On Wednesday, the inflow into US-listed Bitcoin ETFs exceeded 315 million USD, marking a strong reversal from the 96 million USD outflow recorded the previous day.

This increase in demand reflects a positive shift in investor sentiment despite BTC's slight decline on Wednesday.

319 million USD Flows into BTC ETFs in a Day

On Wednesday, none of the twelve BTC-backed ETFs recorded an outflow. According to SosoValue, the total inflow into these funds was 319.56 million USD, marking one of the strongest performance days in recent weeks.

Total Net Inflow into Bitcoin Spot ETF. Source: SosoValue

Total Net Inflow into Bitcoin Spot ETF. Source: SosoValueThis sentiment change indicates new interest from retail and institutional investors, potentially driven by buying opportunities during price dips and increasing confidence in BTC's long-term potential, despite short-term price volatility.

Yesterday, BlackRock's IBIT ETF recorded the highest net inflow, reaching 232.89 million USD. At the time of writing, its total historical net inflow is 45.01 billion USD.

Fidelity's FBTC recorded the second-highest daily net inflow at 36.13 million USD, raising its total historical net inflow to 11.65 billion USD.

BTC Drops Slightly, but Derivatives Show Buyers Remain Confident

BTC is currently trading at 102,413 USD, showing a slight 1% decline over the past day. However, market data indicates that optimistic sentiment remains while spot prices drop.

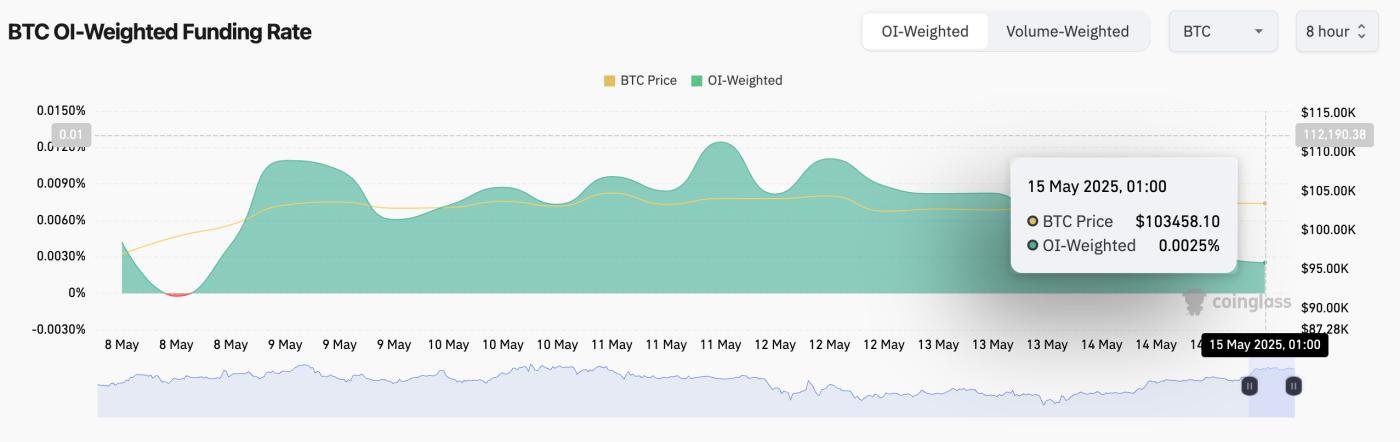

For example, the funding rate remains positive, showing traders are still willing to pay fees to maintain long-term positions in perpetual futures contracts. At the time of writing, this rate is 0.0025%.

BTC Funding Rate. Source: Coinglass

BTC Funding Rate. Source: CoinglassThe funding rate is a periodic payment exchanged between traders in perpetual futures contracts to keep prices aligned with the spot market.

When its value is positive like this, it indicates optimistic sentiment and higher demand for long-term positions. This means long-term BTC position holders must pay those with short-term positions, a trend that could potentially increase the coin's value.

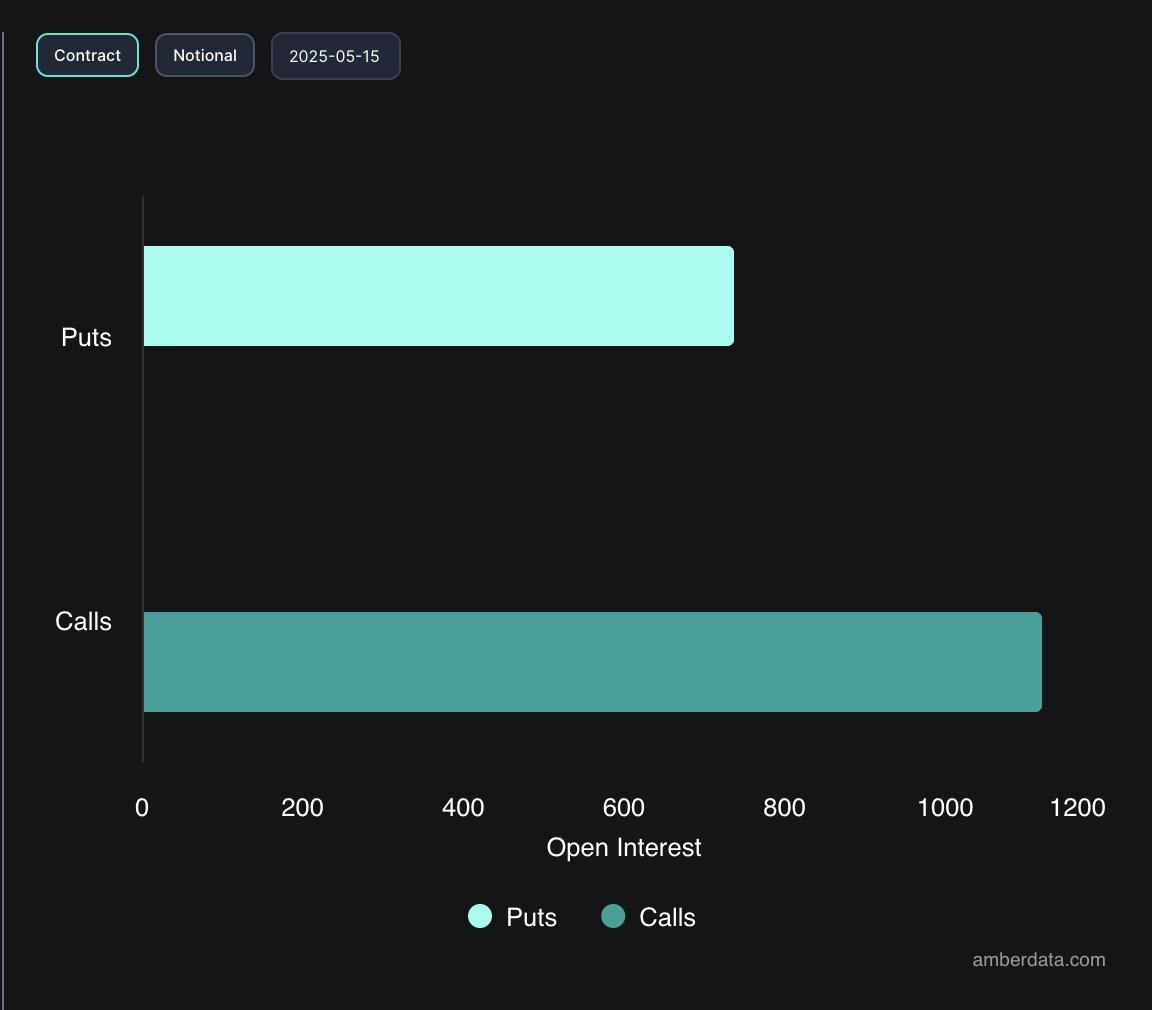

Additionally, options activity shows higher demand for call options compared to put options, suggesting traders are positioning for potential short-term price increases.

BTC Options Open Interest. Source: Deribit

BTC Options Open Interest. Source: DeribitIn conclusion, the cash flow indicates that institutional investors may be buying during price dips, betting on BTC's long-term price recovery.