In recent months, Ethereum has experienced a significant decline in user activity on its blockchain. This slowdown has reduced the network's burning rate - a mechanism that helps decrease ETH supply over time.

With fewer tokens being burned, ETH's circulating supply has increased, creating inflationary pressure on the asset. As a result, the coin has struggled to maintain a stable price above $2,000 in recent months.

Low Burning Rate Means More Circulating Coins

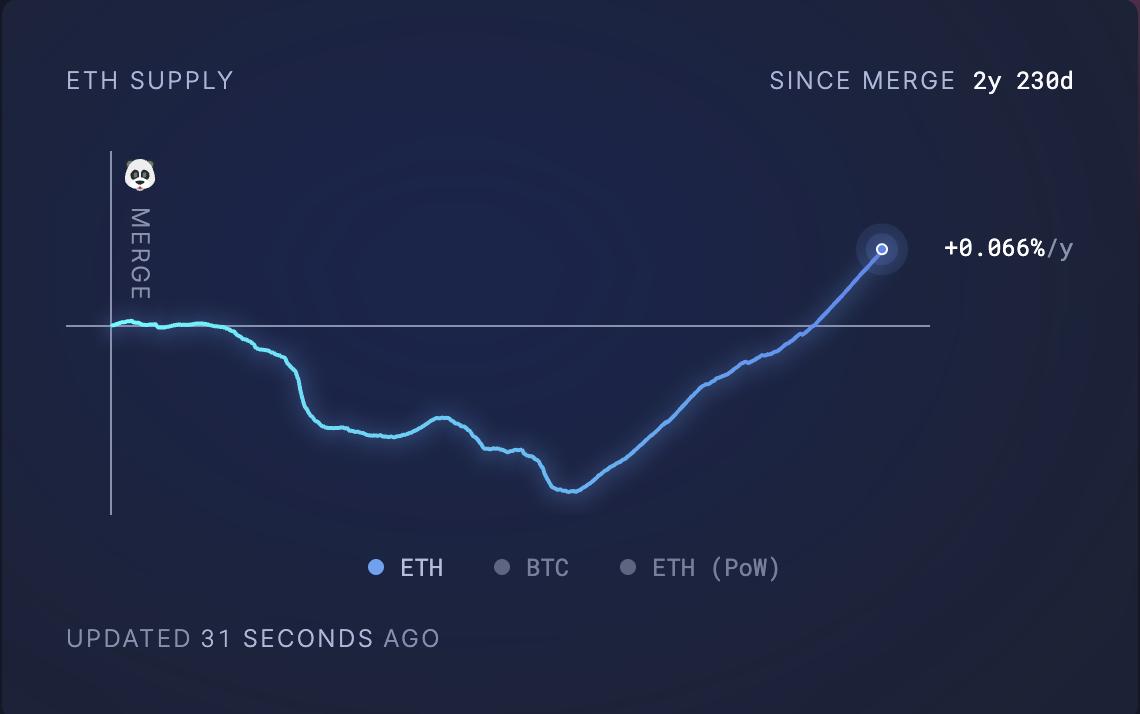

According to Ultrasoundmoney, 72,927 ETH, valued at $134 million at current market prices, was added to ETH's circulating supply in just the past month.

At the time of writing, this number is 120,730,199 ETH, significantly higher than before the merge.

Ethereum's Circulating Supply. Source: Ultrasoundmoney

Ethereum's Circulating Supply. Source: UltrasoundmoneyThis increase in ETH supply is driven by the decline in user activity on the Ethereum network, reducing its burning rate. Ethereum's burning mechanism, introduced through EIP-1559, destroys a portion of transaction fees to reduce ETH's circulating supply.

However, this mechanism directly depends on network usage. Therefore, with fewer transactions occurring, less ETH is burned, leading to a surge in ETH supply.

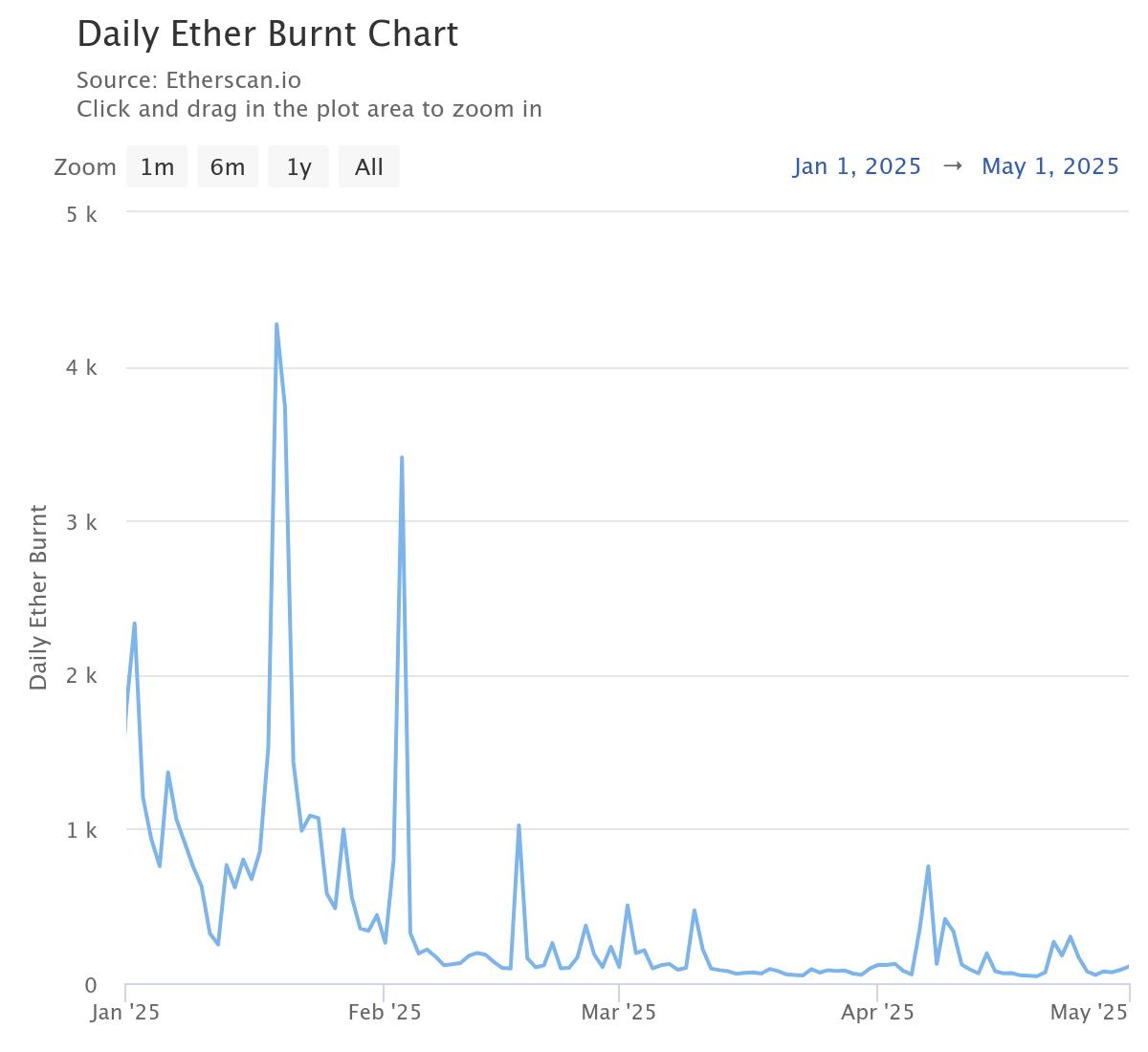

According to Etherscan, the daily amount of ETH burned has decreased by 95% YTD. In fact, the network recently recorded the lowest daily coin burn on 04/20.

Daily Ether Burnt. Source: Etherscan

Daily Ether Burnt. Source: EtherscanWhy Are Ethereum Users Leaving the Blockchain?

Many users and developers are moving from Ethereum to Second-Layer Solutions (L2) like Optimism and Arbitrum. These networks offer significantly lower transaction fees and faster execution, reducing user activity on Ethereum's mainnet.

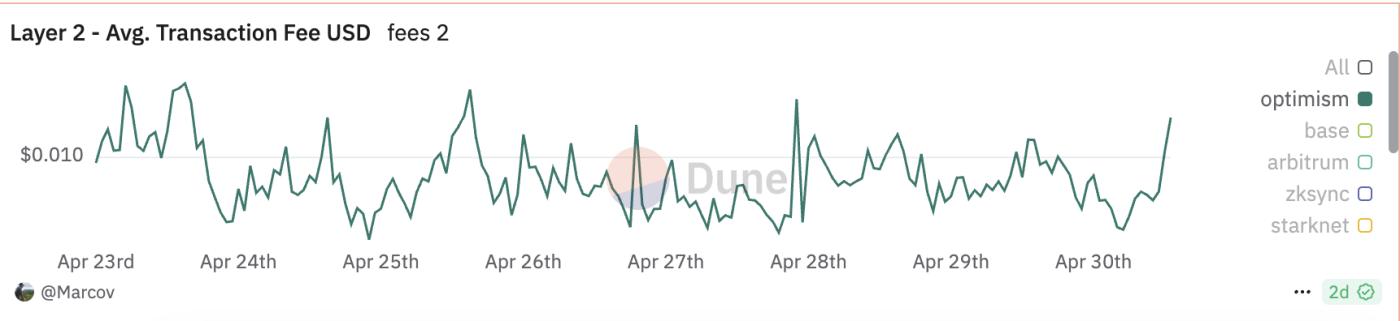

For example, as of 04/30, the average transaction fee on Optimism's mainnet was only $0.024. In contrast, performing a direct transaction on Ethereum cost users an average of $0.18 on the same day, seven times more expensive.

Optimism's Average Transaction Fee. Source: dune analytics

Optimism's Average Transaction Fee. Source: dune analyticsMoreover, due to the recent meme coin frenzy, "Ethereum killers" like Solana have significantly attracted attention in recent months, pulling users away from Layer 1.

Together, these trends have led to a decline in Ethereum's transaction volume, thus lowering the network's burning rate.

(Translation continues in the same manner for the rest of the text) ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingViewHowever, if buying pressure weakens, the value of ETH could drop to $1,733.