After Binance's delisting announcement, Alpaca Finance (ALPACA) experienced an astonishing price surge of up to four digits in the past week.

This counterintuitive market behavior sparked heated discussions among analysts and traders. Many experts believe this could be a market manipulation case.

Why did ALPACA's price surge despite being delisted by Binance?

Typically, listing on Binance is a positive signal for tokens, usually pushing prices higher by enhancing visibility and liquidity. However, recent trends suggest a reversal of this model.

On 24/04/2025, Binance announced the delisting of four tokens, including ALPACA. While the value of other tokens declined, ALPACA's price skyrocketed. Data from BeInCrypto shows the token increased over 1,000% in the past seven days.

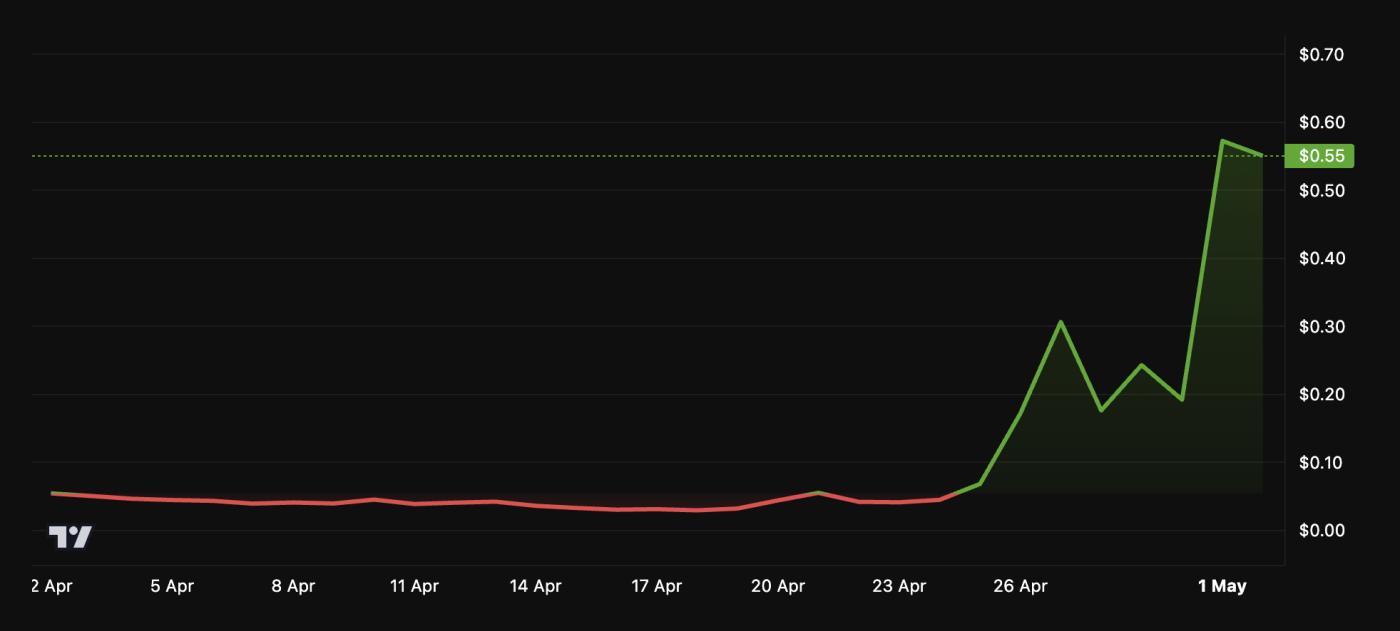

However, the surge seems to have slowed as ALPACA approached its delisting date on 02/05/2025. In the past day, its value dropped 34.5%. At the time of writing, it was trading at 0.55 USD.

ALPACA Price Performance. Source: BeInCrypto

ALPACA Price Performance. Source: BeInCryptoNevertheless, ALPACA's unusual price increase attracted market observers' attention.

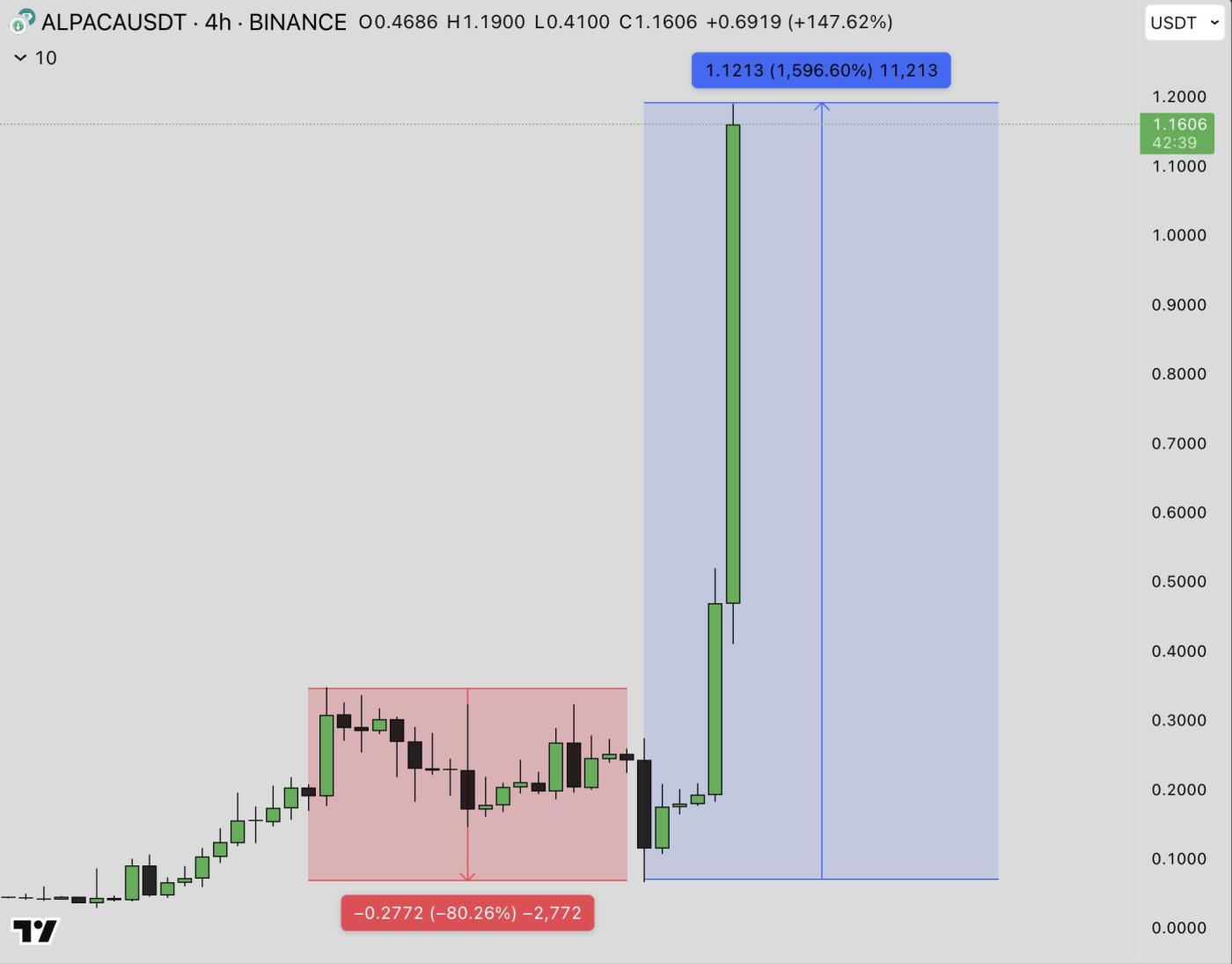

"ALPACA is the worst crypto manipulation I've seen recently. How can you pump a token from 0.02 to 0.3 then sell down to 0.07 and pump from 0.07 to 1.27 then down to 0.3," a user wrote.

Analyst Budhil Vyas called this a "typical liquidation hunt." He explained that large market players, or whales, initially pushed the price down 80%, causing panic and liquidation. Then, just two hours before the delisting deadline, they quickly pumped the price 15 times.

ALPACA Price Manipulation. Source: X/BudhilVyas

ALPACA Price Manipulation. Source: X/BudhilVyasVyas believes this was a strategic move to drain liquidity from the market, with whales desperately trying to secure their positions before the asset is removed from the exchange. He emphasized that no real accumulation was occurring.

The analyst stated that this price surge was entirely tactical, designed to drain any remaining liquidity in the market.

"This is crypto in 2025. Be cautious," Vyas warned.

Meanwhile, Johannes also provided a detailed analysis of the mechanism behind such price manipulations. In his latest X (formerly Twitter) post, he explained how sophisticated parties exploit low liquidity following delisting announcements.

This strategy involves capturing a large portion of the token's supply. Traders place large positions in perpetual futures contracts, betting on the token's price increase, as these contracts have higher liquidity compared to spot markets.

They then buy tokens in the spot market, increasing demand and price. With most of the supply controlled, selling pressure decreases, allowing prices to surge.

Once delisting occurs, perpetual futures positions must close with minimal slippage, enabling traders to lock in significant profits.

DeFi analyst Ignas also commented on the situation. According to him, this pattern has been observed previously, especially in delisting announcements on the Korean exchange Upbit.

In fact, he noted that delisting announcements have received similar, if not more, attention from speculators as new domestic listings.

"A delisting window requires deposit closures, so with restricted flows of new tokens, speculators pump prices to get a final thrill before inevitable price drops," he wrote.

Ignas cited Bitcoin Gold (BTG) as an example. The altcoin's price increased 112% after Upbit's delisting announcement, demonstrating that such price pumping continues to occur.

These cases have sparked debate about whether the "pump → delisting" model is becoming a new trend. As the crypto market matures, these manipulation tactics emphasize the urgent need for more rigorous research, vigilance, and regulatory oversight to protect investors from predatory strategies.