On the evening of May 13, 2025, Binance Wallet announced the exclusive launch of the 16th Token Generation Event (TGE) for the AI+DePIN project Privasea (PRAI), sparking high market attention. As the first privacy computing protocol that deeply integrates fully homomorphic encryption (FHE) technology with a distributed computing network, Privasea is viewed as a "phenomenal project" in the Web3 and AI convergence track in 2025, thanks to its technological scarcity, capital endorsement intensity, and the massive demand in the trillion-dollar data market. This article will provide an in-depth analysis of its disruptive value from dimensions such as team background, technical architecture, financing history, token economic model, and valuation logic.

I. Project Overview: The "Privacy Shield" of the AI Era

Founded in 2022, Privasea is positioned as a decentralized privacy computing infrastructure, committed to achieving "data usability without visibility" through fully homomorphic encryption (FHE) technology, solving privacy leakage and computing power bottleneck problems in AI and machine learning (ML) scenarios.

Its core products include:

- HESea Encryption Engine: An FHE underlying library integrating algorithms like TFHE and CKKS, supporting direct computation of encrypted data, with efficiency improved by a thousand times compared to traditional solutions;

- Privanetix Computing Network: Global nodes executing FHE computing tasks distributedly, combined with a smart contract incentive model, reducing centralized data leakage risks;

- Zero-threshold Developer Tools: Providing APIs and open-source libraries, seamlessly connecting with mainstream AI frameworks like TensorFlow and PyTorch.

According to official data, Privasea has established pilot cooperation with dozens of institutions in healthcare, finance, Web3, and other fields. The mainnet DeepSea testnet phase has attracted over 500,000 users, verifying its technical implementation capabilities in the market.

II. Team Background: NuLink "Veterans" and Cryptography Geeks

The Privasea team consists of serial entrepreneurs in privacy computing and cryptography experts, with core members from the previous DePIN protocol NuLink, and experience from traditional tech giants:

- David Jiao (Founder & CEO): Bachelor of Computer Science from Beijing University of Posts and Telecommunications, former NuLink CEO and Volvo Automotive Systems Designer, who has led multiple industrial-grade data security projects and owns 13 FHE-related patents;

- Zhuan Cheng (Co-founder & CTO): Ph.D. in Applied Mathematics from Illinois Institute of Technology, former NuLink CTO and MAP Protocol Chief Technology Officer, deeply focused on FHE algorithm optimization and distributed network architecture, leading the development of open-source tools like ZAMA Concrete ML;

- Anonymous Cryptography Team: Including multiple ZKP (Zero-Knowledge Proof) and FHE domain scholars who have participated in developing underlying libraries like OpenFHE and TFHE-rs, with technical papers frequently selected at top IEEE security conferences.

The team's previous project NuLink was a well-known decentralized privacy protection protocol, and its technical accumulation and industry resources have laid the groundwork for Privasea's first-mover advantage.

III. Financing History: Top Capital "Team Betting"

Privasea's financing can be described as a "textbook case" in the Web3 privacy track, with valuation skyrocketing 36 times in 14 months, attracting institutions like Binance, OKX, and Nomura Securities to "team bet":

- Seed Round (March 2024): Raised $5 million, led by Binance Labs, with 15 institutions including Gate Labs, MH Ventures, and K300 Ventures participating;

- Strategic Round (April 2024): Introduced OKX Ventures, Nomura's Laser Digital, and SoftBank's Tanelabs, opening up compliance channels in Asia and Europe;

- Series A (January 2025): GSR, Amber Group, and others invested $15 million, with a post-investment valuation of $180 million, ranking in the top three of the privacy computing track.

The capital combination covering exchanges, traditional investment banks, and quantitative giants signals that Privasea will deeply integrate trading liquidity, compliance entry points, and quantitative strategy resources, paving the way for token launch.

IV. Technical Architecture: How Does FHEML Reconstruct the Data Value Chain?

Privasea's technical innovation lies in pushing FHE from theory to large-scale commercial use, with its architecture divided into four layers:

1. HESea Encryption Engine

- Function: Integrating mainstream FHE schemes like TFHE, CKKS, BGV, supporting arithmetic/logical operations on encrypted data;

- Breakthrough: Using ciphertext packaging and batch processing optimization techniques, computing efficiency improved 1000 times compared to traditional solutions, breaking the FHE "performance black hole" problem;

- Open-source Ecosystem: Code library recognized and merged by OpenFHE team, attracting over 200 developers to contribute.

2. Privanetix Computing Network

- Node Mechanism: Distributed computing nodes executing encrypted tasks, automatically settling incentives through smart contracts;

- Risk-resistant Design: Combining Proof of Work (PoW) and Proof of Stake (PoS) to prevent Sybil attacks and computing power monopoly;

- Cost Reduction and Efficiency: Utilizing idle GPU resources to reduce gas costs by 70% compared to centralized solutions.

3. ImHuman Application Layer

- PoH (Proof of Humanity): A DApp based on FHE for biometric feature verification, allowing users to generate encrypted facial vector Non-Fungible Tokens, replacing traditional KYC;

- Anti-robot System: Already providing privacy certification services for Telegram and TON ecosystem, with daily active users exceeding 100,000.

4. Developer Toolchain

- API Interfaces: Supporting languages like Python and Rust, one-click integration with TensorFlow and PyTorch;

- Compliance Adaptation: Built-in GDPR, HIPAA and other regulatory templates, meeting healthcare and financial industry needs.

V. Token Economic Model: 45% Incentivizing Computing Ecology

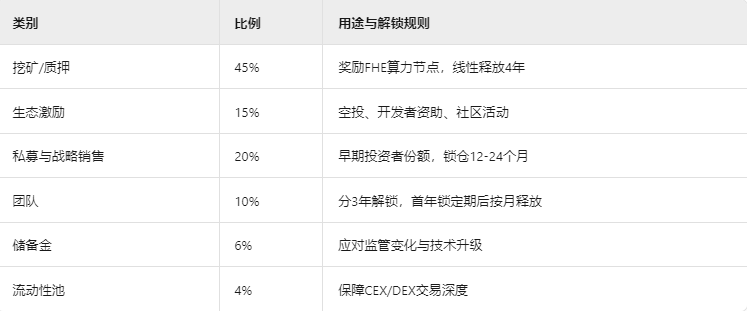

PRVA token total supply is 1 billion, with allocation balancing decentralized governance and long-term value capture:

Core token utilities include:

- Payment Medium: Purchasing privacy computing services, paying network gas fees;

- Governance Rights: DAO voting to decide protocol upgrades and fund allocation;

- Staking Rewards: Node staking annual yield expected to reach 12-18%.

VI. Valuation Logic: "Gatekeeper" of Trillion-Dollar Data Market

With a post-investment valuation of $180 million, Privasea's price-to-sales (PS) ratio is about 25 times (based on expected 2025 revenue of $7.2 million), higher than Oasis Network (PS 18 times) but lower than Render Network (PS 32 times), placing its valuation in a reasonable range. Its growth potential stems from:

- Track Explosion: Global privacy computing market size expected to reach $200 billion by 2030, with a 34% compound annual growth rate;

- Technical Barriers: Leading the track in FHE patent quantity and computing network scale;

- Ecosystem Collaboration: Co-building privacy computing alliance with ZAMA, BNB Chain, TON, etc., seizing the right to set AI+DePIN standards.

If computing power demand reaches the expected 50% after mainnet launch, PRVA market value is expected to exceed $500 million, a 177% increase from the initial TGE valuation.

VII. Risks and Challenges

- Technical Maturity: Large-scale commercial use of FHE still requires algorithm optimization, with competitors Inco and Fhenix accelerating their catch-up;

- Regulatory Uncertainty: Cross-border data flow policies may impact the global deployment of the computing network;

- Token Selling Pressure: Early investor shares account for 20%, and the market's absorption capacity during the unlock period needs attention.

Conclusion

Privasea's Token Generation Event (TGE) is not only a major event for Binance Wallet in 2025 but also a critical milestone for the privacy computing track, moving from "technical experiment" to "commercial implementation". Under the dual wave of awakening data sovereignty awareness and AI regulation intensification, its "FHE+DePIN" architecture is expected to become a new paradigm for Web3 and real economy integration. For investors, in the short term, participating in Binance Alpha points subscription can capture liquidity dividends, while in the long term, focusing on the growth of the computing network and ecosystem application implementation is key to capturing excess returns in the privacy revolution.