The memecoin supercycle was a mistake.

Overheating, liquidity drain, and gambling.

How memecoins changed the market. 🧵👇

2/ First of all, let's remember how it started.

I think no one will argue that the starting point can be considered the fall of 2024. At that time, an influencer gave a presentation criticizing the VC approach.

This made memecoins the main narrative for the next six months.

3/ New memecoins appeared every day and gathered huge liquidity, but just as quickly their popularity ended.

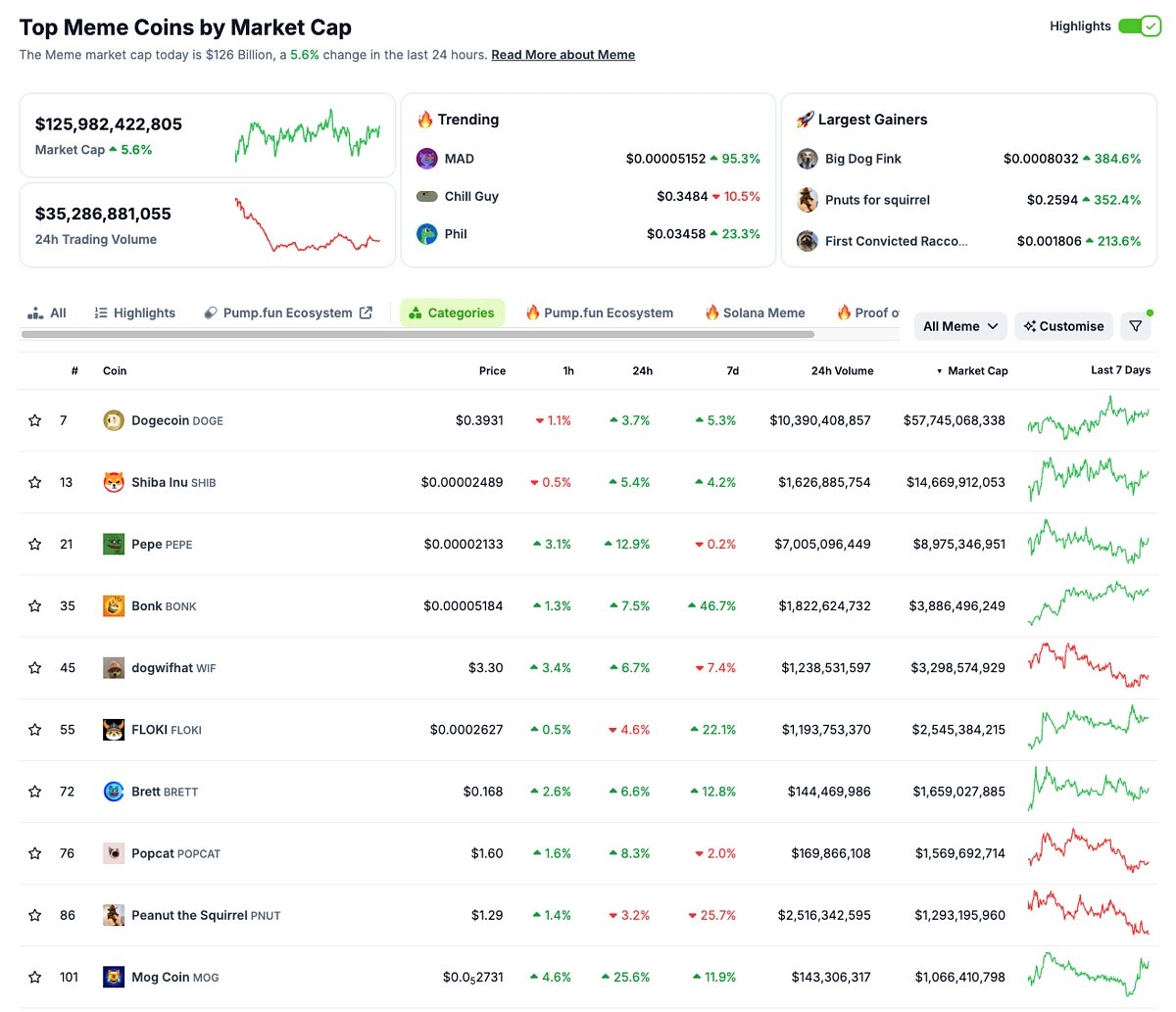

By December 2024, the capitalization of memecoins exceeded $135B, which was more than 5% of the entire crypto market capitalization.

4/ "...What was happening with technology back then?"

Here, we encounter the first global narrative issue.

In the rush for quick profits, the long-term perspective lost its appeal to many. As memecoins gained popularity, meaningful narratives lost liquidity.

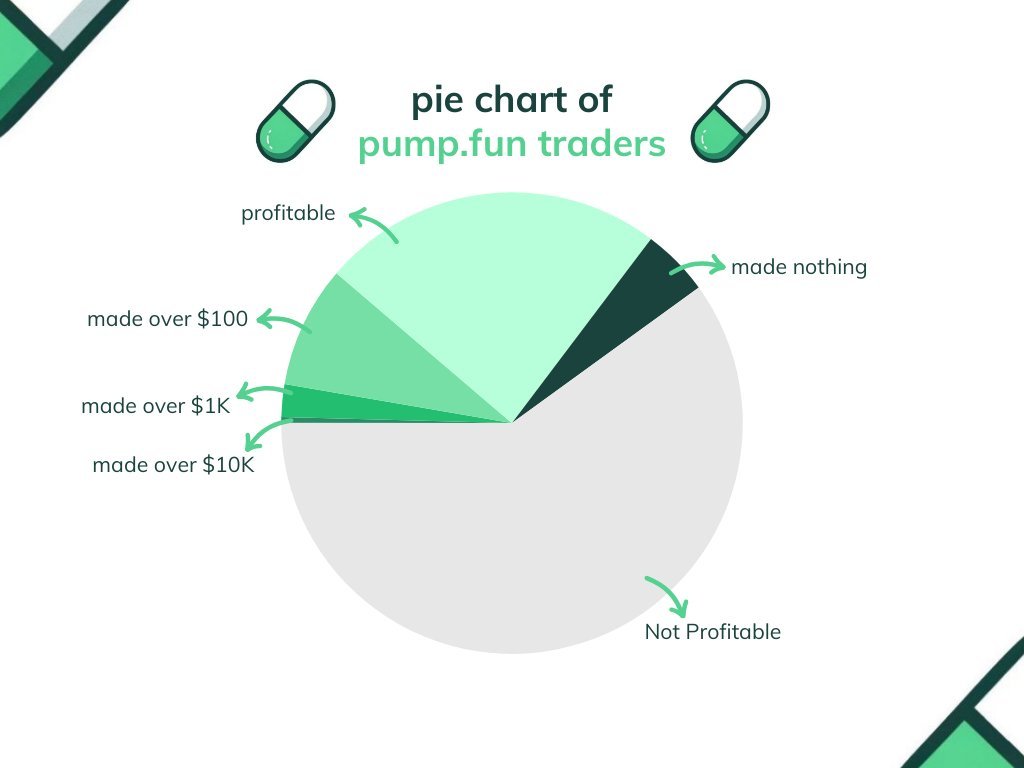

5/ "...Okay, but a lot of people made money, didn't they?"

Another misconception that is driven by hype, social media, and FOMO. You've probably seen plenty of successful screenshots, but the statistics say otherwise.

Most traders stay at a loss, and in an attempt to recoup

6/ "...Hmm, then the next problem is insiders and scammers?"

That's right. History provides many examples of unscrupulous people taking advantage of the rapid pace of this narrative.

Remember $LIBRA? These factors only accelerated the end of the memecoin supercycle.

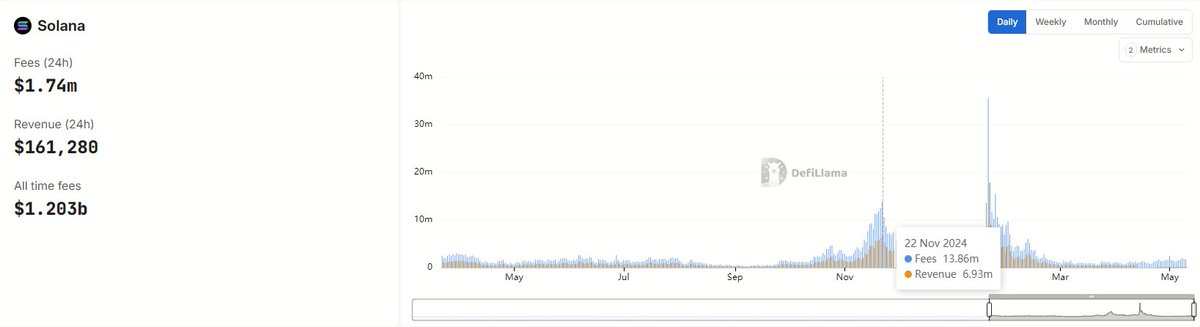

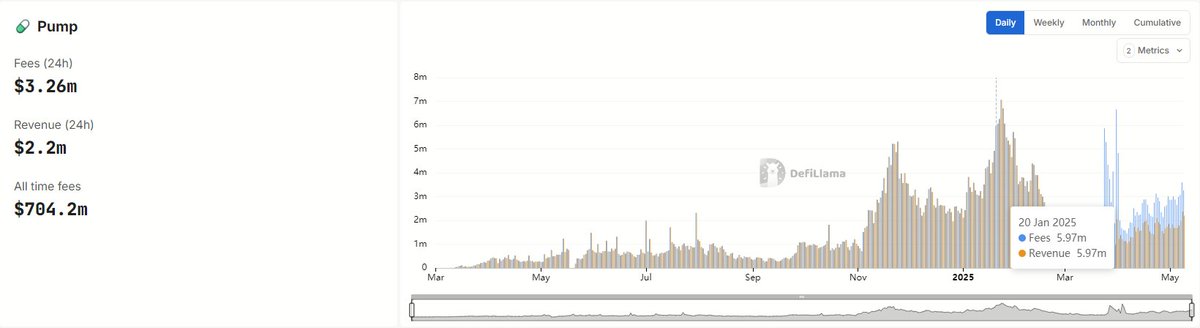

7/ If everyone is losing, who is making money?

The answer is simple: platforms, teams, founders, and the lucky few. Let's set aside the lucky ones and focus on the platforms involved.

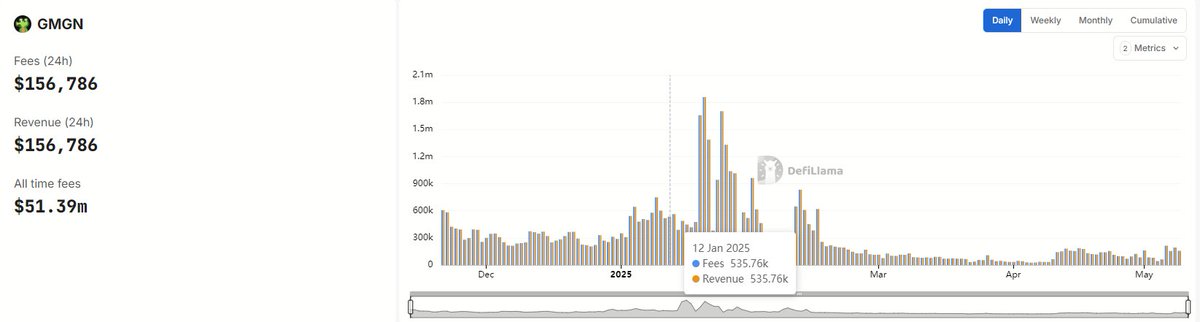

Solana revenue was about $4M/d, Pump fun around $5M/d, and the popular trading terminal GMGN

8/ The losers?

As mentioned earlier, many who traded ended up with nothing. Among my acquaintances, I know of only 1-2 success stories.

Even if you stood on the sidelines, you can still feel the impact of the liquidity and attention drain.

9/ To summarize...

When the supercycle reached its peak, the market was already too overheated, and there was a massive outflow that even the most resilient felt.

Along with this, interests were renewed, and mindshare more and more returned to fundamentals.

10/ Make sure to join my alpha channel so you don't miss out on the hottest updates and news.

➢ Link - http:/bit.ly/3KbglyH.

11/ Wanna more alpha? Follow these chads:

@AlphaFrog13 / @Defi_Warhol / @the_smart_ape / @kem1ks / @splinter0n / @0xDefiLeo / @0xJok9r / @Haylesdefi / @eli5_defi / @belizardd / @0xAndrewMoh / @DOLAK1NG / @kenodnb / @YashasEdu / @rektdiomedes / @thelearningpill / @Flowslikeosmo

12/ Thank you for your attention. I hope this thread helps you get closer to the problems that the memecoin supercycle has presented us with.

Follow me and save this thread in your bookmarks. twitter.com/144759282978666905...

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content