Dubai, UAE, May 7, 2025 - In the aftermath of the largest hacker event in cryptocurrency history, Bybit has demonstrated market resilience, transparency, and user trust. An independent report released by Kaiko, a leading institutional-grade cryptocurrency market data provider, shows that Bybit restored liquidity to pre-event levels within just 30 days - an achievement unprecedented in the industry following similar crises.

On February 21, 2025, Bybit experienced an organized cyber attack that resulted in the unauthorized extraction of assets worth $1.5 billion. Despite the shock to the global crypto ecosystem, Bybit responded quickly and, with its robust infrastructure, ensured uninterrupted trading. In the following weeks, the platform's liquidity, trading depth, and user confidence recovered at an astonishing speed.

Rapid Recovery Within 30 Days, Benefiting from Market Structure Innovation

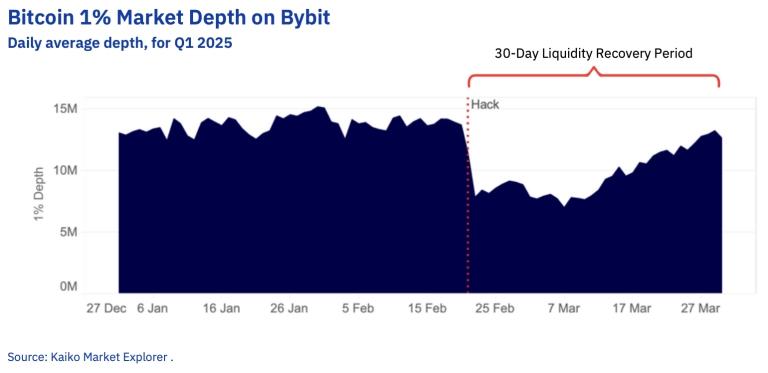

According to Kaiko's analysis, Bybit's Bitcoin liquidity, measured by 1% market depth, recovered to a daily average of $13 million by the end of the first quarter of 2025, fully returning to pre-hack levels. Liquidity across order book levels has been restored, ranging from 0.1% to 8% around the mid-price, indicating deep institutional market maker participation.

A key factor in this recovery was the "Retail Price Improvement (RPI)" order launched by Bybit on February 20th - the day before the incident. This feature is exclusively for retail traders placing manual orders through the Bybit website or app, with no API access. RPI orders are submitted by institutional market makers, specifically designed to optimize retail traders' execution prices. During the market volatility following the event, RPI orders effectively stabilized the trading environment, tightened spreads, and protected manual users from high-frequency algorithmic trading.

Altcoin Market Synchronized Recovery, Spreads Narrowing Comprehensively

Liquidity recovery was not limited to Bitcoin. By March, over 80% of market depth for the top 30 mainstream Altcoins had recovered to pre-event levels. Major tokens, including high-volatility assets like Doge and XRP, saw significantly tightened spreads, reflecting reduced execution costs and restored market maker confidence.

The bid-ask spread volatility - a key indicator of market stress - continued to decline in March, indicating improved order book stability and increased liquidity provider participation.

Trading Volume Recovery Surpasses Previous Market Crises

Despite macroeconomic uncertainty leading to cautious market sentiment, Bybit's trading volume recovered faster than in previous similar events, such as the 2016 Bitfinex hack or the 2023 Binance.US SEC case.

Kaiko data shows that after the event, Bybit's hourly trading volume spiked to $1.2 billion. Although trading volume briefly dropped during the weekend, it subsequently steadily recovered, highlighting user stickiness and continued trust in Bybit's market resilience.

Winning Trust Through Transparency

The Kaiko report noted that Bybit's high transparency during the crisis recovery was a key reason for its exceptional performance. Unlike other platforms where liquidity remains long-term damaged in similar events, Bybit quickly rebuilt market confidence and trading stability through open communication and timely market mechanism optimization.

As the crypto market matures, an exchange's competitiveness is not only reflected in performance during market highs but more critically in its crisis response capabilities. Bybit's rapid liquidity rebound and user-centric continuous innovation have set a new resilience benchmark for the industry.