The U.S. Bureau of Economic Analysis (BEA) has released the PCE and GDP report for the first quarter of 2025 today. Although inflation is lower than expected, U.S. GDP has declined before the tariffs take effect, raising concerns about an economic recession.

Despite these unfavorable signals, Bitcoin remains stable, even reaching a new All-Time-High in Argentina. This reinforces the view that BTC is a safe haven during economic turmoil.

Trump's Tariffs Could Cause Recession

The global economy is extremely complex, full of seemingly contradictory signals. Since Trump's tariff plan began to take effect, concerns about a U.S. recession have overshadowed the market. However, when BEA released the Q1 2025 PCE report this morning, it brought relief to some sectors.

"Personal income increased by $116.8 billion (0.5% at a monthly rate) in March, as estimated today by [BEA]. The increase in current personal income in March primarily reflects increases in wages and proprietors' income," the report stated.

At first glance, this data looks very encouraging. The PCE (personal consumption expenditures) report is the Federal Reserve's preferred tool for measuring inflation, and it is full of reassuring points.

The core PCE price index (YoY) for March was 2.6%, the lowest since June 2024, and the MoM index was at its lowest since April 2020. In other words, the dollar still has spending value.

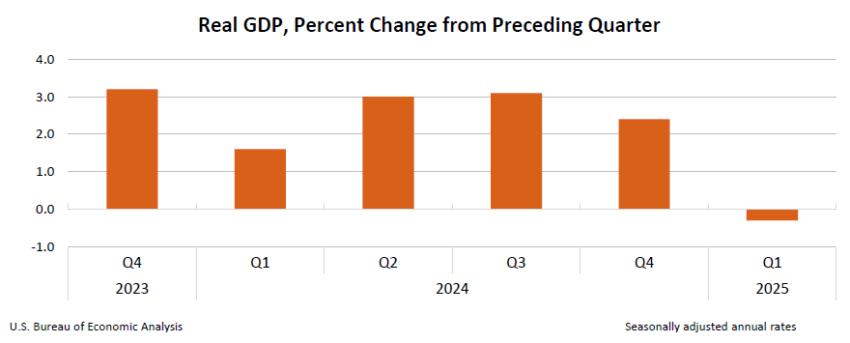

However, BEA also released the GDP report today. Although the tariffs seem not to have affected inflation, a recession occurs after two consecutive quarters of negative GDP growth. The U.S. officially experienced a first quarter, and this report only relates to pre-tariff data:

Recession index before tariffs. Source: BEA

Recession index before tariffs. Source: BEACNN assumes that inflation figures have been artificially pushed up by tariffs. Specifically, U.S. consumers may have purchased more goods in anticipation that they would become more expensive. This systematic behavior would distort typical inflation tracking indicators.

How will these statistics affect the crypto industry? Simply put, Bitcoin is not acting as if the tariffs are about to cause a recession. In fact, it maintains its value, trading above $94,000.

Analysts have wondered whether BTC is a safe haven during economic turmoil, and recent data suggests it may benefit from trade disruption.

Bitcoin also reached an All-Time-High in Argentina, surpassing 110 million ARS per BTC. This surge is likely due to the significant depreciation of the Argentine peso, which is trading near 1,165 per U.S. dollar in the official market.

These developments suggest that Bitcoin can successfully function as a hedge against economic instability.

Ultimately, these statements are still speculative. The tariffs may or may not cause a U.S. recession, which will truly test Bitcoin's status as a safe haven. From today's perspective, at least, this hypothesis seems plausible.