Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

The crypto industry is staging a peculiar "materialization" movement: card issuance.

Using USDT to order takeout, shop on JD.com, or even pay at street convenience stores, digital assets that originally existed only on screens are now silently entering the real world through various crypto cards.

Is card issuance the golden key to bridging Web3 and the real world, or just a brief traffic game?

This article will break down the driving factors, competitive landscape, and potential risks behind this crypto payment wave, providing a clear view of this industrial transition.

Crypto Card War Fully Launched

Capital is betting, and projects are racing. According to RootData, there are currently 37 projects focusing on crypto card business, many of which have received significant investments from top institutions. For example, the crypto credit card project KAST completed a $10 million seed round led by Sequoia China and Sequoia India; the crypto card issuer Rain secured $24.5 million in funding with Norwest Venture Partners leading, and Coinbase Ventures, Circle Ventures, and others participating.

Crypto Card Projects Overview:

Image source: RootData

From "ten chains" and "ten platforms", we now progress to the "ten cards era". This race is not just a stage for startups. More and more top players are personally entering the field, with exchanges, wallets, and public chains all eager to occupy a place in this key entry point for on-chain assets moving to offline consumption.

Crypto card products in the market are already diverse. Here's a comparison of some representative projects:

Meanwhile, more cards are on the way:

OKX will launch OKX Card in collaboration with Mastercard

Kraken reaches an agreement with Mastercard to launch a crypto debit card

MetaMask, CompoSecure, and Baanx will jointly launch a "metal card"

....

A single card becomes a key bridge between Web3 and the real world, also symbolizing crypto assets' transition from "speculative items" to "usable items". It's both a bridge and a battlefield. What is brewing behind this seemingly bustling card issuance trend?

The Business of Crypto Cards

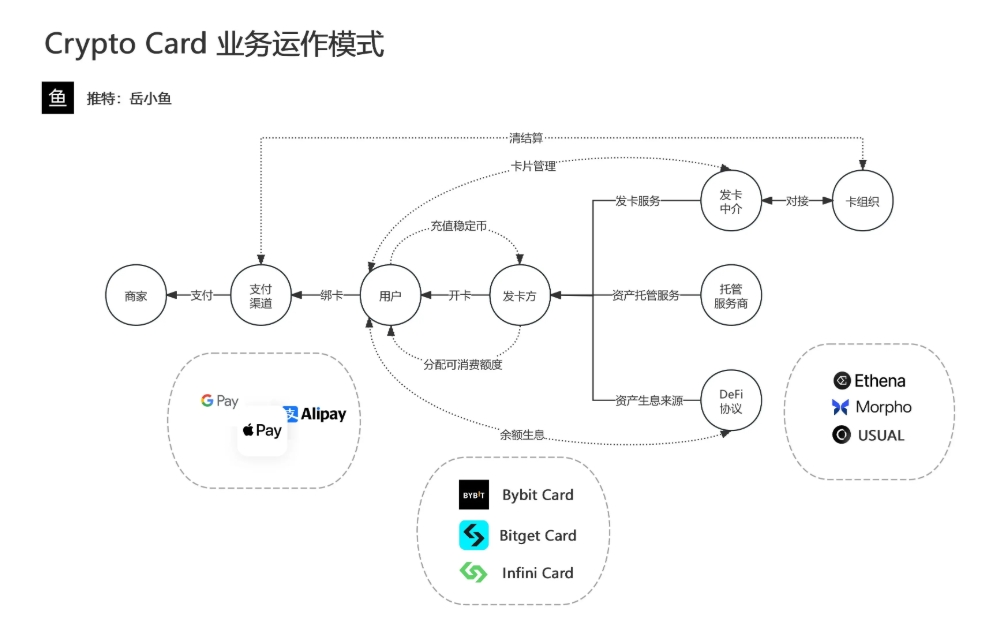

Essentially, crypto cards are a type of prepaid card. When users load USDT, USDC, and other stablecoins into the card, they are not "converting" these assets into card balance, but rather the issuer allocates a corresponding limit in a bank account within the traditional Visa/Mastercard system.

The operating mechanism behind this is a highly centralized funding model, primarily divided into three parts: asset custody (to meet user withdrawal needs), asset interest generation (to generate income), and asset advance (for fiat currency exchange).

Image source: @yuexiaoyu111

In this model, the card issuing platform's revenue sources are relatively clear: on one hand, card fees and exchange commissions, and on the other, operational income from platform deposited funds. However, as seen in the previous crypto card comparison, fee competition has already "opened", with almost all platforms lowering fee thresholds to attract users and even adding various "sugar coatings" - airdrops, consumption rebates, discounts.

Therefore, crypto cards are actually a low-margin business. Platforms can only achieve sustainable profitability by achieving large-scale transaction volume and fund deposits. For platforms, the essence of this business is competing for users' "payment entry points". The real contest is not just about brand building and channel occupation, but a battle for user traffic.

Additionally, exchanges and wallets have natural advantages in expanding this business, which not only helps diversify their business matrix but also enhances market potential and development ceiling.

Waves and Hidden Reefs

This "card issuance wave" brings many opportunities, but also hidden challenges and risks. The industry has various interpretations about the value and challenges of crypto cards.

From a geographical perspective, different markets have varying levels of acceptance for U cards. Researcher @sjbtc9 points out that in Australia, Europe, America, and Latin America, crypto cards are popular for avoiding high inflation and compensating for insufficient local financial services. In contrast, in regions with well-established compliance systems like Singapore, users already have smooth fund withdrawal channels, making them relatively cold towards crypto cards. In the domestic market, crypto cards are often used for paying overseas service subscriptions like ChatGPT.

Moreover, crypto cards play a "middleman replacement" role in some regions. For instance, in contexts with high OTC trading risks, U cards provide a more direct and stable fund entry and exit channel.

But hidden reefs are also surging. Compliance and risk control are challenges that crypto cards cannot avoid. Crypto KOL Yue Xiaoyu once shared that OneKey Card quickly became popular due to its excellent product experience, but was forced to suspend mainland KYC and ultimately shut down its card business under compliance pressure. This not only exposed the high uncertainty under policy regulation but also reflected the difficulty of expanding crypto card business amid weak user growth.

As community user @agintender said, beneath the surface of crypto cards is a "risk control hell": how to handle frozen, stolen, or recoverable funds, how to cooperate with investigations, how to manage user fund flow levels, and how to establish reasonable customer profiling and narrative capabilities are core issues that crypto cards must resolve.

Security risks are also an unavoidable hidden danger. In February this year, card merchant Infini was attacked, losing over $49 million. Crypto KOL @_FORAB revealed that after the incident, multiple U card service providers entered maintenance status, even suspending card issuance. This incident demonstrates that security and risk prevention are key to the continuous development of crypto cards.

The card issuance tide is not just about card competition, but a battle for passage rights between Web3 and the real world. Each metal card flashing is not just a brand logo, but a knock on mainstream society's door by the crypto economy.

Who will succeed or fail, time will provide the answer.