This article is machine translated

Show original

🔎 07 Warren Buffett Indicators to Find Hidden Gems & How to Apply in Crypto? 💎

1. Buffett Indicator

2. P/E

3. PEG Ratio

4. ROE

5. Free Cash Flow Yield

6. Intrinsic Value

7. Safety Margin

8. Applying to Crypto

Author: @jackvi810

Hope everyone supports <@gm_upside> at twitter.com/gm_upside/status/1...

2025/04/28 14:45 :

🫡 This is a once-in-2-3-century opportunity & How Warren Buffett makes money from it!

1. Warren Buffett - The Oracle of Omaha

2. What opportunity did he see?

3. How did Warren Buffett make money step by step?

4. Why is this a once-in-2-3-century opportunity twitter.com/gm_upside/status/1...

1. "Buffett Indicator" – Total market Capital / GDP

The Buffett Index compares total market Capital to GDP to XEM the stock market is overvalued or undervalued. GDP is the “health” of the economy, while market Capital is the value of all stocks.

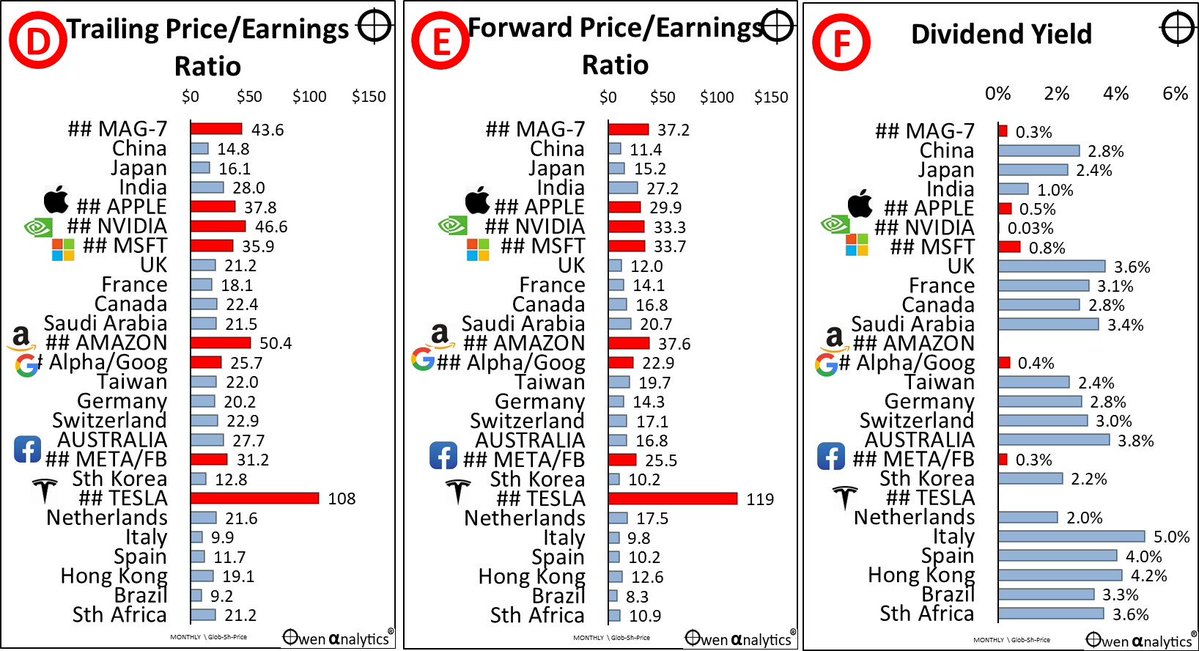

2. P/E Ratio – Price to Earnings

The P/E (Price to Earnings) ratio tells you how much you pay for each dollar of a company’s earnings, helping you judge whether a stock is expensive or cheap.

A high P/E often signals high expectations, but it can also be a sign of overvaluation.

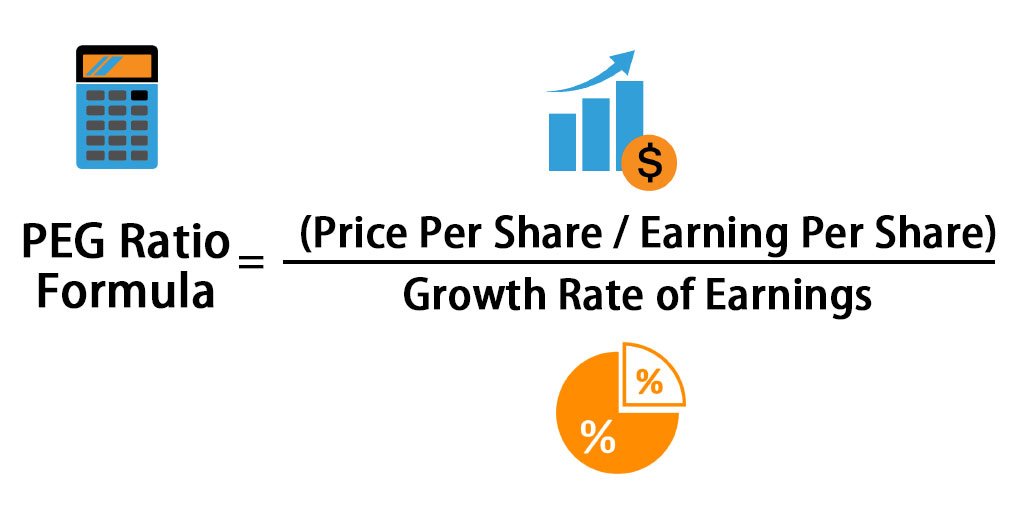

3. PEG Ratio – P/E Chia by profit growth

PEG Ratio (Price to Earnings to Growth) is an improved version of P/E, which helps evaluate a company's valuation relative to its expected earnings growth rate.

A low PEG (<1) suggests the stock may be overvalued.

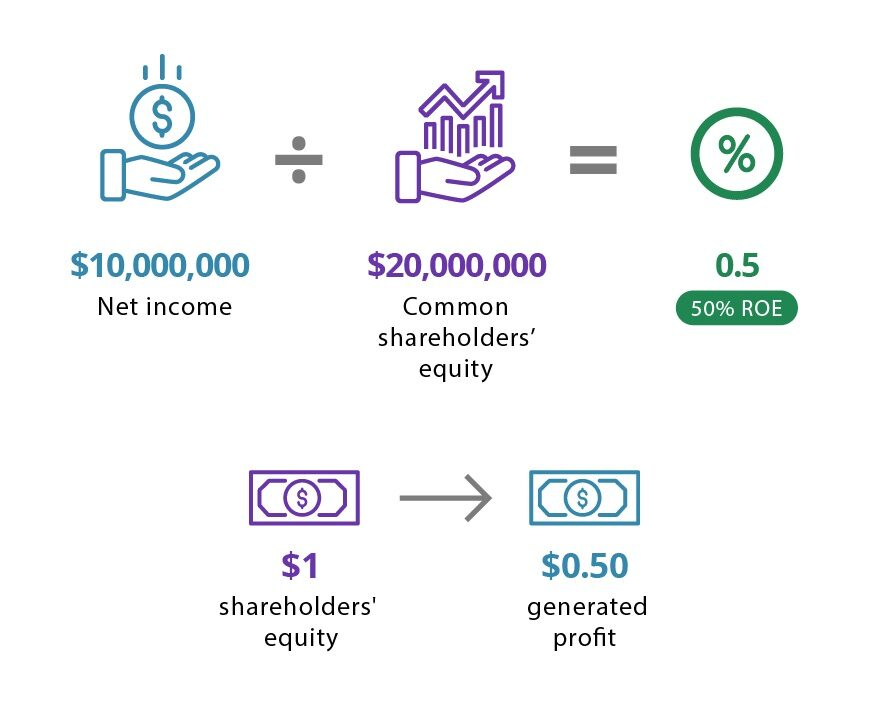

4. ROE – Return on Equity

ROE (Return on Equity) measures how effectively a company uses shareholders' capital to generate profits. This is an important indicator to evaluate the quality of management and profitability of a business.

(1 second advertisement😆)

If the article is useful, I hope you guys support @gm_upside with a follow & retweet 😍

🛫 There is no shortage of good articles, just comment:

"Help me analyze project ABC, trend XYZ,..." and Upside will post it right away ✍️

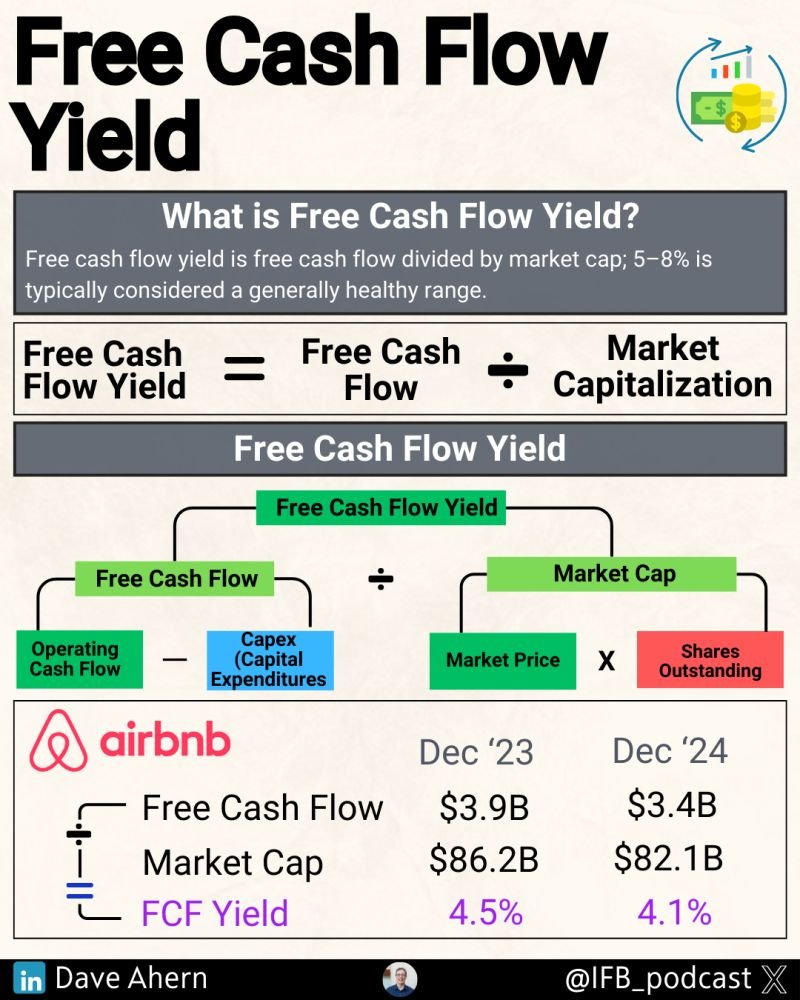

5. Free Cash Flow Yield – Free Cash Flow

Free Cash Flow Yield is a measure of the actual cash a company generates relative to its market value. Free Cash Flow (FCF) is the amount of money left over after a company has paid all its operating expenses.

6. Intrinsic Value

Intrinsic value is a number that represents the actual value of a company, based on its ability to generate future cash flows, not the current market price of the stock.

He often uses the method

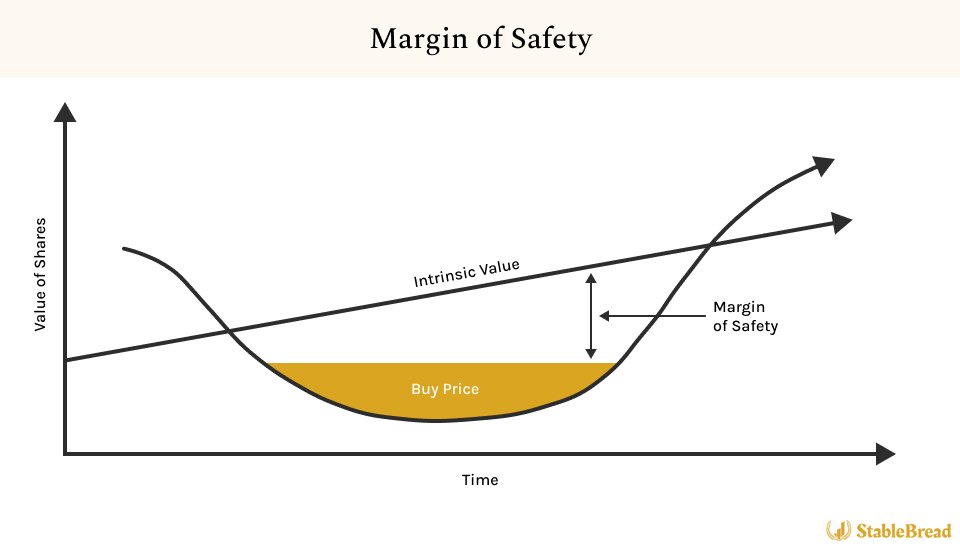

7. Margin of Safety – Risk Shield

Margin of safety is a core principle in Warren Buffett’s investment philosophy, which he learned from his mentor Benjamin Graham.

The idea is to buy stocks only when the market price is significantly lower than the intrinsic value of the company.

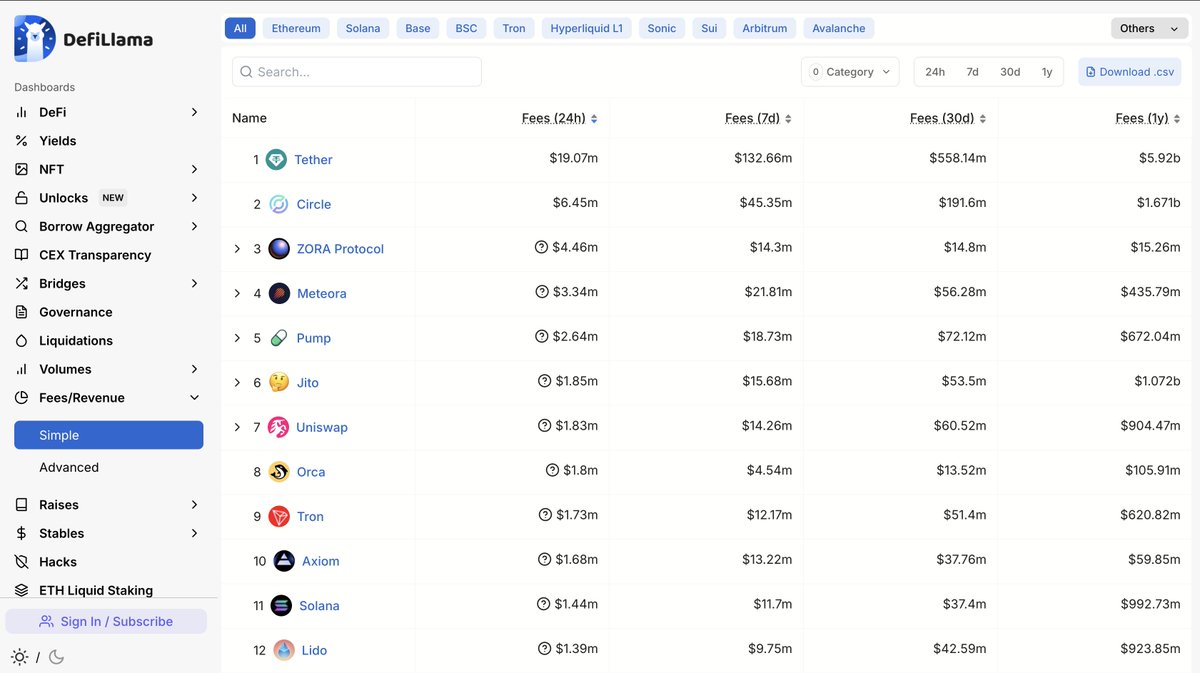

8. Apply to crypto

In fact, most companies in the crypto market have no revenue, no profit, and no real assets of value except for highly volatile Token . So, to apply the metrics that Warren Buffett in

Warren Buffett is holding a pile of more than 350 billion dollars but has not done anything.

If you want me to write more about my 10-year investment journey, please comment +1 for admin @jackvi810 to do more research 😁

x.com/gm_upside/status/1918697...

I hope you guys support @gm_upside with a like & retweet 😍

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content