While the broader cryptoasset market faced challenges in finding direction in April, VIRTUAL went against the trend to record a significant increase. This altcoin increased by 183% in the past month, standing out as one of the few tokens to record a substantial increase in a relatively inactive market.

VIRTUAL increased by 22% in the past 24 hours, becoming the best-performing cryptoasset today. It is continuing its upward momentum, especially with increasing institutional interest.

Smart Money Drives VIRTUAL's Price Surge

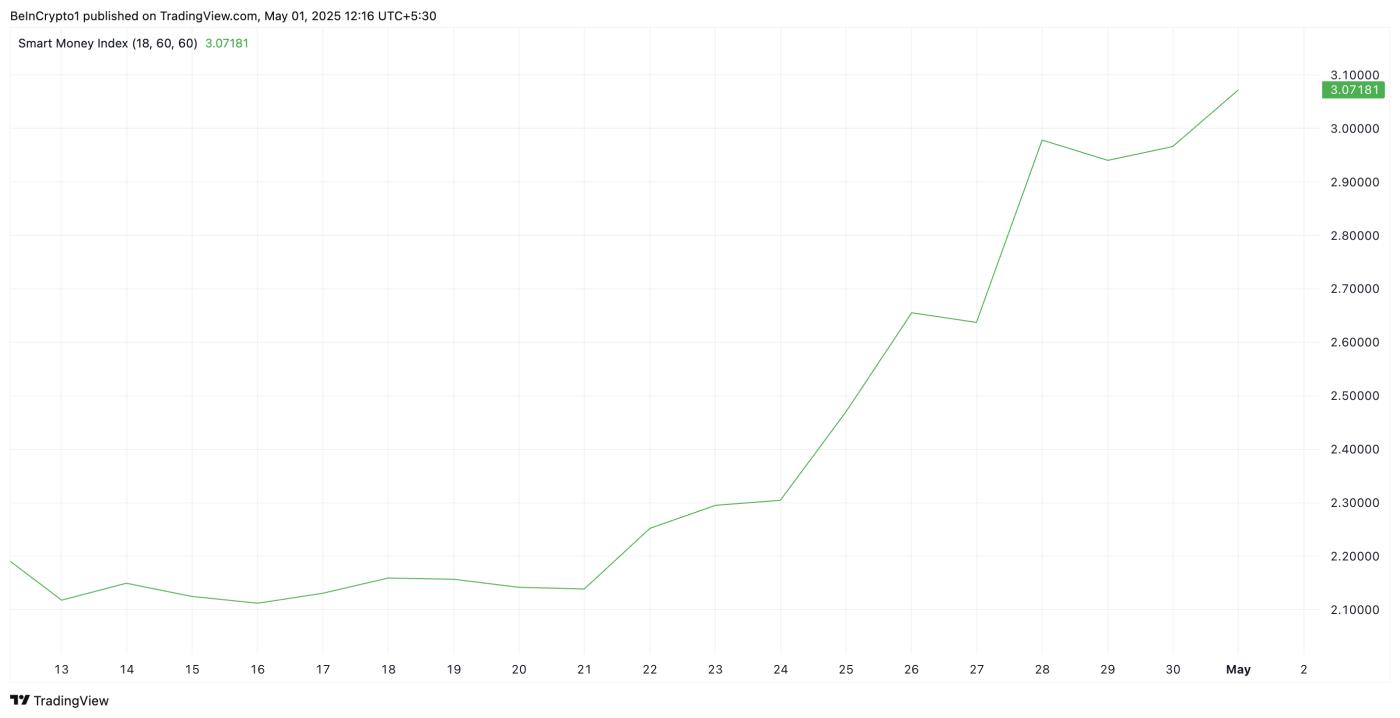

VIRTUAL began its upward trend on April 22 and has continuously recorded new daily highs since then. As its price increased, its Smart Money Index (SMI) also rose, currently standing at 3.07.

VIRTUAL SMI. Source: TradingView

VIRTUAL SMI. Source: TradingViewThe SMI tracks the trading activities of institutional investors, often called "smart money." It analyzes price fluctuations during the day, focusing on the first and last trading hours.

When SMI increases alongside an asset's price, large investors are accumulating positions, reflecting growing confidence in the asset's upward momentum. The current increase in VIRTUAL's SMI suggests that institutional investors are actively accumulating tokens, likely preparing for further increases.

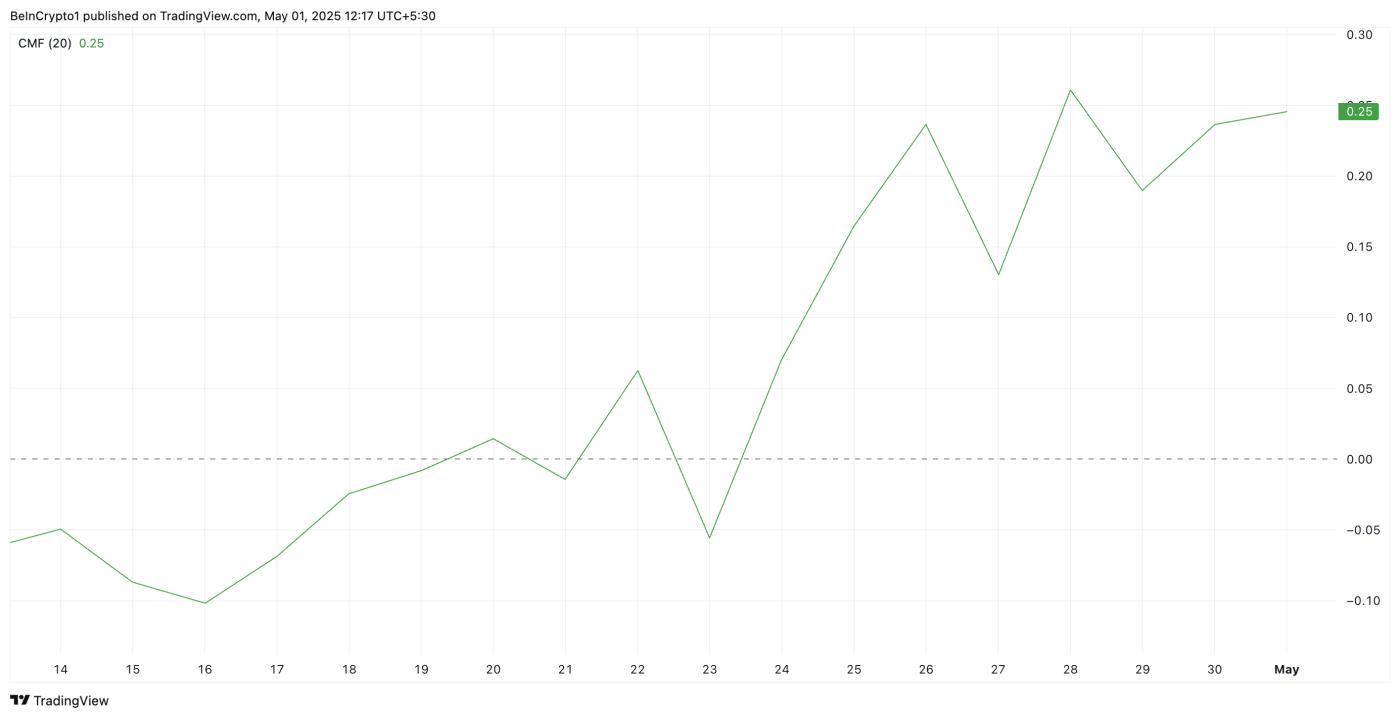

Additional support for the price increase is the rising Chaikin Money Flow (CMF) index of the token. At the time of writing, this momentum indicator is at 0.25 and continues to trend upward.

VIRTUAL CMF. Source: TradingView

VIRTUAL CMF. Source: TradingViewThe CMF measures the inflow and outflow of capital from an asset. Such a CMF increase reflects increased capital flow and positive sentiment among traders.

Therefore, VIRTUAL's CMF index reinforces its price increase and suggests the possibility of continued short-term growth.

VIRTUAL's Price Action Suggests Potential Further Growth

VIRTUAL's three-digit increase since April 22 has caused it to trade in an ascending parallel channel. This pattern forms when an asset's price continuously creates higher and lower levels, moving between two upward-sloping trend lines.

It signals an upward trend, indicating that the asset's price may continue to increase as long as it maintains within the channel. If demand increases and VIRTUAL climbs, maintaining its position in the channel, it could trade at $2.26.

VIRTUAL Price Analysis. Source: TradingView

VIRTUAL Price Analysis. Source: TradingViewHowever, increased profit-taking activity could hinder this price increase forecast. If selling begins, the VIRTUAL token could lose its recent gains, breaking below $1.55 and dropping to $0.96.