This article is machine translated

Show original

🤔 Have investors been trapped by the big fund's scam?

In the past few weeks, the US stock market has been continuously rising. From concerns about recession, now people are competing to "buy in", especially small individual investors.

Is the market truly twitter.com/gm_upside/status/1...

2025/05/06 11:47 :

⭐ [MUST READ] I spent 2 days reading the Pantera report to compile the 14 most important insights for everyone 👇

1/ Should I exit the market?

2/ Why am I losing money this season?

3/ Should I rush into AI, meme coins,...?

4/ BTC dropped 30%, should I cut my losses?

5/ 2025 is just beginning twitter.com/gm_upside/status/1...

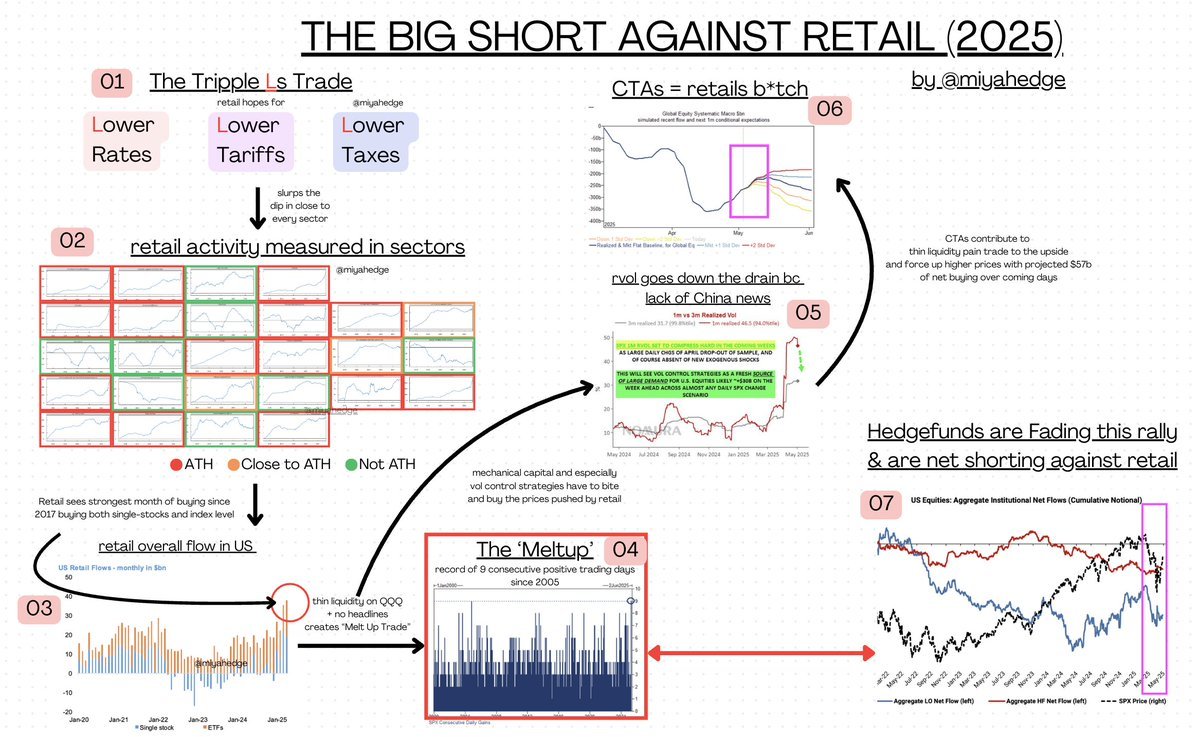

01. “Three L’s” make individual investors delusional

Currently, the US stock market is receiving great expectations thanks to Mr. Trump’s three political commitments:

👉Lower Rates – Trump is pressuring the FED to cut interest rates, even wanting to have

02. Retail Investors Buy Almost Every Sector

Chart 2 in the figure shows that retail investors are buying almost every sector – from technology, healthcare, finance, consumer, energy, etc.

The red boxes are the sectors that have

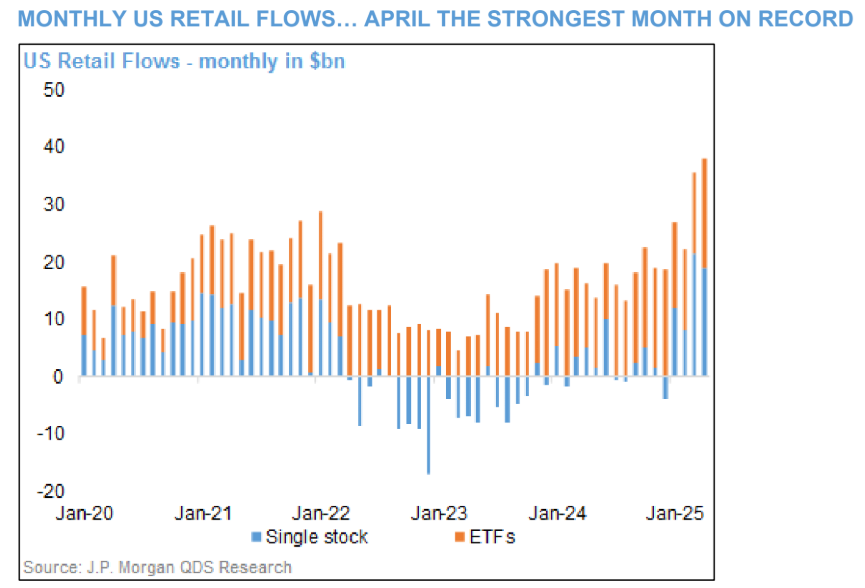

03. Retail Flows Are at Their Highest Since 2019

The chart below shows that retail flows in the past month have been the highest since pre-COVID.

They are not only buying individual stocks but also ETFs (index funds), especially

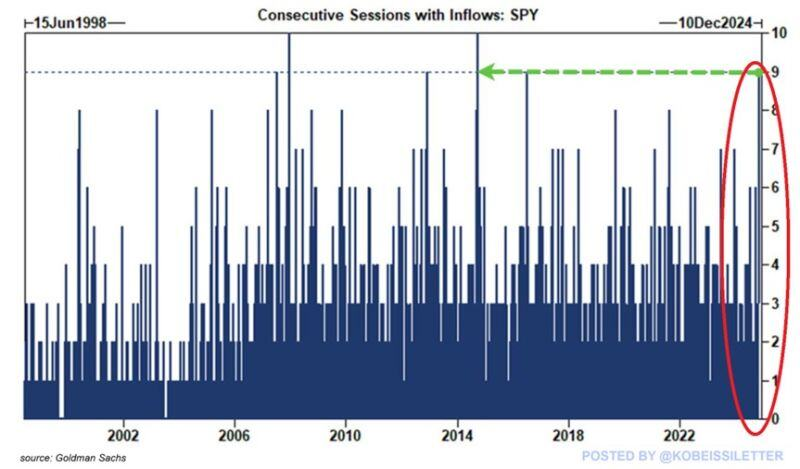

04. “Melt-up” – Price increase without reason

Because retail buys too strongly and continuously, combined with no bad news and thin market liquidity, the market has experienced a phenomenon called “melt-up”.

This is a term that refers to a very strong and very fast price increase,

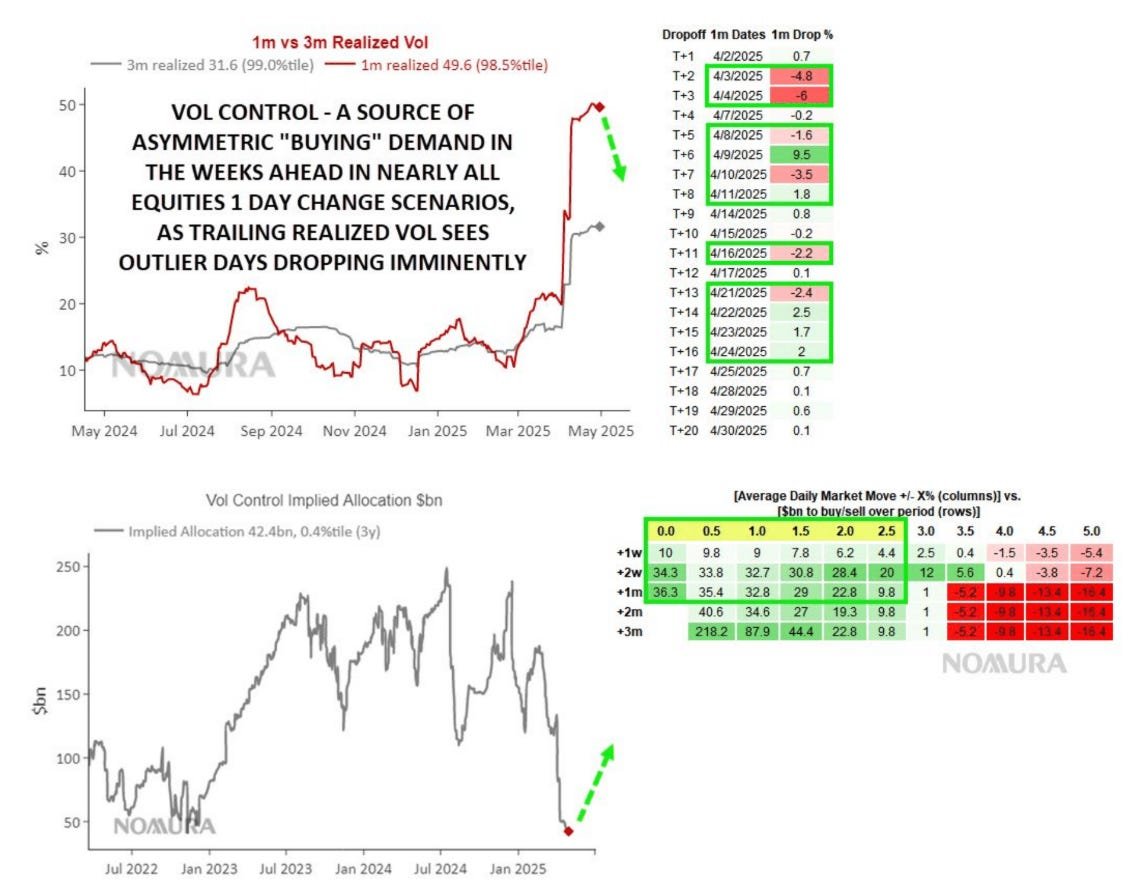

05. Market volatility is unusually low due to lack of news from China

The realized volatility (rVol) chart shows:

Market volatility is falling sharply, mainly due to lack of news from China – no good/bad news

06. CTA funds are “forced” to buy after retail

CTAs (Commodity Trading Advisors) are trend-following funds that use computer models to make buy/sell decisions.

When stock prices are pushed up by retail buying, these models also send buy signals, forcing retail investors to buy.

07. Meanwhile, large funds are quietly selling

The most dangerous thing is that professional hedge funds are quietly selling and betting that the market will fall (Short selling).

The final chart number 7 shows:

- Retail continues to buy.

-

🤔 A nine-session winning streak is rare – but rarity isn’t always a good sign.

Beneath the shiny surface of the recovery lies a troubling truth: retail investors are betting big on promises that haven’t been delivered.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share