Welcome to the US Cryptocurrency Morning Briefing. We'll briefly summarize today's key cryptocurrency developments.

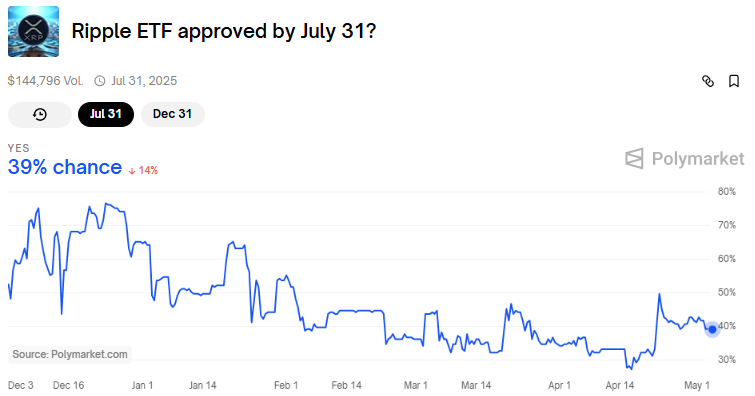

Let's take a look at the market sentiment for the XRP ETF (Exchange-Traded Fund) in the United States while enjoying coffee. As the prospects for this financial product continue to grow, experts have assessed the potential impact on Ripple's XRP Token.

Today's Cryptocurrency News: XRP ETF Inflows Reach $8.3 Billion... Standard Chartered Prediction

This week in cryptocurrency has seen much discussion about the XRP ETF. From false rumors and reports to delays in crucial decisions. But one thing seems certain: the conversation is more active than ever.

The recent approval decision for the ProShares Leveraged Futures XRP ETF has provided optimism. Expectations are now growing.

In a recent US cryptocurrency news publication, ETF analyst Eric Balchunas revealed they raised the probability to 85%. Based on this, analysts present various perspectives on how these products might perform.

"XRP price could rise to $12.23 or $22.20 after ETF approval, if the XRP ETF captures 15% to 30% of Bitcoin ETF inflows," shared a popular X account.

According to BeInCrypto data, at the time of writing, XRP is trading at $2.22, having fallen almost 1% in the past 24 hours.

In this context, BeInCrypto requested commentary from Standard Chartered. Jeff Kendrick, the bank's digital assets research head, said it's difficult to predict exact inflow figures. However, he mentioned that European comparative data could provide some guidance.

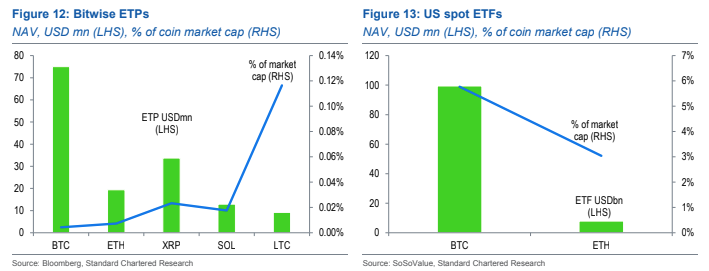

"It's challenging to estimate the final inflows for the XRP ETF. But Bitwise has listed ETPs for XRP, Solana, Litecoin, BTC, and ETH in Germany, which can provide a direct comparison," Kendrick told BeInCrypto.

While predicting how the XRP ETF might perform and its impact on XRP price, Kendrick compared it with Bitcoin, Ethereum, and other altcoins.

Citing Bitwise data, the Standard Chartered executive noted that altcoins represent a larger percentage of ETP (Exchange-Traded Product) net asset value (NAV) compared to Bitcoin and Ethereum.

However, he acknowledged this might be due to fewer altcoin ETPs. Kendrick added that the NAV to market capitalization ratio of already approved US spot ETFs provides a useful benchmark.

Based on these assessments, Jeff Kendrick estimated that a US-listed spot XRP ETF could attract up to $8.3 billion in inflows during its first year.

"Among US spot ETFs approved so far, NAV is 3% for Ethereum, less than 6% for Bitcoin. For the current XRP market cap, this suggests a future total NAV range of $440 million to $830 million, which seems a reasonable target range for inflows in the first 12 months," Kendrick added.

Kendrick Forecasts Ripple Price at $8... Bitfinex Analyst Questions XRP ETF Investor Interest

The Standard Chartered executive said he expects XRP price appreciation to keep pace with Bitcoin price growth targets. According to recent US cryptocurrency news publications, the bank anticipates Bitcoin's price to reach $120,000 in Q2, $200,000 by the end of 2025, and $500,000 by 2028.

He predicted Ripple's price would rise to $8 by 2026 following the approval of a spot XRP ETF in the US. This represents a 260% increase from the current price of $2.22.

"Practically, XRP inflation is currently 6%, while Bitcoin is 0.8%. Therefore, we target XRP-USD price levels at $5.50 by the end of 2025, $8.00 by the end of 2026, $10.40 by the end of 2027, $12.50 by the end of 2028, and $12.25 by the end of 2029," Kendrick explained.

Meanwhile, Bitfinex analysts warn against excessive optimism, suggesting that investor interest in a US-based spot XRP ETF might not match what was observed with the Bitcoin ETF.

"We expect XRP ETF inflows to be limited because some investors might expand their exposure to available cryptocurrency ETFs. However, we're unlikely to see inflows at the level experienced with Bitcoin," Bitfinex analysts told BeInCrypto.

These contrasting assessments reflect broader uncertainty about how altcoin ETFs will perform in the regulated US market, which remains heavily influenced by Bitcoin's dominance and the SEC's evolving attitude towards digital assets.

To date, Grayscale, Wisdom Tree, Bitwise, Canary, and 21Shares have applied to the SEC for XRP ETF approval. Bitwise's application was officially recognized on February 18, and several timelines for approval, rejection, or extension have begun.

The final deadline is October 12th, and 240 days after official submission. This date is the same as the 'final deadline' for BTC ETF approval on January 10th, 2024.

However, as other applications including XRP ETF for Solana and Litecoin are pending approval, Kendrick mentioned that other applications could impact the XRP ETF approval schedule.

"Litecoin is most likely to proceed quickly and will provide early insights into how the new SEC leadership will handle altcoin ETFs," Kendrick said.

As a hard fork of Bitcoin, Litecoin can already be considered a commodity by the SEC. According to Kendrick, it may be conceptually easy for investors to understand due to its similarity to Bitcoin. This aligns with Balchunas's prediction that the Litecoin ETF could take precedence over the Solana ETF.

"Next year, a wave of crypto ETFs is expected, but they won't all come at once. Most likely first will be a BTC + ETH combo ETF, followed by Litecoin (a commodity as a BTC fork), then HBAR (not labeled as a security), and finally XRP/Solana (labeled as securities in ongoing litigation)," Balchunas said.

According to current Polymarket data, the probability of XRP ETF approval by July 31st is 39%, and by December 31st is 79%.

Today's Chart

This chart compares the USD-based net asset value (NAV) of Bitcoin, Ethereum, XRP, Solana, and Litecoin through Bitwise ETP and US spot ETFs.

Figure 12 (left) shows the Bitwise ETP, emphasizing Bitcoin's dominance, and Figure 13 (right) focuses on US spot ETFs, with Bitcoin again leading.

Byte Size Alpha

Here is a summary of notable cryptocurrency news today:

- Bitcoin price expected to reach $100,000. Exchange inflows have hit a 7-year low, reducing selling pressure.

- Kraken recorded $472 million in revenue for Q1 2025. This is a 19% increase year-over-year, driven by Bitcoin volatility and a 29% increase in trading volume.

- Ethereum risks losing developers to Solana. Solana is gaining attention with better startup support and simplified user experience.

- Immutable (IMX) surged 15%. The rise is supported by an increasing long/short ratio above 1.

- Meteora proposes allocating 25% of MET token supply to liquidity rewards and TGE reserve. This ensures liquidity and token support post-launch.

- BOOP's market cap exceeded $500 million immediately after launch. This is due to high interest in meme coins and major Solana investor attention.

- Kraken discovered a North Korean hacker posing as a job applicant. The hacker was proceeding through the hiring process to gather information about infiltration tactics.

Cryptocurrency Stock Pre-Market Overview

| Company | Closed May 1st | Pre-Market Overview |

| Strategy (MSTR) | $381.60 | $391.45 (+2.58%) |

| Coinbase Global (COIN) | $201.30 | $204.85 (+1.76%) |

| Galaxy Digital Holdings (GLXY.TO) | $24.05 | $26.39 (+9.72%) |

| Marathon Holdings (MARA) | $14.05 | $14.29 (+1.71%) |

| Riot Platforms (RIOT) | $7.77 | $7.90 (+1.67%) |

| Core Scientific (CORZ) | $8.55 | $8.73 (+2.11%) |