I. Market Status: SOL Price Pullback with Solid Support

From April 29 to 30, Solana (SOL) price dropped 4%, failing to hold the critical $150 level. However, the $140 support level has remained unbroken for a week, the first time since mid-February, indicating relatively optimistic market sentiment. As of the latest data, SOL is priced at $148.37, with traders closely watching its potential to break through the $200 mark.

II. Futures Market Signals: Surge in Open Interest, Institutional Interest Rises

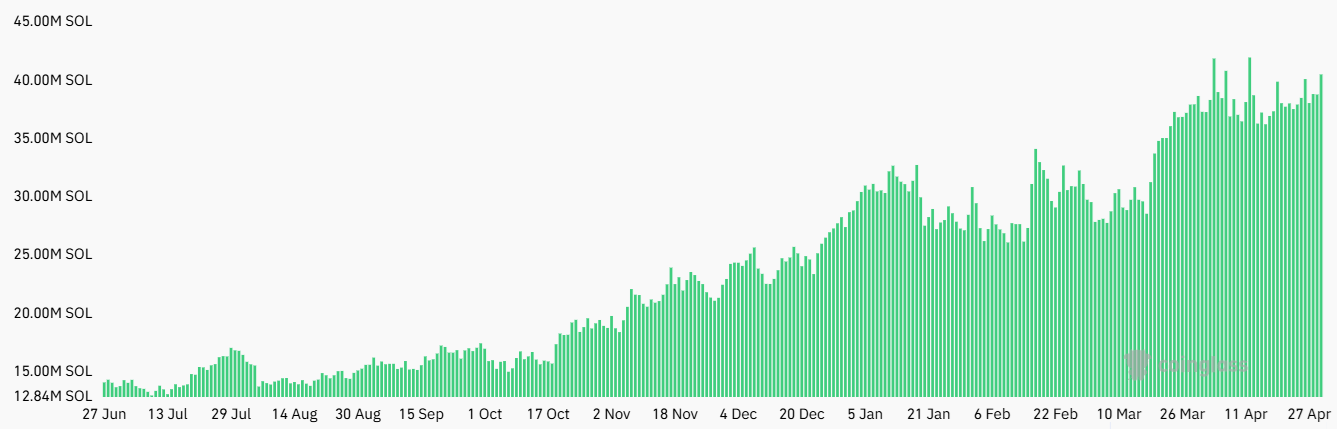

Solana Futures Total Open Interest SOL.

Solana Futures Total Open Interest SOL.

On April 30, SOL futures open interest surged to 40.5 million (approximately $5.75 billion), a 5% increase, approaching the historical peak. This scale ranks third in the cryptocurrency derivatives market, over 50% higher than XRP futures positions. Such a massive position typically indicates institutional investors are increasing their layout, significantly enhancing market liquidity.

However, increased open interest does not necessarily mean a bullish signal. As futures market long and short positions are always matched, rising positions only represent increased trading activity, not unilateral bullishness. To judge the true market sentiment, key indicators like funding rates need to be considered.

III. Funding Rates Reveal Short Dominance, Short-term Pullback Risk Exists

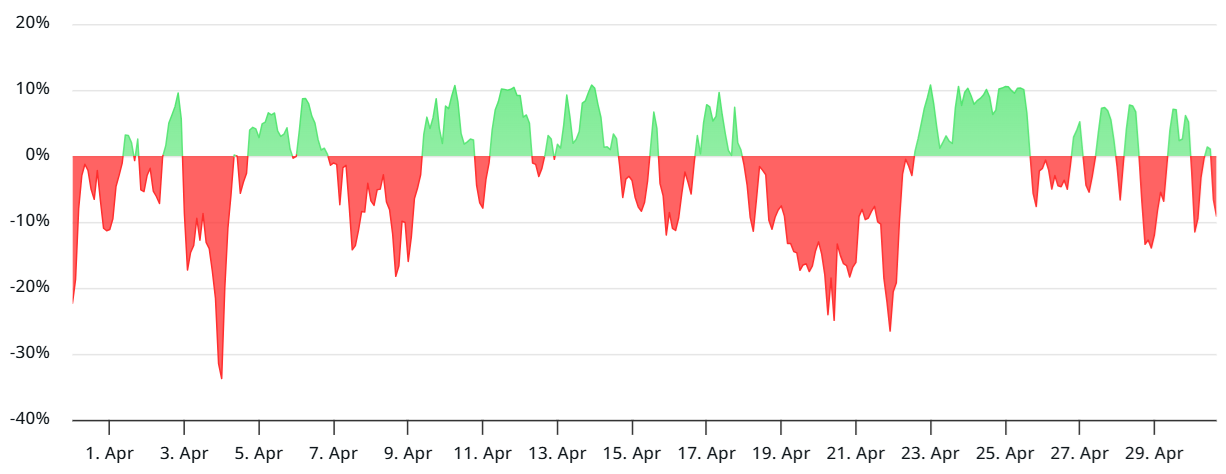

SOL Perpetual Futures 8-hour Funding Rate. Source: Laevitas.ch

SOL Perpetual Futures 8-hour Funding Rate. Source: Laevitas.ch

Currently, SOL perpetual contract funding rates are negative, indicating stronger short position demand. This phenomenon began on April 25 when SOL failed to break the $156 resistance, followed by cooling market sentiment. Additionally, SOL has accumulated a 43% increase from April 8 to 29, with some profit-taking potentially choosing to short at high levels, leading to weakened leveraged long demand.

IV. Is the $200 Target Realistic? Historical Performance and Ecosystem Support

Although the $200 target seems aggressive, SOL touched $195 in mid-February when its decentralized application (DApp) count had already dropped 80% from the January peak. This indicates that SOL's price drivers are not solely dependent on DApp ecology, but also include market liquidity and speculative demand.

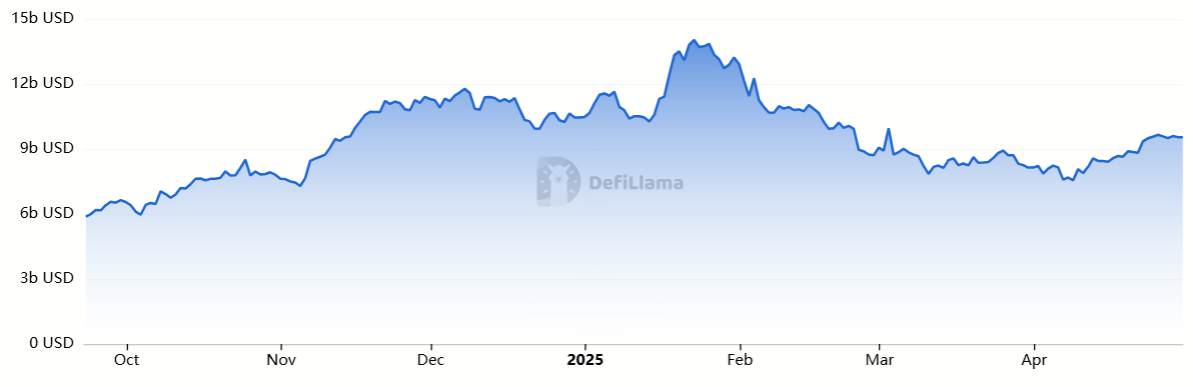

Total Locked Value (TVL) on Solana Network, in USD. Source: defillama

Despite criticism for meme coin dependence, Solana's ecosystem value far exceeds speculation. According to defillama, Solana's Total Locked Value (TVL) reaches $9.5 billion, covering liquid staking, lending protocols, automated market makers (AMM), and more. Moreover, top DApps like Meteora, Pump.fun, and Juto have weekly fee revenues exceeding $10 million, demonstrating strong profitability.

V. DEX Trading Volume Explodes, Solana Challenges Ethereum's Dominance

Since April 14, despite Ethereum's base layer transaction fees remaining below $0.65, Solana's decentralized exchange (DEX) trading volume has grown nearly 90% against the trend.

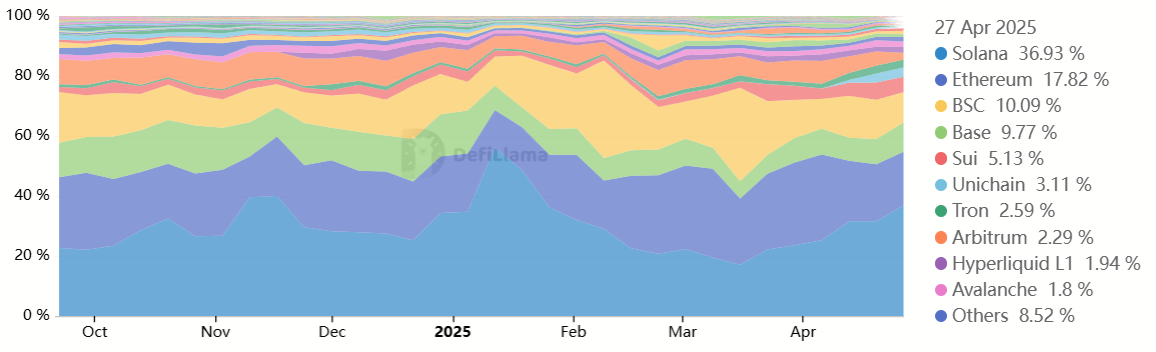

Decentralized Exchange Trading Volume and 7-day Market Share. Source: defillama

Decentralized Exchange Trading Volume and 7-day Market Share. Source: defillama

In the past week, Solana DEX total trading volume reached $21.6 billion, even surpassing the entire Ethereum Layer-2 ecosystem. Among them:

- Raydium trading volume increased 87% week-on-week

- Meteora grew 58%

This trend indicates that Solana has significant advantages in trading efficiency and cost, attracting a large number of users to migrate.

VI. Potential Catalyst: Solana Spot ETF Approval Expectation

From a policy perspective, SOL may receive a major positive boost. The market widely expects the U.S. Securities and Exchange Commission (SEC) to approve the Solana spot ETF before October 10, with analysts giving a 90% probability of approval. If realized, massive institutional capital inflow could push SOL to break its historical high.

Additionally, continuous innovation in the Solana ecosystem (such as Firedancer upgrade) and increasing retail attraction provide fundamental support for price appreciation. Even with short-term weakened leveraged long demand, SOL may gradually rise based on improved on-chain data.

VII. Technical Analysis: Key Resistance and Support Levels

- Resistance Levels: $156 (recent high), $170 (psychological level), $200 (long-term target)

- Support Levels: $140 (short-term strong support), $130 (medium-term defense line)

If SOL can stabilize at $150 and break through $156, upward momentum will further strengthen; conversely, if it falls below $140, a deeper pullback may occur.

VIII. Conclusion: Short-term Volatility, Long-term Bullish

In summary, SOL is currently at a critical stage of long-short game:

- Short-term: Negative funding rates show short dominance, price may continue consolidation;

- Medium-term: DEX trading volume growth, stable TVL, and ETF expectations provide strong support;

- Long-term: If breaking $200, SOL may initiate a new bull market cycle.

Investors should closely monitor funding rate changes, ETF progress, and Bitcoin market trends to capture the best entry timing.