Token Unlock is a process where tokens that have been locked up for a certain period are released to be circulated in the market. The unlock event can cause an increase in supply, expansion of liquidity, and rising selling pressure, which can be a critical variable for token price volatility and market sentiment. Especially when the unlock ratio is high compared to market capitalization or a large number of tokens are released in a short period, the possibility of price adjustment increases, requiring proactive response. This article summarizes the token unlock schedule and details planned for this week that can be referenced for investment decisions. [Editor's Note]

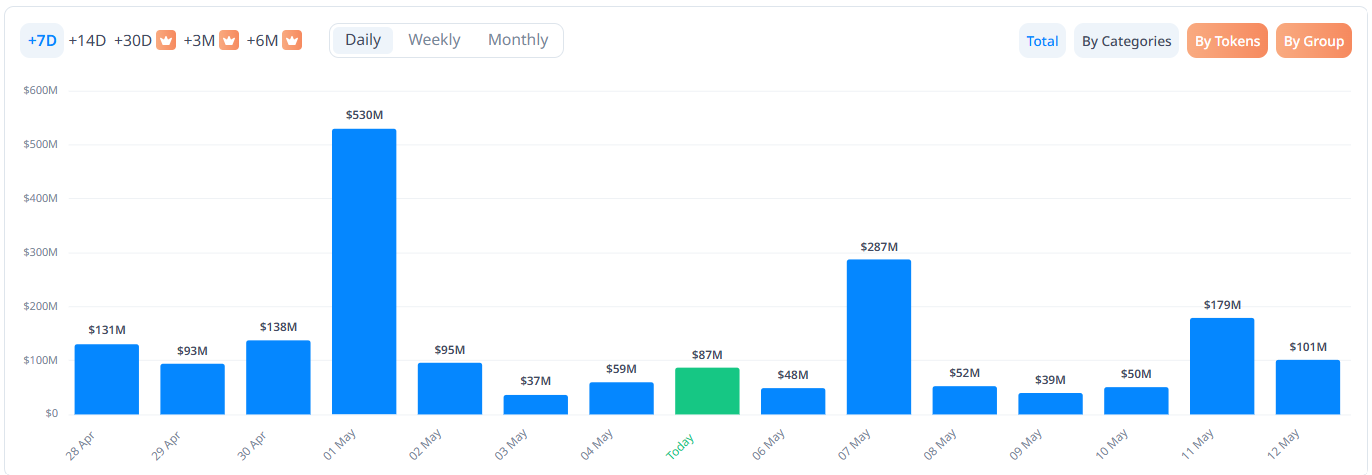

According to CryptoRank, a total of $741.27 million in token lockup will be released during the week from the 5th to the 11th. The largest amount is scheduled to be released on the 7th ($287.3 million) and 11th ($178.6 million). During this period, lockup releases will also be conducted for tokens like Galaxy (GAL), Eneta (ENA), and other tokens with market cap over $100 million.

Major Lockup Release by Date

May 5th (86.5 million dollars) GAL|ENA|XION

May 6th (48.1 million dollars) MAVIA|SPEC

May 7th (287.3 million dollars) MYRIA|ATA|HFT|JTO|NAVX|NEON|EAI|GRND

May 8th (51.7 million dollars) SCA|MASA

May 9th (38.95 million dollars) MOVE

May 10th (50.12 million dollars) CETUS|CHEEL|FHE

May 11th (178.6 million dollars) GODS|GFI|IO|AGI|SEAM

Xion (XION), JTO, and Chili (CHEEL) will conduct the largest token lockup releases. Eneta's (ENA) lockup release amount is equivalent to $50.08 million, which corresponds to 2.96% of its market cap.

-

Eneta (ENA): $50.08 million

JTO: $18.28 million

Chili (CHEEL): $17.26 million

Spectral (SPEC): $11.73 million

Movement (MOVE): $8.49 million

Tokens with high lockup release ratios compared to market cap include Spectral (SPEC), Neon (NEON), and Heroes of Mavia (MAVIA).

-

Spectral (SPEC) 29.10%

Neon (NEON) 22.50%

Heroes of Mavia (MAVIA) 20.90%

Seamless Protocol (SEAM): 7.19%

Eagle AI: 6.51%

Recent Domestic Listings

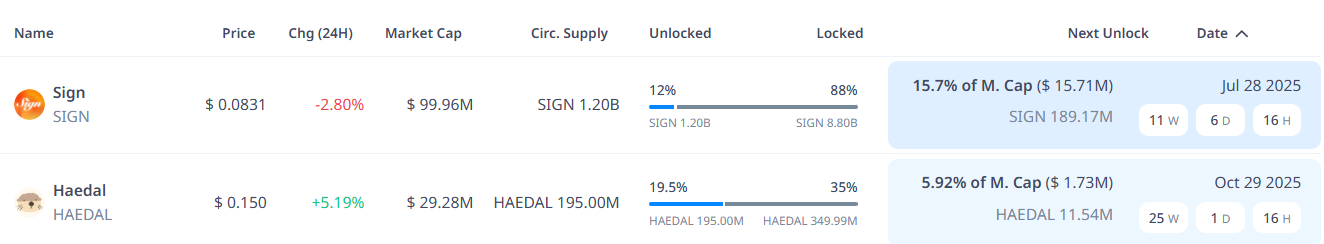

SIGN, listed on Upbit on April 29th and Coinone on the 30th, will release 18.917 million SIGN ($15.71 million), which is 15.7% of its market cap, on July 28th. HAEDAL, listed on Bithumb on May 2nd, plans to release 11.54 million HAEDAL ($1.73 million), which is 5.92% of its market cap, on October 29th.

TGE Lockup Release Schedule

On the 29th of last month, HAEDAL released 195 million tokens, which is 20% of its total supply, through TGE lockup release. On the same day, Milkyway (MILK) released 198.9 million tokens, corresponding to 19.90% of its total supply. B2 Network released 22.65 million tokens, which is 10.8% of its total supply, on the 30th.

TGE (Tokens Generation Event) is the process of officially issuing tokens by a blockchain project. Some of the generated amount is locked up for a certain period, and the first release schedule is called TGE lockup release. It includes initial investor, team, and ecosystem quantities.

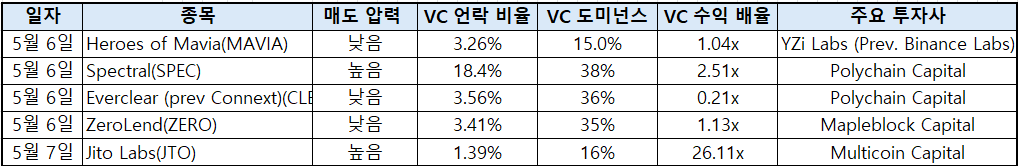

VC Lockup Release Schedule

VC (Venture Capital) lockup release is a process where tokens held by initial investors can be liquidated in the market, providing opportunities for the project's long-term growth and investor profit realization, but can also generate selling pressure. Particularly, the higher the VC profit multiple (current price compared to initial purchase price), the greater the possibility of selling, which can expand price volatility.

[This article does not provide financial advice, and the investment results are the sole responsibility of the investor.]

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>