This article is machine translated

Show original

Coinbase Leads S&P 500 Mainstream Crypto Adoption, Arbitrum Tops Inflows for Four Consecutive Weeks - 0513 Coin Research Weekly Report

$ETH Breaks Through $2,700, Bottom Rises by Over 90% 📈

🔥 @coinbase Included in S&P 500: On May 19, it replaced Discover Financial Services, becoming the first pure crypto company to be selected, with post-market stock price rising over 10%. Base ecosystem TVL reaches $4.7 billion, marking crypto mainstreaming.

View the full content, welcome to subscribe to the Coin Research Weekly

Let's grasp the weekly macro trend and ambush alpha 💥

Short link: bit.ly/defi-0515

📍 After the Geneva talks between China and the United States, the US tariff on China was reduced from 145% to 30% (24% suspended for 90 days), and China's tariff on the US was reduced from 125% to 10%, and both sides canceled some of the additional tariffs.

📍SEC Chairman Paul Atkins announced that he will adopt a more supportive regulatory policy for cryptocurrencies, formulate new guidelines for issuance and custody, allow funds to be self-custodial, and provide conditional exemptions for innovative products to adapt to the existing framework. twitter.com/137371591275965235...

📍 @coinbase will replace Discover Financial Services and be included in the S&P 500 index on May 19, becoming the first pure crypto company to be included. Its stock price rose more than 7% after the market closed.

📍 @pumpdotfun launches "Creator Revenue Sharing", 50% of the revenue from token trading PumpSwap will be returned to creators, and each transaction will receive a 0.05% SOL reward. It will be automatically calculated starting today and can be claimed at any time.

📍DeFi Development twitter.com/574032254/status/1...

📍 @solana co-founder @aeyakovenko promotes Meta blockchain, which puts data on Ethereum, @Celestia, @solana and other chains, organizes them in a unified way, and uses the cheapest data storage and access services.

📍 @worldlibertyfi stated that WFLI is the only DeFi project endorsed by the Trump family. Other cryptocurrencies claiming to be related are scams. Investors need to be wary of false information.

📍Irish presidential candidate Conor McGregor

💡 Market Trends

The US-China tariff truce agreement eased trade tensions and pushed US stocks higher, but BTC fell from a high of $105,720 to $102,600, diverging from the S&P 500 (83% correlation in the past 30 days), reflecting profit-taking and risk aversion. Technically, BTC faces resistance at $106,000. If it falls below $100,000, it may retest $99,700–100,500.

💡 Release time of important macro events in May (UTC +8)

May 15

📍Initial jobless claims in the U.S. for the week ending May 10 (10,000 people) (20:30)

📍US PPI annual rate in April (20:30)

📍The Federal Reserve holds the second Thomas Laubach Research Conference

May 16

📍Preliminary forecast for the one-year inflation rate in the United States in May (22:00)

📍United States 5

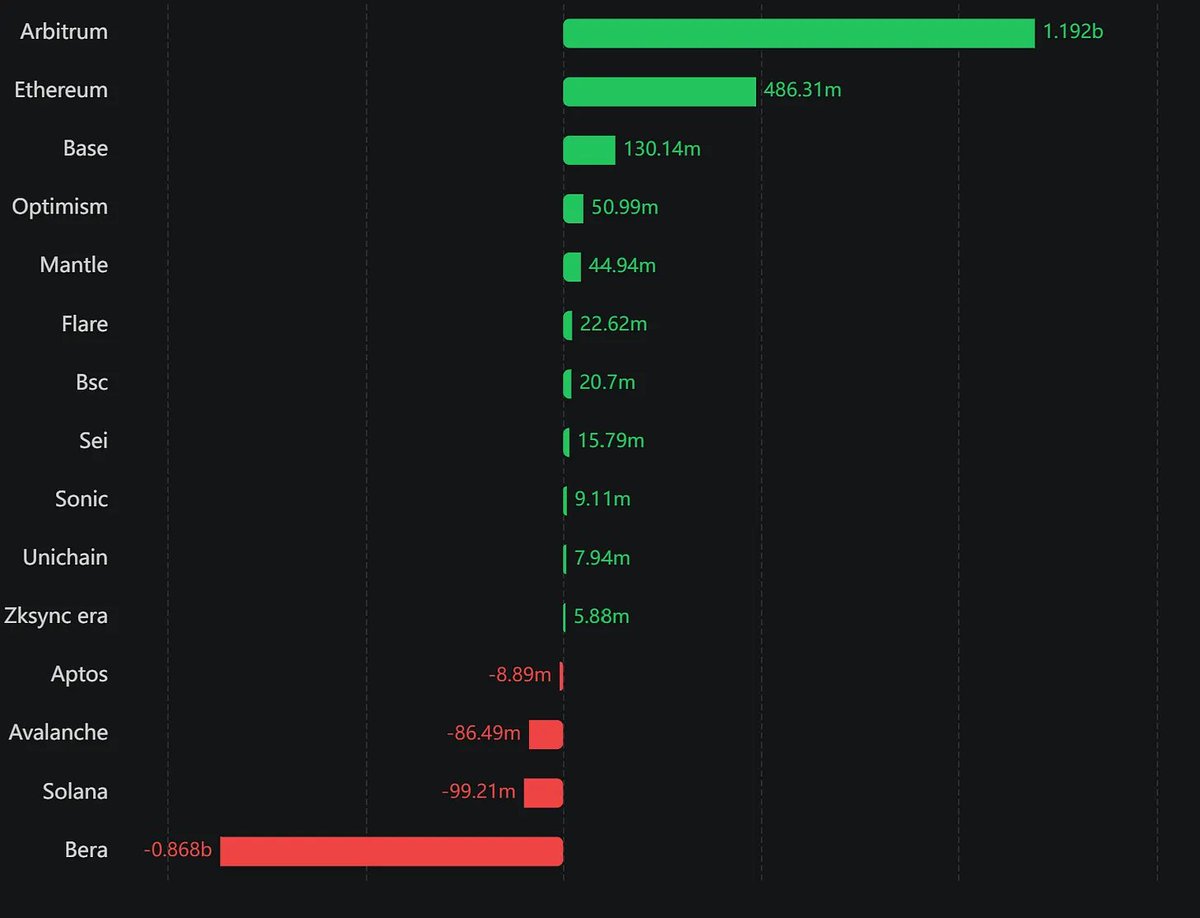

💡Cross-chain net inflow data

📍 @arbitrum / @HyperliquidX +1.19 billion (previous +270 million) for four consecutive weeks🔥🔥🔥🔥

@hyperbridge launched this week with @LayerZero_Core, supporting USDT0, USDe and other assets from any chain to @HyperliquidX

Fee income on the 9th reached 3.2 million USDC, and open interest soared to 5.6 billion USDC. The launch of $USDT0 and the listing of new coin contracts have boosted capital enthusiasm. 8 twitter.com/574032254/status/1...

💡Coin Research’s DeFi Farming recommendations for this week🧑🌾

📍 @bluefinapp is the top DEX in the @SuiNetwork ecosystem, with original CLMM and smart routing. Depositing into the SUI/USDC pool can enjoy high rewards in the Grand Prix competition, with an APR of about 300%.

📍 @SuiNetwork hybrid DEX, the first on-chain/off-chain order book and CLMM, deposit into BLUE/SUI pool to earn transaction fees and Blue Points incentives, APR is about 50-66%.

💡TVL Growth List Top 10

📍 @RiverdotInc (formerly Satoshi Protocol) (144 million USD, 198%) is a CDP protocol on BTC, supporting a total of 8 public chains. This week, the protocol was upgraded to @RiverdotInc (TGE expected), and the satUSD staking pool will be launched, attracting a total of more than 46 million USD in capital inflows.

📍 @Hyperion ($67.12 million, 137%) is the 7th largest in the Aptos ecosystem twitter.com/174930798644998553...

📍 @TermMaxFi (US$11m, 121%) is a lending project on @ethereum. @TermMaxFi's TVL has soared to US$10m in the past week, thanks to its 32.99% APY USDC pool, new trading pairs (such as wETH/PT-pufETH), and leveraged lending functions, which have attracted capital inflows.

📍 @yield (12.88 million USD, 114%) is a yield aggregation protocol in the @base ecosystem.

💡 Top 5 Financing List

📍 @DeribitOfficial

($2.9 billion) @coinbase has agreed to acquire @DeribitOfficial for approximately $2.9 billion

, the world's largest Bitcoin and Ethereum options trading platform. The deal still requires regulatory approval, and Coinbase will also take over Deribit’s operating license in Dubai.

📍 @Metaplanet_JP

($21.25 million) Metaplanet

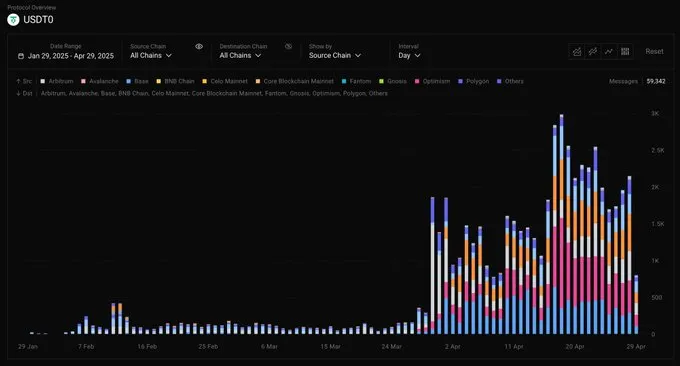

💡 Content Selection - Content Selection - Tether USDT Stablecoin Expansion and USDT0 Strategy by

@FourPillarsFP

1️⃣ USDT expansion challenges: 12 native chains, bridged to 80+ chains, high security risks, Tether does not compensate for losses; Ethereum USDT is 64.94 billion, 8 billion is bridged, and compliance tracking is difficult; Tron USDT accounts for 98%, with an annual fee of 2.5 billion US dollars, and Tether has difficulty in gaining ecological value.

2️⃣ USDT0 use

The full content is on Biyan Substack, welcome to subscribe🔥

bit.ly/defi-0515

🔥 Join the Biyan community to discuss more market opportunities:

📍 Chinese Telegram group: bit.ly/3YmFBrN

📍 Hong Kong Telegram Community: bit.ly/HK-TG-Group

📍Subscribe to the Daily Coin Research Telegram channel:

t.me/cryptowesearch_news

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content