This article is machine translated

Show original

[Hyperliquid 50x veteran] @qwatio is shorting $BTC again with high leverage.

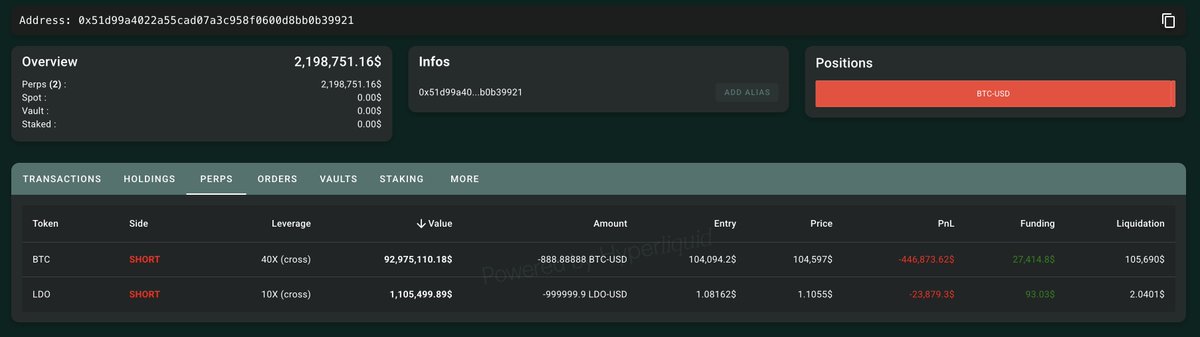

After 35 days, the veteran once again opens a high-leverage large position contract on Hyperliquid: using 2.683 million USDC as margin

◉40x short 888.8 $BTC ($92.93M), entry price $104,094, liquidation price $105,689.

◉10x short 1 million $LDO ($1.1M), entry price $1.08, liquidation price twitter.com/EmberCN/status/190...

2025/04/07 19:24 :

Update: [Hyperliquid 50x brother] closed his long position at a profit half an hour ago, and then withdrew 6.395 million USDC back to the address.

Opened a long position of 69 million ETH at $1459, and closed the long position at $1491. Earned $1.87 million (+41%).

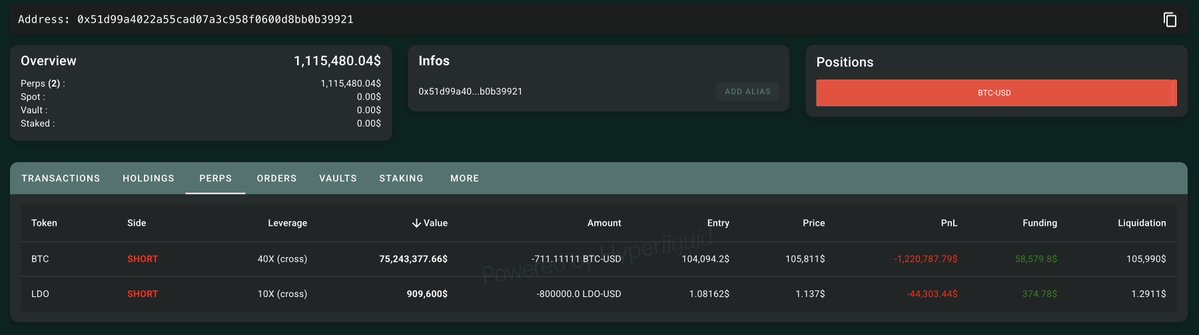

As the news of China reducing tariffs on the United States was released, the price of BTC rose to near the liquidation price of [Hyperliquid 50x brother].

The brother reduced his position: $177.7 BTC was closed at $105,806, with a loss of $304,000.

Currently, he still has 711.1 BTC short, worth $75.13 million, and the liquidation price is $105,990.

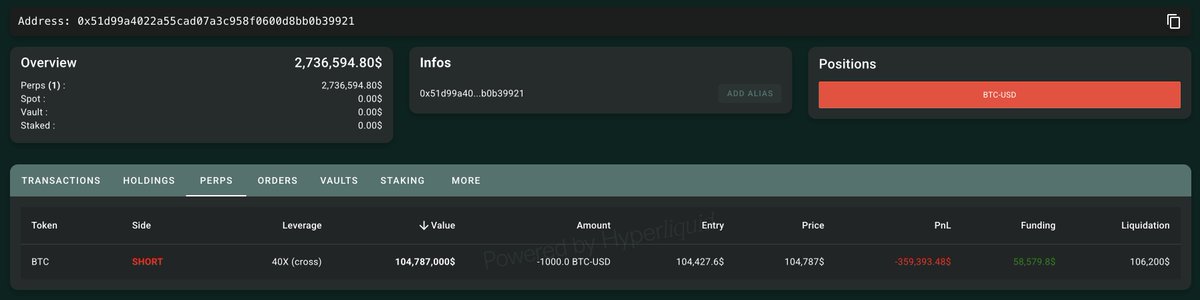

[Hyperliquid 50x brother] just closed his LDO short position, transferred 795,000 USDC to Hyperliquid to increase margin, and then continued to increase his BTC short position.

Now he has a total of 1,000 BTC short, worth $104.8 million, with an opening price of $104,427 and a liquidation price of $106,200.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content