The founder of TRON, Justin Sun, has once again accused First Digital Trust (FDT), claiming that the company transferred $500 million of customer funds to banks in Dubai.

In a post on May 3rd on X, Sun stated that this money was distributed across multiple organizations, including Mashreq Bank, Emirates NBD, Abu Dhabi Islamic Bank (ADIB), and EFG.

TRON Founder Calls for Dubai to Investigate FDT

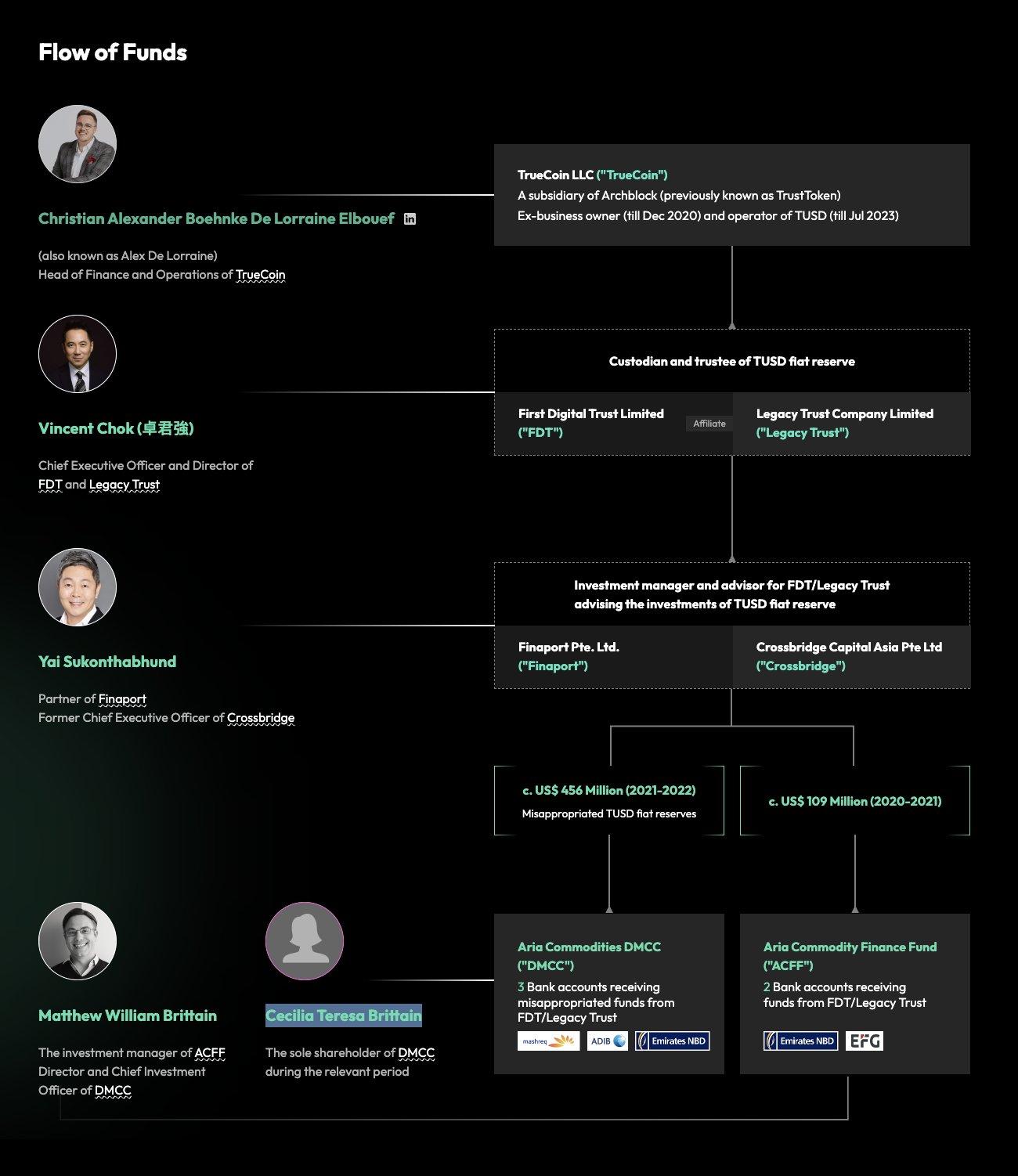

Sun also named several individuals whom he believes were involved in authorizing or supporting these fund transfers. These individuals include Christian Alexander Boehnke, De Lorraine Elbouef, FDT CEO Vincent Chok, Yai Sukonthabhund, Matthew William Brittain, and Cecilia Teresa Brittain.

According to him, these individuals hold executive positions at FDT and related entities, which allegedly gave them the necessary authority and access to misappropriate customer assets.

The alleged flow of funds from First Digital Trust. Source: Justin Sun

The alleged flow of funds from First Digital Trust. Source: Justin SunSun's accusations come as Dubai positions itself as a global center for cryptocurrency innovation. In recent years, authorities have introduced multiple crypto-supportive initiatives that have attracted international attention and investment.

In this context, Sun calls on local banks, regulators, and government agencies to take immediate steps to investigate the fund transfers and freeze any suspicious cash flows.

He also promotes internal audits, public disclosure of irregularities, and active cooperation from the involved organizations.

"I once again call on the Dubai government, regulators, and banks to act quickly and decisively. Dubai must not become a safe haven for fraud and money laundering. Banks must conduct internal checks, immediately freeze suspicious cash flows, and proactively report them. Do not become accomplices to criminal activities," Sun stated.

These accusations escalate the dispute between Sun and the Hong Kong-based custody company.

Last month, he compared the alleged embezzlement at FDT to the FTX scandal, calling it "much worse" because it was not related to loan collateral structures or user consent.

Sun has launched a $50 million reward program to support the investigation, uncover more details, and hold those responsible accountable. He has also launched a dedicated website to expose the alleged fraud.

FDT has denied all accusations and filed a defamation lawsuit against Sun. Meanwhile, Hong Kong regulators have begun reviewing the conduct of local trust companies in light of the accusations.

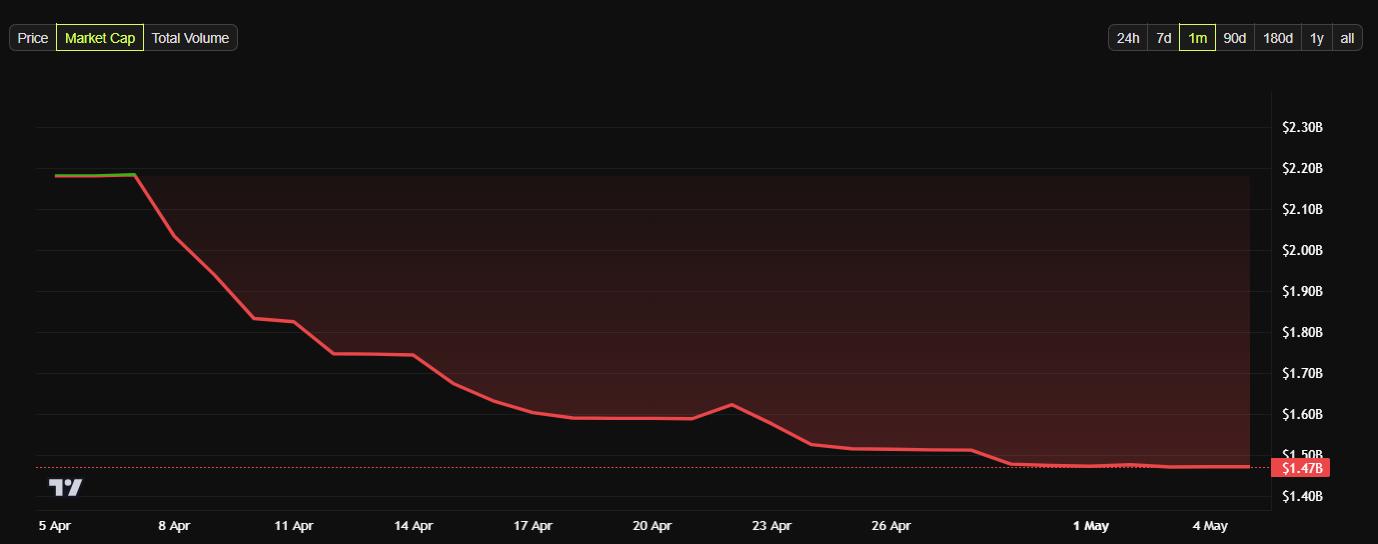

Market capitalization of First Digital Trust's FDUSD Stablecoin. Source: BeInCrypto

Market capitalization of First Digital Trust's FDUSD Stablecoin. Source: BeInCryptoSince the dispute began, the market capitalization of FDT's FDUSD stablecoin has dropped significantly. According to data from BeInCrypto, the stablecoin's market capitalization has decreased from over $2.5 billion to around $1.4 billion at the time of writing.