin's dominance reflects investors' preference for assets with the highest institutional accessibility and macroeconomic correlation. Despite price declines, long-term Bitcoin holders continue to accumulate, with reduced liquidity supply and a significant increase in at-loss held Bitcoin proving this point, indicating renewed confidence among strategic allocators.

Spot ETFs Remain Crucial to Market Structure

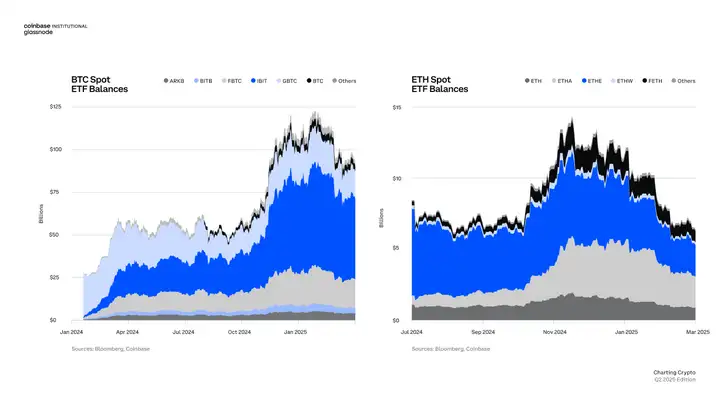

Despite recent fund outflows, Bitcoin and Ethereum ETFs maintain considerable holdings, indicating continued institutional investor interest

ETF fund flows remain a key indicator of institutional investor sentiment. In the first quarter, while Bitcoin and Ethereum spot ETF fund inflows were subdued, they persisted, with Bitcoin ETF total balance approaching $125 billion. Although futures market financing rates have decreased, signaling reduced speculative willingness, spot ETF activity reflects long-term position allocation.

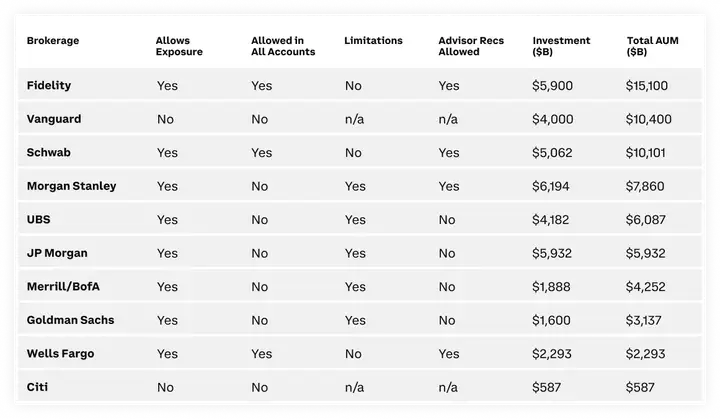

Major brokerages continue to restrict client Bitcoin ETF investments. If these platforms set a 2% Bitcoin allocation ratio, it would mean ETF net inflows 22 times those of 2024

Notably, investment restrictions by major brokerages suggest a potential demand wave if access limitations are relaxed.

Stablecoin supply and on-chain transaction volumes have reached historical highs, highlighting their increasingly important role in global digital payments.

As a core component of the crypto financial system, stablecoins continue to attract attention. After adjusting for inactive trading, stablecoin transaction volume hit a historical high last quarter. With continuously decreasing fees and expanding use cases (from remittances to corporate payments), stablecoins are poised to attract more institutional and retail investors in 2025, especially in high-inflation economies.

The crypto market may bottom out in the mid-to-late second quarter of 2025, laying the foundation for the third quarter's trend. Overall, the market will show oscillating trends in the short term, then rebound and set new highs in the second half of the year.

If the Federal Reserve ends quantitative tightening, it will increase global liquidity and support the crypto market. Similarly, if the EU or medium-sized major economies introduce more global fiscal stimulus measures, it could increase M2 money supply and boost available market capital.

The only concern is that further trade uncertainty might prolong market negative sentiment, and global shocks could further reduce liquidity.

Today's fear index is 60, with the market turning greedy.

Yesterday's market twice pulled back from 93,000 and was lifted, a key position that supported Bitcoin's record high rally in January this year. Currently, Bitcoin is seeing increasing new buying pressure, with MicroStrategy continuously buying, and more institutions following suit, along with national team entry, which will bring continuous buying. 100,000 is just around the corner. Short-term traders can sell between 95,000-100,000, waiting for an emotional release pullback. With many data releases this week, take profits when appropriate. Long-term holders can stay calm, riding with institutions without fear, and patiently await the bull market.