HBAR has seen a notable growth in recent days, showing signs of recovery after significant losses recorded in March. If this momentum continues, this cryptocurrency could soon return, potentially pushing prices higher.

The positive development of HBAR in April brings hope that it can avoid repeating previous sharp declines, opening up opportunities for sustainable growth in the coming weeks.

Hedera is observing a strong price momentum

The Relative Strength Index (RSI) of HBAR is currently above the neutral 50.0 level, indicating a positive market sentiment. This is often considered a bullish signal. However, previous cases show that HBAR has undergone corrections after a strong RSI increase, due to significant price volatility.

However, this time, market volatility seems much lower, suggesting that HBAR's current upward momentum is more natural. If the RSI remains stable in the positive zone, it could signal a more sustainable increase for this cryptocurrency.

HBAR RSI. Source: TradingView

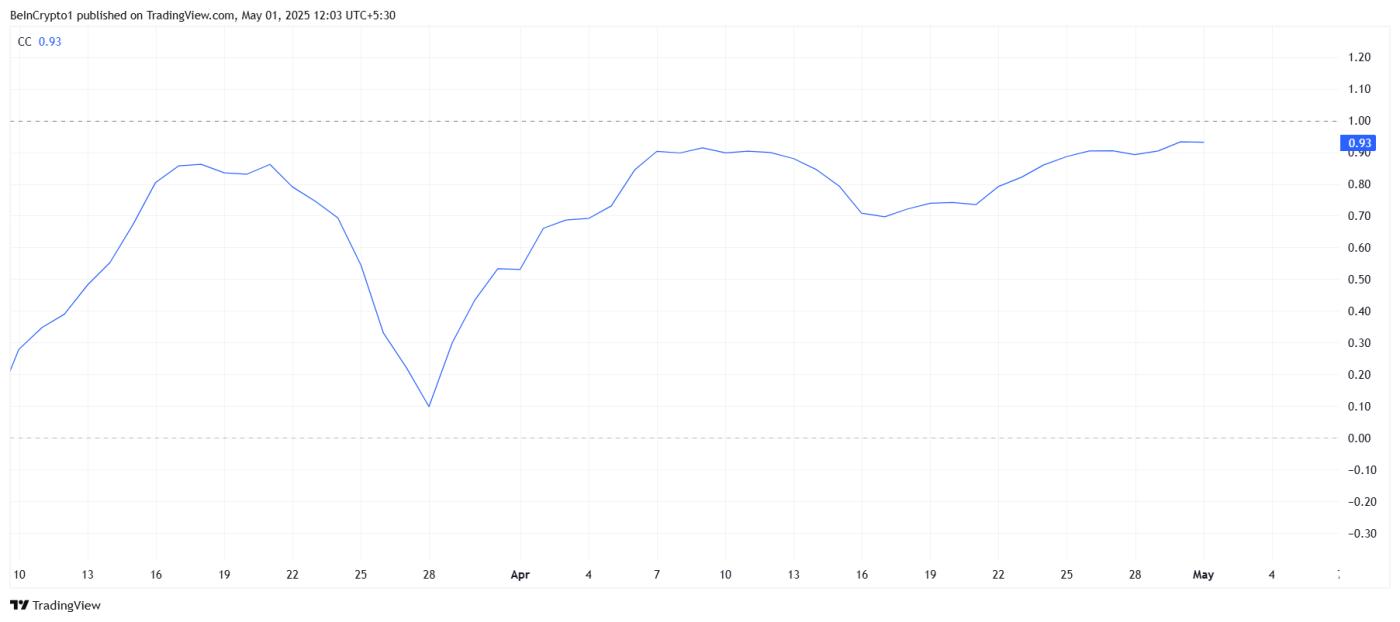

HBAR RSI. Source: TradingViewHBAR's performance also seems closely tied to Bitcoin's price action, with a strong correlation of 0.93 between the two currencies. As Bitcoin continues to rise, currently approaching $95,000, HBAR is likely to follow.

With Bitcoin's strong position in the market, any further growth for this leading cryptocurrency is likely to spread to altcoins like HBAR. If Bitcoin continues its price increase, surpassing important resistance levels, HBAR could see similar gains, driven by overall market optimism and positive influence from BTC.

HBAR Correlation to Bitcoin. Source: TradingView

HBAR Correlation to Bitcoin. Source: TradingViewHBAR price is approaching an important resistance level

Throughout April, HBAR has maintained an upward trend, which is crucial for recovery from the 43% decline seen in March. Price action in April will be a key factor for HBAR as it seeks to regain its lost position. Maintaining this upward trajectory is essential for the altcoin to recover and build on its current momentum.

Currently trading at $0.183, HBAR is aiming to break through the important resistance level of $0.200. This level represents a psychological barrier for investors, and successfully converting it into support could trigger further price increases. If this occurs, HBAR could rise to $0.222 as investor confidence is reinforced and more market participants join in.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingViewHowever, if HBAR cannot break through the $0.200 mark, it may face a drop to $0.167. If this happens, additional selling pressure from investors looking to minimize losses could push the price down to $0.154. This decline would invalidate the short-term price increase prospects, potentially leading to larger losses if market sentiment turns negative.