Author: Stacy Muur

Translator: Tim, PANews

In the blockchain field dominated by infrastructure-first approaches, Abstract made a strong debut on January 27, 2025, with a bold strategic adjustment: prioritizing end-users over developer testnets, aiming to drive genuine large-scale application adoption.

Overview

- Launch Date: January 27, 2025

- Development History: Abstract is the first consumer-designed Layer 2 scaling solution in the Ethereum ecosystem, developed by the Igloo team behind the famous Non-Fungible Token series 'Pudgy Penguins'.

- Core Value Proposition: Designed for mass adoption, Abstract eliminates key barriers like wallets, seed phrases, and gas fees

- Application Fields: Games, Social, Non-Fungible Tokens, and Prediction Markets

- Technical Architecture: Built on zkSync ZK Stack

Data as of April 22, 2025:

- Over 1.31 million independent wallets

- Total transaction volume exceeding 51.3 million

- Contract creation volume reaching 2.26 million

- Total Value Secured (TVS): $46.66 million

- DeFi TVL: $16.86 million

- Daily Average Transaction Volume: 500,000 to 700,000

- Daily Active Wallets: 50,000 to 100,000

Developers can offer "voting bribes" to compete for token releases based on voting weight (similar to Aerodrome mode), but the system scale is driven by activity rather than solely relying on token holdings.

Positive incentive cycle:

- Users: Benefit from usage

- Applications: Benefit from increased participation

- Governors: Benefit from driving ecosystem activity

This is a thorough revolution of the traditional "lock and idle" token model.

Using Livestreaming as a Growth Engine

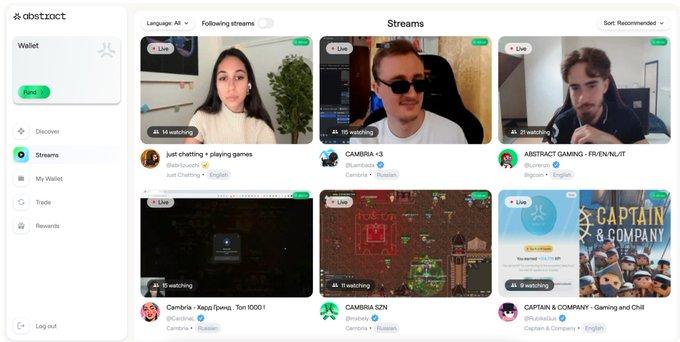

Most blockchain projects view livestreaming and creator content as a marketing layer outside the protocol. Abstract directly embeds it into the on-chain protocol through a consumer entry point, making livestreaming a native component of user registration, ecosystem discovery, and user growth.

Unique aspects of the Abstract platform:

- The platform natively integrates Twitch-like livestreaming functionality, not through external access.

- Streamer revenue uses an on-chain payment mechanism, with revenue sharing primarily based on:

- Number of viewers

- Promotion effect on applications within the Abstract ecosystem

- Subsequent user behavior (tracked through the AGW tracking system)

The platform actively recommends popular video clips and livestream content, thereby building a complete traffic loop among creators, application developers, and users.

Flywheel Effect in Operation

Streamers showcase new applications on the Abstract platform;

Audiences log in through AGW (Abstract Gateway) and immediately experience these applications;

Application usage rises, attracting more creators and driving funding for developer and streamer collaboration projects;

Abstract promotes high-quality content clips, injecting more potential user attention traffic into the platform.

This closed loop internalizes the entire content → usage → growth chain within the platform, rather than dispersing across multiple platforms.

Conclusion: Abstract's Current Positioning

Abstract has demonstrated the appearance of a user-centric blockchain infrastructure in practical application:

- Wallet functionality internalization: Deeply integrated, not an external plugin

- Discovery and interaction nativization: Functions native to the platform, not fragmented

- Content embedded ecosystem: Content grows autonomously on the platform, without relying on external channels like Twitter

- Behavior incentive orientation: Rewarding user behavior contributions, not just token holders