Raoul Pal, the "Prophet" of the 2008 Financial Crisis, Talks About Steady Wealth Creation and Macro Trend Insights in Cryptocurrency.

Compiled by: KarenZ, Foresight News

Raoul Pal, a former Goldman Sachs executive, author of "Global Macro Investor", and founder of Real Vision, renowned for successfully predicting the 2008 financial crisis, recently delved deep into how to steadily accumulate wealth in the cryptocurrency field during a conversation with "When Shift Happens" and a speech at the Dubai Sui Basecamp. He discussed topics such as Bitcoin, ETH, meme, AI, Non-Fungible Token, Sui ecosystem, Strategy Bitcoin strategy, investment strategies, macro trends, and market directions.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating into English.]X. Market Attention and Quality Project Selection

This is an attention game. People's focus on key tokens is dispersed, and the duration of various narratives is relatively short. Pal emphasizes that holding Bitcoin is always a wise choice. Additionally, buying Solana at the bottom of the cycle and SUI last year were also good strategies.

Investors should focus their attention on the top 10 or top 20 tokens, paying special attention to projects that can continuously improve network adoption rates, which often have higher investment value. According to Metcalfe's law, project potential can be assessed from aspects such as active user numbers, total transaction value, and user value.

The Bitcoin network has numerous users and involves sovereign nation purchases, which is why Bitcoin is more valuable; Ethereum has a massive user base and rich applications. Although the emergence of L2 slightly complicates the situation, it still possesses significant value. Investors should actively seek projects with simultaneous growth in user numbers and value application, such as Solana, which at the cycle bottom had a continuously growing developer community, stable user numbers, and Bonk's emergence further enhanced market confidence in Solana (Note: The host mentioned previously in a conversation with Toly that Mad Lads was Solana's turning point); Sui is similar.

Highlights of Raoul Pal's Speech at Sui Basecamp in Dubai

1. Macro Core Factors: Liquidity and currency depreciation. Cryptocurrencies and the economy present a four-year cycle, driven by the debt refinancing cycle. Since the global debt peak in 2008, we have been maintaining economic operation by borrowing to repay old debts.

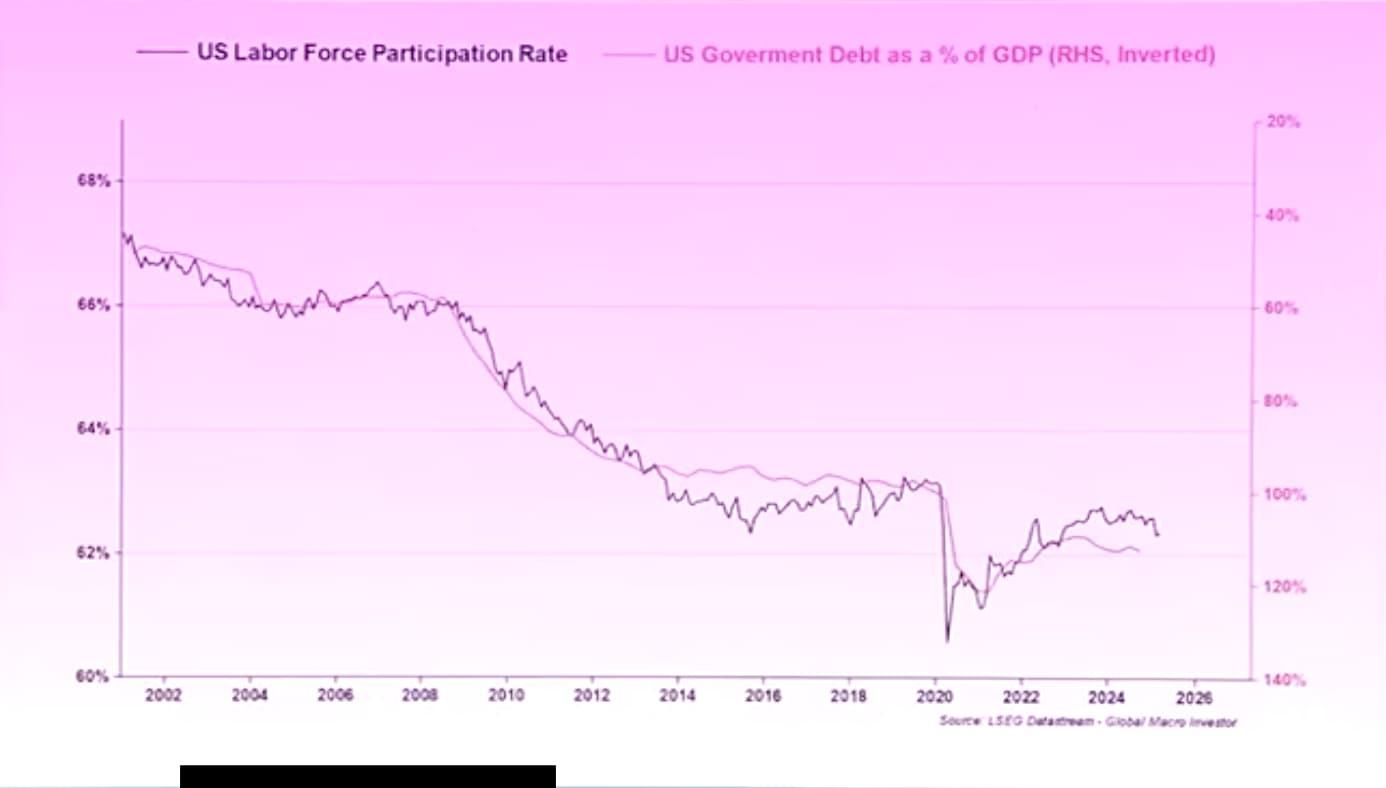

2. Population Aging and Economic Growth: Population aging leads to economic growth slowdown, and more debt is needed to maintain GDP growth. This phenomenon is widespread globally, which can be clearly observed through the correlation chart between debt and GDP.

3. Liquidity Drives Everything: The Federal Reserve's net liquidity is a core indicator. From 2009-2014, liquidity was mainly provided through balance sheet expansion, and later added tools like bank reserve regulation. Currently, total liquidity (including M2) is crucial, with an astonishing explanatory power to Bitcoin (90% correlation) and Nasdaq (97% correlation).

4. Currency Depreciation Mechanism: Currency depreciation is like a global tax, with an 8% hidden inflation tax globally each year, plus 3% explicit inflation, meaning you need an 11% annual return to maintain wealth. This explains why young people are flocking to crypto—traditional assets (real estate, stocks, etc.) have insufficient returns, forcing them to choose high-risk assets for excess returns.

5. Wealth Disparity and Crypto Opportunities: The rich hold scarce assets, while the poor rely on labor income (declining purchasing power year by year). The crypto system subverts this pattern—young people seek breakthroughs through high-risk assets.

6. Crypto Asset Performance: Annualized 130% since 2012 (including three major pullbacks), Ethereum 113%, Solana 142%. Bitcoin's cumulative increase is 2.75 million times, extremely rare in investment, and crypto assets are gradually becoming a "super black hole" attracting funds.

7. Sui Ecosystem Has Enormous Potential. DEEP (DeepBook liquidity layer protocol) has recently performed best. SOL/SUI ratio shows SUI is relatively strong.

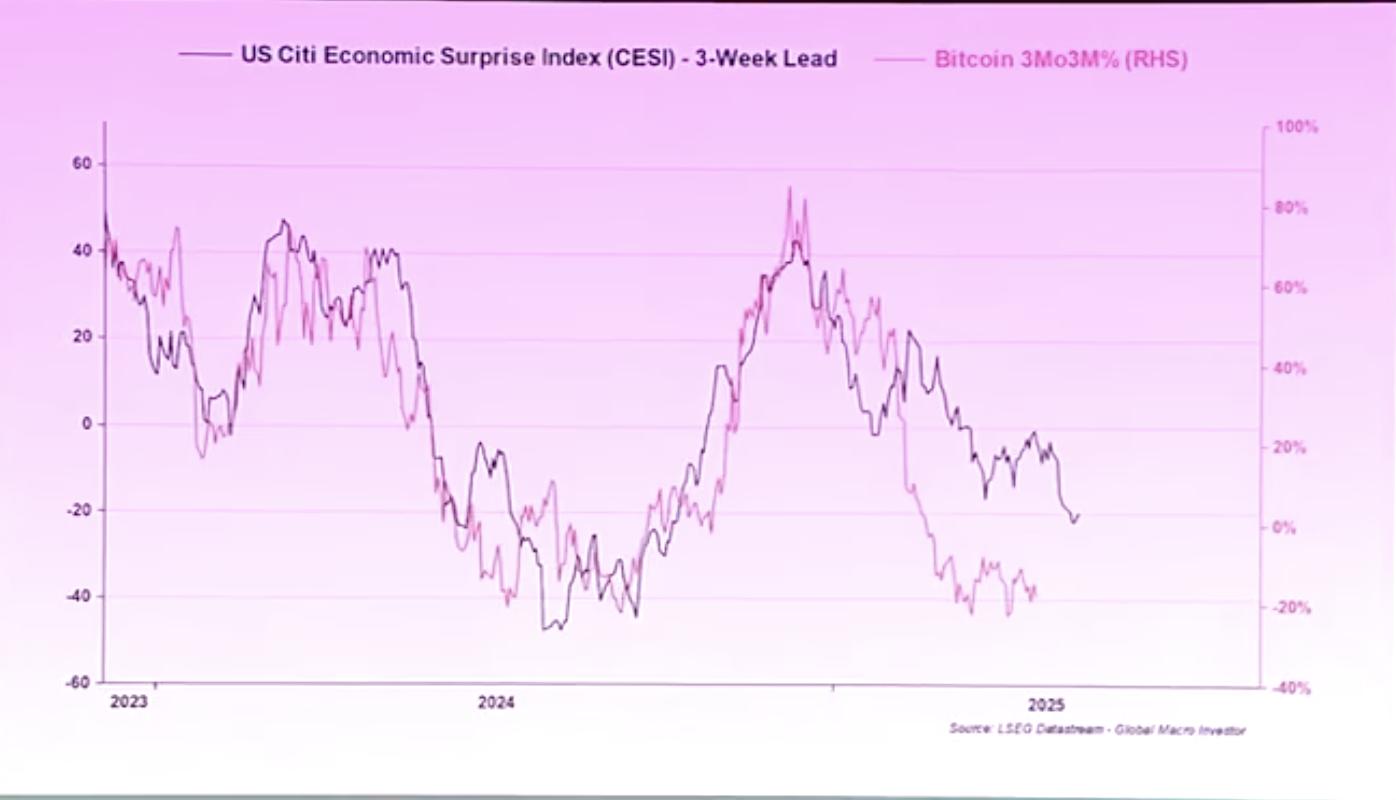

8. Current Market Misjudgment Analysis: People often interpret current market narratives using liquidity conditions from three months ago (such as tariff panic), which is biased. Actually, tightened financial conditions in Q4 2024 (rising US dollar interest rates, rising oil prices) produced a three-month lag effect. The economic surprise index (comparing US and global) indicates the current economic weakness is only temporary. Reviewing the 2017 Trump tariff cycle, the dollar rose first, then fell, followed by liquidity driving asset prices to rise significantly.

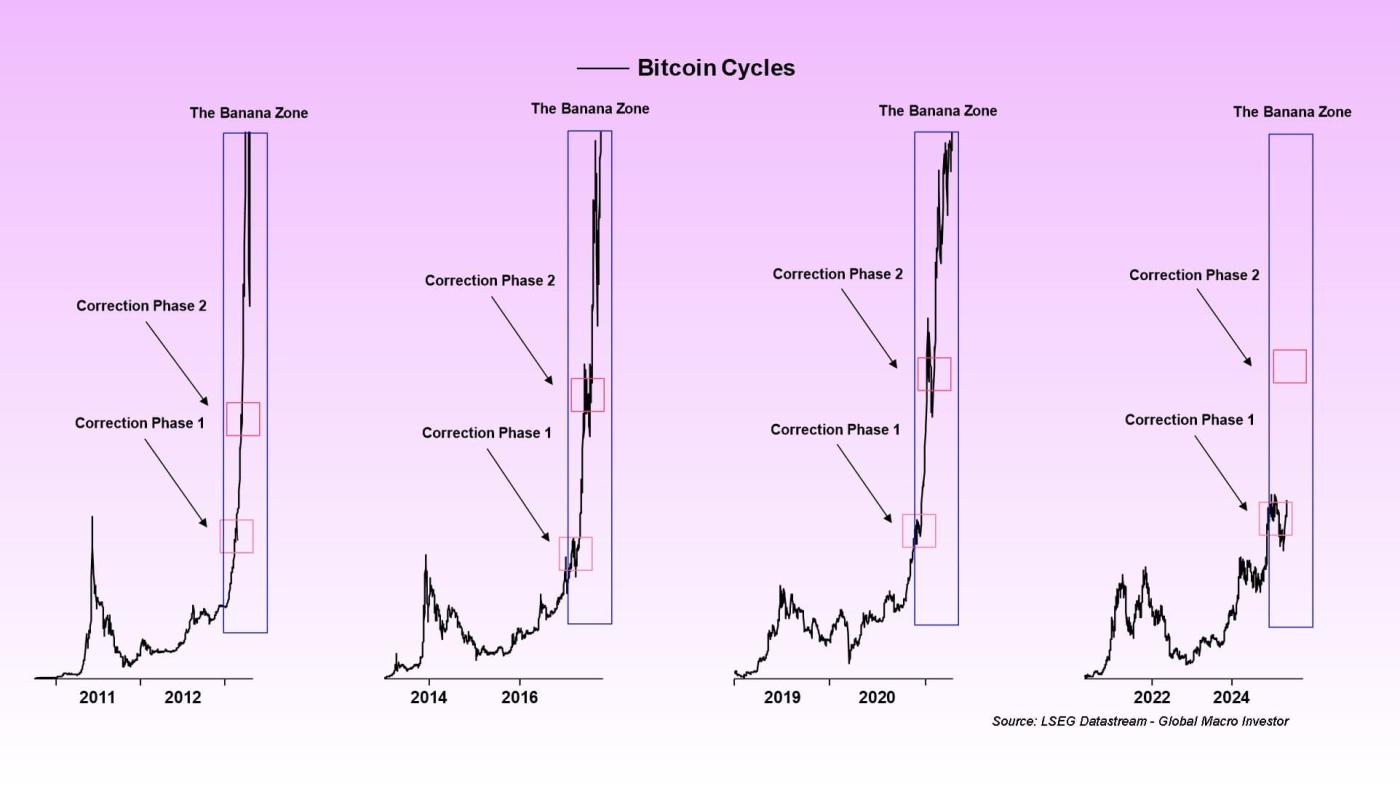

9. Global M2 and Asset Relationship: When global M2 reaches a new high, asset prices should rise synchronously. Taking Bitcoin as an example, its price trend usually shows a breakthrough, pullback, and then accelerates in the "banana zone". Comparing the 2017 cycle, Bitcoin rose 23 times that year. Although the current market is different, considerable appreciation is still expected. The market is currently in the correction phase after the first part of the "banana zone" breakthrough, about to enter the second part, which typically brings an Altcoin market.

10. Business Cycle and Bitcoin Trend: The ISM Manufacturing Index is an important forward-looking indicator. When this index breaks 50, it signals economic growth recovery, increased corporate earnings, and active reinvestment, which will accelerate Bitcoin price increases. If the ISM index reaches 57, Bitcoin price could even reach $450,000. As the business cycle recovers and household cash increases, risk appetite rises, making Altcoin investment logic similar to junk bonds and small-cap stocks.

Note: Raoul Pal is also a board member of the Sui Foundation.

Source: https://www.youtube.com/watch?v=O59gLZZUQcg

https://x.com/RaoulGMI/status/1920463194201444513