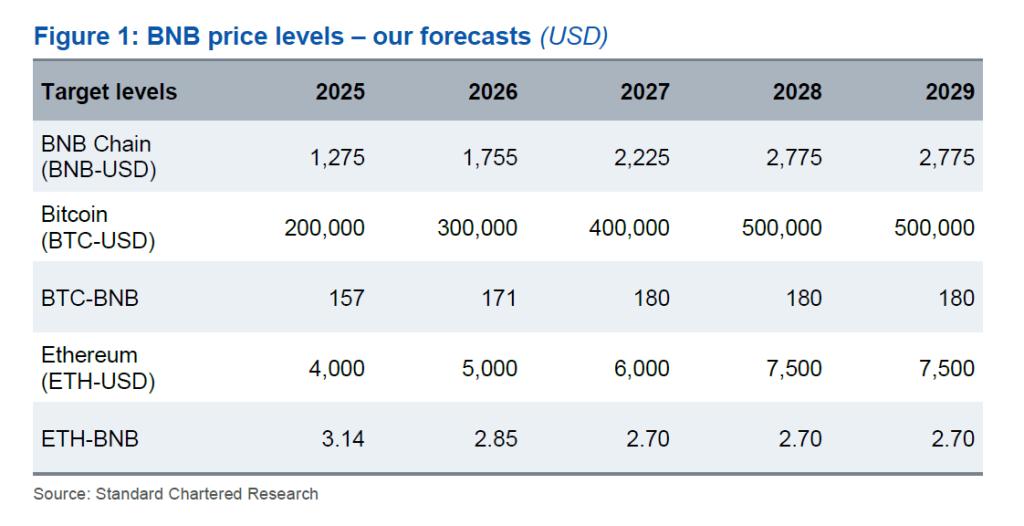

Standard Chartered predicts BNB could reach $1,275 by the end of 2025, more than double the current price, based on correlation with major assets.

Investment bank Standard Chartered has just released a new analysis report, providing an optimistic forecast for the growth prospects of BNB – the native token of the BNB Chain ecosystem operated by Binance. According to the report, BNB's price could reach $1,275 by the end of 2025, increasing more than twofold from its current trading level.

The report indicates that analysts at Standard Chartered believe BNB's price could continue its long-term upward trend, with an expected target of $2,775 per token by the end of 2028. As of May 6, BNB was trading around $600, with a fully diluted valuation (FDV) estimated at approximately $84 billion, according to data from CoinMarketCap.

Mr. Geoff Kendrick, Head of Digital Currency and Digital Asset Research at Standard Chartered, stated: "From May 2021 to now, BNB has almost always moved in line with an unweighted basket of Bitcoin and Ethereum assets, in terms of both performance and volatility. We expect this correlation to continue, providing a basis for BNB's price increase to $2,775 by 2028."

BNB currently serves as the primary utility and governance token of BNB Chain – a Layer-1 blockchain closely linked to Binance, the world's largest centralized cryptocurrency exchange (CEX). Although Standard Chartered notes lower application development and developer activity on BNB Chain compared to competing platforms like Ethereum or Avalanche, the report suggests this is not necessarily a systemic weakness.

Specifically, over 60% of on-chain activity on BNB Chain comes from decentralized exchanges (DEX), reflecting the ecosystem's clear focus on digital asset trading. In contrast, other Layer-1 blockchains typically have a more diverse application distribution, ranging from DeFi and Non-Fungible Tokens to blockchain gaming models (GameFi).

Notably, the report highly values Binance's central role in maintaining ecosystem stability. Mr. Kendrick emphasized: "As long as Binance maintains its position as one of the world's top CEXs, the primary drivers of BNB's value are unlikely to change significantly in the short term."

Based on this premise, Standard Chartered believes BNB could serve as a benchmark for the entire digital asset market. Currently, according to data from defillama, BNB Chain is the fourth-largest Layer-1 blockchain by total value locked, with a size of approximately $6 billion.

Additionally, on May 5, asset management company VanEck filed an application with the U.S. Securities and Exchange Commission (SEC) to list the first ETF based on the BNB token. This move is seen as a signal of increasing interest from traditional financial institutions in Binance's ecosystem and the digital asset market in general.