Introduction

In the volatile and risky cryptocurrency market, how to safely and effectively manage assets has always been a major challenge for investors, with many platforms in the past losing user assets due to lack of transparency or risk management capabilities.

This article will introduce AM Management, a Korean cryptocurrency quantitative trading company, exploring how it provides a stable return while ensuring fund safety through an innovative asset management model, offering a reference option for investors in this high-risk market.

What is AM Management?

AM Management was established in December 2021 in South Korea, with its main product being cryptocurrency quantitative trading investment solutions. In the early stages after its establishment, the company focused on building effective quantitative trading strategies. After three years, AM successfully verified the stability of its investment plan and obtained Seed, Pre-A, and A-round financing, with investors including Japan's largest BTC lending company J-cam, Korean GTM consulting company DeSpread, and well-known Korean startup venture capital firms such as Mashup Angels and D.CAMP Investment.

With so many asset management companies, what makes AM Management different?

Existing asset management companies have three main problems:

Entrusted operation - Users need to completely entrust their assets to the operator, unable to obtain real-time information about the intermediate operation, and can only learn about the asset status through periodic reports.

Asset management outsourced to third parties - Most asset management companies will re-entrust assets to third parties, unable to manage risks.

No experience in long-term management of large assets - Most Korean CeFi platforms like Haru Invest, Heybit, and Delio have gone bankrupt in the past few years.

In response to these three main problems, AM Management provides differences that other companies do not:

API management - Managed via API, allowing users to instantly view all asset statuses.

100% operated by proprietary algorithm - AM Management operates through its own quantitative trading algorithm, effectively managing risks.

Experience in long-term management of large assets - Operated over $140M in assets over the past 3 years.

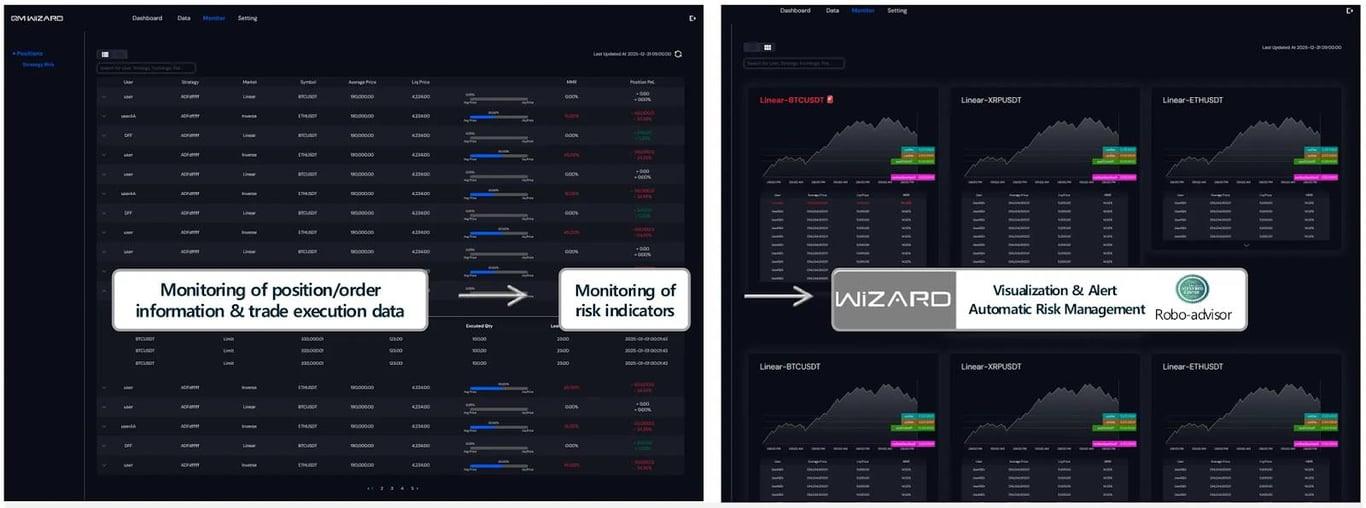

Moreover, AM Management adopts a more conservative system in risk management, assessing forced liquidation risks through visualization tools and setting up warning mechanisms. The core feature of the system is to intuitively present the safety distance ratio between current price and liquidation price through a dashboard, while deeply managing risks using the MMR indicator based on margin ratio. AM Management has successfully passed the Robo-Advisor certification by the Korean Financial Supervisory Service (FSC), proving the reliability of its trading algorithm.

Of course, under good risk management, being able to bring stable returns is the most important. According to the actual asset operation data, AM's quantitative trading solution maintained better performance than market performance during past bear markets. Especially in 2022, despite BTC's price dropping by 60%, AM Management's investment strategy continued to deliver good performance, verifying the profitability of its trading strategy.

What products does AM Management have?

AM Management primarily offers two investment products, providing the most appropriate solutions based on different customer needs.

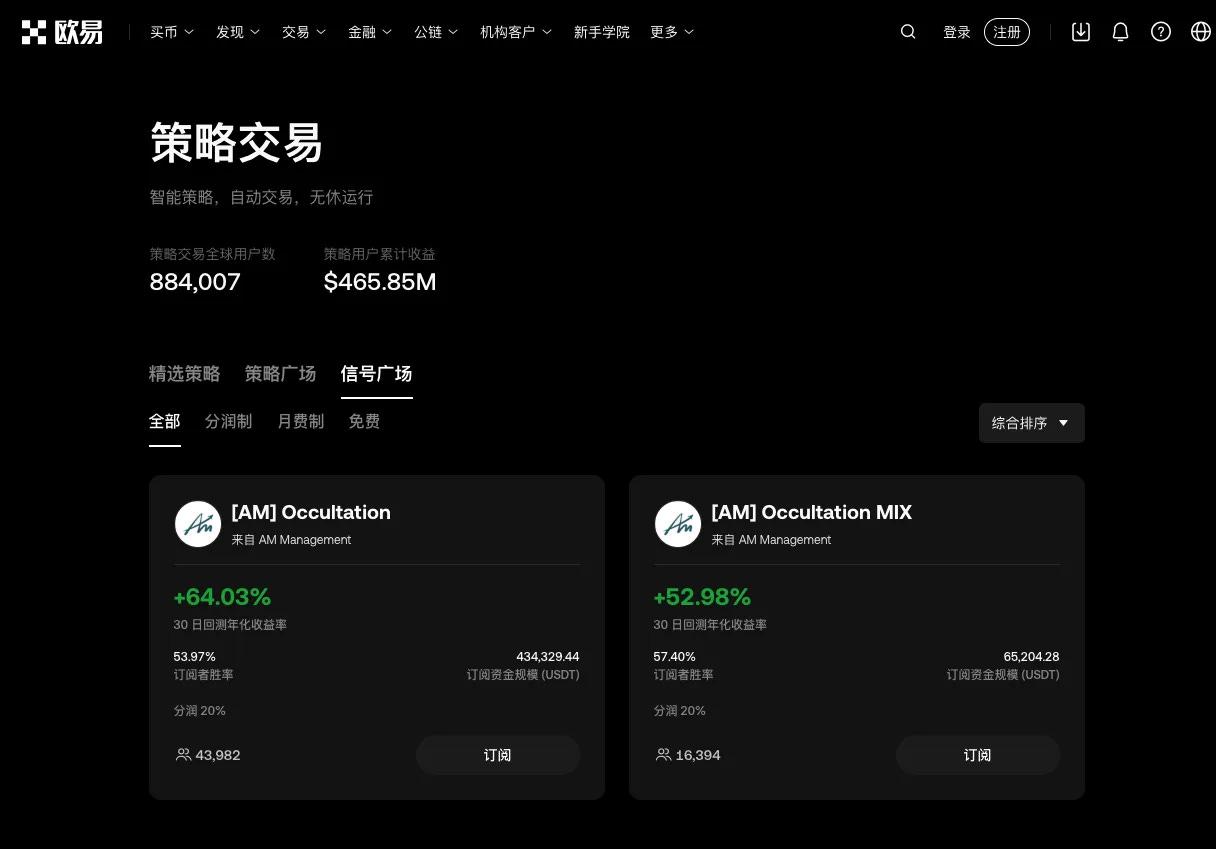

1. OKX Trading Bot: Suitable for general users

AM Management is an OKX partner, officially providing two quantitative trading strategies for OKX users since November 2023. After about a year and a half, over 60,000 users have subscribed, with AUM reaching $500K.

Occultation: 4 currency pairs (BTC, ETH, XRP, Doge) | 5x~25x | 1,000 USDT

Occultation MIX: 8 currency pairs (Doge, OP, ADA, MINA, IMX, XCH, ICP, ATOM) | 2x~20x | 500 USDT

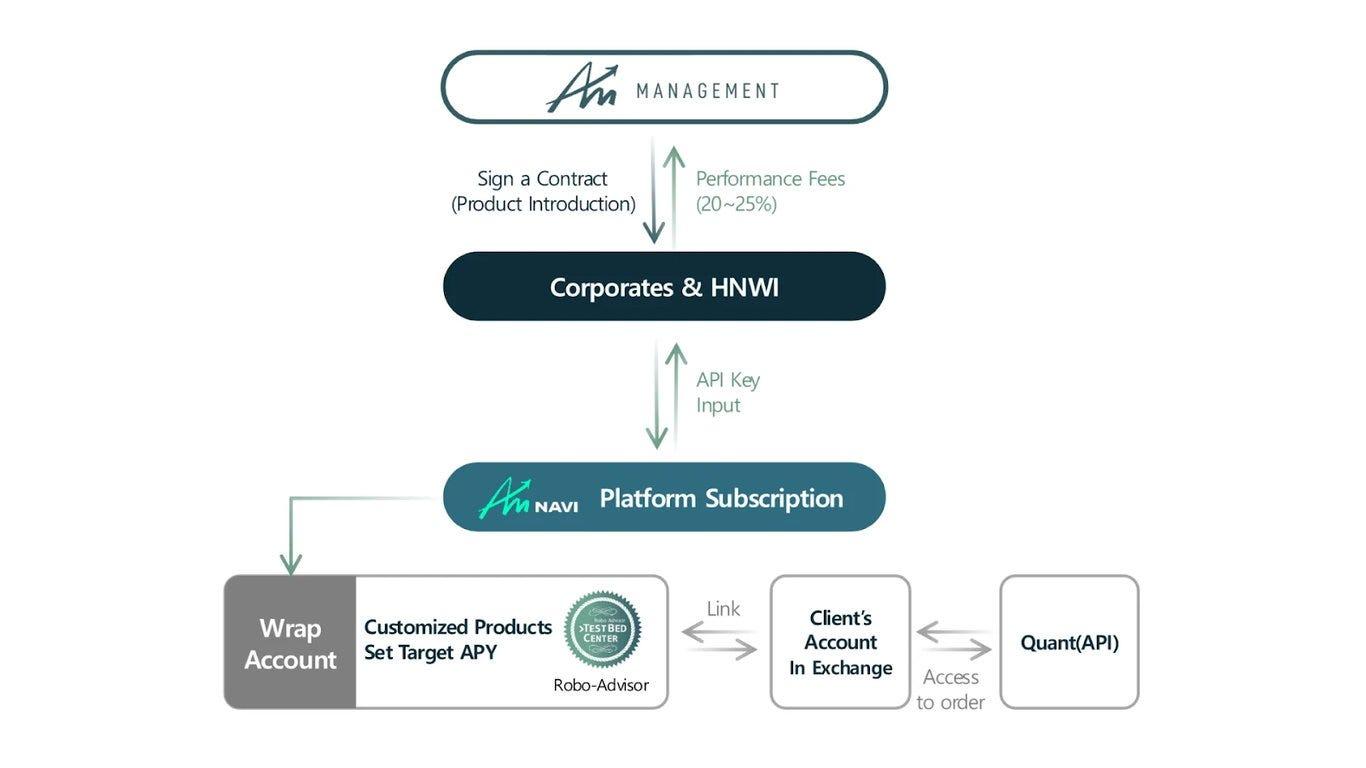

2. Navi: Suitable for B-end and high-income users with larger asset operations

Navi is an investment product for B-end and high-income users. The biggest difference from other asset management providers is that users do not need to entrust their assets to the platform, only needing to connect trading APIs on supported exchanges (Binance, OKX, Bybit) to start using. This way, users can not only instantly confirm asset operation status to increase transparency but also ensure safety because AM has no permission to withdraw user funds.

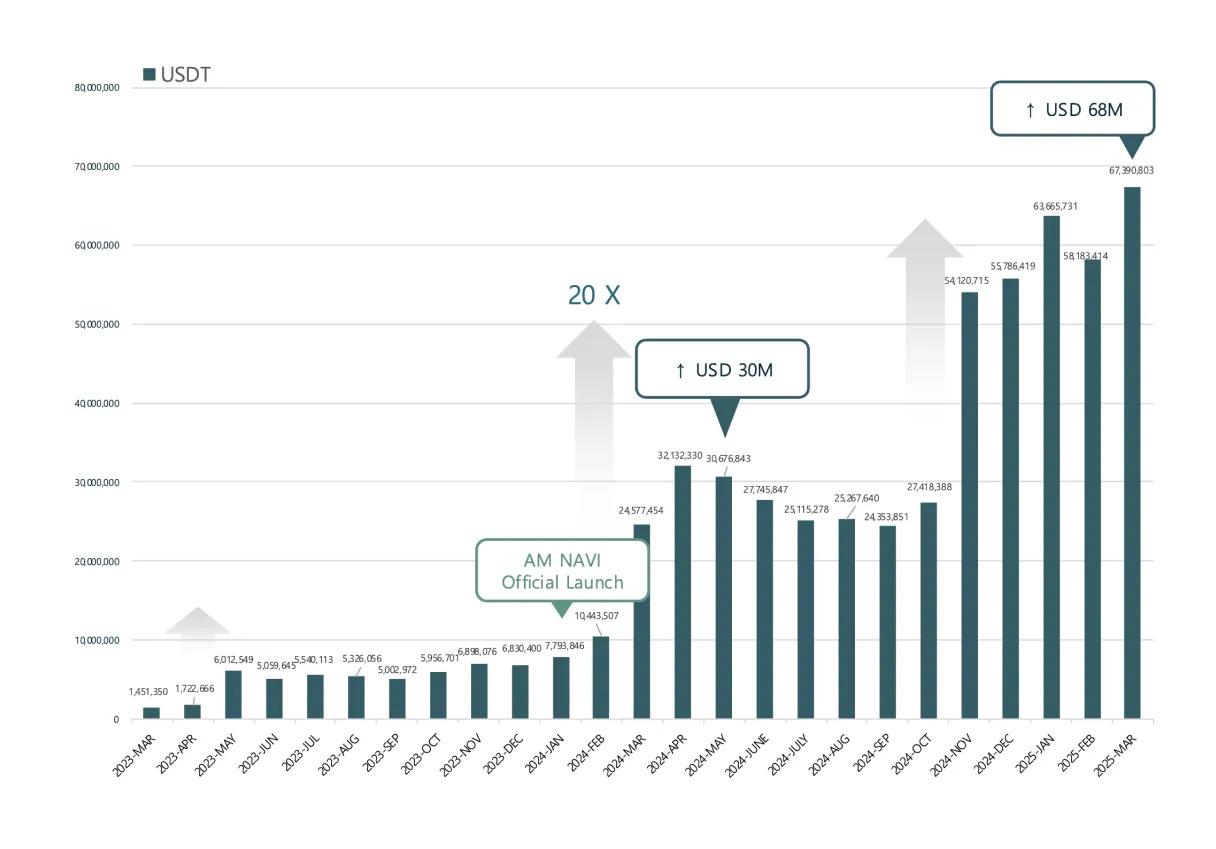

AM Management's AUM has maintained a growth trend, breaking through $90M as of May 8, growing nearly 12 times compared to when AM NAVI was officially launched.

Summary

Cryptocurrency investment is generally recognized as high-risk, but in such a market, risk and return are often corresponding. Seizing opportunities and finding a relatively reliable strategy is the key to becoming a long-term winner.

AM Management's biggest feature is that users do not need to entrust assets, and through this method, ensure users can always control personal funds under any circumstances, not only increasing trust but also allowing AM to provide real-time asset status reports in the most transparent way. Although cryptocurrency asset management companies have had ups and downs in the past, the demand for asset management will always exist in the opportunity-rich cryptocurrency industry, making AM Management's future development worth continuous observation.

AM Management official website:

https://www.amcryptoteam.com/

OKX Trading Bot by AM (Occultation):

https://www.okx.com/zh-hans/trading-bot/signal/647567187825397760

OKX Trading Bot by AM (Occultation MIX):

https://www.okx.com/zh-hans/trading-bot/signal/648997092438056960

TechFlow is a community-driven in-depth content platform dedicated to providing valuable information and thoughtful perspectives.

Community:

Public Account: TechFlow

Subscription Channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

To join the WeChat group, add assistant WeChat: blocktheworld

Donate to TechFlow and receive blessings and permanent record

ETH:0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC:0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A