On the evening of May 5, 2025, while the crypto market was still debating Bitcoin's oscillating trend, a token named Jager in the BNB ecosystem quietly landed on Binance Alpha platform, with a stunning circulating market value of $30 million, pulling everyone's attention back to the "Meme+DeFi" battlefield. Named after the smallest unit of BNB (1 Jager = 0.00000000001 BNB), this token is neither a simple cultural symbol of traditional Meme nor a dull numerical game of conventional DeFi, but an on-chain perpetual machine experiment that blends airdrop gaming, tax dividends, and liquidity absorption

I. From "Ordinary Meme" to "Mechanism Monster": Jager's Triple Flywheel Architecture

In the crypto world of parallel chains including BNB Chain, Solana, and Ethereum, Meme projects often follow the parabolic law of "surge - FOMO - crash". However, Jager's sudden emergence demonstrates a new possibility of "DeFi + Meme + Short" trinity through a precise designed gaming mechanism.

1.1 Airdrop Gaming: Prisoner's Dilemma of Time Cost

Jager's airdrop mechanism is far from simple token distribution, but a carefully designed on-chain behavioral economics experiment. Its core logic is to force participants to voluntarily lock positions through time difference and revenue redistribution, forming an early chip sedimentation moat.

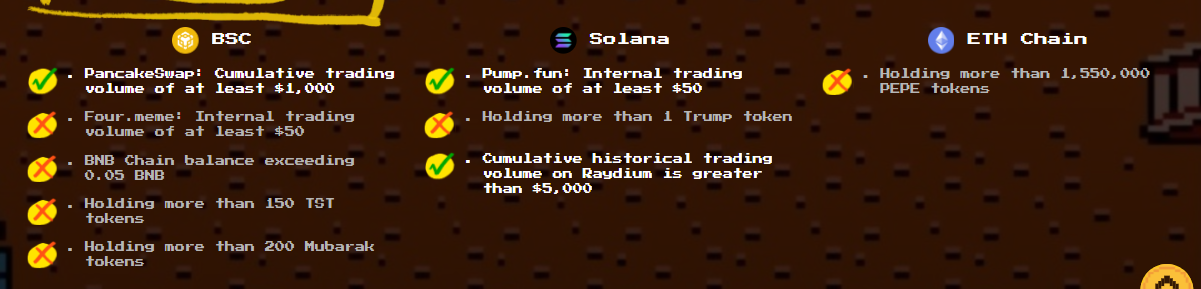

- Precisely screening "on-chain active users": Airdrop targets wallet addresses meeting transaction thresholds on BNB, SOL, and ETH chains (e.g., BSC chain requires transaction volume > 0.01 BNB), directly aiming at "old money" users with on-chain interaction capabilities. This strategy avoids Sybil attacks and ensures participants have basic crypto awareness and operational skills.

- Dynamic reduction and lock-up gaming: Airdrop adopts an "early bird harvest" mode, with each 2.5% total claim triggering a 20% reduction. Users face a dilemma: immediately claim only 65% of airdrop, or wait 3 days to get 100% and share the 35% reward pool surrendered by others.

- This design essentially transforms "opportunity cost" into gaming chips - making those eager to cash out become fuel for long-termism.

From on-chain data, users choosing 3-day lock-up can ultimately earn 9.23 times more than immediate claimers. Such a stark difference forces rational players to actively delay claiming, forming a group consensus of "voluntary lock-up".

1.2 LP Liquidity Pool: Confiscation Mechanism's Flywheel Acceleration

Jager's most radical innovation is the mandatory confiscation mechanism for unclaimed airdrops. After a 7-day claim window, all unclaimed tokens will be permanently locked and injected into the JAGER-BNB LP pool as liquidity rewards.

This rule brings three-fold effects:

- Punishing bystanders: Tokens of hesitant or forgetful users automatically transform into public resources of the LP pool, forcing participants to "take active action" rather than passively wait.

- Creating a liquidity black hole: Initial LP pool gains massive token reserves through confiscation mechanism, combined with 50% transaction tax injection, forming high APY expectations attracting arbitrageurs to provide initial liquidity depth.

- Two-pool flywheel circulation: LP providers must lock for 14 days with linear reward release, preventing instant liquidity withdrawal and converting short-term speculators into medium-term holders, forming a positive cycle.

As of May 6, over 110,000 addresses have participated in airdrop claiming, with daily new addresses exceeding 30,000.

This explosive growth validates the mechanism design's user attraction.

1.3 Tax Dividends: War of Interests between Holders and Speculators

Jager's tax mechanism constructs a binary antagonistic system of "holders VS speculators":

- 10% transaction tax in the first 14 days (later reduced to 5%), with 50% proportionally distributed to addresses holding ≥1.46 billion JAGER, and the remaining 50% injected into LP pool.

- Dividend threshold: 1.46 billion JAGER is approximately $1,000 at current market value, filtering small speculators while incentivizing large holders for compound income.

This design is essentially a game of "token holders exploiting traders". Frequent traders bear high friction costs, while long-term holders achieve "passive earning" through tax dividends. Data shows early LP mining participants have achieved 3%-5% daily dividends, further stimulating holding willingness.

II. Mechanism Dissection: Underlying Logic of Structural DeFi Game

Unlike traditional Meme projects driven by community sentiment, Jager is more like an "on-chain gaming mechanism driven by gaming".

2.1 Gaming Matrix: Nested Design of Time, Behavior, and Revenue

Jager's rule system builds a multi-layered gaming network:

- Time gaming: Revenue difference between immediate and locked claiming, creating confrontation between "early birds and patient ones";

- Behavior gaming: Users dynamically adjust strategies between "claiming airdrop", "doing LP", and "holding for dividends";

- Psychological gaming: 7-day claim window and 14-day LP lock period create countdown pressure, triggering FOMO emotions.

This nested structure makes each participant both a game player and rule fuel, forming a self-reinforcing system closed loop.

2.2 Scarcity Engine: Reduction Mechanism and Liquidity Absorption

Jager creates scarcity through two mechanisms:

- Airdrop reduction: 20% quota decrease triggered by each 2.5% claim, forcing players to enter quickly to avoid revenue shrinkage;

- Liquidity absorption: Unclaimed tokens and transaction taxes continuously inject LP pool, forming a positive feedback of "more liquidity → higher returns → attracting more LP providers".

This design cleverly transforms user behavior into token economic regulation levers, rather than relying on project party intervention.

2.3 Community Viral Spread: Nine-Level Acceleration

Jager's referral rebate mechanism (9% direct push + 3% indirect push) is similar to the Musk shill model (like GROK case).

But instead of relying on celebrity effect, Jager focuses more on stimulating self-propagation through economic incentives:

- Users actively pull new users and educate gameplay to obtain higher rebates;

- "Revenue screenshots" and "strategy analysis" on social media form secondary propagation materials.

This "interest binding + content co-creation" model significantly reduces project cold start costs.

III. Maximizing Revenue Strategy: Finding the Optimal Path in the Flywheel

3.1 Airdrop Stage: Time Window and Risk Balance

- Lockup Strategy: Prioritize claiming within 3 days, especially in the early project phase (first 3 days), as the 40% reward pool has not yet been diluted, with significant revenue amplification effect;

- Multi-chain Operation: Utilize the independent airdrop qualifications of BSC, SOL, and ETH chains by splitting addresses through cross-chain tools to maximize capturing multi-chain revenue.

3.2 LP Mining: Risk Hedging Behind High APY

- Early Entry: During the initial token injection period of airdrop (days 7-10), LP pool APY usually reaches its peak, allowing entry to enjoy liquidity premium;

- Hedging Tools: While providing LP, short the proportional token through perpetual contracts to hedge price fluctuation risk.

3.3 Token Holding Dividends: Whale Game and Survival Rule for Small Investors

- Position Layering: Split funds into "lockup mining", "token holding dividends", and "liquidity reserve", corresponding to long, medium, and short-term revenue targets;

- Threshold Management: If unable to reach the 146 billion JAGER threshold, avoid frequent trading and instead obtain tax dividends indirectly through LP mining.

IV. Life and Death Test: Jager's Three Vital Points

Despite sophisticated mechanism design, Jager still faces three fatal challenges:

4.1 Liquidity Trap: Can High APY Resist "Mine-Withdraw-Sell"?

Historical data shows high-yield LP pools often accompany token price drops, forming a "death spiral of high APY—increased selling pressure—price drop—passive APY increase".

Whether Jager can suppress selling pressure through tax dividends will be a key observation point.

4.2 External Dependency: Who Will Inject New Fuel into the Flywheel?

Without new users and capital inflow, the game will degrade to zero-sum trading. The project needs to continuously introduce external liquidity through cross-chain expansion, exchange listings (such as already being on Binance Alpha).

4.3 Sentiment Cycle: FOMO Trigger Point After 7-Day Window

Current market sentiment is concentrated on the airdrop claiming period (May 4-7), and if no price breakthrough or community hot event occurs after 7 days, it may lead to collective selling after expectation falls flat.

V. Conclusion: When Meme Dances in DeFi's Shackles

Jager's experimental significance far exceeds the success or failure of a single project. It marks the paradigm shift of the Meme track from "cultural consensus" to "mechanism consensus"—transforming human game theory into a perpetual machine of token economics through sophisticated rule design.

The risk of this model is that overly complex mechanisms might raise participation barriers, losing Meme's core "grassroots nature". However, regardless, Jager has opened a new door for the industry: when DeFi's rational architecture deeply merges with Meme's emotional transmission, the crypto world may give birth to a truly "autonomous economic entity".