Actually, in the previous rounds of competition, Binance's layout has been somewhat slow. For example, during the inscription period, OKX Wallet seized the initiative early (Binance Wallet only entered the inscription market in April 24, and the market cooled down within a few months). In the previous MEME season and AI season, the Solana ecosystem was clearly the core of liquidity, especially with markets like PumpFun constantly becoming massive pumps, while BNB Chain, backed by Binance, was lukewarm without any standout coins or eye-catching trading markets.

On the other hand, the rise of on-chain derivatives markets is also impacting Binance, including the rise of platforms like HyperliquidX, which attracts users and funds to on-chain markets. So under multiple impacts, Binance is indeed in a challenging position. Therefore, the launch of Binance Alpha in December last year actually reveals its intentions:

So I believe its strategic significance can be summarized in several points

1) Activate platform-wide user trading activity and liquidity

Binance CEX itself lacks neither users (250 million registered) nor funds, but what it lacks is a factor to fully mobilize users' trading activity and fund liquidity, especially guiding these token-holding users into its own chain ecosystem. Therefore, Alpha 2.0 introduced a points mechanism, using TGE, Alpha airdrops, and IDO as catalysts, hoping to encourage more token-holding users to participate in Alpha zone trading, particularly to attract liquidity to the Alpha zone.

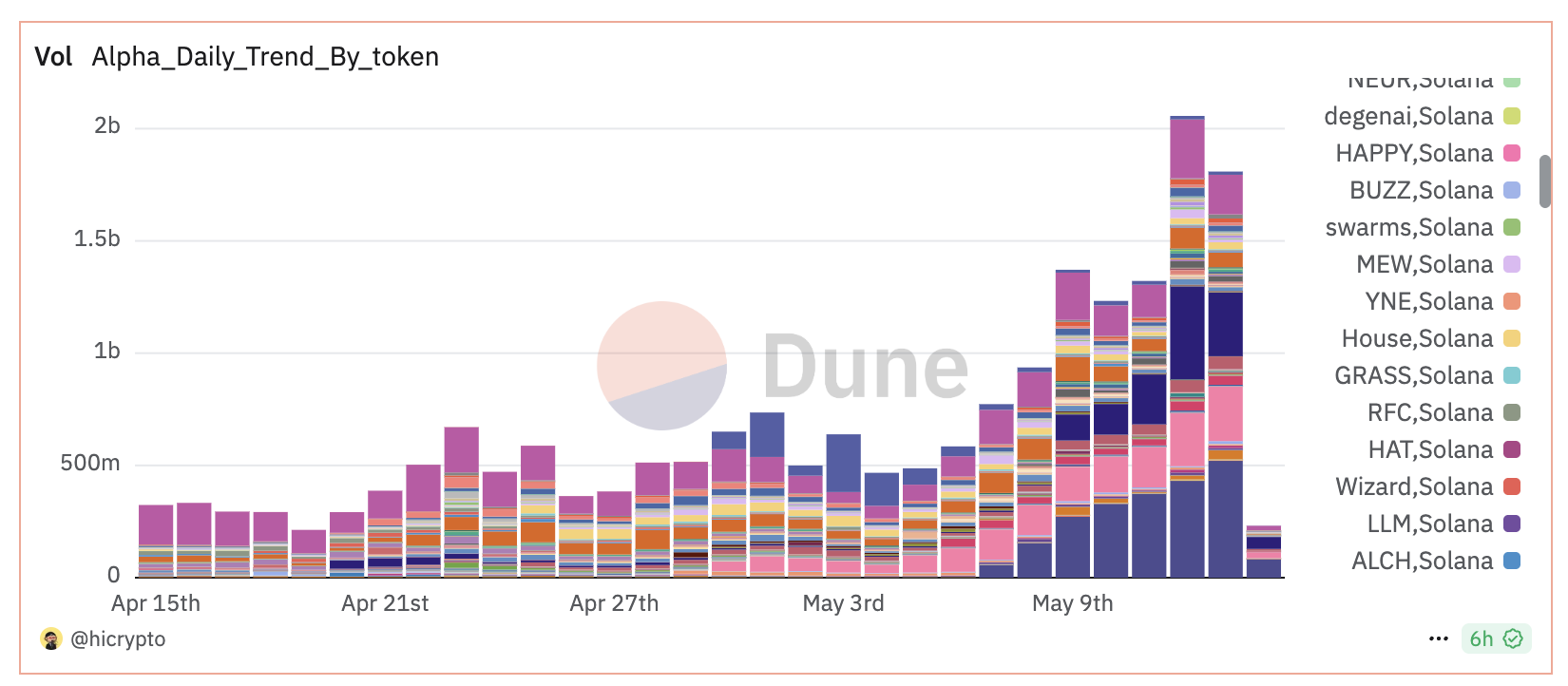

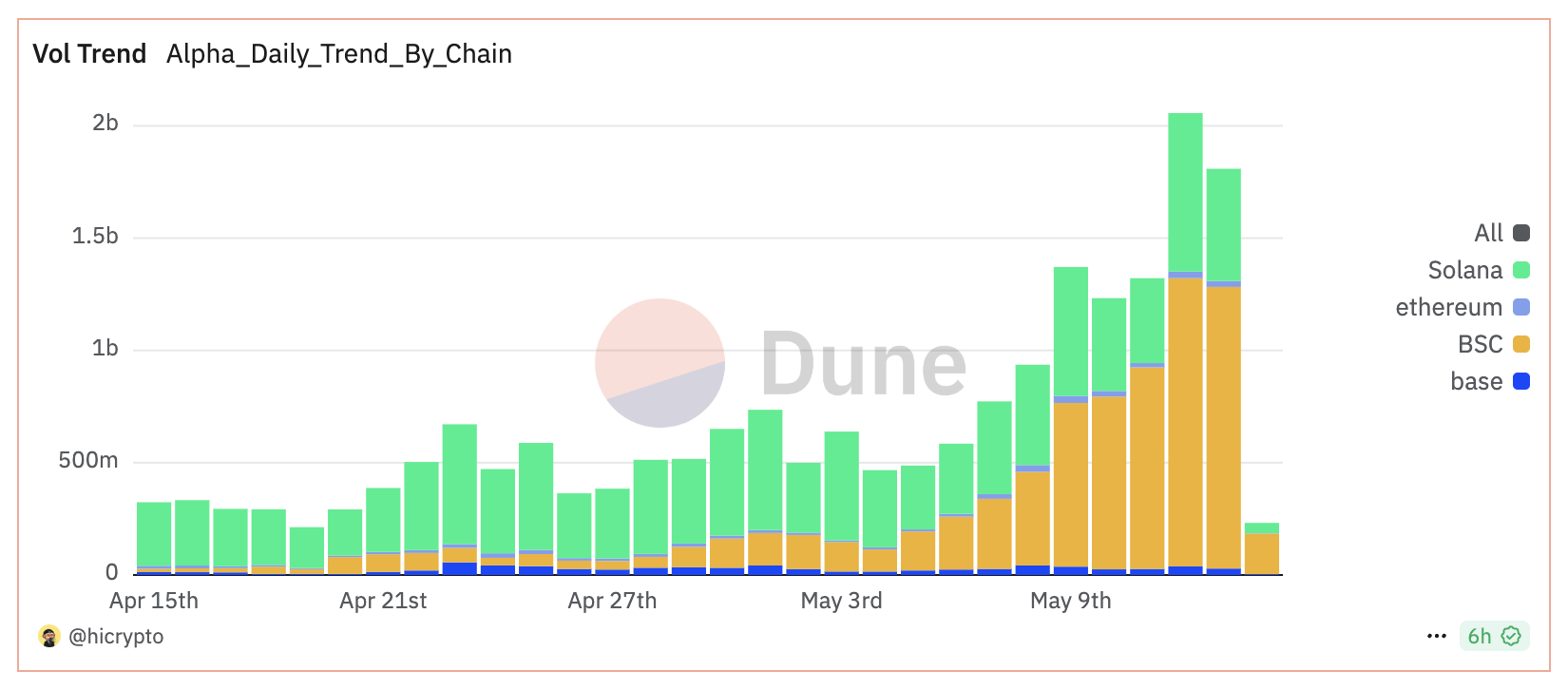

We can see that after 2.0, especially after introducing the points system, the trading effect on Binance Alpha trading zone has been extremely obvious. Since the first TGE event with points threshold on the 25th, trading volume has surged dramatically, and the more competitive it becomes, the better the trading volume effect.

2) Bring traffic and revitalize the BNB Chain ecosystem to support more of its own chain projects

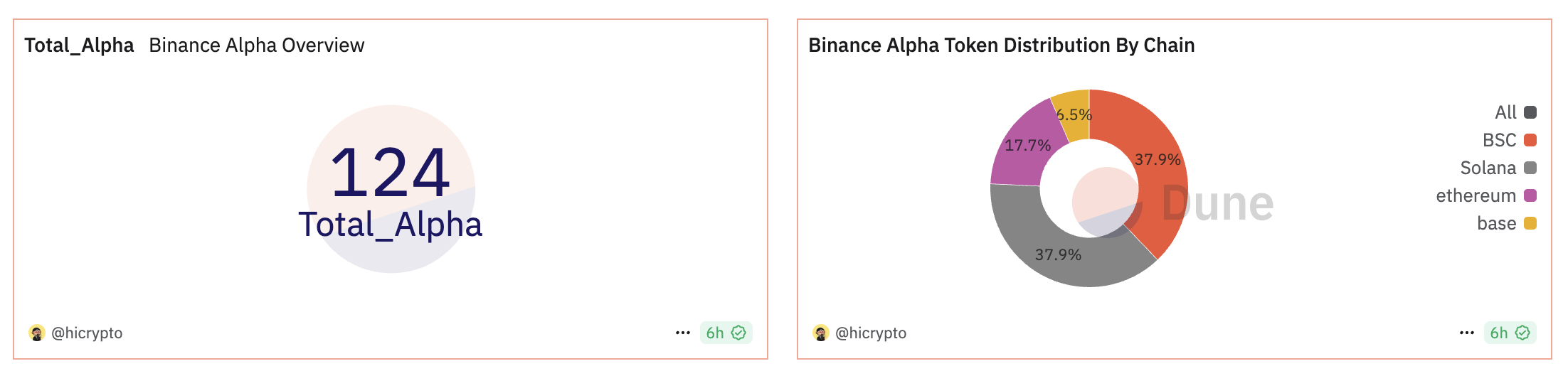

Binance Alpha's purpose of driving traffic and revitalizing the BNB Chain ecosystem to support more of its own chain projects is quite obvious. As early as the 1.0 period, we could easily see that the proportion of BNB Chain coins on Alpha was high. Currently, among the 124 Alpha projects online, over 70% are BNB Chain tokens, with 38% being native BNB Chain projects in hot fields like AI, MEME, and DeFi.

Trading volume leads: BSC tokens account for about 40% of Alpha's total trading volume, with weekly trading volume surging 122.5% and weekly trading amount rising 78%, highlighting the strong ecosystem momentum.

Moreover, many policies are tilted towards BNB Chain. For example, the double points policy launched on May 1st directly encourages users to trade on BNB Chain, hoping to bring further liquidity and user imports. According to Lookonchain's May 9th data:

-

In the top 10 newly active Alpha tokens in early May, 90% are based on BNB Chain, with 6 projects having new user adoption rates exceeding 20%.

-

BNB Chain added about 4.3 million new addresses in the first week of May, with new daily addresses exceeding 1 million for two consecutive days. Daily active addresses surpassed 2 million, with total unique addresses reaching 552 million.

The growth of Alpha asset trading data on BNB Chain also demonstrates this point.

3) Seize user traffic and liquidity from other chains

Alpha also aims to capture user traffic, liquidity, and attention from other chains, especially its "old rival" Solana. The proportion of Solana chain tokens listed on Alpha is also quite high, particularly some popular Solana tokens like ai16z. Besides Solana, Ethereum and Base also have many quality assets worth noting in MEME and AI tracks. Therefore, the Alpha platform is expected to further seize active users, attention, and liquidity from other chains (especially in the current situation lacking hot spots and FOMO narratives).

4) Incremental users

Alpha point farming has actually brought many new incremental users. On one hand, point farming is not difficult once you understand the rules, unlike the high-cost Layer 2 trading volume farming. Many point farming users will bring friends and family, providing a key opportunity for many users to reach the Binance platform and become crypto investors. Although there's no clear data showing the exact trading volume, the growth of new registered addresses on BNB Chain reveals some insights.

5) Reshaping listing mechanism

Another point I believe is related to reshaping Binance's listing mechanism. After the previous controversial listing event (the "sorority group" controlling the listing process), the top executive personally came out to clarify and stated that listing transparency and fairness would be strengthened. So now, Alpha is actually a good demonstration, also providing many community-based, MEME, and small-scale crypto projects with a channel to reach broader investors and strive for Binance listing.

Of course, after Alpha 2.0 integrated the Alpha zone into the APP, trading Alpha zone tokens became more convenient. I even feel that from a user perception perspective, there's not much difference between trading here and listing on the main site. So the previous Alpha zone effect was actually quite good, bringing significant volume to projects.