- The market structure of Optimism is trending downward and may continue to decline

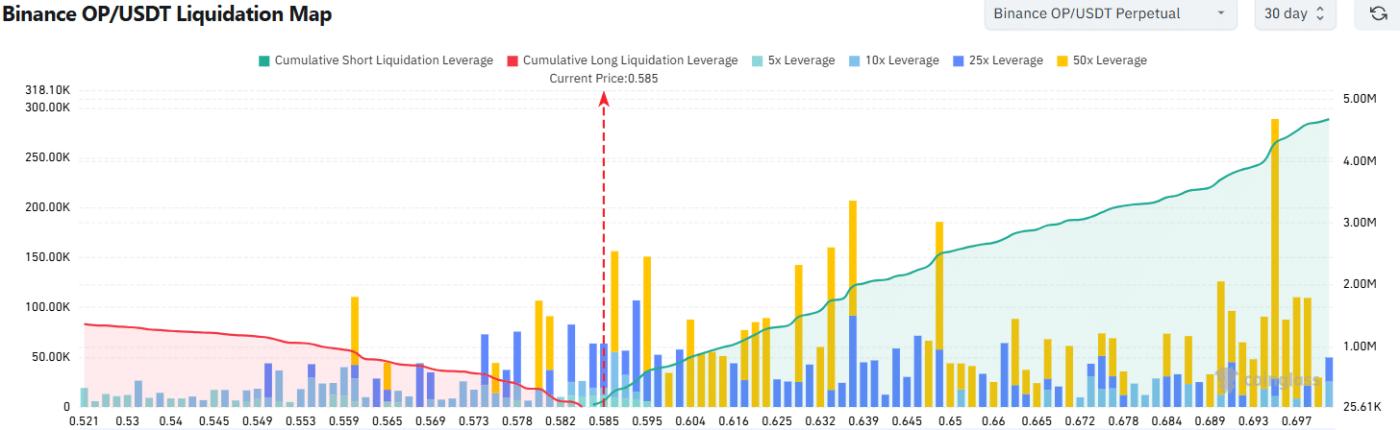

- Many high-leverage short orders around the $0.62 level indicate a potential squeeze may occur

Optimism [OP] has lost 29% of its value in the past ten days, wiping out all profits achieved from April 9 to 26. At this point, sellers are dominant and the potential for continued losses remains very high.

However, an upward trend from [BTC] could change the market sentiment of OP.

Optimism Buyers Forced to Retreat

Source: OP/USDT on TradingView

The one-day market structure shows no signs of increase. The price has not surpassed the recent high of $0.92 set in mid-March during the token's four-month downtrend. After forming another high at $0.842, the OP price was once again rejected.

A 29% decline was recorded in the past ten days. OBV returned to the low level formed in early April. Awesome Oscillator shows a decrease in momentum as the indicator falls below the zero line.

Selling pressure has reappeared, and the momentum shift is consistent with the long-term declining market structure. Therefore, investors and swing traders can expect continued losses.

A move below the support level at $0.59 would be a sign that OP could drop to $0.51. Traders can use the $0.59 level as resistance to enter short positions.

Source: Coinglass

The one-month liquidation map shows many high-leverage short orders above the current price. Therefore, despite the downward momentum and price chart structure, the presence of liquidation could lead to a small price bounce.

The area from $0.6-0.63 is an attractive short-term target. A price recovery in the next few days could provide an opportunity for short sellers to enter positions. However, the increase in Bitcoin's price still needs to be monitored.