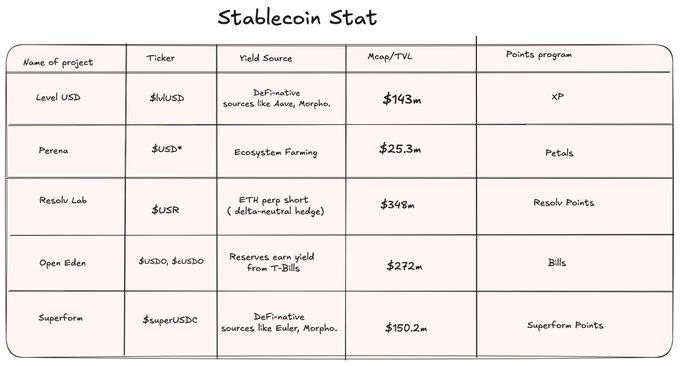

Upcoming Stablecoin super thread

on @levelusd @Perena__ @ResolvLabs @OpenEden_X @superformxyz

Covering

• Yield Source

• Farming strategy, (Points details and yield)

Showing you 5 upcoming stablecoin yield protocols without token

the yield, the strategies and incentives.

We will talk about

• TLDR on how it works

• Yield source

• DeFi Legos

• Points program

Read to keep yourself update to the market even if you are not farming

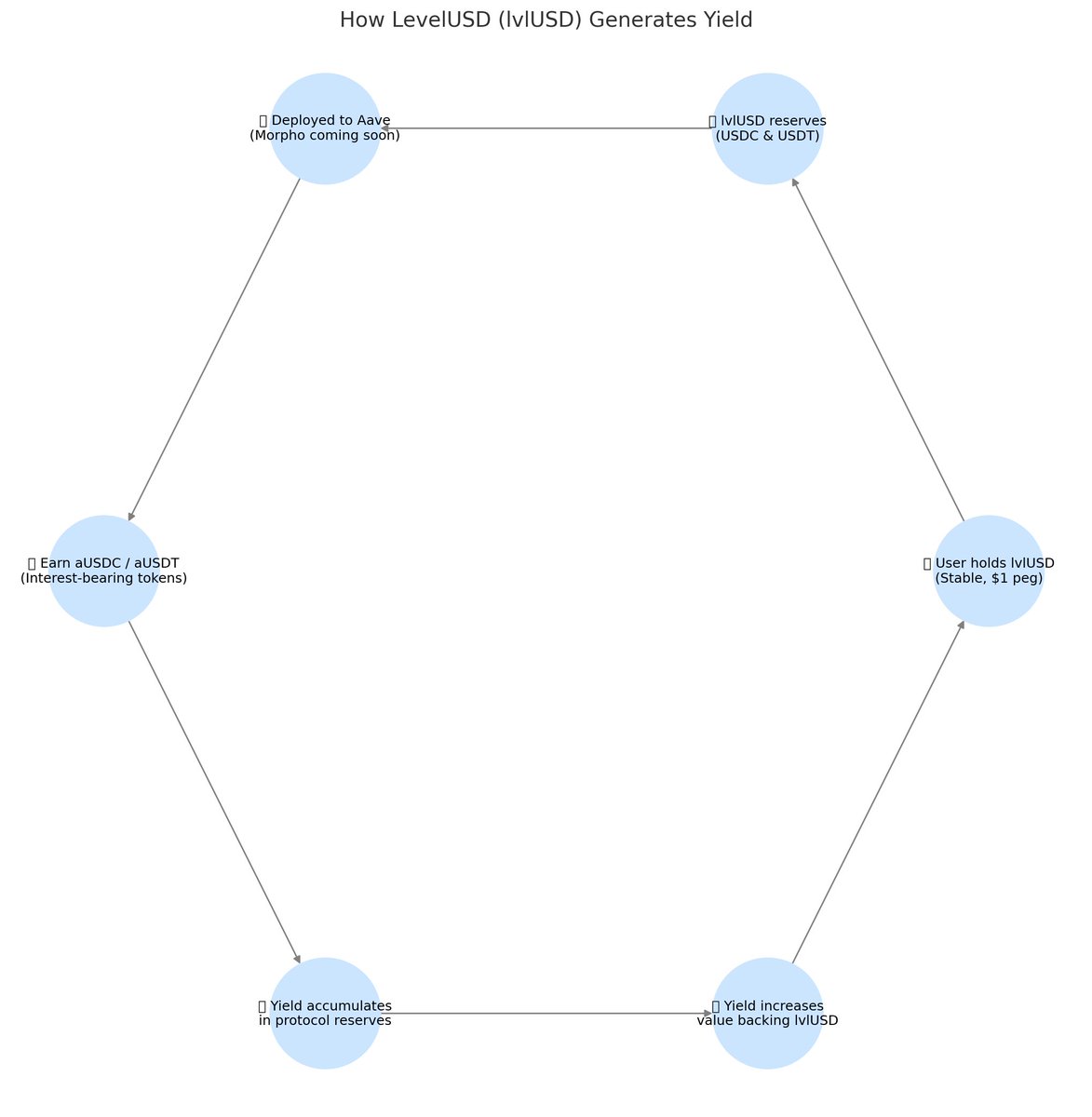

1️⃣ @levelusd

ticker- $lvlUSD

Chain- Ethereum

How does it work?

check my old tweet

I have also done a podcast with their founder @KedianSun here

x.com/2lambro/status/190905831... twitter.com/155919319860577485...

🔹 Yield source

• User holds $lvlUSD — a stablecoin pegged to $1.

• Note that; Protocol reserves back $lvlUSD 1:1 with $USDC and 4USDT.

• These reserves are deployed into lending platforms like @aave ( @morpho coming soon).

• The protocol receives interest-bearing tokens

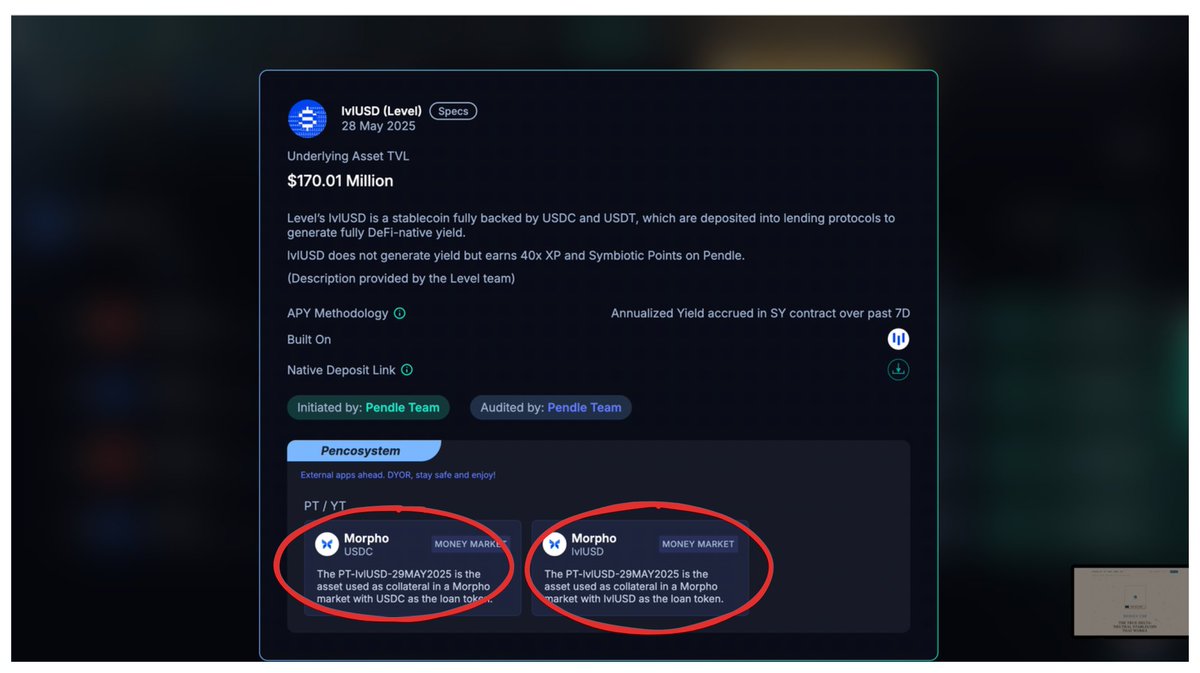

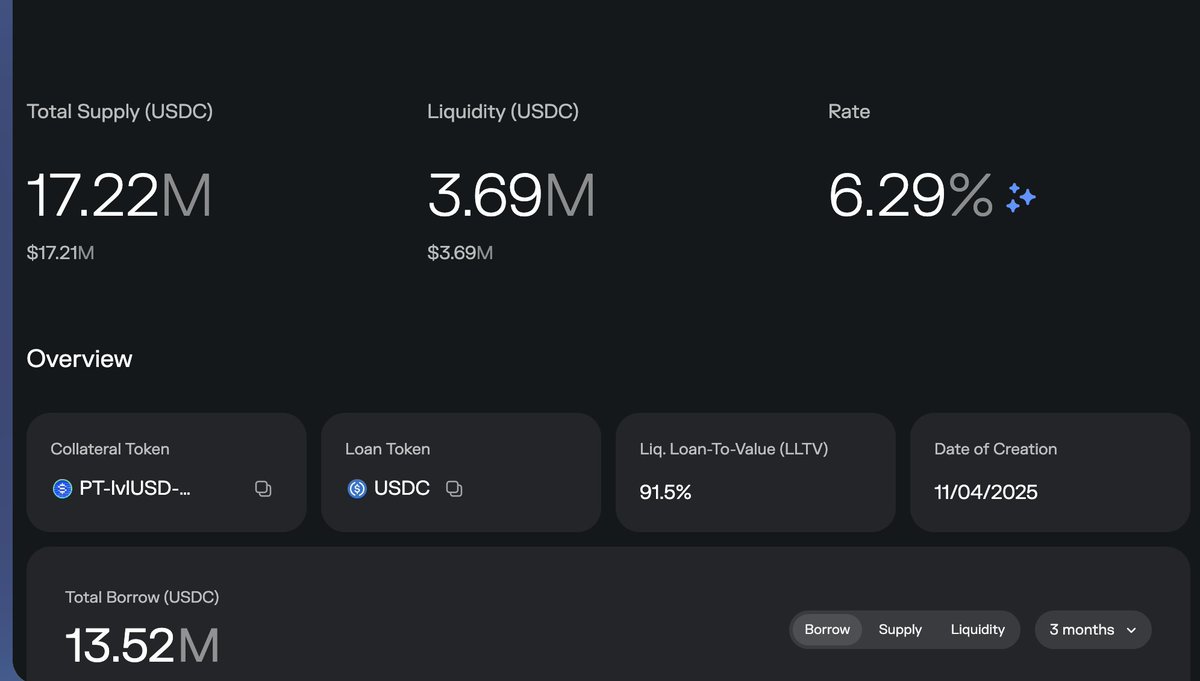

🔹 DeFi integrations

what in the looping is going on?

quick explainer

• Pendle $lvlUSD pool has an apr of up to 10.34% ( at the time of research)

• While $slvlUSD pool has an apr of 11%

• Option to max looping your PT-lvlUSD into Morpho

• PT-lvlUSD at a borrow rate - 4.16%

🔹 Points program tldr

It is deeply integrated with whitelisted protocols like pendle, curve and more , depositing your assets into this vault enables you to earn XP..

For instance

• YT pendle vault earns you earn 20xp and 40xp

+ symbiotic multipliers on PT- $lvlusd and

2️⃣ @Perena__

Chain- Solana

ticker - $USD*

what is perena?

Stablecoin with swap fees from pool of LP + looking to focus on on/offramp, not just DeFi legos,

Here's a podcast I did with their founder @gizmothergizzer here

x.com/2lambro/status/191249509... twitter.com/155919319860577485...

🔹 yield source

• mint $USD* with any of this asset- $USDC, $USDT and $PYUSD

• USD* earns fees from the Seed Pool and serves as your base asset across the Perena ecosystem.

• the fees are then distributed back to $USD* holders

🔹 Defi Integrations

Not much right now

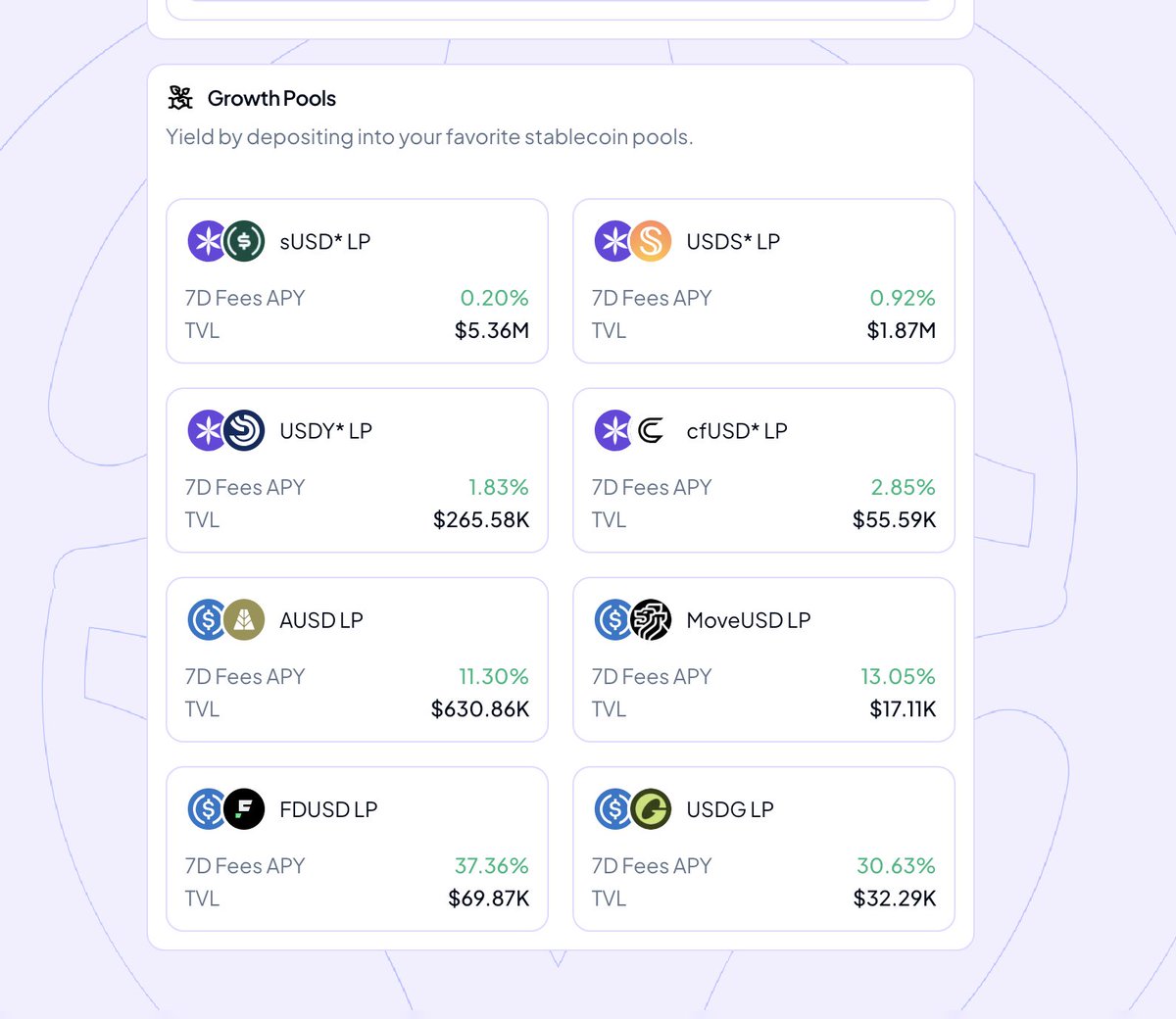

img 1 growth pools which consists of various stablecoin LP pairs.

img 2 Only protocol integration probably worth farming is rateX…

4x rate multiplier + 3x perena multiplier

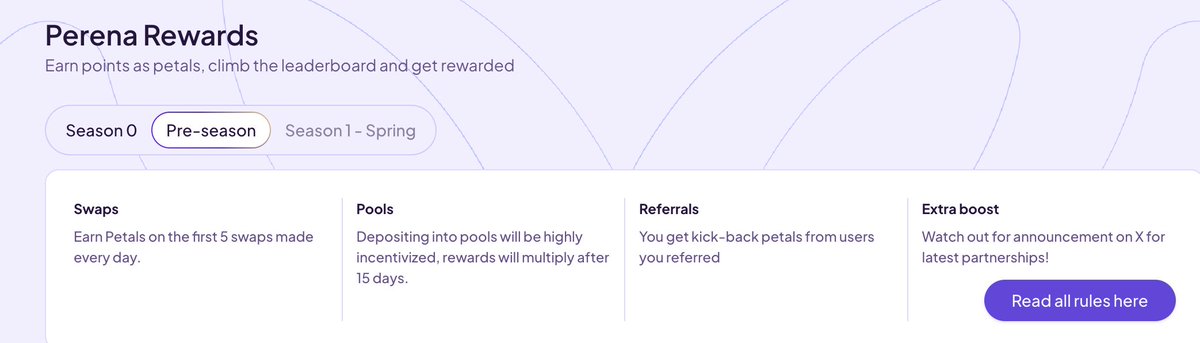

🔹 Points program tldr

Their petals distribution campaign which rewards all user activity until now via retroactive distribution of Petals.

Season 0 is ended, now they’re on pre-season with promise of lesser emissions.

How to Earn

• Swap stablecoins

Users will earn Petals on

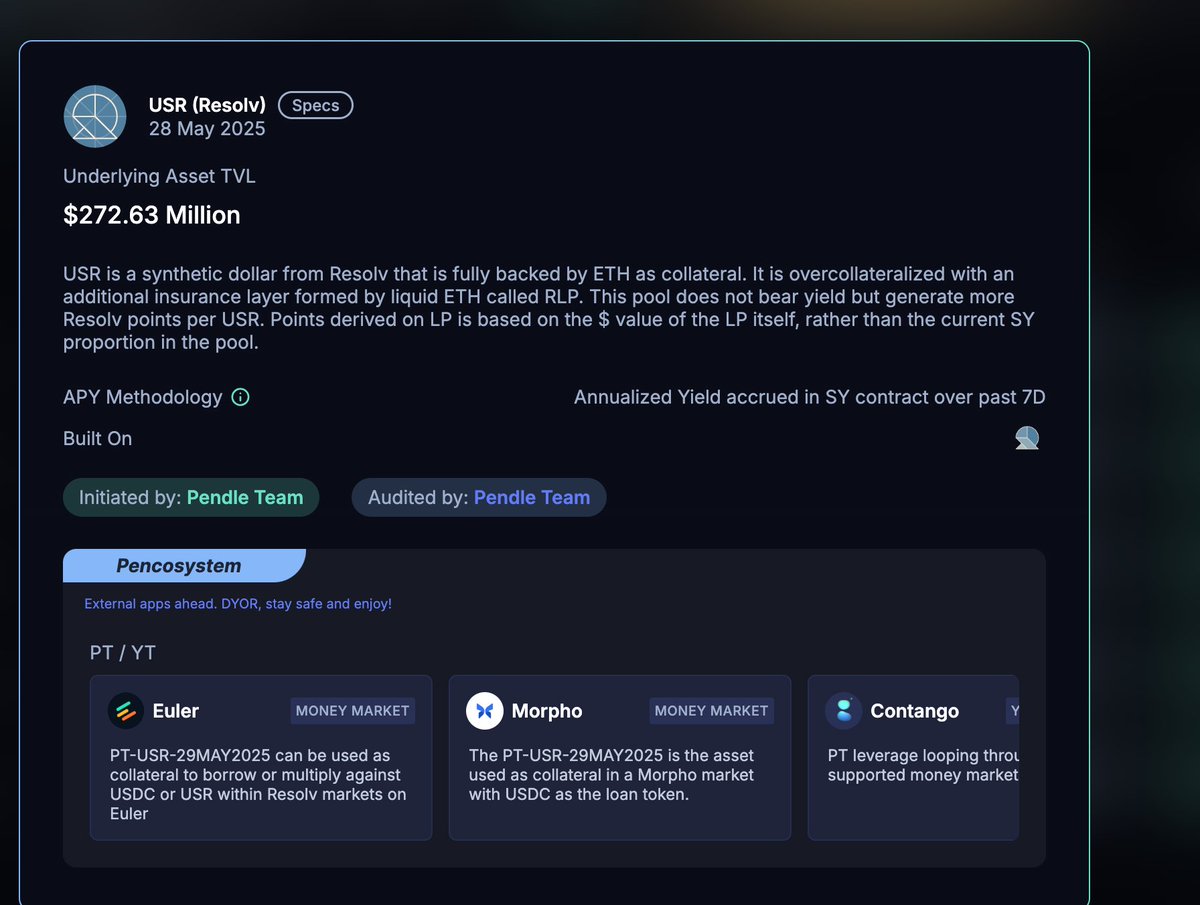

3️⃣ @ResolvLabs

ticker- $USR

Chain- Ethereum

How does it work?

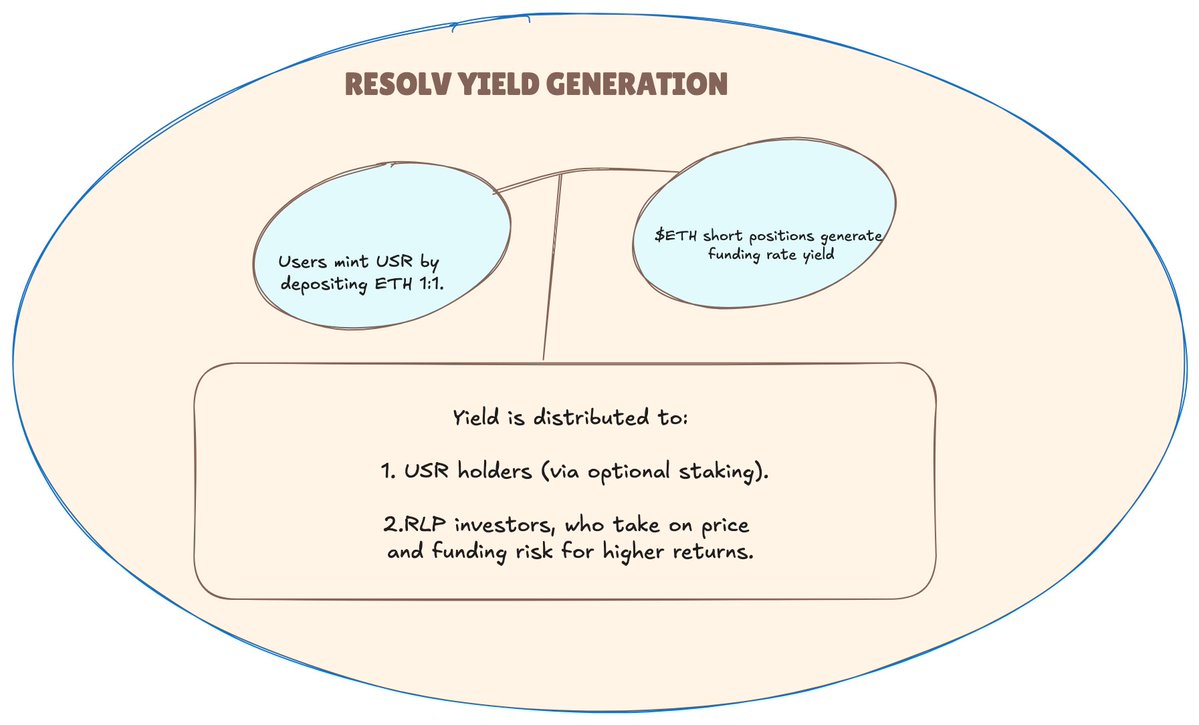

Resolv issues $USR a stablecoin fully backed by overcollaterised ETH and pegged to the US Dollar.

$USR employs a delta-neutral strategy to maintain its peg and generate yield and RLP strategy which absorbs losses if

🔹 Yield Source

• Users mint USR by depositing ETH 1:1; That ETH is held in reserve and simultaneously used to open short perpetual positions (delta-neutral hedge).

• These short positions generate funding rate yield.

• The funding yield is collected and funneled into the

🔹 DeFi Integration

quick test?

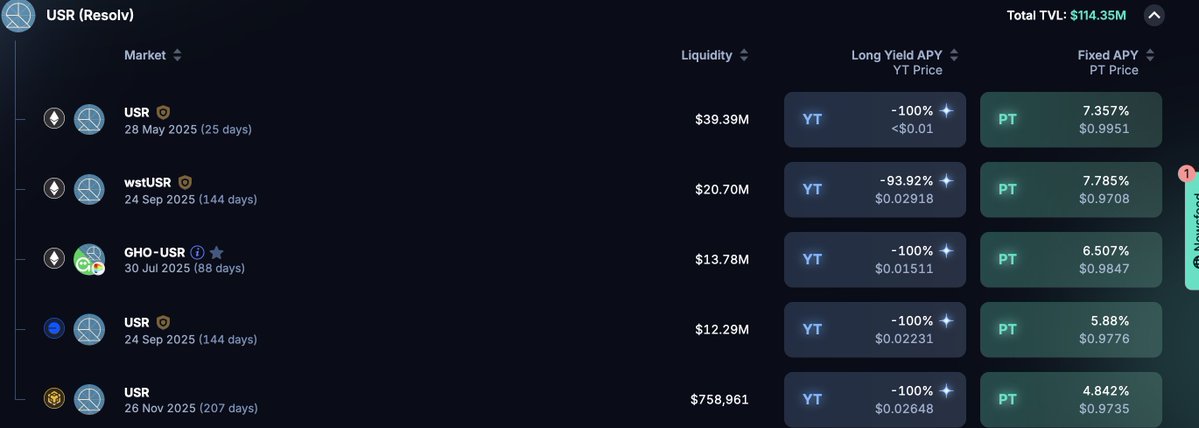

punch $USR into pendle or euler and you're hit with img 1 and 2

• hold PT- $USR on pendle

• put it into work in Euler or morpho with PT-USR as your supply or collateral asset. ( apr is around the 7% ish so looks good)

p.s there's more where it

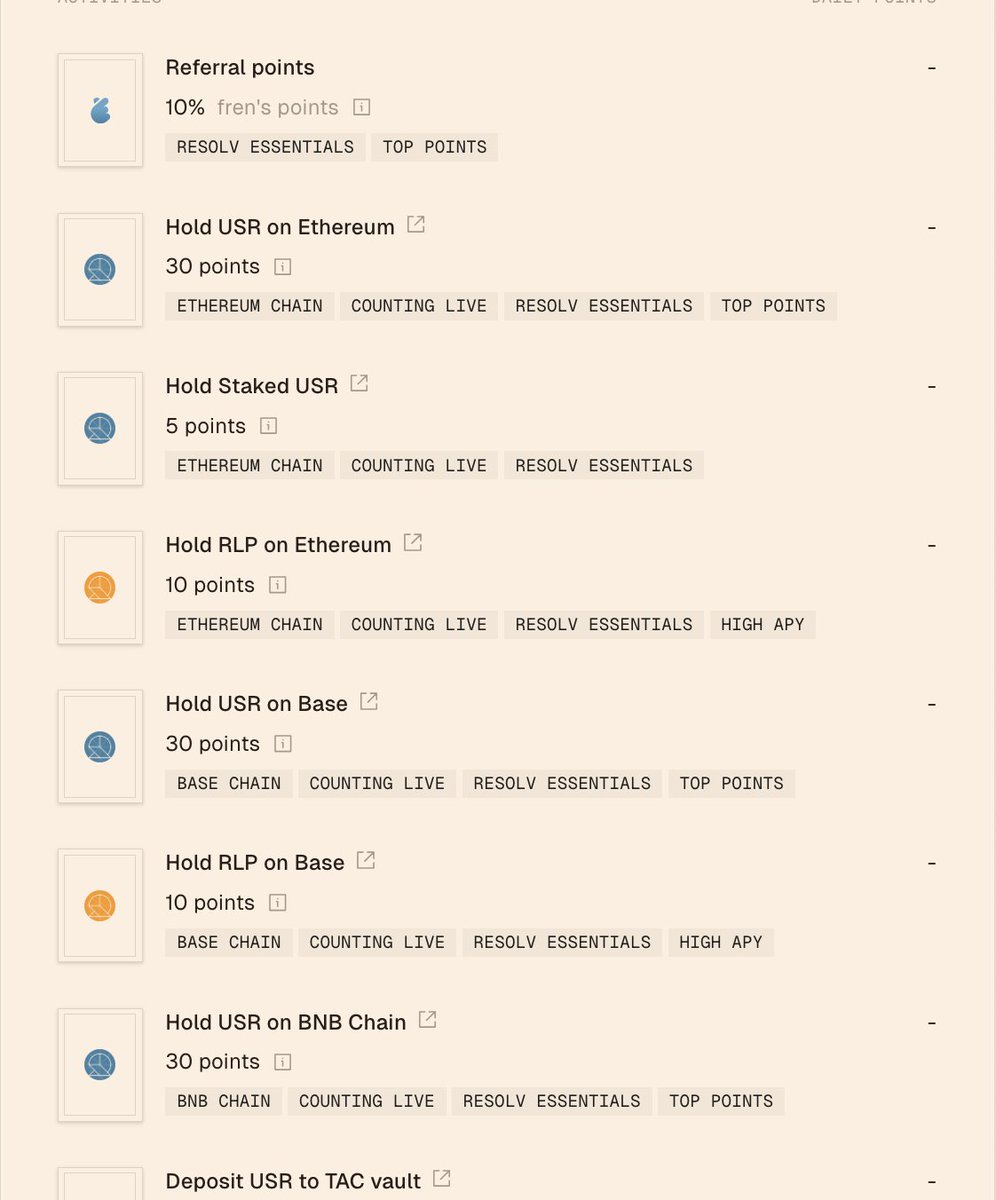

🔹 Points System

Resolv points are earned through various activities within Resolv.

img 1 activities earn them base payout.

img 2 Boosters available on Pendle- 45x multiplier

img 3 additional 7.68x multiplier in Euler

Their token launch is here.

Airdrop is staked for 14 days lol twitter.com/167073136987647180...

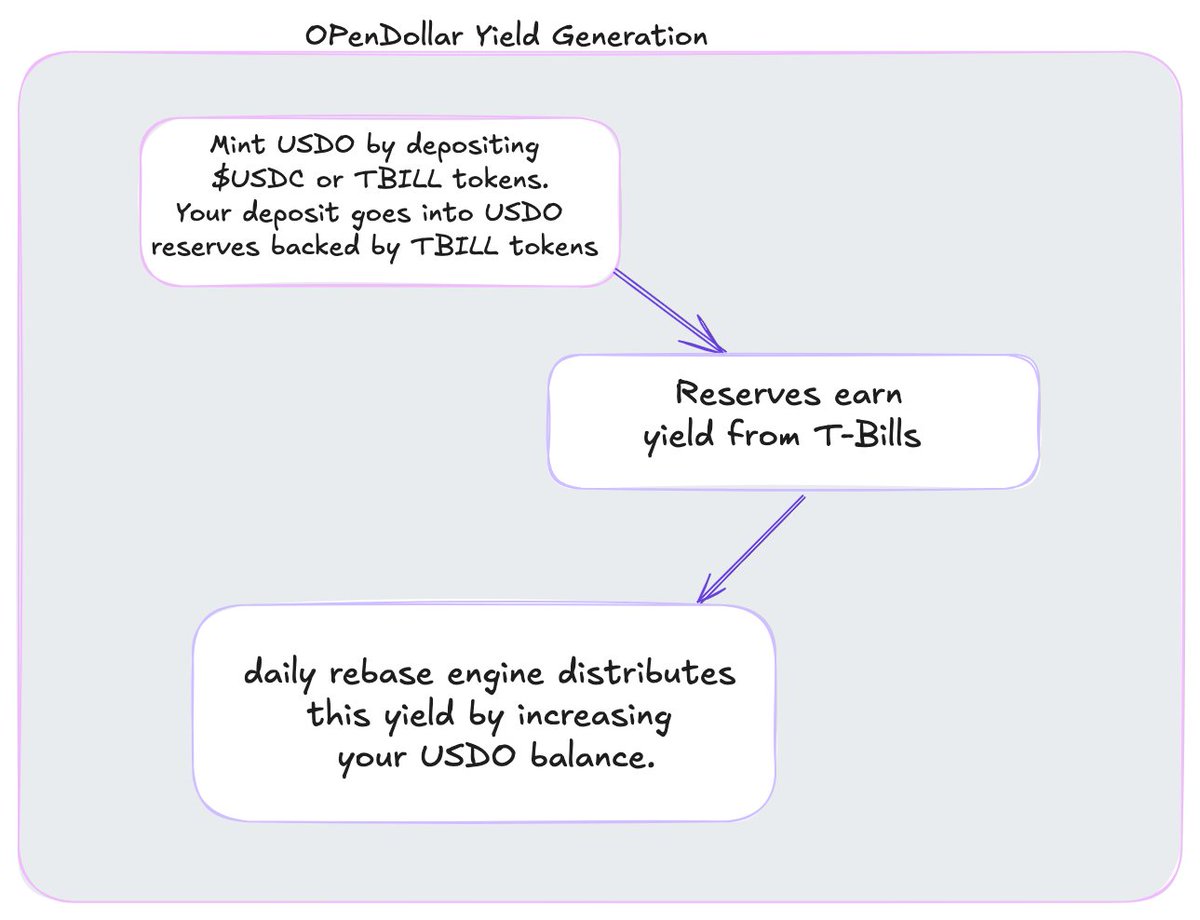

4️⃣ @OpenEden_X

Chain- Ethereum, Base

ticker - $USDO, $cUSDO

what is OpenEden?

Open Eden platform's flagship product is $USDO (OpenDollar), a yield-bearing stablecoin backed by Treasury bills.

🔹 Yield source

• Mint USDO by depositing USDC or TBILL tokens.

• Your deposit goes into USDO reserves, backed 1:1 by tokenized U.S. Treasury Bills.

• These reserves earn yield from T-Bills

• The reserves are stored in the TBILL Vault, offering on-chain, real-time proof.

• A

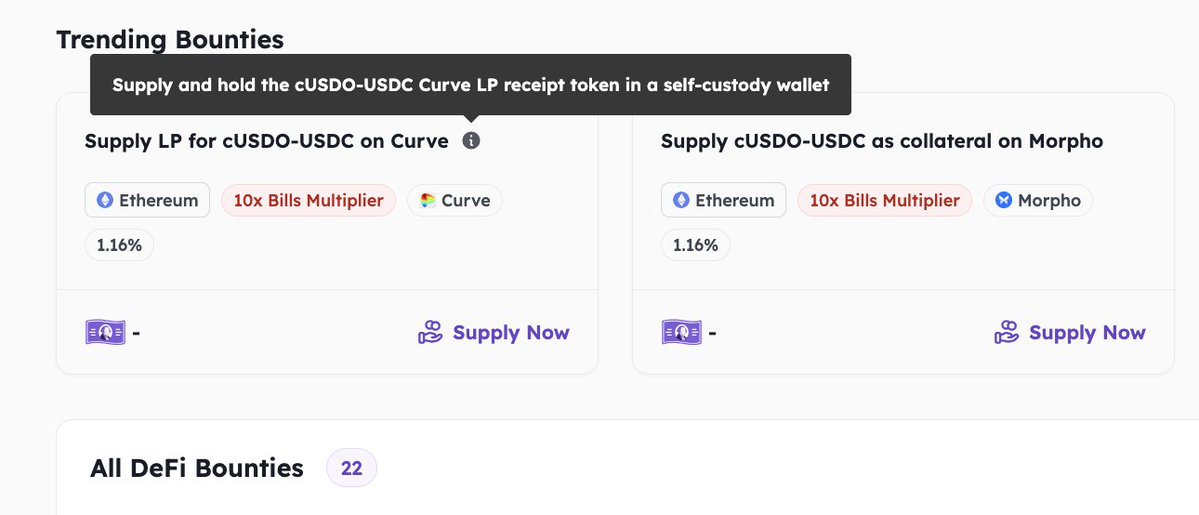

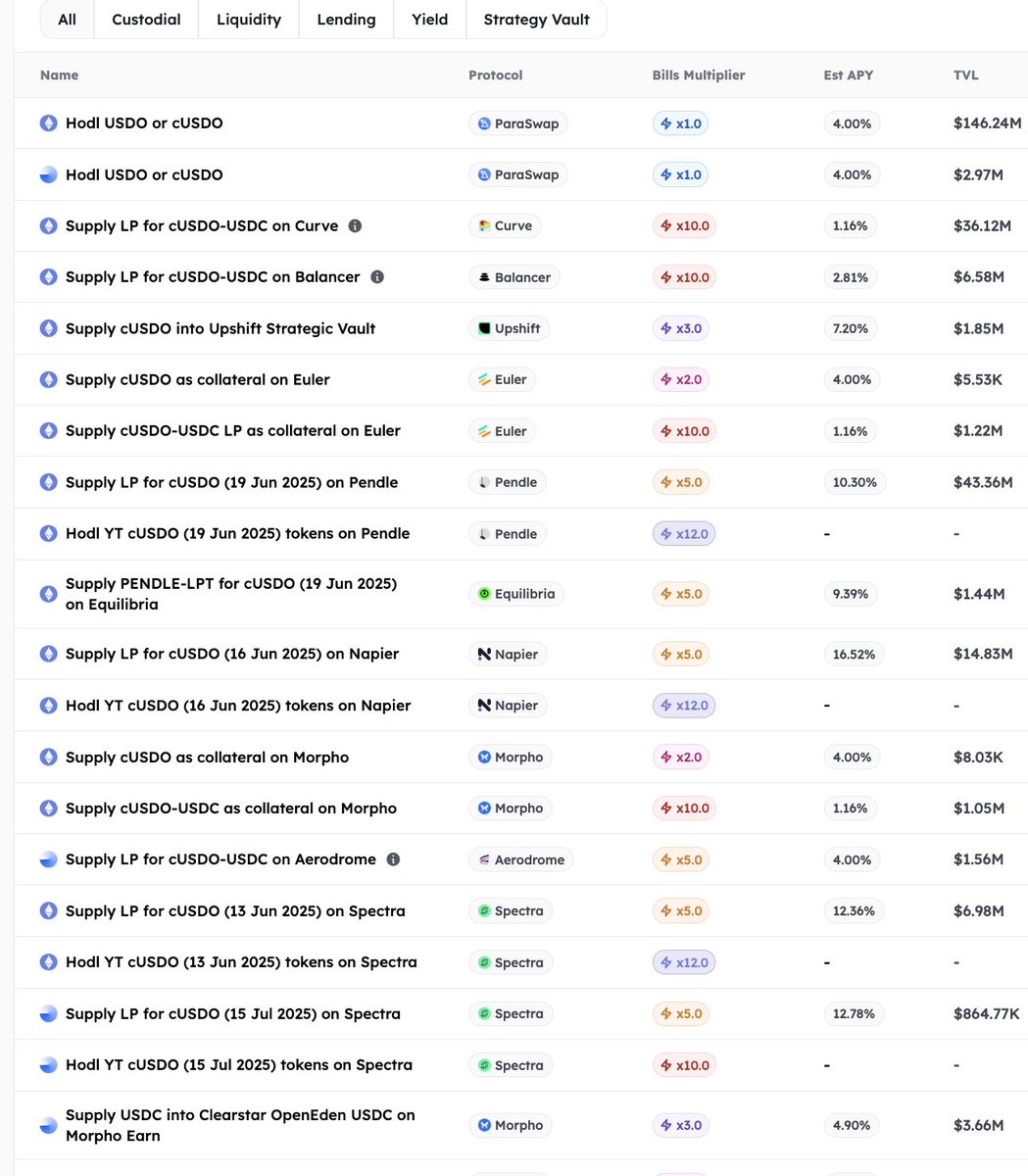

🔹 DeFi Integration

Supply $cUSDO- $USDC on curve, Morpho or upshift for 10x multipliers on bills.

🔹 Points program tldr

there are some good yields to try out

🌟 Supply LP for $cUSDO (16 Jun 2025) on @NapierFinance - 15% apr + 5x bills multiplier

🌟 Supply LP for $cUSDO (19 Jun 2025) on Pendle- 10.30% apr+ 5x bills multiplier

5️⃣ @superformxyz

Chain- Ethereum, Base

ticker - $SuperUSDC

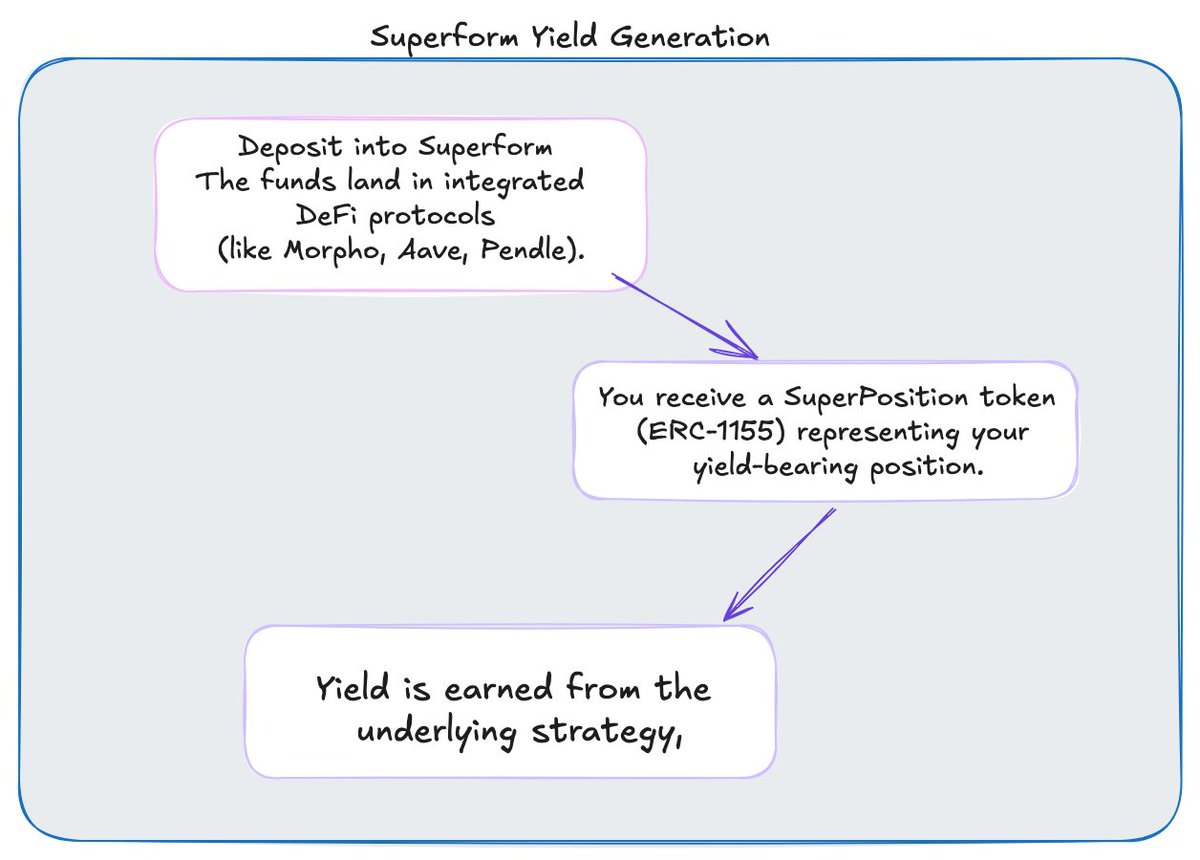

What is superform?

superform interface lets you access and deposit into yield vaults (like Aave, Morpho, Pendle, etc.) from any chain.

Deposits are represented as SuperPositions (ERC-1155 tokens), which are portable,

🔹Yield Source

• when you deposit into Superform

• your funds is integrated into whitelisted strategies

• You get a suuperposition token( representing your strategy)

• this position is your yield bearing asset

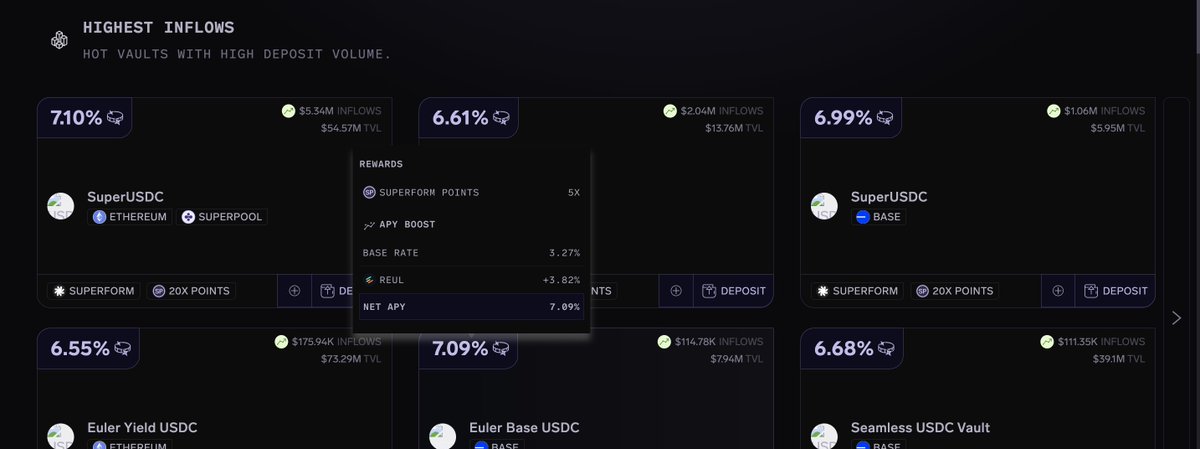

🔹 DeFi integration

Good stuff going on superform, let's check out

base APY looks good on both chains.

and a 50x booster when you deposit your superUSDC to pendle.

🔹 Points program tldr

there are 3 ways to earn on superform

• Refer friends

• Hold superfren NFT (5x points)

• Deposit to Earn

You have multiple options:

• Authenticated Vaults = 5x Points

• SuperVaults = 20x Points

• SuperVault Lending = 30x Points

• SuperVault

My thoughts

Stablecoin is competitive, the best protocol /= best farm.

Farming and testing on protocols gives you the idea on how the team executes. Given how competitive stablecoin market, team's ability in execution and privot matters a lot

Over all I still like perena for trying something new and solana native, however not enough real yield and meaningful integration yet.

lvl and resolv and in the most competitive sector but the real yield + points are not bad.

Open Eden is a good RWA bet and you have some yield

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content