Written by: arndxt

Translated by: Azuma (@azuma_eth)

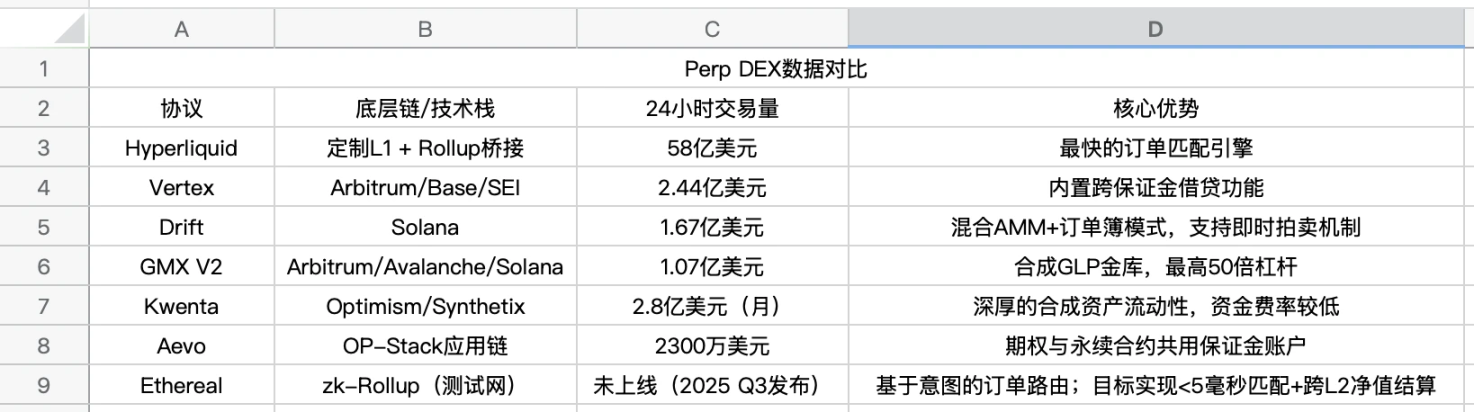

Editor's Note: Decentralized Perpetual Contract Exchanges (Perp DEX) have become one of the most competitive tracks in the industry. Although Hyperliquid's leading position is emerging, many new-generation Perp DEXs are also making significant strides. In the following article, crypto analyst arndxt provides a differentiated analysis of the core highlights of multiple rising stars in the Perp DEX track, comparing targets that cover Vertex, Drift, GMX V2, Kwenta, Aevo, Ethereal, OstiumLighter, and edgeX, which may help investors find potential alpha in this track.

The rise of Decentralized Perpetual Contract Exchanges (Perp DEX) is inevitable, as they fundamentally eliminate the possibility of centralized platform meltdowns from an economic mechanism perspective.

The current technical architecture is trending towards a design that retains Binance-level user experience while completely eliminating fund custody risks. The next 12 months will be a critical period for this track's development, with winners able to monopolize liquidity by optimizing this design structure, while losers will become just another mediocre project propped up by token incentives.

Necessary Design Mission

The collapse of FTX in November 2022 interrupted the development trend previously taken for granted by the industry - exchanging fund custody permissions for speed and liquidity. Suddenly, execution speed became meaningless in the face of fund safety.

However, the first-generation Perp DEXs (such as GMX V1 and Gains) were too slow and rigid, making it difficult to compete with Centralized Exchanges (CEX) in execution quality. The gap between "CEX-level speed" and "DeFi-level security" became the core issue urgently needing resolution in the industry.

Now, a large number of new Perp DEXs are directly responding to this issue, with trading matching speeds generally below 10 milliseconds, funds settled completely on-chain, and absolutely no user fund custody.

Liquidity is gathering around order book engines (rather than vAMM models). Whoever can first break through the daily trading volume threshold of $100 million to $500 million will build a moat - with arbitrageurs and copy trading bots taking root.

Besides the much-discussed Lighter and Ostium, Ethereal is also worth noting. If its team can achieve matching speeds below 5 milliseconds while maintaining non-custodial status, it could become the first "high-frequency trading" DEX directly connected to intent routing (rather than isolated order books).

How New Entrants Build Moats

It's becoming increasingly clear that the competitive dimension of the new generation of Perp DEXs is no longer just trading volume, but also intent trading, vertical scenario deep cultivation, and filling systematic gaps not yet addressed by industry leaders like Hyperliquid.

Under this context, the development strategy of new Perp DEXs is very clear - first identify trading demands not met by Hyperliquid, then build a dedicated execution layer around it, and finally use technological primitives that were not feasible two years ago as core support.

Currently, the following projects are targeting blank areas not yet covered by Hyperliquid:

Ostium: Traditional Financial Assets (TradFi Assets);

Lighter: Cryptographic Fairness;

edgeX: Ultra-Private Throughput;

Ethereal: Cross-L2 Intent Routing;

When evaluating the development status of various Perp DEXs in Q3 2025, I tend to use differentiated order flow (rather than pure trading volume) as the core rating indicator.

Hyperliquid: Still the undisputed king, anticipating Q2 airdrop.

Vertex Protocol + Drift Protocol: Cross-margin pioneers on the two fastest blockchains (Arbitrum and Solana).

edgeX + Lighter: Once zk-proof throughput is battle-tested, they may become institutional-level choices.

Ostium: Dark horse, with potential nominal trading volume for RWA perpetual contracts that could crush native crypto assets.

Traditional vAMM-type Perp DEXs (GMX, Gains): Still have a strong retail user base, but must launch order books or risk losing trading volume.