Source: 0x Todd

Recently, I deposited some money in Uniswap V4, so I carefully studied its hooks. Many people have privately told me that after Uni launched V4, they didn't feel the same excitement as when V3 was launched. Mainly because the concept of "hooks" itself is too abstract and easy to criticize.

Instead of literally translating "Hook" as a hook, in my humble opinion, it would be better to interpret it as a plugin. The hook itself adds functions to the pool that go beyond Uniswap itself. The documentation repeatedly emphasizes when hooks can be called, but most people don't care about that; it's better to explain what hooks can actually do.

【Examples of Hook Uses】

--For example, it can make the pool you create, such as ETH-USDT, usable only by specific addresses;

--Or, it can make your pool charge more fees during busy times and less during idle times;

--Or, it can even allow your pool to not use the X*Y=K curve (PS: probably stimulated by Curve).

In short, you can freely develop various functions that Uni officials might never launch.

It's a bit like the Steam Workshop, where the official stops doing things and lets others create freely.

In the past, there were only two profitable positions on Uni: LP and traders, who were essentially taking money from each other. After V4 and hooks, script writers now also have a profitable position.

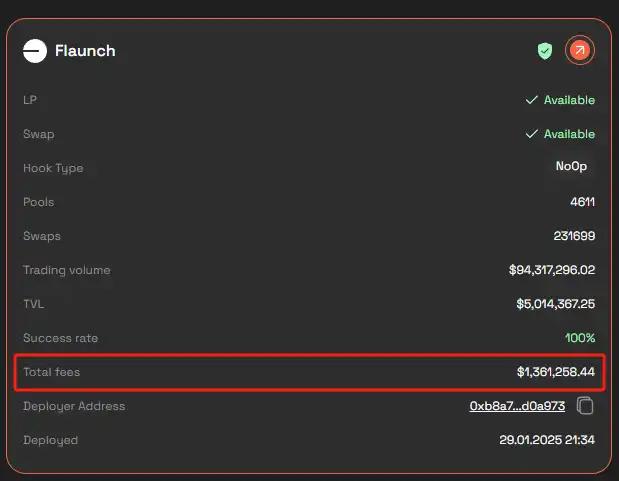

You write a hook, and others can pay to use your hook when creating a pool (selling.. hooks?). Each pool can use 1 hook plugin, but 1 set of hook plugins can be subscribed to by countless pools, with very low marginal costs. There's a website called Hook Rank that lists hundreds of hooks, showing how much money each hook has earned. One of the most commonly used hooks, Flaunch, has already earned over $1 million according to the developer.

What does it do? With this hook, when creating a pool for a meme coin, you can direct 80% of the pool's fees to your own wallet, and 20% for buyback.

Fortunately, Trump's son didn't know about this feature when launching $Trump, otherwise he might have directed all fees to future world finance?

As they say, only competitors truly understand you. Later, Pancake also decisively introduced hooks, though not calling it V4 but "Pancake Infinity" - but that's another story for another time. In any case, hooks are quite interesting, worthy of the V4 name.

Here's another practical hook use case.

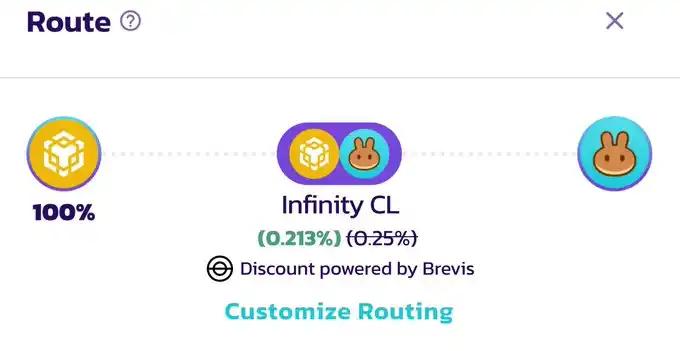

Since Pancake launched Infinity (their V4), hooks on the BSC chain have also started developing. For example, the Brevis hook actually created a VIP account effect on-chain: long-term $CAKE holders trading CAKE-BNB in a pool with this hook will have lower fees; similarly, high-volume chain whales can also get lower fees.

The hook is speculated to trigger once before trading, allowing special accounts to have special rates. It successfully implemented this familiar business model through a third-party smart contract without changing Pancake's underlying structure, which is indeed quite innovative.

Additionally, since each pool can typically only carry one hook, this pool may become one of Pancake's designated pools in the future.

Brevis's main business is ZK, part of YZI Labs' portfolio. Previously discussed as one of the most difficult areas in the industry, creating a hook is naturally not a challenge for them.

Moreover, if they can strongly bind with Pancake and launch various hook functions, Pancake might become a DEX with more trading features than Binance's main site. And Brevis, by pushing various hooks, could become the number one contributor to the Pancake Infinity era.

Looking forward to the new hook era.