This article is machine translated

Show original

💎 10 Golden Investment Philosophies of Warren Buffett & Practical Examples! ✍️

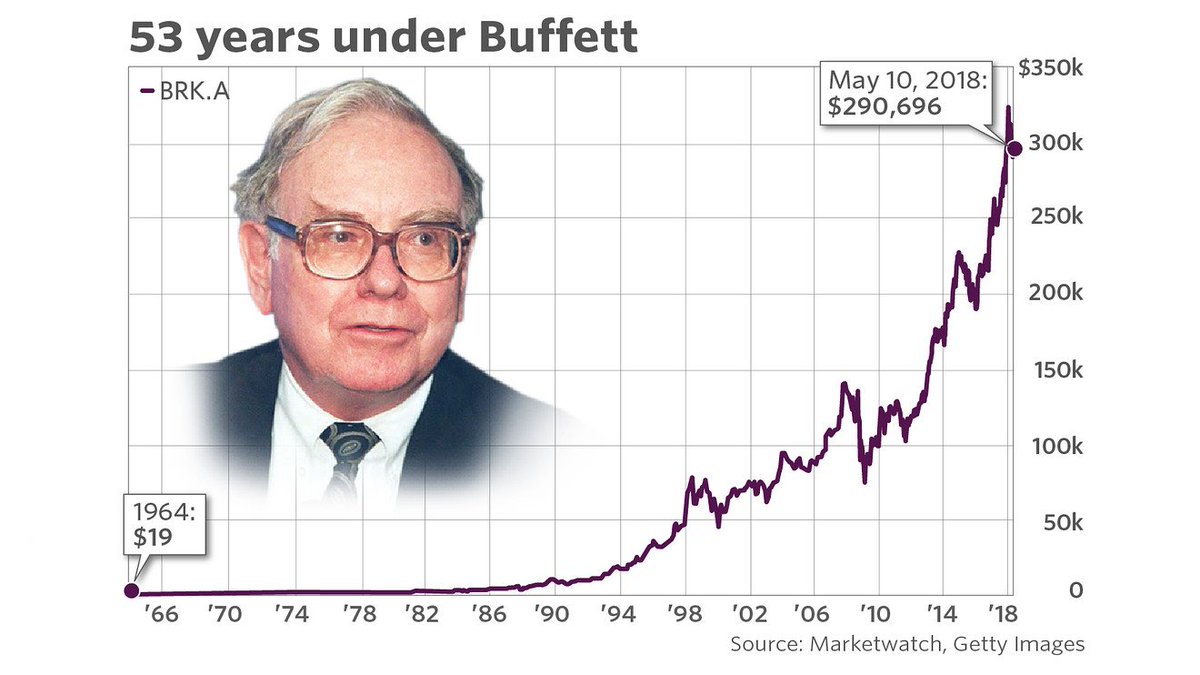

Warren Buffett through the numbers:

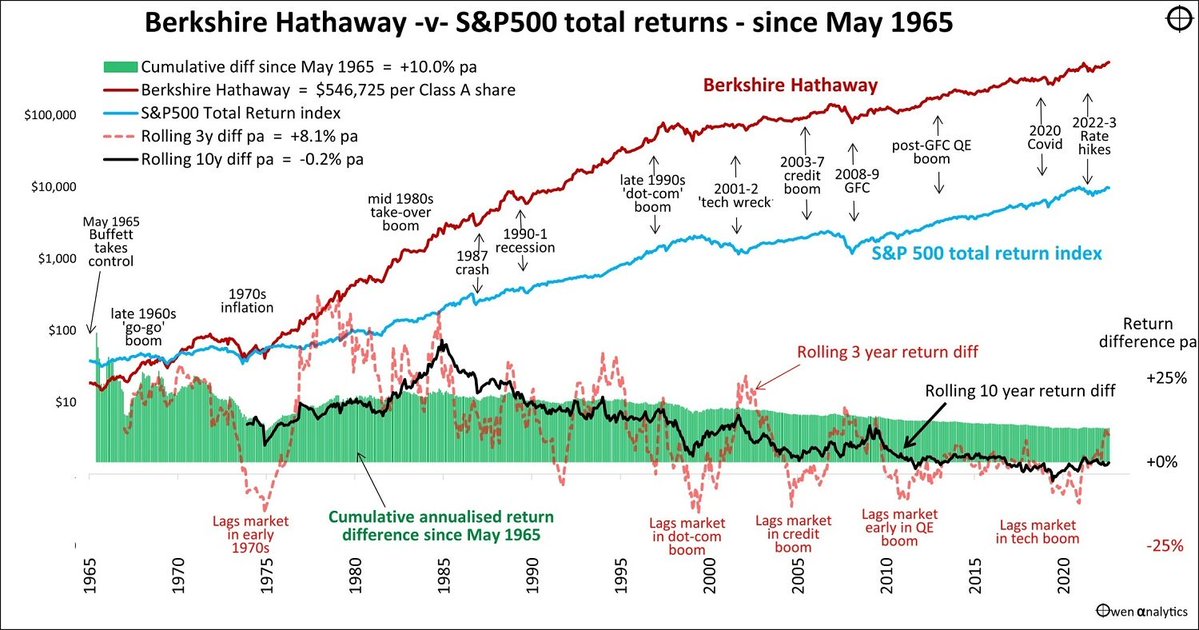

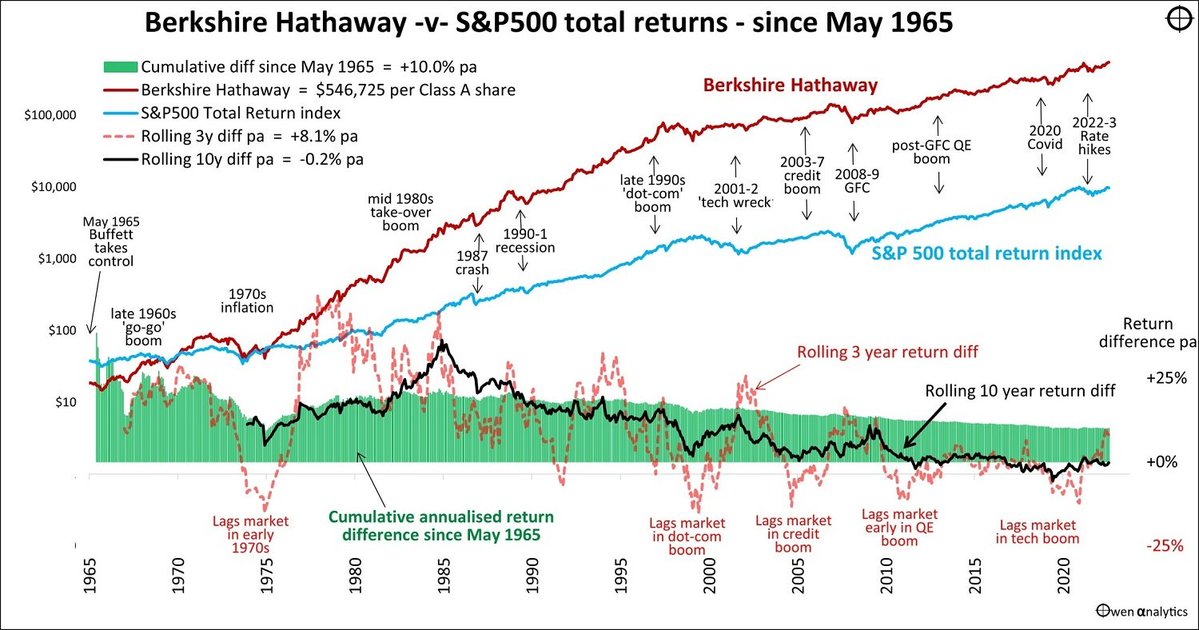

📍Led Berkshire Hathaway to grow 3,787,464%

📍Helped his investment fund reach 900 billion USD in Capital

📍Investment rate exceeded S&P 500 in 47 out of 57 years

📍Assets of 168

1. Rule #1: Never lose money. Rule #2: Never forget rule #1.

“Rule No.1: Never lose money. Rule No.2: Never forget Rule No.1.”

📚Warren Buffett XEM Capital preservation a core principle in investing. Losing money not only reduces your wealth,

2. Price is what you pay. Value is what you get.

“Price is what you pay. Value is what you get.”

📚Buffett distinguishes between price – a short-term number that fluctuates due to market sentiment – and intrinsic value – a business’s ability to generate sustainable profits.

(1 second advertisement😆)

If the article is useful, I hope you guys support @gm_upside with a follow & retweet 😍

🛫 There is no shortage of good articles, just comment:

"Help me analyze project ABC, trend XYZ,..." and Upside will post it right away ✍️

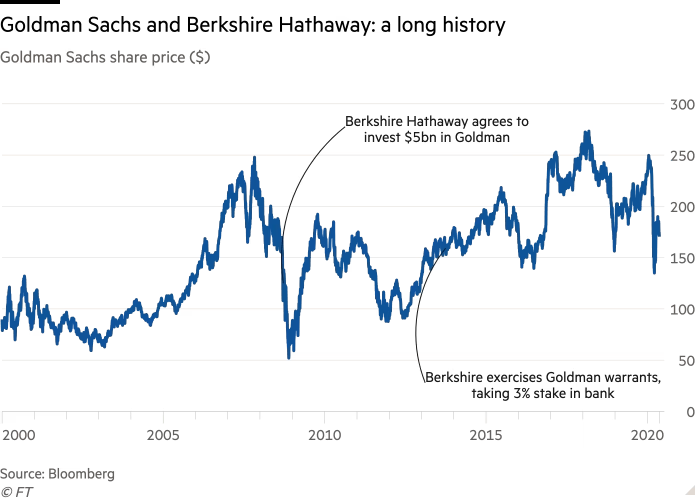

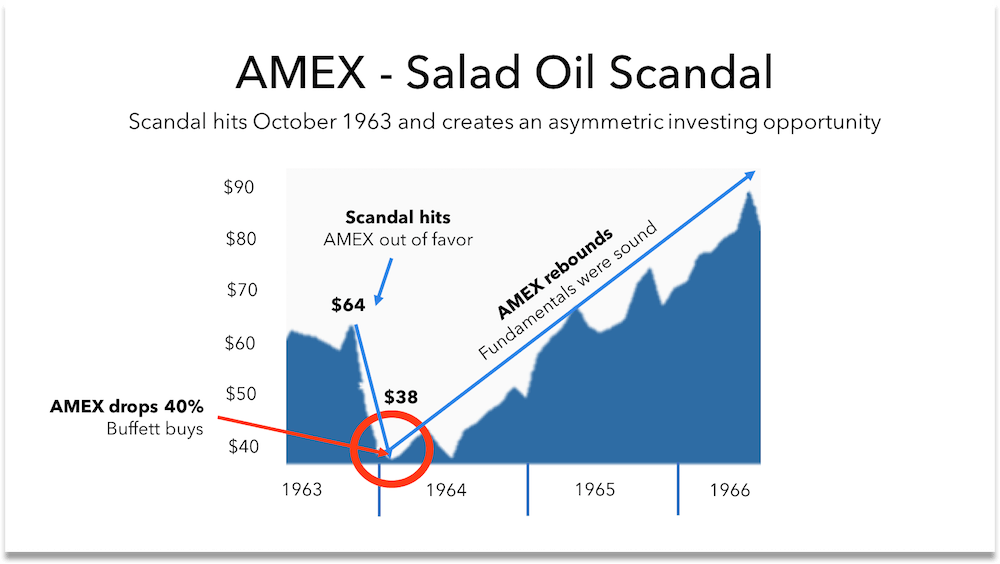

3. Be fearful when others are greedy and greedy when others are fearful.

“Be fearful when others are greedy and greedy when others are fearful.”

📚The market is driven by greed and fear. When people are overly optimistic, stock prices are easily inflated, creating

4. The stock market is a device for transferring money from the impatient to the patient.

“The stock market is a device for transferring money from the impatient to the patient.”

📚The stock market tests patience. Short-term investors, running

5. Someone is sitting in the shade today because someone planted a tree in the past.

“Someone is sitting in the shade today because someone planted a tree a Longing time ago.”

📚Buffett emphasizes the importance of long-term vision and compound interest. Great results require

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share