Perhaps more like a "correction-style replenishment" triggered under extremely low valuation and extremely weak expectations.

Written by: ChandlerZ, Foresight News

At this time last year, the Bitcoin ecosystem was at the peak of its narrative. From the inscription boom sparked by BRC-20, to the rapid market cap expansion of assets like ORDI, and the multiple-fold surge of projects such as SATS and RATS in a short period, Bitcoin on-chain transaction volume, gas fees, and miner income once soared, driving the Bitcoin ecosystem to an unprecedented high.

But the heat dissipated instantly. Over the past year, the performance of the Bitcoin ecosystem has almost become a "reverse indicator" of sector rotation. In terms of price decline, representative projects like ORDI and SATS saw maximum drawdowns of over 95%; in terms of on-chain activity, inscription transaction volume continued to shrink, with project release intervals significantly lengthening; from a community expectation perspective, multiple project airdrops disappointed, and the Runes ecosystem's heat quickly declined after launch, with overall sentiment turning cautious and even indifferent.

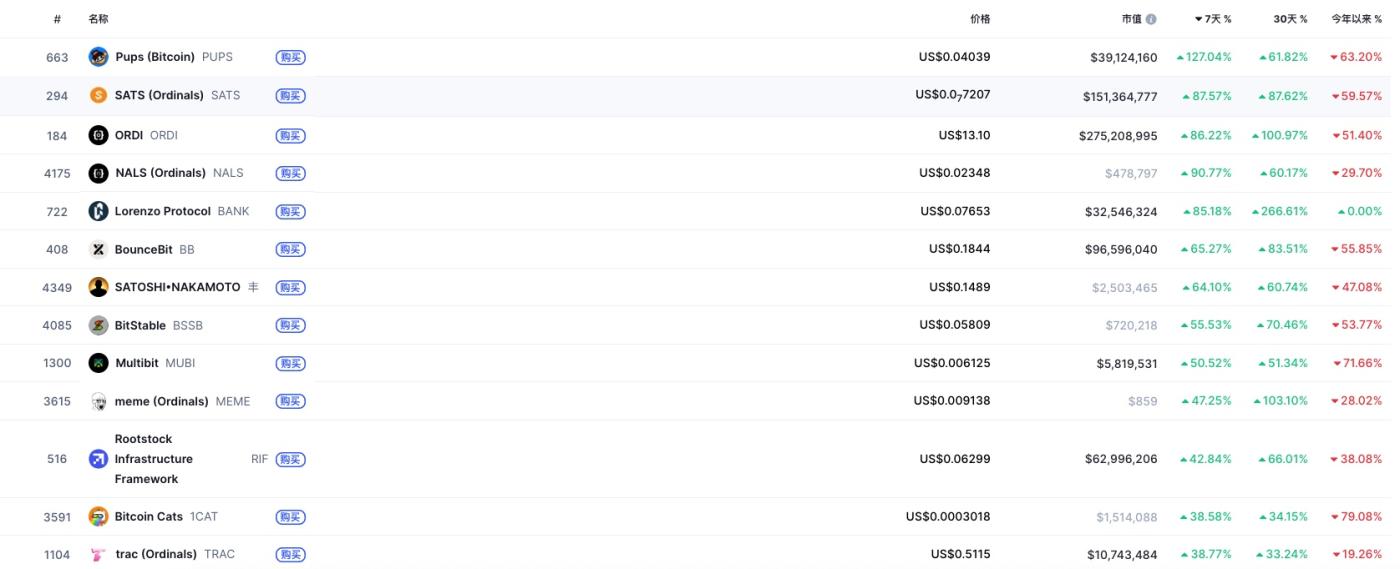

Over the past week, the Bitcoin ecosystem sector showed significant rebound signs. Top asset ORDI rose nearly 97% in six days, PUPS increased by 127.04%, becoming one of the strongest performers in this round of rebound; SATS rose 87.57%, nearly doubling from its yearly low; ORDI and NALS rose 86.22% and 90.77% respectively, with other assets like BANK, BB (BounceBit), and BSSB recording 40-80% weekly gains, with mainstream BRC-20 and Runes assets seeing recovery. Simultaneously, on-chain capital inflow became notably increased.

The "Challenging" Ecosystem Status

Behind this rapid surge, reviewing the medium to long-term trend of the entire Bitcoin ecosystem, investors can easily notice its "hot and cold" characteristics:

- Year-to-date decline generally between 50-70%, with drawdowns exceeding 90% from peak points being commonplace;

- Most project fundamentals progress slowly, with BTC L2 mostly in idle stages, lacking mature product implementations;

- Airdrops and incentives not meeting expectations, with some projects once holding high hopes but slow ecosystem progress leading to prolonged community confidence insufficiency;

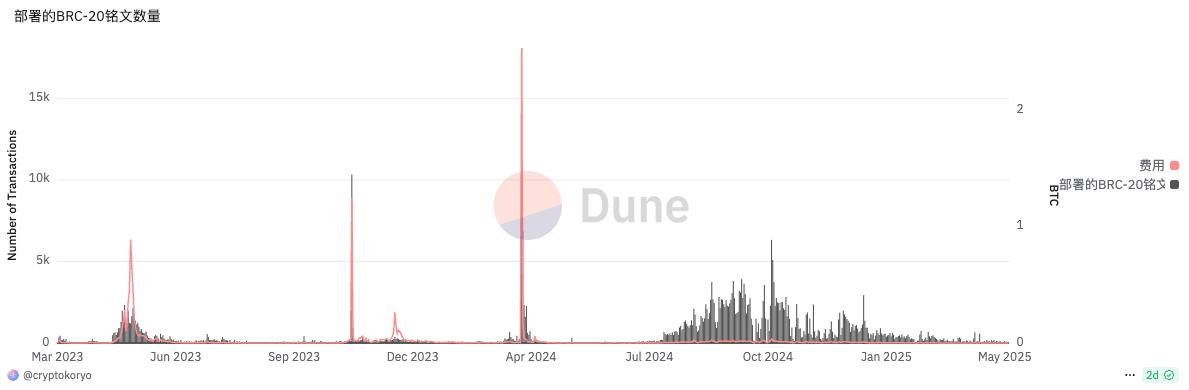

- Protocols scattered, with Runes protocol heat quickly dissipating, despite briefly occupying over 60% of BTC on-chain transactions during its initial launch, the peak data only maintained for a few days before rapidly declining to single-digit levels.

In terms of deployed BRC20 quantity, it's currently approaching a "freezing point"

These data indicate that this surge is not built on a fundamental change, but more like a high-elasticity game driven by "sentiment repair" + "capital rotation".

Why Rebound at This Timing?

- Market Style Shift Background Clearly Defined

Ethereum previously rebounded 50% under massive community FUD, verifying a typical market structure of "low expectation reversal". This phenomenon triggered capital migration to more undervalued, more fully corrected sectors.

- Bitcoin Ecosystem Dropped Deeply, with High Elasticity

Almost all top projects have generally dropped over 90% after last year's boom, with the market widely viewing them as "value compressed to no trading logic". Rebounds often start from such "abandoned" zones.

- Speculative Gaming Enhanced

Marginal ecosystem assets instead became high-volatility targets for short-term funds.

Will Subsequent Market Have Sustainability?

Despite the current eye-catching gains, if the perspective is extended, the current Bitcoin ecosystem rebound presents more as an expectation repair rather than trend reversal confirmation. The ecosystem still faces a series of structural issues constraining its continued performance.

First, from the overall development pace, whether BRC-20 or Runes, related project advancement remains slow. The originally anticipated "Bitcoin native DeFi" has yet to construct a complete vertical system, and the lack of infrastructure support makes it difficult to form true synergistic effects within the ecosystem. Meanwhile, developer enthusiasm has also waned. Update frequency of multiple core projects' GitHub has noticeably decreased, with overall technical community activity far less active than chains like Ethereum and Solana. Against the backdrop of capital and user attention's periodic shift, the cooling of the developer ecosystem undoubtedly further weakens medium-term expectations.

Comprehensively, this rebound is more like a "correction-style replenishment" triggered under extremely low valuation and extremely weak expectations. After a year of emotional exhaustion and valuation decline, funds at the style-switching node re-focus on these deeply fallen assets, releasing periodic elasticity.

To truly drive an independent market for the Bitcoin ecosystem, price surge alone is insufficient. Ecosystem recovery depends on more solid product delivery, more convincing user growth data, and community re-convergence on future prospects. If rebounds can be ignited by sentiment, trend continuation must be built on confidence and substantial progress.