Author: 100y

Translated by: TechFlow

Key Points

Visa and Mastercard are the two major operators of global payment networks, and it is no exaggeration to say that they almost dominate the global payment market. The total global payment transaction amount is expected to reach $20 trillion by 2024. If card payments can be processed through blockchain networks in the future, this will bring huge development opportunities for the blockchain and stablecoin industries.

Although the front-end experience of payment systems today has been significantly improved by the innovation of various fintech companies, the back-end systems that actually process transactions still rely on outdated technology. There are still many problems in settlement and cross-border payments, and blockchain provides an promising solution to these issues.

In April this year, Visa and Mastercard respectively announced their roadmaps for blockchain and stablecoin applications. Both companies have plans in the following areas: 1) Card services linked to stablecoins; 2) Settlement systems based on stablecoins; 3) Peer-to-peer international remittances; 4) Institutional tokenization platforms. Who will take the lead in the Web3 payment market remains to be seen.

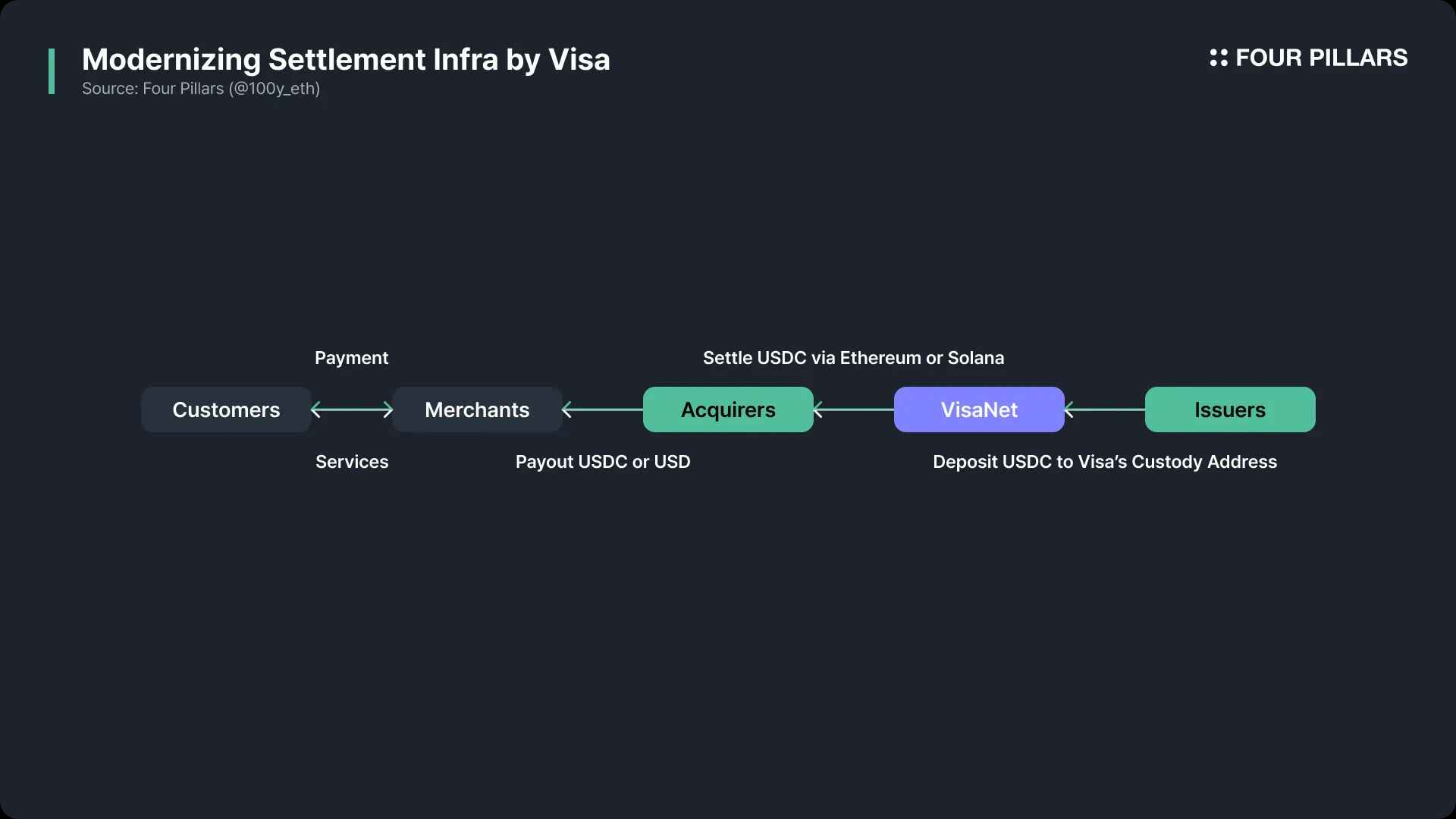

In summary, Visa has successfully built a pipeline that enables card issuers to settle with acquiring banks via the Visa network using USDC instead of US dollars. In the future, Visa plans to expand this stablecoin settlement system to more partners and regions, implement 24/7 real-time settlement, and support multiple blockchains and stablecoins.

2. Strengthening Global Remittance Infrastructure

Visa has already supported large-scale cross-border transactions through its VisaNet infrastructure. One of its services, Visa Direct, can facilitate peer-to-peer fund transfers through card, wallet, and account numbers, covering payment scenarios between friends and between businesses and customers. Visa plans to further enhance global remittance efficiency by integrating stablecoins into Visa Direct. Additionally, Visa recently invested in BVNK, a startup developing stablecoin infrastructure for businesses, aiming to expand its stablecoin capabilities beyond the retail sector to cover the enterprise ecosystem.

3. Launching Programmable Digital Currency

Compared to traditional cash, one of the main advantages of stablecoins is the ability to leverage smart contracts on the blockchain. Visa is highly focused on the potential of blockchain-based automated financial services and announced the launch of the "Visa Tokenized Asset Platform (VTAP)" in October 2024.

VTAP is a blockchain-based financial infrastructure that allows banks and financial institutions to issue and manage fiat-based digital tokens (such as stablecoins and tokenized deposits). Since these capabilities are provided through Visa's API, integration with existing financial systems becomes very easy. Tokens issued through VTAP can be used in conjunction with smart contracts, enabling the automation of complex processes, such as conditional payments or customer loans.

Currently, VTAP has not been publicly released and is still running in a sandbox environment. Initially, it tested token issuance, transfer, and redemption functions in collaboration with Spanish bank BBVA. According to the roadmap, Visa plans to launch a pilot project for real customers on the Ethereum public blockchain in 2025.

4. Developing Stablecoin Top-up and Withdrawal Cards

Visa is helping card issuers provide top-up (on-ramp) and withdrawal (off-ramp) services through stablecoin-linked cards. To date, Visa has processed over $100 billion in cryptocurrency purchases and $25 billion in cryptocurrency spending through its cards. To expand this ecosystem, Visa is collaborating with stablecoin card infrastructure companies like Bridge, Baanx, and Rain.

Bridge, a stablecoin infrastructure platform acquired by Stripe, recently collaborated with Visa to launch a card issuance solution that enables users to make real-world payments using stablecoins. Fintech companies can provide stablecoin-linked card services to users through Bridge's simple API. Cardholders can directly use their stablecoin balance for payments, while Bridge converts the stablecoins to cash and pays the merchant. Currently, the service is live in Argentina, Colombia, Ecuador, Mexico, Peru, and Chile, with plans to gradually expand to Europe, Africa, and Asia.

Baanx, a London-based fintech company founded in 2018, focuses on connecting traditional finance with digital assets. In April 2025, Baanx announced a collaboration with Visa to launch a stablecoin payment card that allows users to pay directly using USDC from their self-custodial crypto wallets. During the payment process, USDC is sent in real-time via smart contract to Baanx, which then converts it to fiat currency to settle with the merchant.

Rain, a New York fintech company founded in 2021, operates a global card issuance platform based on stablecoins. Rain provides APIs that make it easy for businesses to issue Visa cards linked to stablecoins, along with various financial services including 24/7 real-time payment settlement, tokenization of credit card receivables, and automated settlement processes through smart contracts.

Mastercard's End-to-End Stablecoin Payment Solution

Source: Mastercard

Like Visa, Mastercard is a leading company in the global payment network domain. Unlike Visa's high-processing centralized network VisaNet, Mastercard processes payments through Banknet, a powerful distributed structure supported by over 1,000 global data centers. On April 28, 2025, Mastercard announced that it has established an end-to-end infrastructure covering the entire stablecoin payment ecosystem, from wallets to checkouts.

1. Card Issuance and Payment Support

Mastercard has collaborated with multiple crypto wallets (such as MetaMask), crypto exchanges (like Kraken, Gemini, Bybit, Crypto.com, Binance, and OKX), and fintech startups (such as Monavate and Bleap) to provide stablecoin payment services.

MetaMask collaborated with Mastercard and Baanx to launch the MetaMask card, allowing users to make card payments using crypto assets stored in MetaMask. Payment settlement is completed in the background through Monavate's solution, which connects the Ethereum network with Mastercard's Banknet and converts cryptocurrencies to fiat currency. The MetaMask card will initially launch in Argentina, Brazil, Colombia, Mexico, Switzerland, the United Kingdom, and the United States.

Mastercard also collaborates with the aforementioned crypto exchanges to support users making payments using stablecoins from their accounts.

2. USDC Settlement Support for Merchants

Although stablecoin-based payments are becoming increasingly popular, most merchants still prefer to settle in fiat currency. However, if merchants have a need, Mastercard supports settlement in USDC through collaborations with Nuvei and Circle. In addition to USDC, Mastercard also supports settlement of stablecoins issued by Paxos through its partnership with Paxos.

3. Blockchain Remittance Support: Mastercard Crypto Credential Service

Sending stablecoins via blockchain offers advantages of simplicity, speed, and low cost. However, user experience, security, and compliance remain key challenges when applying this to real-life scenarios. To address this, Mastercard launched the "Mastercard Crypto Credential" service, allowing crypto exchange users to create aliases through a verification process and easily send stablecoins using these aliases. Visa and Mastercard are actively expanding stablecoin payment use cases, from card issuance to on-chain settlement and merchant support, driving the integration of blockchain technology with traditional payment systems through deep collaborations with fintech companies, crypto wallets, and exchanges. This marks a significant step for stablecoin payments globally and lays the foundation for the future development of the crypto industry.

Mastercard's Crypto Credential service simplifies blockchain payment experiences through an alias system, eliminating the need to enter complex crypto wallet addresses and significantly improving user-friendliness. Additionally, if the recipient's wallet does not support a specific cryptocurrency or blockchain before the transfer, the transaction will be blocked in advance to prevent asset loss. In terms of compliance, Mastercard automatically exchanges Travel Rule data required for international remittances, meeting regulatory requirements and ensuring transaction transparency. Currently, supported exchanges include Wirex, Bit2Me, and Mercado Bitcoin. The service is live in Latin American countries such as Argentina, Brazil, Chile, Mexico, and Peru, as well as European countries like Spain, Switzerland, and France.

4. Enterprise Tokenization Platform

Mastercard's Multi-Token Network (MTN) is a private blockchain-based service designed to help financial institutions and enterprises issue, destroy, and manage tokens, enabling real-time cross-border transactions. Here are some application cases of MTN:

Ondo Finance tokenized its US Treasury short-term bond fund (OUSG) and integrated it into MTN. This enables enterprises to buy and redeem OUSG in real-time, 24/7, without relying on traditional financial infrastructure, while also obtaining stable returns.

JPMorgan integrated its blockchain payment system Kinexys with MTN to support enterprises' real-time payment needs.