Author: Deep Thinking Circle

While the entire tech circle is busy chasing the AI wave, Sequoia Capital has already started thinking about the deeper opportunities behind this technological revolution. At their annual AI Ascent conference, three core partners Pat Grady, Sonya Huang, and Konstantine Buhler shared their unique insights into AI development trends and market opportunities.

This speech was not filled with intimidating technical terms, but instead revealed how AI is changing the business world and our lives in easy-to-understand language. From market size to application layer value, from data flywheel to user trust, they unveiled the key success factors of AI entrepreneurship. More importantly, they predicted the arrival of the AI agent economy and how it will fundamentally change our way of working. For entrepreneurs and investors, this sharing revealed a clear signal: The AI wave has arrived, and now is the time to move full speed ahead. Don't worry about macroeconomic noise; the wave of technology adoption is enough to drown out any market fluctuations.

If you want to understand why Sequoia believes the AI market is ten times larger than cloud computing, how startups can succeed in this field, and how the upcoming "intelligent agent economy" will disrupt our world, this interpretation provides you with a first-hand feast of ideas.

Market Opportunities: Why AI is a Trillion-Dollar Shockwave

[The rest of the translation follows the same professional and accurate approach, maintaining the original meaning and tone while translating into clear, fluent English.]From Hype to Real Value: Significant Increase in AI User Engagement

Next, Sonya Huang reviewed the significant progress of AI applications over the past year. She shared an exciting data point: in 2023, the daily active users to monthly active users (DAU/MAU) ratio for native AI applications was very low, meaning users were curious to try but did not use them frequently, with hype far exceeding actual value. However, the situation has now dramatically reversed. ChatGPT's daily/monthly active user ratio has been steadily climbing and is now close to Reddit's level.

"This is fantastic news," Sonya said excitedly, "it means more and more people are gaining real value from AI, and we are collectively learning how to integrate AI into our daily lives."

This usage has both a fun and lighthearted side and profound practical value. Sonya candidly admitted that she personally burned an astonishing number of GPUs trying to "Ghibli-fy" various images. But beyond these entertaining applications, more exciting are the deeper applications, such as creating surprisingly precise and beautiful ad copy in advertising, instantly visualizing new concepts in education, and applications like OpenEvidence in healthcare that can better assist in diagnosis.

"We have only just touched the tip of the iceberg of possibilities," Sonya said, "as AI model capabilities continue to improve, what we can do through this 'front door' will become increasingly profound."

[The translation continues in this manner for the entire text, maintaining the specified translations for specific terms and preserving the structure of the original text.]The first challenge is persistent identity. Konstantine explains that persistent identity actually encompasses two aspects. First, the agent itself needs to maintain consistency. If you are dealing with someone doing business who changes every day, you are unlikely to continue cooperating long-term. The agent must be able to maintain its own personality and understanding. Second, the agent needs to remember and understand you. If your partner knows nothing about you, and can barely remember your name, this will also pose a challenge to trust and reliability.

Current solutions such as RAG (Retrieval-Augmented Generation), vector databases, and long context windows are all trying to solve this problem, but significant challenges remain in achieving true memory, memory-based self-learning, and maintaining agent consistency.

"Imagine personal computing without TCP/IP and the internet," Konstantine says, "We are just beginning to build the protocol layer between agents." He specifically mentions the development of MCP (Model Collaboration Protocol), which is just one of a series of future protocols for achieving information transfer, value transfer, and trust transfer.

The third challenge is security. When you cannot communicate face-to-face with your partner, the importance of security and trust becomes more prominent. In the agent economy, security and trust will be more critical than in the current economy, which will give rise to an entire industry around trust and security.

From Determinism to Randomness: A Fundamental Shift in Thinking

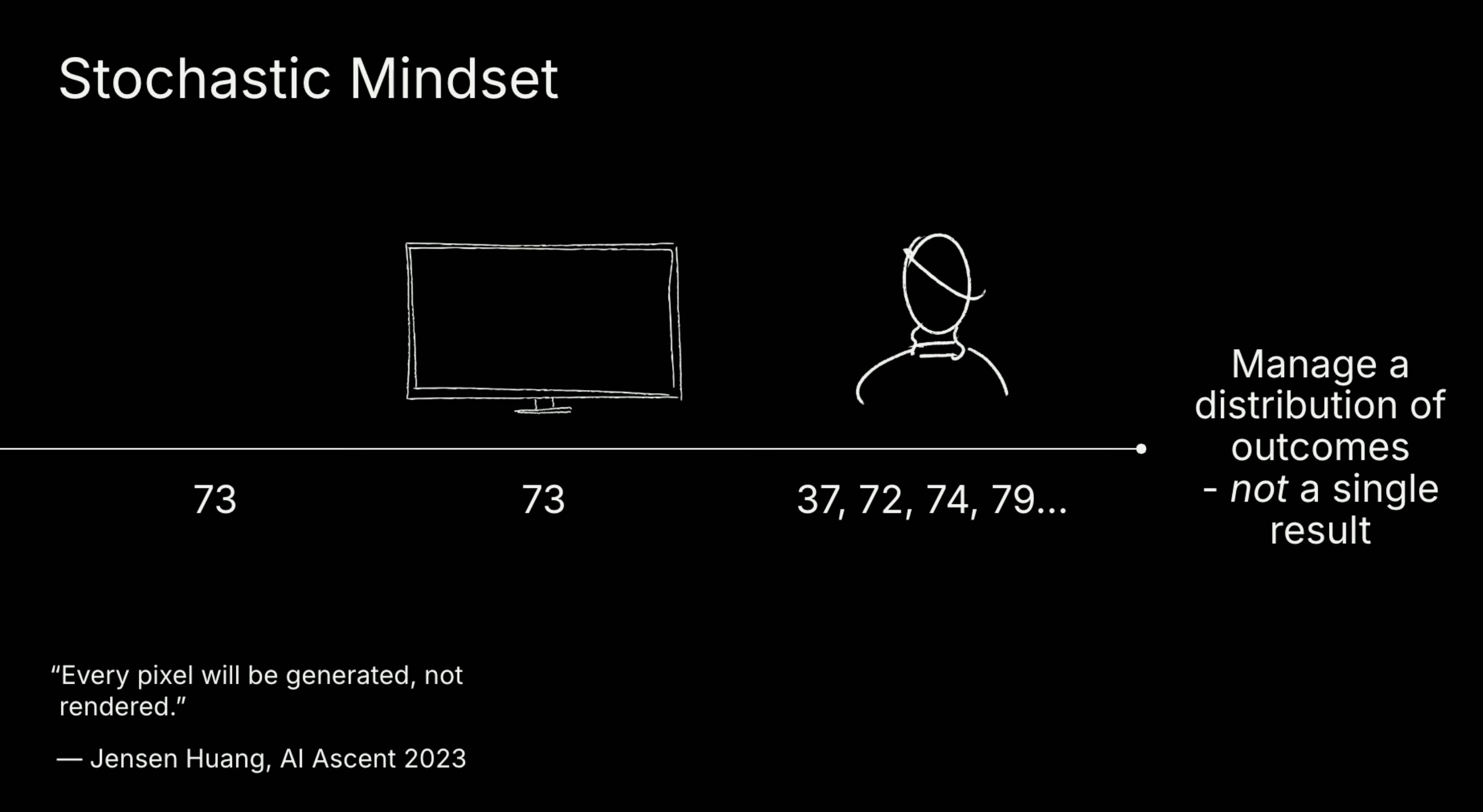

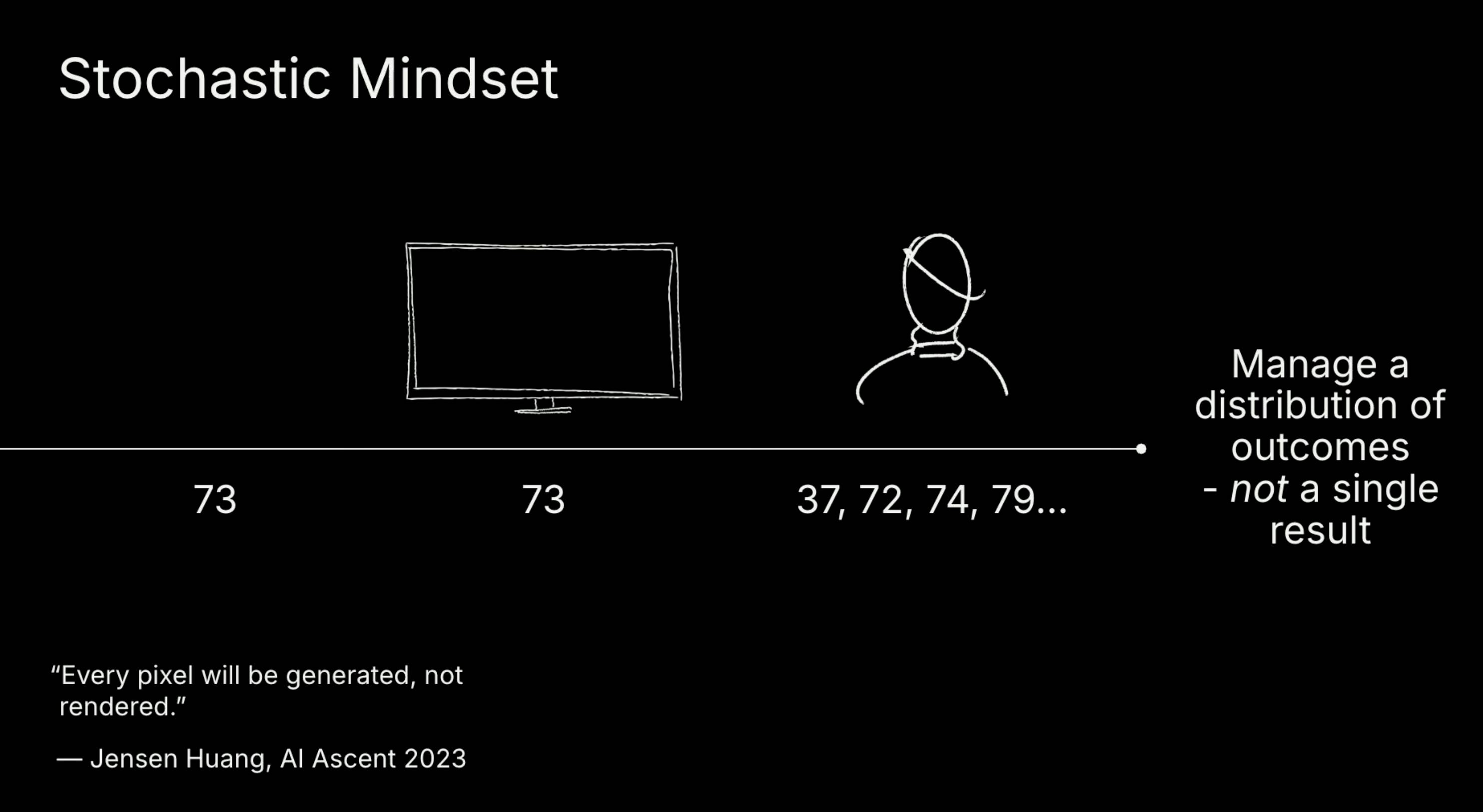

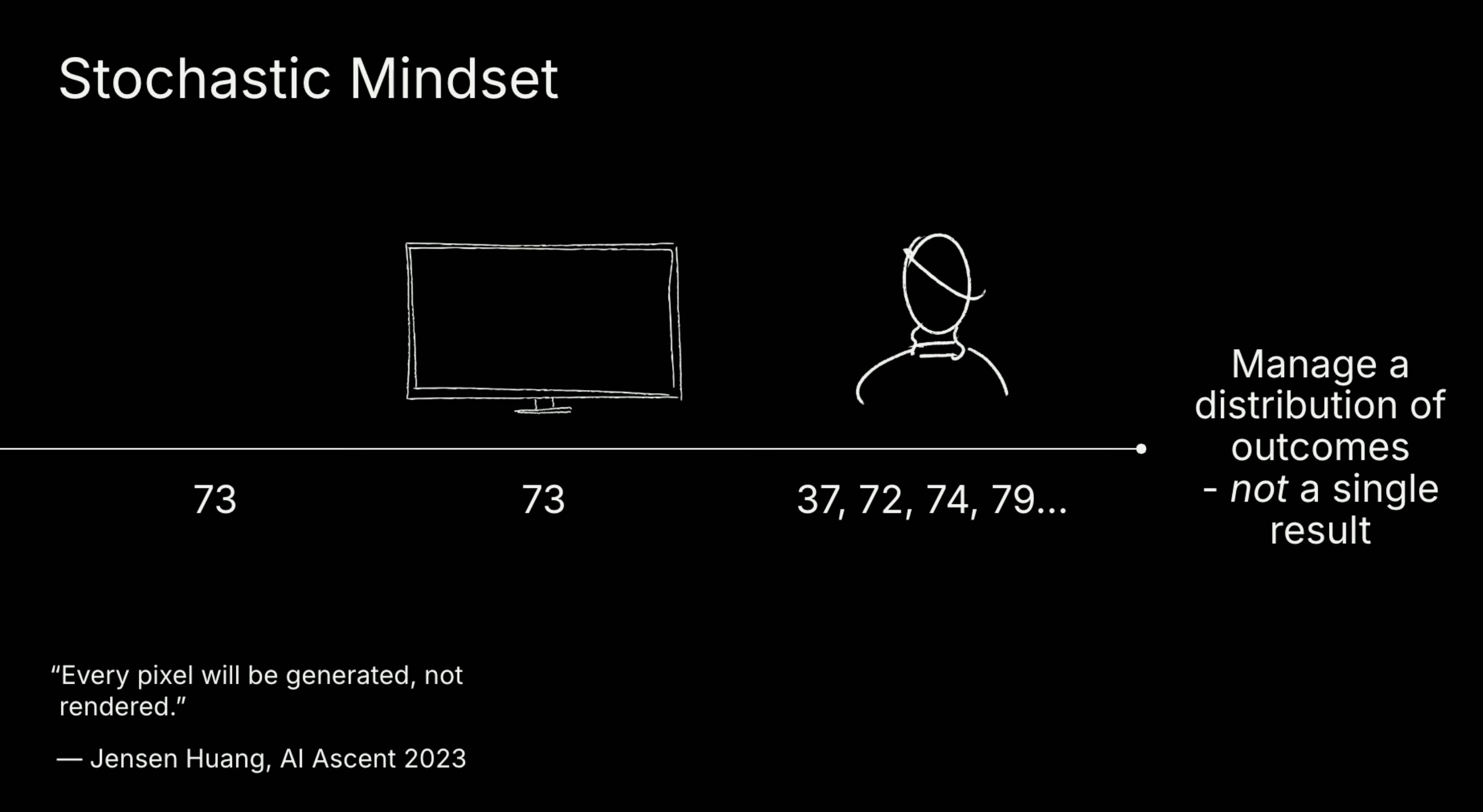

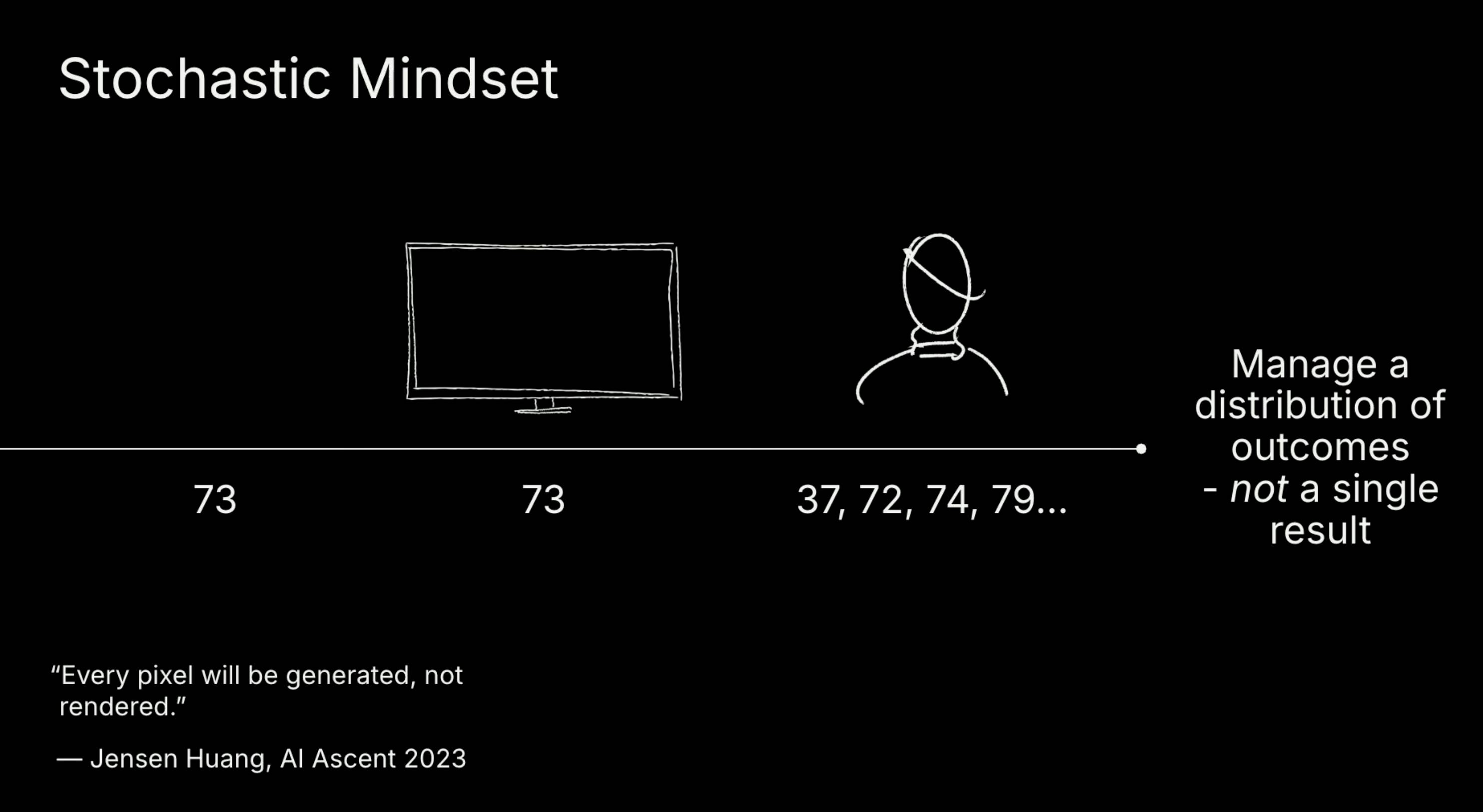

Konstantine believes that the arrival of the agent economy will fundamentally change our way of thinking. He introduces the concept of a "stochastic mindset", which is entirely different from traditional deterministic thinking.

"Many of us fell in love with computer science because it was so unambiguous," he explains, "You program a computer to do something, and it does it, even if the result is a segmentation fault. Now, we are entering an era where computation will have randomness."

He illustrates with a simple example: if you tell a computer to remember the number 73, it will remember it tomorrow, next week, and next month. But if you tell a person or AI to remember, it might remember 73, or 37, 72, 74, or perhaps the next prime number 79, or even nothing at all. This shift in thinking will have profound implications for how we handle AI and agents.

The second change is the management mindset. In the agent economy, we need to understand what agents can and cannot do, which is similar to the process of transitioning from an independent contributor to a manager. We will need to make more complex management decisions, such as when to stop certain processes and how to provide feedback.

The third major change is a combination of the previous two: we will have stronger leverage effects, but certainty will significantly decrease. "We are entering a world where you can do more things, but you must be able to manage this uncertainty and risk," Konstantine says, "In this world, everyone here is very well-suited to thrive."

The Ultimate Leverage Effect: Reshaping Work, Companies, and the Economy

A year ago, Sequoia's prediction group suggested that various functional departments within organizations would begin to have AI agents and gradually merge, ultimately with entire processes being completed by AI agents. They even boldly predicted the emergence of the first "solo unicorn company".

While a "solo unicorn" has not yet been realized, we have already seen companies expanding at an unprecedented speed with fewer people than ever before. Konstantine believes we will reach an unprecedented level of leverage.

"Ultimately, these processes and agents will merge to form a network of neural networks," he envisions, "This will change everything, reshaping individual work, company structures, and the entire economy."

Through this talk, Sequoia's three partners have outlined a clear path for AI's development from the current state to its potential future. From macro market opportunity analysis to insights into application layer value, and to the vision of the agent economy, they not only explained the What and Why but, more importantly, indicated the How—how to seize opportunities and create value in this trillion-dollar opportunity.

For entrepreneurs, this is not just an intellectual feast but an action guide: capture the value of the application layer, build real rather than "atmosphere" revenue, establish a data flywheel, prepare for the upcoming agent economy, and always remember—now is the time to go all out and maintain maximum speed.