Bitcoin Futures Basis Roars Back as BTC Tops US$90K—Here’s Why It Matters 🧵

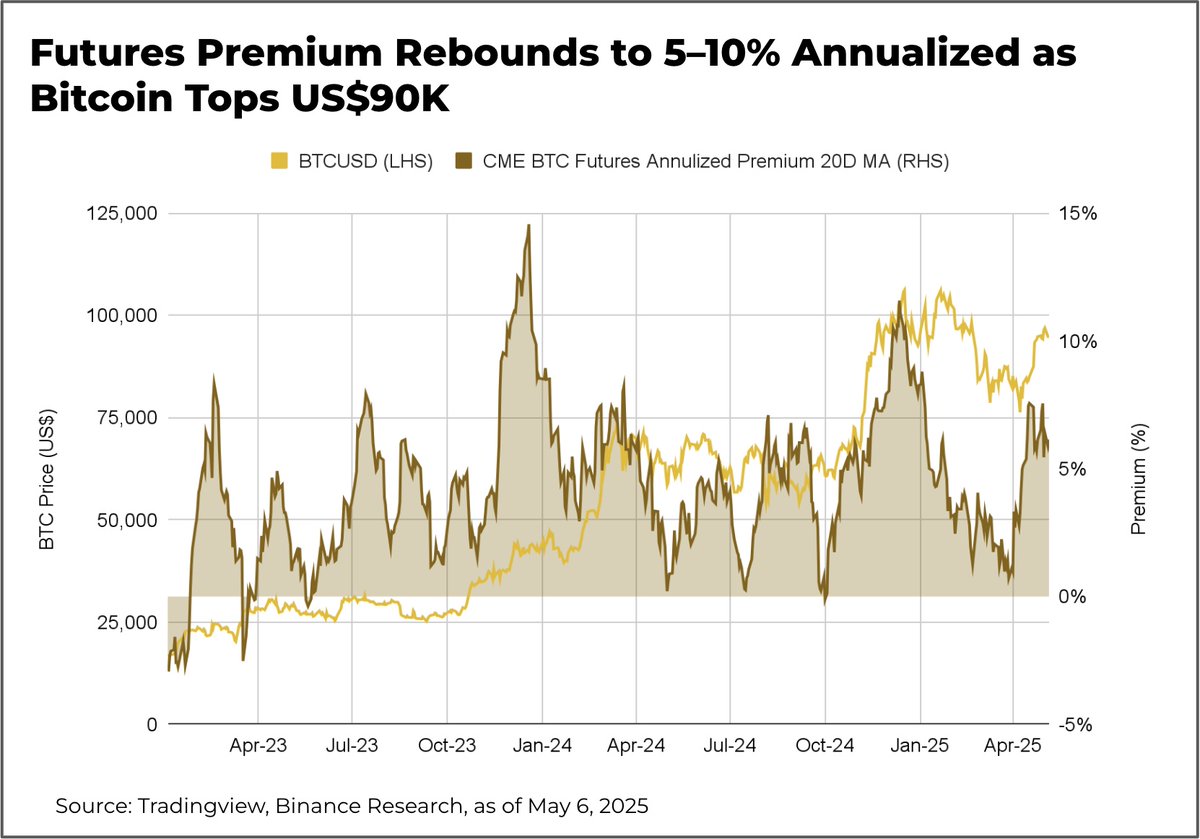

1/ Futures Premium Rebounds

As BTC climbed above US$90k, the CME futures basis jumped back to an annualized 5-10%, signaling renewed leveraged interest and growing market confidence.

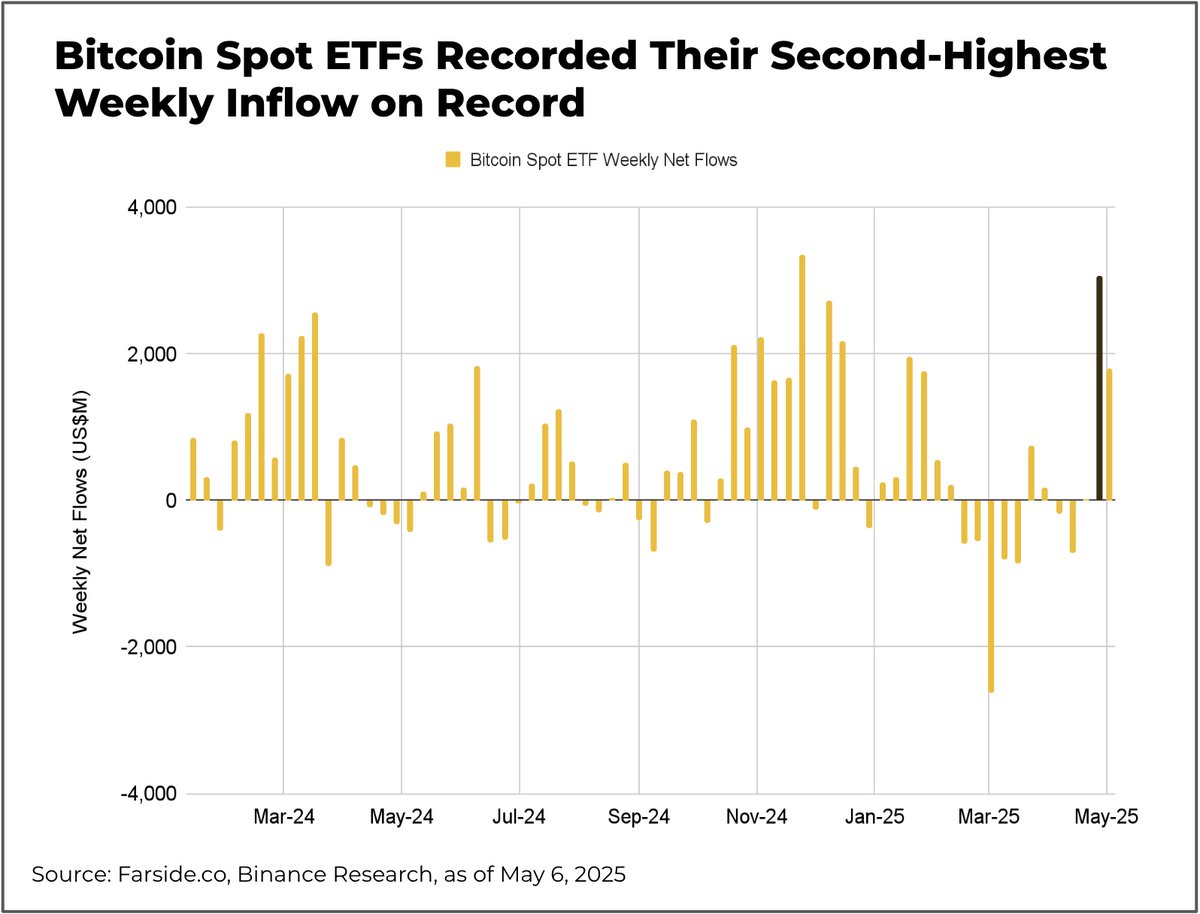

2/ Spot ETF Inflows Surge

The futures basis rebound coincides with the U.S. Spot Bitcoin ETFs posting their second-highest weekly net inflows on record, attracting ~US$3B. This highlights strong demand for the underlying spot asset.

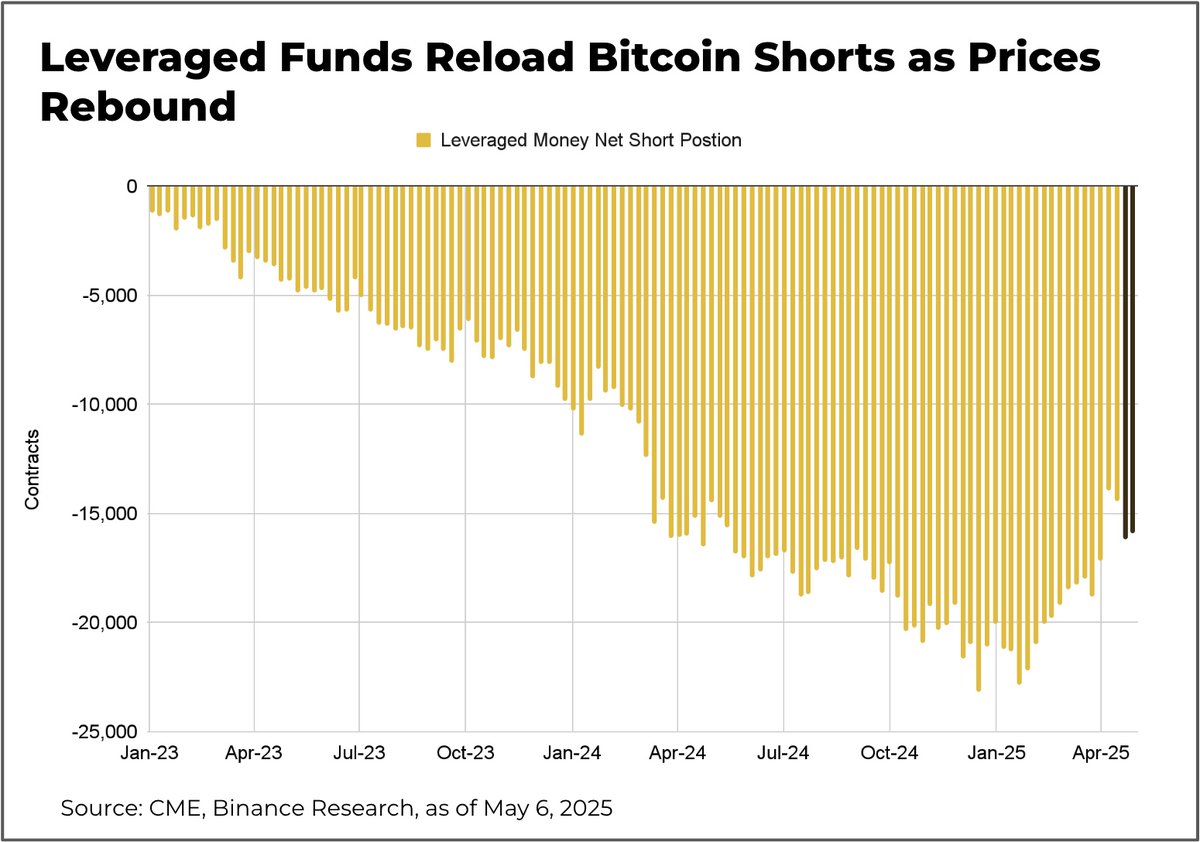

3/ Leveraged Funds Add Shorts Despite Price Rally

Last week, leveraged funds increased their net short positions in Bitcoin futures to -16,203 contracts—roughly 81,000 BTC or US$7.8B. This move runs counter to the spot price increase and aligns with their typical pattern of

4/ Basis Trade Makes a Comeback

Rising futures premiums, increased leveraged shorts, and strong ETF inflows points to a revival of the basis trade strategy—long spot or ETF, short futures. This indicates arbitrageurs are actively re-entering the market.

5/ Futures Premium Could Reinforce Spot Support

The rising premium reflects growing optimism in the futures market. If sustained, it may incentivize more basis trading activity—long spot, short futures—which can drive capital into the spot market and provide underlying support

6/ What Drives the Futures Premium

Unlike commodities with storage costs, Bitcoin’s futures premium typically reflects financing or opportunity costs—mainly the risk-free rate foregone by holding spot BTC. In theory, futures prices equal spot price plus the implied interest over

Found this helpful? Check out the Binance Research website for more in-depth reports.

www.binance.com/en/research

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content