Author: FLOW

Translated by: Tim, PANews

Since the end of January, the crypto market has been in a downward trend, mainly affected by macro uncertainty and sentiment fatigue. However, we have recently observed a new round of upward momentum in the market.

Although still in the early stages, various signs suggest that we may be standing at a turning point in the development of cryptocurrencies. This trend inspired me to write about the current state of the Solana ecosystem.

For me, Solana remains one of the most powerful Layer 1 blockchains in the market. It is the fastest-growing ecosystem in the crypto space, one of the few public chains with a natural growth advantage, and has even surpassed Ethereum in many on-chain metrics.

Without further ado, let's begin.

Upcoming discussion directions:

- Network Status

- On-chain Activity

- Ecosystem

- SOL Price Analysis

Solana Network Status

When starting the analysis, let's temporarily set aside price factors and focus on fundamentals. It needs to be pointed out that Solana, as a blockchain network, seems to be in the strongest development phase in its history.

(Note: The translation continues in the same manner for the entire text, maintaining the specified translations for specific terms.)DeFi Gradually Maturing

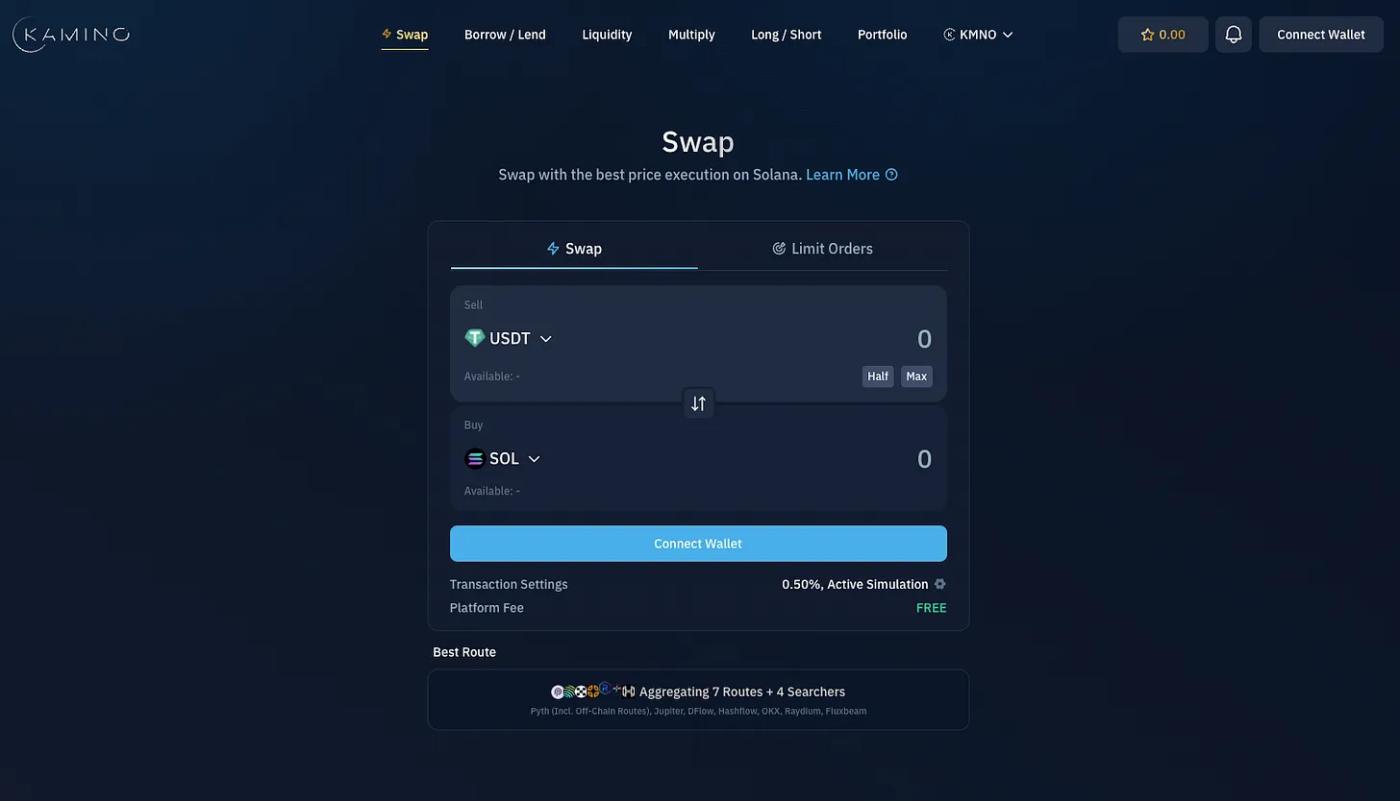

The DeFi ecosystem on Solana is moving towards maturity. As previously mentioned, Solana has become the second-largest Layer 1 blockchain by TVL, and is one of the few public chains expected to break through its historical TVL peak in 2025 while maintaining the growth momentum from the previous cycle. This performance reflects both user stickiness and genuine market attractiveness.

The first wave of DeFi on Solana in 2021 was primarily experimental and driven by market hype. Today, its growth appears more sustainable, with a more solid foundation and clearer market fit.

I believe the notable protocols include Jito, Kamino, Marinade, Radium, and Jupiter.

To showcase Solana's development speed, the official account posted some dynamics on X in May:

Moreover, we are witnessing the emergence of a new wave of DeFi primitives, with notable mentions including:

- Real yield platforms, such as RateX, Exponent Finance, Sandglass, or Pye Finance

- Liquidity re-staking through Kyros

- New stablecoin base protocols in collaboration with Perena, Global Dollar, or KAST Card

- Yield aggregators like Lulo and Carrot

- Oracles based on Switchboard

There are many similar examples.

Solana continues to attract existing protocols, with a recent example being 1inch, which just launched on the mainnet.

What's Next?

Of course, we cannot predict where the price will go. Instead, what we can do is establish a framework to better assess investment opportunities from the perspective of risk and return. A simple heuristic method I like to use is: comparing the fundamental changes of an asset from point A to point B with its price changes.

Currently, what I see is that you can now buy SOL at the same market price as during the frenzy of 2021. At that time, Solana was just a dream, with no product-market fit and its DeFi ecosystem just beginning. Today, the network's development prospects are bright, it has become the fastest-growing blockchain in the crypto space, with real users, actual application scenarios, and growing institutional interest.

Moreover, I believe the market structure is evolving, in which underlying networks will continue to be the area where most market value accumulates.

From this perspective, here is my thinking:

As more applications and projects continue to develop on crypto networks, coupled with a friendly regulatory environment and continuously rising adoption rates, the value of crypto networks will continue to grow. Ultimately, all global investors will want a piece of this field.

Besides Bitcoin, I believe Layer 1 blockchains will remain the core carrier of value accumulation (they are the operating systems of the crypto world).

Based on all the reasons we mentioned earlier, I believe Solana is in a very favorable position among Layer 1 blockchains.

Therefore, I believe SOL remains one of the excellent investment opportunities for those who focus on cryptocurrencies in the long term.

Finally, I will leave you with this: Most people are still underestimating Solana, and isn't that a good thing?