This article is machine translated

Show original

⚠️ Exposing the Market Maker Scandal of Movement that Forced Binance to Intervene! 🔎

1/ Initial Prospects

2/ Secret Contract

3/ Sudden Change

4/ Selloff that Prompted Binance Intervention

5/ Unsuccessful Recovery Efforts

6/ Anonymous Individual with Authority twitter.com/gm_upside/status/1...

2025/04/30 22:43 :

💯 Jeff Yan - From Zero to a $20 Billion Hyperliquid Empire That Even Binance Fears!

How Did Jeff Build Hyperliquid Worth $20 Billion from a Physics-Loving Boy?

1/ From Harvard to Wall Street

2/ Chameleon Trading

3/ Hyperliquid at <twitter.com/gm_upside/status/1...>

1/ A promising start

In 2024, two 22-year-olds, Rushi Manche and Cooper Scanlon, dropped out of Vanderbilt University to found Movement Labs, a layer-2 blockchain project that aims to extend Ethereum using the Move programming language – which was Capital by

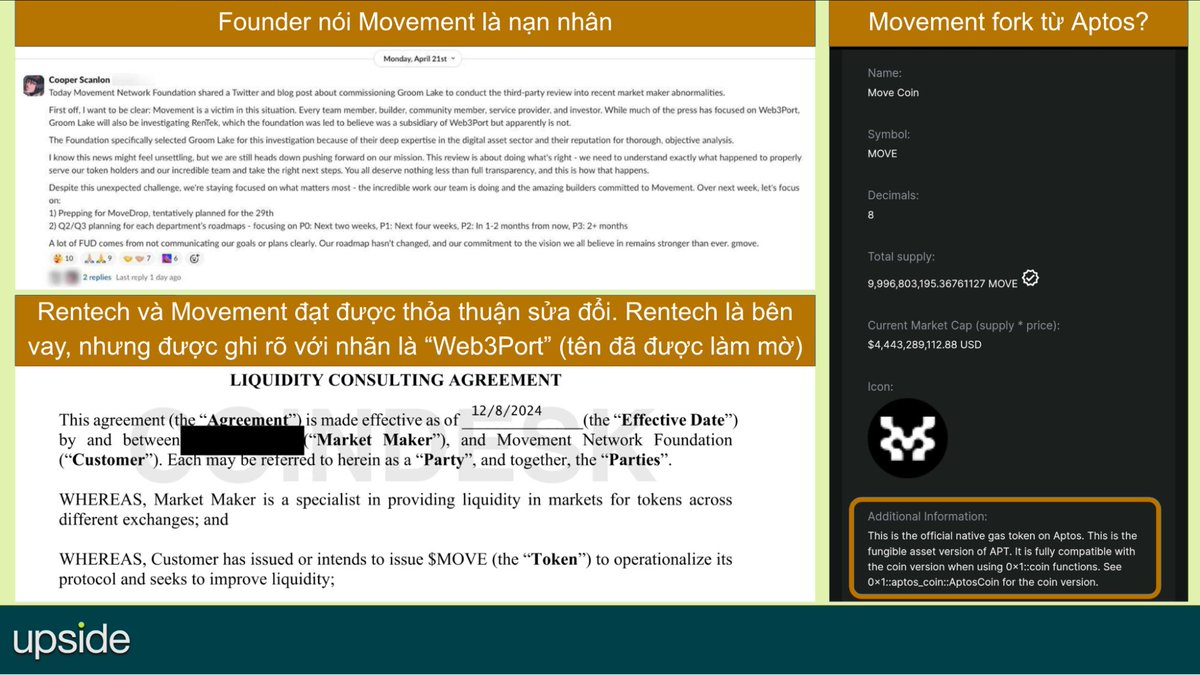

2/ Implicit Contracts & Risk Warnings

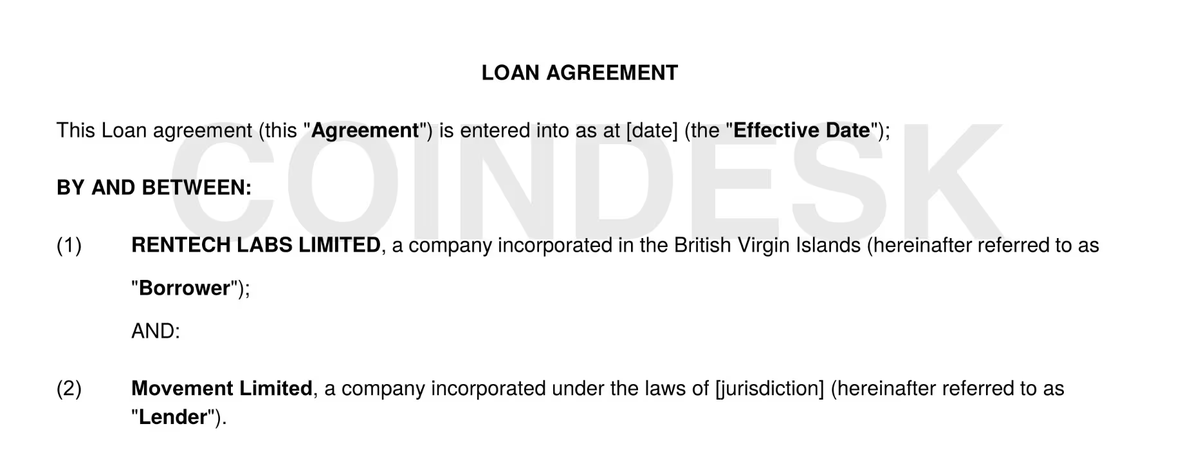

On November 25, 2024, Rentech (founded by Galen Law-Kun in Singapore) signed a market-making contract with Web3Port, claiming to be a representative of Movement.

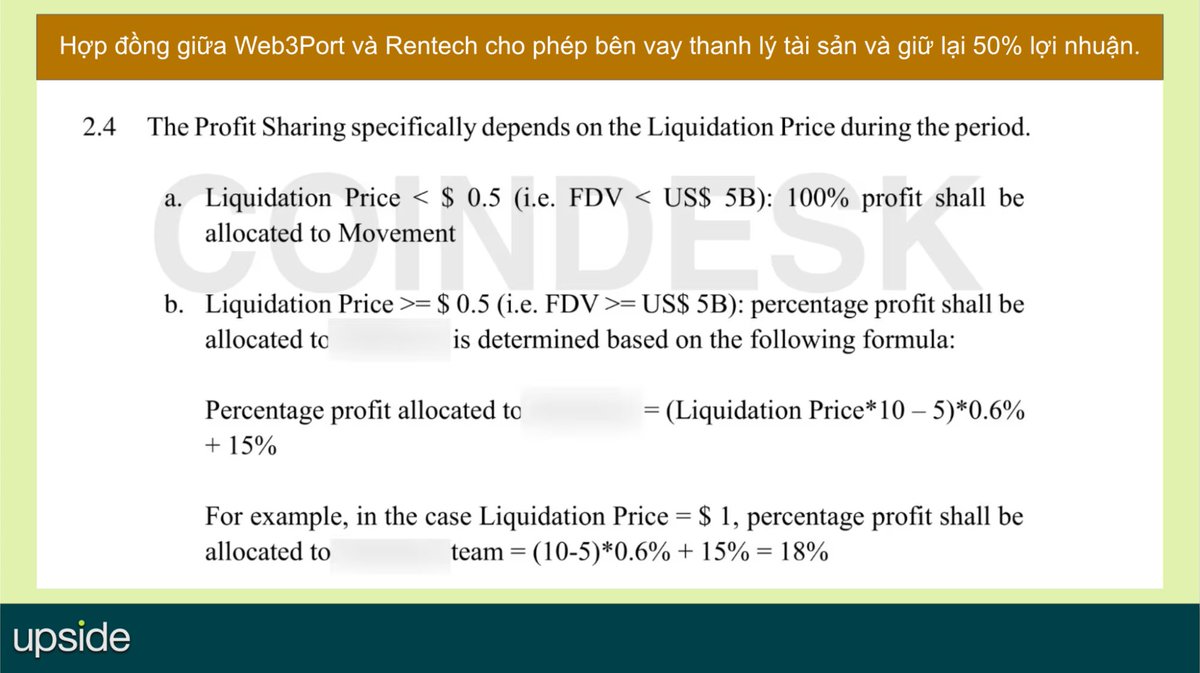

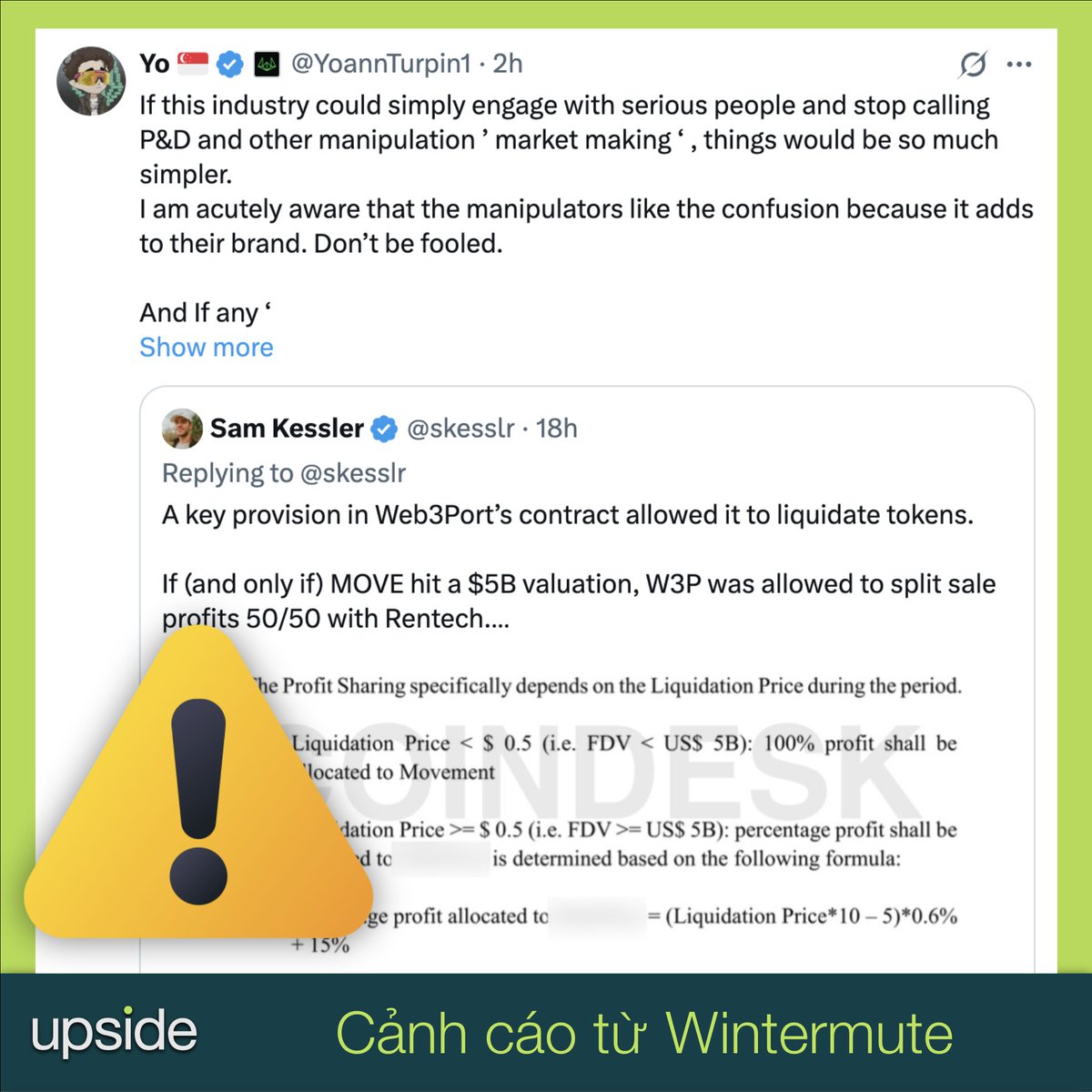

⛔ They allow Web3Port to Token Sale and Chia 50% of the profits if FDV exceeds

3/ The sudden change and the contract signed

Despite the initial rejection, Rentech did not give up.

They continued to negotiate, and to reassure the Movement Foundation, they declared themselves a subsidiary of Web3Port, and pledged to deposit $60 million as collateral.

(1 second advertisement😆)

If the article is useful, I hope you guys support @gm_upside with a follow & retweet 😍

🛫 There is no shortage of good articles, just comment:

"Help me analyze project ABC, trend XYZ,..." and Upside will post it right away ✍️

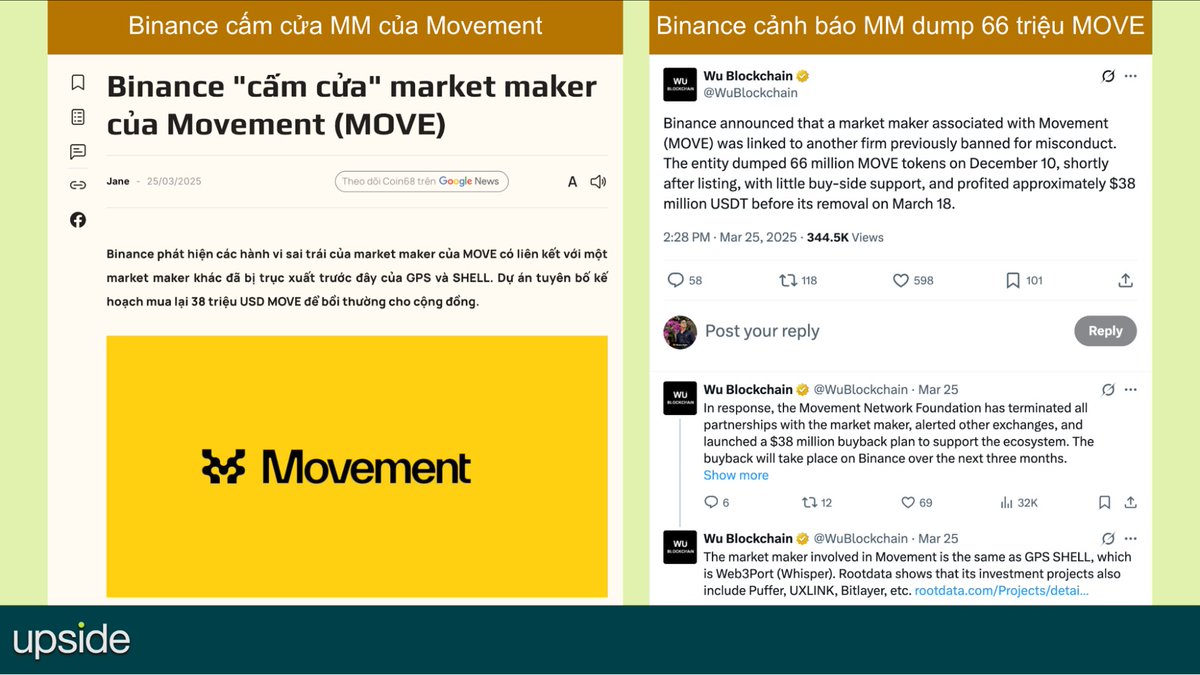

4/ The sell-off forced Binance to intervene

On December 9, 2024, $MOVE officially listed on exchanges, including #Binance.

But the next day, December 10, 2024, @Web3Port_Labs suddenly dumped 66 million MOVE Token , worth $38 million. The Token price immediately plummeted.

5/ Consequences & Unsuccessful remedial efforts

The sell-off had dire consequences.

By April 2025, $MOVE has dumped 80% from ATH, FDV is still at 2.2 billion USD!

MOVE's on-chain operations are nearly paralyzed: volume on the Decentralized Exchange is only 1.44

6/ Internal Conflict & Anonymous People Have Real Power!

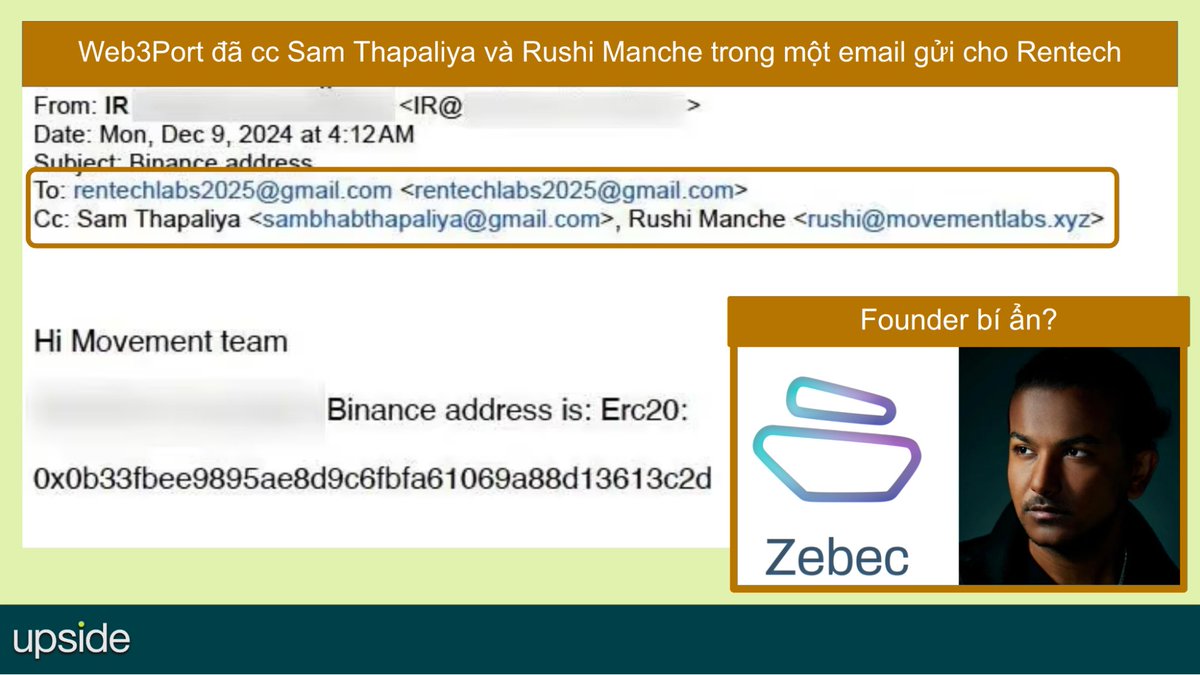

The scandal exposed internal rifts within Movement Labs. Rushi Manche, a 22-year-old co-founder, sent the Rentech contract to the Foundation via Telegram on March 28, 2025, but was suspended in April 2025 and declared

7/ The ambiguous relationship with Rentech

Rentech - the center of the scandal is a mysterious company. Galen Law-Kun, the founder of Rentech, claims that it is a branch of Autonomy - a financial services company in Singapore with the purpose of connecting crypto projects with

✍️ The Token scandal $MOVE is not only an indelible scar for Movement, but also a wake-up call for crypto investors about loopholes in governance and transparency.

Yoann Turpin, co-founder of Wintermute, believes that the crypto industry often uses the term

You can read the article about manipulation below 👇

How Dogecoin is manipulated by sharks?

x.com/gm_upside/status/1894776...

In the next article, I will Chia more about the topic of OTC trading funds. If you support me, please comment +1 for me @jackvi810 🥰

x.com/gm_upside/status/1917819...

Hope you guys support @gm_upside with a like & retweet😍

Don't forget MewDrop $5,400 👇

x.com/gm_upside/status/1915663...

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content