I. Project Overview: The Underlying Engine of Sui Ecosystem Liquid Staking

1.1 Core Positioning and Market Opportunities

Haedal Protocol is a liquid staking protocol deployed on the Sui blockchain, aimed at solving the pain points of long asset lock-up periods and liquidity fragmentation in traditional staking mechanisms. By staking SUI, users obtain the liquid staking certificate haSUI, which retains the basic staking income (currently 3.21% APY) and can be used in DeFi ecosystem for lending, trading, and other scenarios, achieving income stacking and liquidity release.

As of April 2025, the liquid staking penetration rate in the Sui ecosystem is only 2%, significantly lower than Ethereum (20.78%) and Solana (10.1%).

With the Sui mainnet TVL breaking through $1 billion and DeFi applications accelerating prosperity, Haedal, as the TVL leader in this track (117 million USD), is expected to benefit from the 10x growth potential brought by increased penetration rate.

1.2 Technical Architecture and Innovative Breakthroughs

Haedal's underlying design revolves around the Hae3 framework, comprising three core components:

- HMM (Haedal Market Maker): Optimizes DEX liquidity through oracle pricing and real-time market data, capturing 0.04% trading fees. From February to March 2025, the HMM module drove protocol revenue from $59.13 million to $284 million, generating $23,600 in fees, and increasing haSUI's annualized yield by 24.4% to 3.21%.

- HaeVault (Yield Vault): Adopts an ultra-narrow rebalancing strategy, raising the annual yield of the SUI-USDC liquidity pool from 250.8% on Cetus platform to 1117% (net yield 938% after fees), significantly optimizing capital efficiency.

- HaeDAO (Governance Module): HAEDAL token holders can participate in protocol governance through the veToken model, including adjusting staking parameters and income distribution rules, forming a decentralized decision-making system.

1.3 Capital Endorsement and Ecosystem Integration

Haedal has completed its seed round, with investors including Hashed, OKX Ventures, Animoca Brands, Sui Foundation, and other top institutions, with funds used for staking infrastructure development and ecosystem expansion. Its liquid staking certificate haSUI is deeply integrated into top Sui DeFi protocols:

- Cetus: The largest DEX in the Sui ecosystem, with a daily trading volume of $92 million, where haSUI accounts for 6.12% of its liquidity pool;

- NAVI Protocol: A lending protocol with a TVL of $499 million, supporting haSUI as collateral;

- Aftermath Finance: An all-in-one DEX + perpetual contract platform where haSUI can be used for cross-protocol yield portfolios.

- Optimistic Scenario: If the Sui mainnet upgrade triggers an ecosystem explosion, HAEDAL could potentially reach $0.2-0.25, but be cautious of profit-taking;

- Neutral Scenario: Based on current TVL and income capability, the price may oscillate in the $0.08-0.12 range;

- Pessimistic Scenario: If token unlocking and ecosystem growth fall short of expectations, the price might drop below $0.05.

Long-term (6-12 months):

- Key Variables: haSUI cross-chain progress, HaeDAO governance utility implementation, Sui staking APY increasing to over 4%;

- Target Range: If these conditions are met, HAEDAL is expected to break through $0.5, corresponding to an FDV of $500 million.

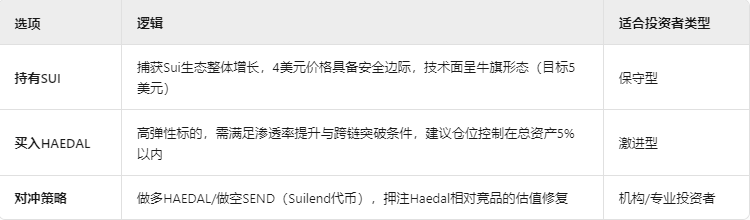

4.3 Asset Allocation Recommendation

V. Conclusion: Rebalancing Risk and Reward

Haedal has become the core infrastructure of the Sui liquid staking track through dynamic yield optimization, capital resources, and ecosystem first-mover advantages. However, its current valuation has partially discounted growth expectations, and investors should be wary of the following risks:

- Excessive Ecosystem Dependence: If Sui fails to replicate Solana's MEME coin craze or Ethereum's institutional adoption, TVL growth will stagnate;

- Token Economic Defects: Uncontrolled release of 55% ecosystem incentive tokens may create long-term selling pressure;

- Technical Substitution Risk: New paradigms like zero-delay redemption and re-staking could weaken Haedal's competitive advantage.

Final Recommendation: Short-term wait for a pullback below $0.1, focus on haSUI cross-chain progress and governance token empowerment in the medium to long term, and build positions in batches when opportune.