Digital asset funds record $3.4 billion capital inflow in a week, the third-highest level in history, with Bitcoin and Ethereum leading the trend.

According to the report on the latest capital flows from CoinShares, digital asset investment products recorded a strong capital inflow of $3.4 billion in the past week, marking the third-largest capital inflow in history. This increase occurs as investors increasingly view cryptocurrencies as a safe haven amid prolonged concerns about trade policies and escalating trade tensions.

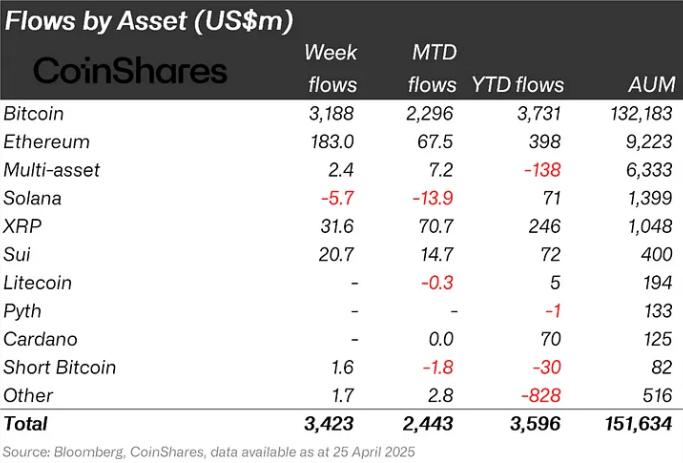

Investment products related to Bitcoin dominated, attracting $3.18 billion in capital inflow, helping the total Assets under Management (AUM) of the entire digital asset market return to $132 billion, a level not seen since February 2025.

Ethereum's Recovery and Market Trends

Ethereum also saw a strong recovery, attracting $183 million in capital inflow, ending eight consecutive weeks of capital outflows. Meanwhile, the altcoin market remained largely quiet, with a few notable exceptions.

Solana went against the positive market trend with $5.7 million in capital outflow. In contrast, XRP and Sui recorded significant capital inflows, reaching $31.6 million and $20.7 million respectively.

Geographically, the digital asset capital flow growth was primarily led by U.S. investors, contributing $3.3 billion, with significant support from Germany and Switzerland.

Blockchain technology stocks also had a positive trading week, recording $17.4 million in capital inflow, mainly focused on Bitcoin mining ETFs.

This strong shift into digital assets reflects the growing demand for alternative assets in the context of continuing macroeconomic uncertainty, especially as trade tensions and concerns about trade policies put pressure on traditional markets.