1/n - $JELLYJELLY explaining the -50% crash in a day

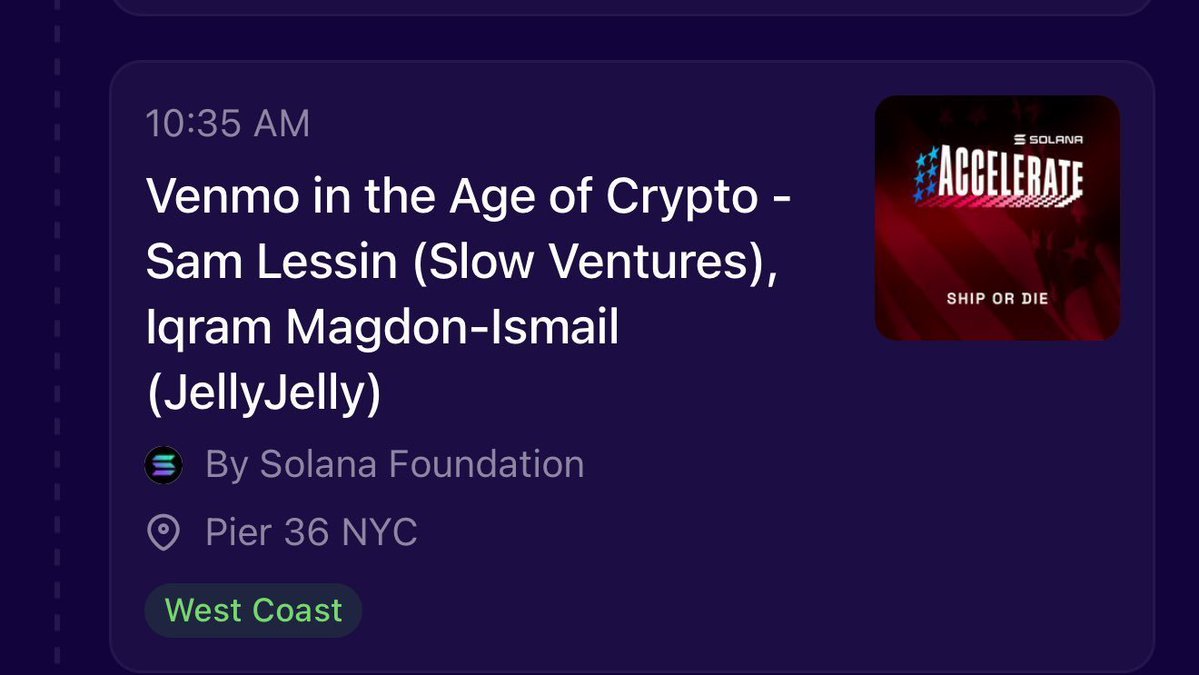

2/n - $JELLYJELLY was the only CEX token that fitted the Internet Capital Markets meme - it was by the founder of Venmo - and i felt that there would be tremendous tailwind from the confluence of it being highly shorted by MMs and the meta tailwind

3/n - However, the high short interest in $JELLYJELLY (1.27x OI/mkt cap) actually incentivised MMs who were short to try to suppress prices

4/n - When a token has more OI than market cap, UNLESS there are entities who duplicate and offset OI across multiple exchanges - there will be naked shorts, because there is simply not enough spot by definition to cover the short exposure. (simplified)

5/n - On the CEX perps - the index price is taken from the spot prices of $JELLYJELLY from these few spot exchanges

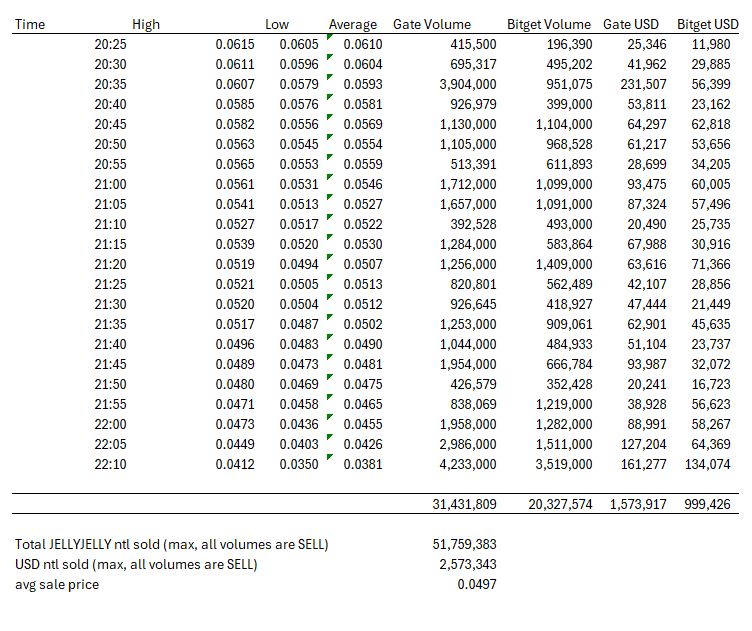

If you look at today's volumes - Gate did 36M, Bitget did 11M, KCS did 4.8M and MEXC did 1.5M - to simplify things, i will just focus on Gate and Bitget

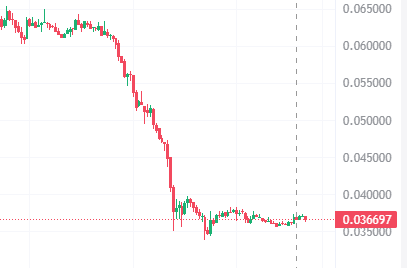

7/n - The selling started at 20:25 UTC+8 - attached is the Bitget chart

8/n - and here is the Gate chart

9/n - Being extremely autistic - i compiled how much volume was done on each 5 min candle along w an estimate of the average price

10/n - In short, a MAXIMUM of 52M of $JELLYJELLY was sold on spot markets to tank it down by 50% - i say a maximum because that assumes all volume done on the candle was a directional sell order and there were no wash volumes

11/n - If you go by a 50% wash volume hit rate in crypto, that implies ~ 25M of $JELLYJELLY spot (1.2M USD) sold into the market caused a 50% dump in prices

12/n - IMO, the high OI/mkt cap created a very tempting but faustian bargain for MMs caught short. They tried to dump spot to push prices down (and they succeeded!)

13/n - for now at least. But this is drinking water from a poisoned chalice, because they lost some amount of spot supply.

14/n - While longs by and large did NOT close. Prior to the puke, OI/mkt cap was ~1.25x, currently it is ~1.27x.... so in fact ...the MMs could potentially be in a worse position right now IF longs are not interested to close out (otherwise they self deal)

15/n - IMO, the situation for longs has gotten more advantageous. However, because the perp market can be extremely easily manipulated via the illiquidity in this token - i strongly recommend any exposure in this to be via spot

16/n - The entity caught short in this may resort to more desperate stunts to stem their bleed. But as a spot holder, i can stay retarded longer than they can

17/n - In short, the thesis remains simple. INTERNET CAPITAL MARKETS - Venmo Founder actively building AND attending Solana Accelerate

full disclosure - i am converting my perp exposure into spot via DCA with a limit

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content