Written by: Chilla

Translated by: Block unicorn

Preface

Decentralized Finance (DeFi) on Bitcoin is no longer just a theory. Despite some setbacks, the momentum around unlocking Bitcoin's potential beyond digital gold is growing.

But to be honest: no one is truly paying attention. This is understandable. Because until recently, things have been a bit chaotic.

While Ethereum established a massive DeFi economy, Bitcoin remained on the sidelines, with over $1.5 trillion in liquidity locked in cold wallets. Without DeFi smart contracts, lack of decentralized wrapping/bridging (wBTC), and Bitcoin's identity as digital gold, these limitations restricted the development of the ecosystem around this orange currency. But things are changing.

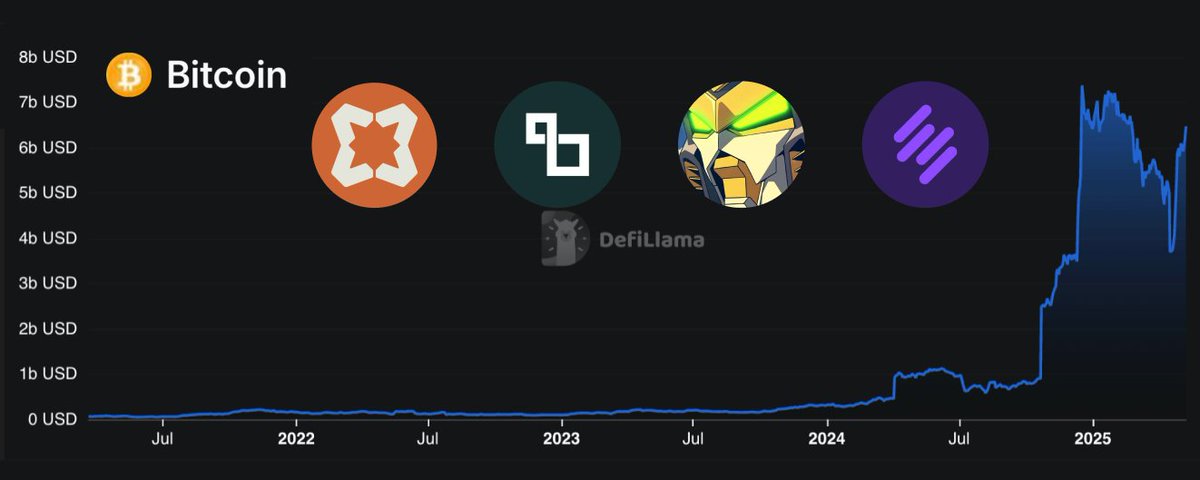

With the launch of a new batch of protocols on and around Bitcoin, we are seeing the foundations of a truly BTC native DeFi stack. Projects like Babylon, Lombard, SatLayer, and Solv Protocol are leading the way in technology and Total Value Locked (TVL), each addressing different parts of the DeFi Lego.

Babylon: Bitcoin's Staking Layer

Babylon can be compared to Ethereum's Beacon Chain, but designed specifically for Bitcoin. It is a native Bitcoin staking protocol with over $5 billion in TVL, a first of its kind.

What makes Babylon unique is that it allows users to stake BTC directly on the Bitcoin mainnet without bridging or wrapping. The coins remain in place, stored in a non-custodial manner.

But Babylon is not just about staking for staking's sake. Its main innovation is extending Bitcoin's security to other blockchains, whether EVM chains, Rollups, or application chains.

Bitcoin holders can now help secure network security by locking their coins and earn rewards from the chains they protect.

Lombard: Bitcoin's Liquidity Staking

It is the Lido of Bitcoin. Babylon handles staking; Lombard makes it composable.

Thus, Lombard has $1.9 billion in Bitcoin-related TVL, built on top of Babylon. It allows users to stake BTC through Babylon and receive LBTC, a liquidity staking token representing the staking position.

In fact, as we mentioned earlier, BTC staked through Babylon remains locked on the BTC network. So without validating the consensus mechanism of other networks, they are "useless". They cannot be used in DeFi. This is exactly where Lombard comes in. Now, users can obtain liquidity staked BTC (LBTC) and start trading, lending, mining, and all other similar activities.

Lombard earns returns by delegating BTC to Babylon validators, who in turn protect external networks and receive rewards, as mentioned earlier. These rewards are shared with LBTC holders. Simply put, the more chains Babylon validates, the higher the stakers' returns.

Lombard is active in multiple ecosystems like Sonic, Sui, and Base, and collaborates with protocols such as Aave, Pendle, Ether.Fi, and Corn, demonstrating its composability. It also played a crucial role in the Boyco Berachain liquidity activity, helping to launch early TVL.

SatLayer: Bitcoin's EigenLayer

As the title suggests, SatLayer can be imagined as an EigenLayer built on top of Babylon.

Although its TVL is the lowest on the list at just $340 million, it introduces a new re-staking model. While Babylon locks BTC to protect external networks at the consensus layer, SatLayer allows users to re-stake LBTC to secure the application layer.

This opens the door to a market of rewards directly from protected applications, such as an oracle paying re-stakers to ensure data integrity, a Rollup paying re-stakers to ensure transaction validity, or a bridge paying to avoid slashing or fraud.

SatLayer supports re-staking on EVM and Sui networks.

Do You See the Whole Picture Now?

Babylon as the base layer, providing consensus for the network;

Lombard as liquidity staking, unlocking BTC locked in Babylon;

SatLayer providing re-staking, providing economic security for the application layer.

Are the similarities with Ethereum, Lido, and EigenLayer starting to become apparent?

However, it's worth noting that Lombard and SatLayer currently depend on Babylon, but not vice versa.

SatLayer does not necessarily depend on Lombard, although given its decentralized nature, Lombard is currently its only utilized solution.

Solv Protocol: BTC Reserves and DeFi Vault

Solv Protocol has $524.27 million in TVL in the BTC ecosystem and takes a different approach.

Similar to Lombard, it provides liquidity staking for BTC but does not rely on Babylon and focuses on building its own Bitcoin reserve strategy and other DeFi products.

In fact, the SolvBTC token is a liquidity representative of its BTC reserve strategy, where users deposit wrapped versions of BTC, which Solv then mostly converts to native BTC through institutional channels and stores via centralized custody.

While Solv does not rely on Babylon, it benefits from Babylon-related assets like LBTC. In turn, thanks to its DeFi vault, it offers greater composability.

Conclusion

DeFi on Bitcoin is no longer just a pipe dream. With the emergence of new protocols and increased liquidity, we may be witnessing a new era of decentralized Bitcoin yields.

This is no longer just about wrapping BTC on Ethereum, but about unlocking native BTC DeFi.

As more projects like Botanix launch EVM-compatible Bitcoin blockchains, the composability and potential value of these layers could soar. Billions of idle BTC may soon become active collateral, helping to validate networks, secure applications, and earn real yields.