🧵 Some names are already present in institutional blueprints.

Not hypothetically - structurally.

@Axelar is one of them.

The battle is already underway - not for users, but for control over capital flows.

Axelar is not a bystander; it’s embedded in the infrastructure where institutions tokenize registries and securities.

As @sergey_nog, Axelar co-founder, highlights, in a world moving toward twitter.com/118449677397017395...

and @bakermckenzie state it clearly:

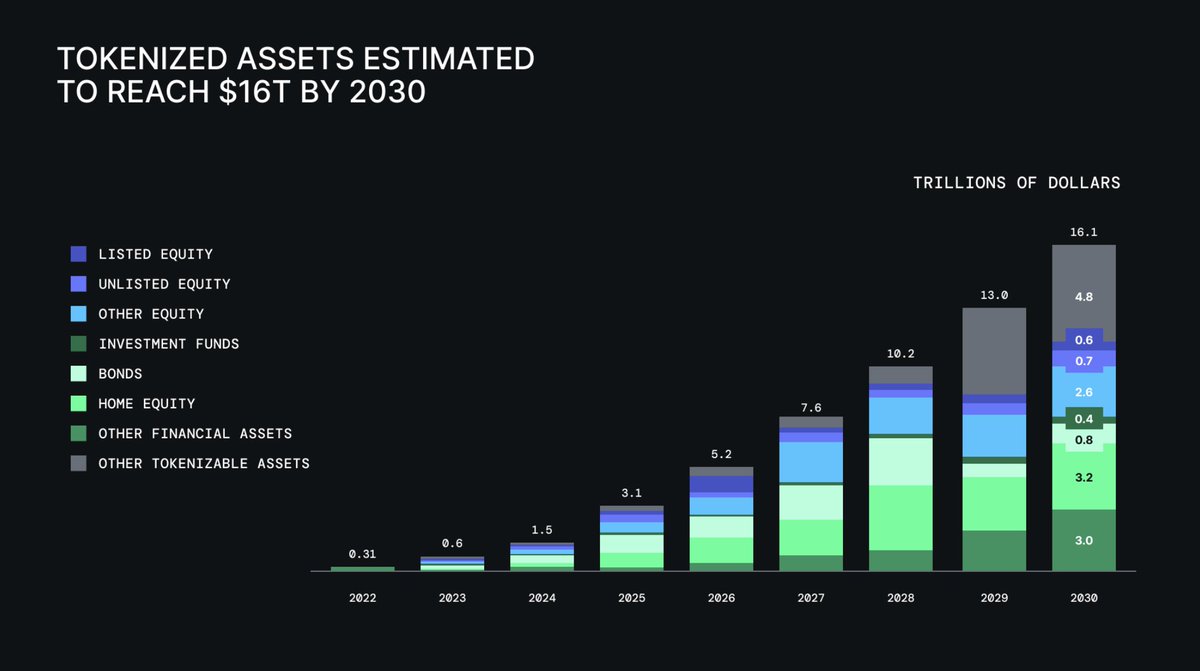

Tokenization is on the horizon.

Without interoperability, it cannot succeed.

Proven solutions already exist.

Axelar is mentioned specifically - not as a startup, but as an operational layer between public and private chains. twitter.com/132198224840145715...

What stands out to me is how financial assets are becoming programmable at the core - not just wrapped.

Legal analysts compare this architecture to internet routers.

However, instead of routing data packets, it manages capital, obligations, and collateral.

Infrastructure is just one layer of the contest.

@Ripple and @BCG highlight the second layer: those who enable connectivity between these new systems will control the flow of liquidity.

Their report clearly states:

The winners will be the most connected. twitter.com/132198224840145715...

Today, tokenization functions independently. Each bank has its own stack, rules, and bridges, which hinders liquidity.

Transferring a token between systems is still a challenge. Axelar tackles this issue at the network level, not just at the interface.

Interestingly, tokenization isn't shifting toward hyper-decentralization. Instead, it's developing through coordinated architecture involving banks, funds, and infrastructure providers.

Axelar plays a crucial role in this vision.

It participates in DAMA-level projects and

Ripple and BCG outline a three-phase adoption model. We're currently in phase two: institutional expansion.

Banks are transitioning from pilot projects to live platforms.

> private assets

> stablecoins

> credit

> collateral are all being tokenized.

However, without shared

Axelar connects over 75 networks at the consensus layer, not just through APIs.

This connectivity is crucial for delivery-versus-payment, collateralization, market-making, and funding.

Without it, real markets can't function.

Tokenization is no longer a concept of the future.

It's a competition for architecture, standards, rails, and control over who sees, moves, and services assets.

If you observe the progression of institutional initiatives, one thing becomes clear: the real struggle is about connectivity, architectural positioning, and control over transitions.

That’s why I stopped tracking the loudest names and started paying attention to those already

Road to 1,000,000 chains?

@belizardd @0xDefiLeo @lenioneall @Haylesdefi @alphabatcher @Mars_DeFi @thelearningpill @0xAndrewMoh @kenodnb @DOLAK1NG @0xHvdes @DeRonin_ @cryppinfluence @eli5_defi @RubiksWeb3hub @the_smart_ape @AlphaFrog13 @0xJok9r @BringMeCoins @0x99Gohan

I hope you've found this thread helpful.

Follow me @splinter0n for more.

Like/Retweet the first tweet below if you can. twitter.com/315021946/status/1...

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content