As of April 15th, HTX has launched 47 projects in 2025, covering multiple hot tracks. Starting from the second half of 2024, HTX has been focusing on "Sun Bro's Strict Selection", where Sun Bro personally reviews each new asset. So can ordinary investors discover industry trends and wealth codes from this?

From 2025 to Now, MEME Remains the Main Battlefield

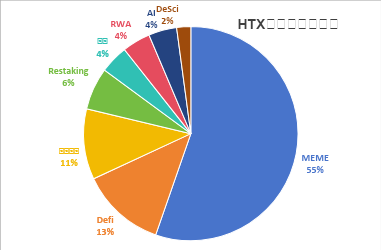

From the chart, it's clear that HTX covers the currently hot market tracks, which can be broadly divided into 7 tracks: MEME, DeFi, Infrastructure (L1/L2), reStaking, Gaming, RWA, AI, and DeSci. Among these, MEME accounts for 55%, followed by DeFi at 13%, Infrastructure at 11%, and RWA and AI at 4% each.

(Data as of 2025.4.15)

In 2025, MEME projects show significant differentiation, with top projects' average lifecycle shortened to 14 days, a 40% reduction from 2024. Behind this rapid rotation are factors like oversupply from batch launch platforms (such as Pump.fun V3), accelerated capital turnover through leveraged MEME farming tools, and new models incorporating NFT holdings into token distribution weights.

In the past few months, market funds have mainly been focused on short-term MEME trading, with heat concentrated on MEME coins. HTX's listed coins can basically meet users' needs for MEME trading. The platform's listing strategy is clear, offering both short-term MEME assets and long-term track assets like RWA and AI. Due to BTC's poor performance this year, there's an inevitable choice of numerous short-term MEME tokens.

DeFi and reStaking Tracks Demonstrate Value Potential

Although MEME has high new listings, the opportunity window is very short. Unlike previous periods of ten or hundred-fold MEME gains, no significant MEME has emerged in 2025 so far, which is related to increased launch speed and frequency dispersing market funds. However, HTX's selected DeFi and reStaking assets have provided good wealth opportunities.

(STO's performance since listing on HTX)

StakeStone is a decentralized cross-chain liquidity infrastructure protocol in the reStaking track. Listed on HTX on February 11th, it has been rising, reaching up to 3x returns.

(PLUME's performance since listing on HTX)

Plume Network is the first full-stack L1 RWA chain and ecosystem built for RWAFi, belonging to the RWA track. After listing on HTX on January 21st, it has been steadily oscillating upward, with returns exceeding 3x.

(BUZZ's performance since listing on HTX)

MEME projects, however, tend to have high openings and low closings, with market trends rarely lasting more than two weeks before entering a long-term low.

(BTC trend since 2025)

This year, BTC has mainly been in correction, only rebounding in recent weeks, so new assets provide fewer opportunities. Against this backdrop, HTX still offers multiple new assets with good growth.

New Asset Operation Strategy Sharing

MEME assets show clear 20-80 differentiation, with most MEMEs eventually going to zero, and only a few rare ones potentially having over 10x gains. So MEME operations either involve participating as much as possible to bet on the 10x probability or trading short-term heat, taking profits quickly.

Assets other than MEME can be laid out long-term, paying attention to HTX's new listings and track layouts to choose promising targets. The exchange's sense is definitely superior to ordinary retail investors, especially since HTX's new listings are personally reviewed by Sun Bro, covering almost all potentially explosive and long-term potential tracks.

As HTX continues to list high-quality new assets in 2025, Sun Bro's personal "strict selection" mechanism has created a strong wealth effect. For investors, "trading new coins on HTX" is becoming an investment habit for discovering early potential assets. Whether it's long-term potential projects like StakeStone and Plume or short-term high-heat MEME hits, investors can seize the first-mover advantage and capture quality assets on HTX.

The crypto market has entered a new cycle dominated by professional institutions. Ordinary investors can build a new investment framework through the exchange's layout logic to capture trend-driven returns in volatility. In uncertainty, HTX's "new listing logic" might be a beacon for retail investors to navigate through bull and bear markets.