Bitcoin surpassed the 105,000 USD mark early this week, triggering a new wave of accumulation from whales in the cryptocurrency market. On-chain data shows that many altcoins are attracting significant attention from large investors.

Among the notable choices in the third week of 05/2025 are Ondo (ONDO), Render (RENDER), and Optimism (OP).

ONDO

This week, the real-world asset token (RWA) ONDO has attracted attention from whales. According to Santiment, whale addresses holding between 10,000 and 100,000 tokens collectively bought 2.63 million ONDO over the past seven days.

ONDO supply distribution. Source: Santiment

ONDO supply distribution. Source: SantimentCurrently, this ONDO whale group holds 143.94 million tokens. The token is trading at 0.99 USD at the time of writing, recording a 3% price increase in the context of market growth over the past 24 hours.

If whale activity becomes stronger, ONDO could reclaim the 1.00 USD level in the short term. In this case, the altcoin could rise to 1.23 USD.

ONDO price analysis. Source: TradingView

ONDO price analysis. Source: TradingViewHowever, if whales stop or sell to take profits, ONDO could lose its recent gains and drop to 0.92 USD.

Render (RENDER)

RENDER is another altcoin that cryptocurrency whales have paid attention to this week. According to Santiment, large investors holding between 1 million and 10 million tokens have bought 250,000 RENDER, valued at approximately 1.22 million USD at current market prices.

RENDER supply distribution. Source: Santiment

RENDER supply distribution. Source: SantimentThis increasingly growing accumulation trend from whales could encourage smaller retail investors to follow, as increased buying activity from large investors typically signals confidence in the asset's potential.

Historically, momentum from whales often attracts broader market participation, which could push RENDER's price up in the short term. If accumulation continues, the altcoin could rise to 6.09 USD.

RENDER price analysis. Source: TradingView

RENDER price analysis. Source: TradingViewConversely, if demand decreases, RENDER could break support at 4.72 USD and drop to 4.18 USD.

Optimism (OP)

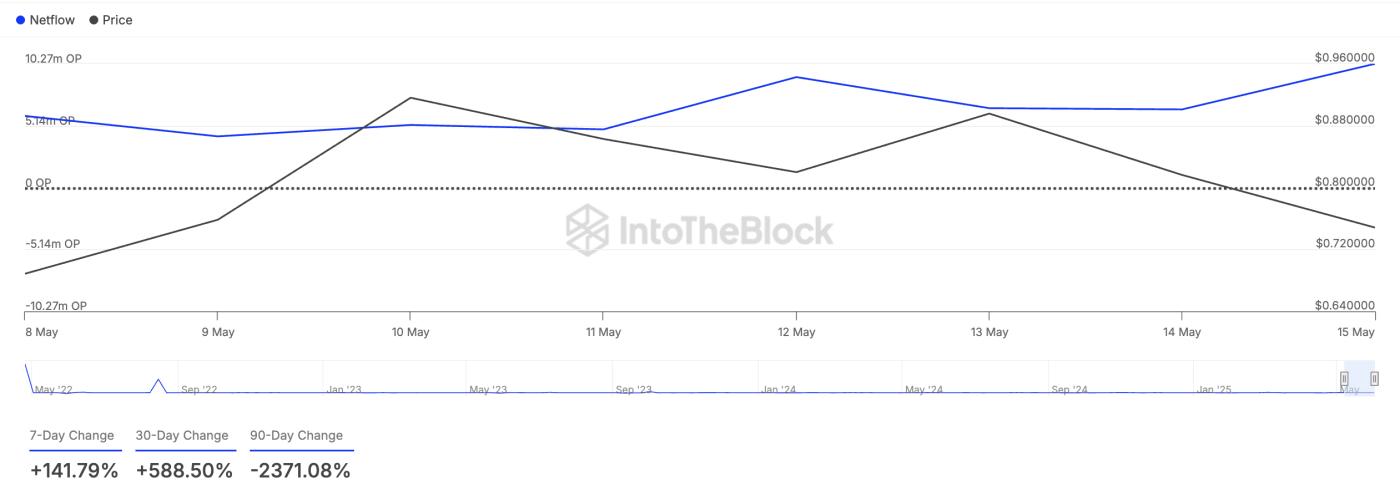

The Layer-2 (L2) token OP is another asset with strong whale accumulation this week. This is reflected in the increased net inflow from large investors of the altcoin, which has increased by over 140% in the past seven days, according to IntoTheBlock.

OP large investor net flow. Source: IntoTheBlock

OP large investor net flow. Source: IntoTheBlockThe net flow of large investors tracks the total number of tokens entering and leaving wallets classified as large investors (those controlling more than 0.1% of an asset's circulating supply).

When this indicator increases, it suggests a large amount of assets are moving into the hands of these investors, signaling strong buying interest. An increasing net flow often precedes a price increase, so the OP price could rise to 1.08 USD.

OP price analysis. Source: TradingView

OP price analysis. Source: TradingViewConversely, if selling continues, the value of OP could drop to 0.54 USD.