You probably wrote off Sei after that airdrop. I did too.

But now they’re about to launch the first-ever staking ETF.

Something’s clearly changed. Here’s the story 🧵

1/

In 2023, @SeiNetwork launched one of the most anticipated L1s and botched the airdrop so badly they trended as #SeiScam.

Broken criteria. Clunky claims. Token dump.

The community turned on them fast.

2/

Then they did the rarest thing in crypto.

They fixed it.

New allocation rules. Faster chain (Sei v2).

Real builder outreach. Loyal community

And somehow, slowly, price started climbing again.

3/

But what just happened took me (and many) by surprise.

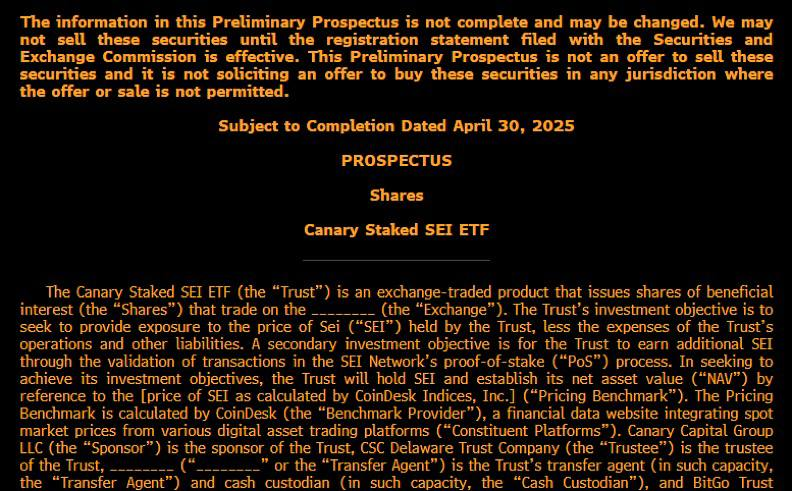

Canary Capital filed an S-1 for the first-ever staking ETF on Sei.

Yes, ETF. On staking. On a chain many thought was dead.

4/

This ETF, if approved, gives TradFi exposure to staking rewards with custody handled by Coinbase and BitGo.

No wallets. No bridges. No crypto UX pain.

Just yield, through a ticker.

5/

For Sei, this changes everything.

ETF = institutional narrative

staking = yield

turnaround = strong comeback story

Suddenly, they have the tech, the asset, and now the meme.

6/

Most people sold the bottom and muted the word “Sei” months ago.

Now we’re here.

You can fade it again. Or pay attention this time.

7/

btw, almost 10% price growth after news.

$2.22B FDV. 🤷♂️

I hope you've found this thread helpful.

Follow me @AlphaFrog13, I'll keep you updated.

Like/Retweet the first tweet below if you can: twitter.com/151494177222446694...

My bros:

@Mr_Lumus

@0xJok9r

@TweetByGerald

@0xDefiLeo

@cryppinfluence

@belizardd

@the_smart_ape

@DeRonin_

@dealerdefi

@splinter0n

@Haylesdefi

@0xAndrewMoh

@Defie_Warhol

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content